What will the next crypto cycle look like?

The core feature of the next cycle will no longer be a "speculative liquidity shock," but rather the structural integration of cryptocurrencies with global capital markets.

The core feature of the next cycle will no longer be a "speculative liquidity shock," but rather the structural integration of cryptocurrencies with global capital markets.

Written by: arndxt

Translated by: Luffy, Foresight News

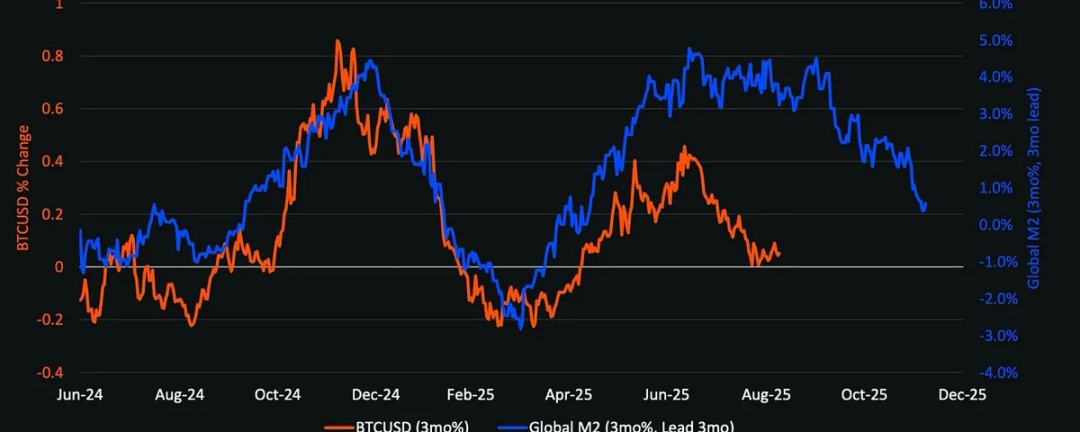

Global M2 and Bitcoin Price Chart

The most critical structural conclusion is: cryptocurrencies will not decouple from the macroeconomy. The timing and scale of liquidity rotation, the Federal Reserve's interest rate trajectory, and institutional adoption patterns will determine the evolution path of the crypto cycle.

Unlike in 2021, the upcoming altcoin season (if any) will be slower, more selective, and more institutionally focused.

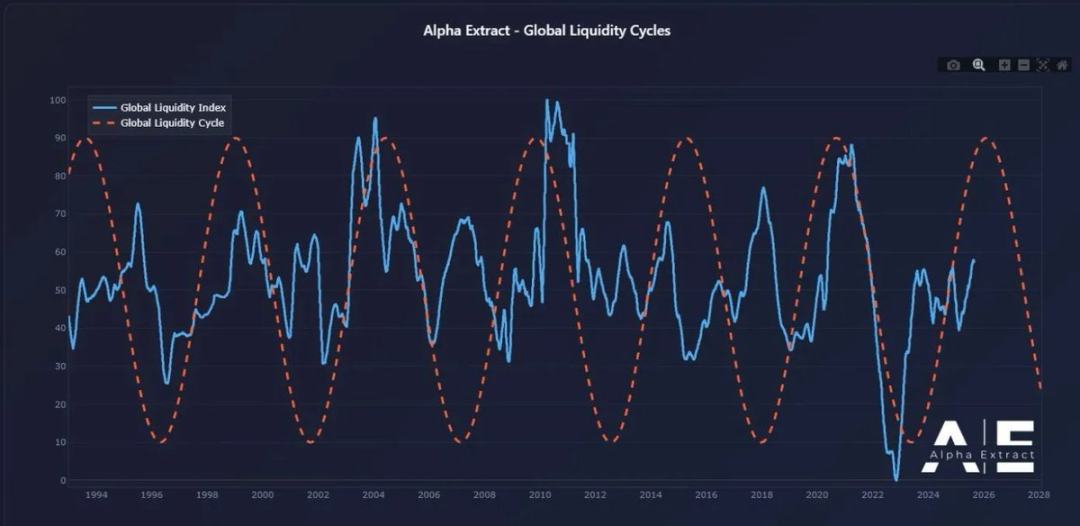

If the Federal Reserve releases liquidity through rate cuts and bond issuance, while institutional adoption continues to rise, 2026 could become the most significant risk asset cycle since 1999-2000. Cryptocurrencies are expected to benefit, but their performance will be more regulated rather than explosive.

Divergence in Federal Reserve Policy and Market Liquidity

In 1999, the Federal Reserve raised rates by 175 basis points, yet the stock market soared to its 2000 peak. Today, forward market expectations are the exact opposite: a 150 basis point rate cut is expected by the end of 2026. If this expectation materializes, the market will enter an environment of increasing, rather than tightening, liquidity. From a risk appetite perspective, the market backdrop in 2026 may resemble 1999-2000, but with a completely opposite interest rate trend. If so, 2026 could be an "even fiercer 1999-2000."

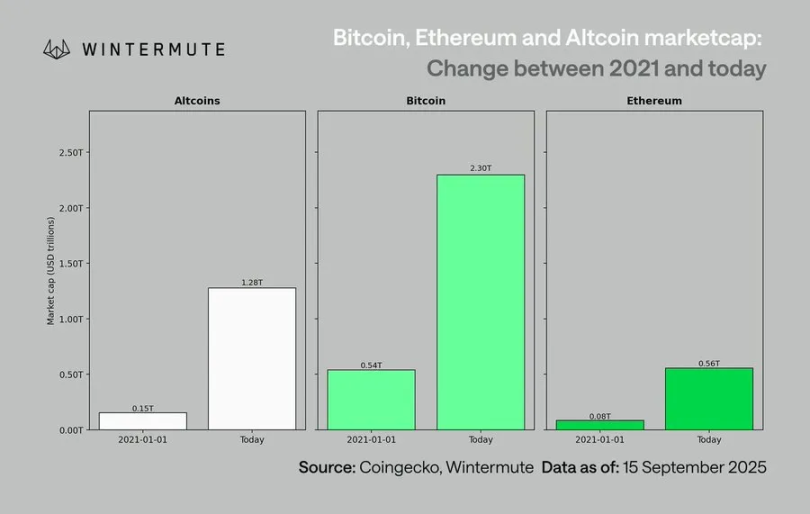

The New Context for the Cryptocurrency Market (Compared to 2021)

Comparing the current market to the previous major cycle, the differences are significant:

- Stricter capital discipline: High interest rates and persistent inflation force investors to be more cautious in selecting risk assets;

- No pandemic-level liquidity surge: The absence of a broad money supply (M2) spike means industry growth must rely on increased adoption and capital allocation;

- Market size expanded tenfold: A larger market cap base means deeper liquidity, but the possibility of 50-100x excess returns is much lower;

- Institutional capital inflows: Mainstream institutional adoption is now deeply rooted, with capital inflows becoming smoother, driving slow market rotation and integration rather than explosive rotation between assets.

Bitcoin’s Lag and the Liquidity Transmission Chain

Bitcoin’s performance lags behind the liquidity environment because new liquidity is trapped "upstream" in short-term Treasuries and money markets. As the asset at the far end of the risk curve, cryptocurrencies only benefit after liquidity is transmitted downstream.

Catalysts for strong cryptocurrency performance include:

- Bank credit expansion (ISM Manufacturing Index > 50);

- Outflows from money market funds after rate cuts;

- Treasury issuance of long-term bonds, pushing down long-term rates;

- A weaker dollar, easing global funding pressures.

Historical patterns show that when these conditions are met, cryptocurrencies typically rise in the later stages of the cycle, lagging behind stocks and gold.

Risks Facing the Baseline Scenario

Although the liquidity framework appears bullish, several potential risks remain:

- Rising long-term yields (triggered by geopolitical tensions);

- A stronger dollar, tightening global liquidity;

- Weak bank credit or tightening credit conditions;

- Liquidity stuck in money market funds, not flowing into risk assets.

The core feature of the next cycle will no longer be a "speculative liquidity shock," but the structural integration of cryptocurrencies with global capital markets. As institutional capital flows in, prudent risk-taking, and policy-driven liquidity shifts converge, 2026 may mark the transformation of cryptocurrencies from a "boom-and-bust" model to one with "systemic relevance."

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

An overview of two new projects in the Polkadot ecosystem and what they will bring to Polkadot Hub

HIC: Continue to bring truly valuable new projects to Polkadot in a sluggish market!

Three cases demonstrate what Revive and Polkadot Hub can achieve!

Bridging the Development Gap: How is HashKey Ushering in a New Era for Web3 in Asia?

HashKey Group, which is currently striving for a listing on the Hong Kong Stock Exchange, reveals a clear path for us through its unique business strategies and practices.