Bitget Daily Digest (September 23)|Hacker Mints 1 Billion UXLINK Causing 120% Crash; $517M in Token Unlocks This Week; ETH Sees $375M Liquidated in 24 Hours

Today's Outlook

- Pyth Network will begin CO-PIP 9 governance voting on September 23, 2025, involving a proposal for Douro Labs to act as the initial distributor and on-chain subscription manager for Pyth data.

- Korea Blockchain Week 2025 (KBW2025) flagship IMPACT Conference will be held in Seoul, South Korea from September 23 to 24, 2025, gathering global leaders, developers, and investors from the blockchain and Web3 sectors.

- CV Summit 2025, a blockchain and cryptocurrency conference, will take place in Zurich, Switzerland, from September 23 to 24, 2025.

Macro Hot Topics

1.Over the next seven days, the crypto market will see significant token unlocks totaling over $517 million, covering projects such as Particle Network (PARTI), Nillion (NIL), Jupiter (JUP), and others, which could trigger market volatility.

2.BitMEX co-founder Arthur Hayes sold approximately 96,600 HYPE tokens worth around $5.1 million. With HYPE facing major unlock pressure, about $11.9 billion is expected to enter circulation in the next 24 months.

3.Large-scale linear unlocks are also coming for projects including SOL, WLD, TIA, DOGE, TAO, AVAX, ASTER, SUI, DOT, IP, MORPHO, ETHFI, JTO, NEAR, etc. Monitor potential impacts on liquidity.

4.The Bitcoin team and overall market sentiment remain cautious. The upcoming wave of token unlocks puts valuation under pressure, with short-term market volatility expected to rise.

5.The UXLINK attacker’s address suffered a loss of approximately 540 million UXLINK tokens due to signing a malicious authorization.

Market Performance

- BTC fell below $111,490, while ETH dropped to around $4,120. Market sentiment is cautious and pessimistic. In the past 24 hours, more than $1.4 billion was liquidated, mostly from long positions.

- All three major US stock indexes closed higher, with tech stocks driving both the Nasdaq and SP 500 to record highs. The Dow Jones also closed slightly higher.

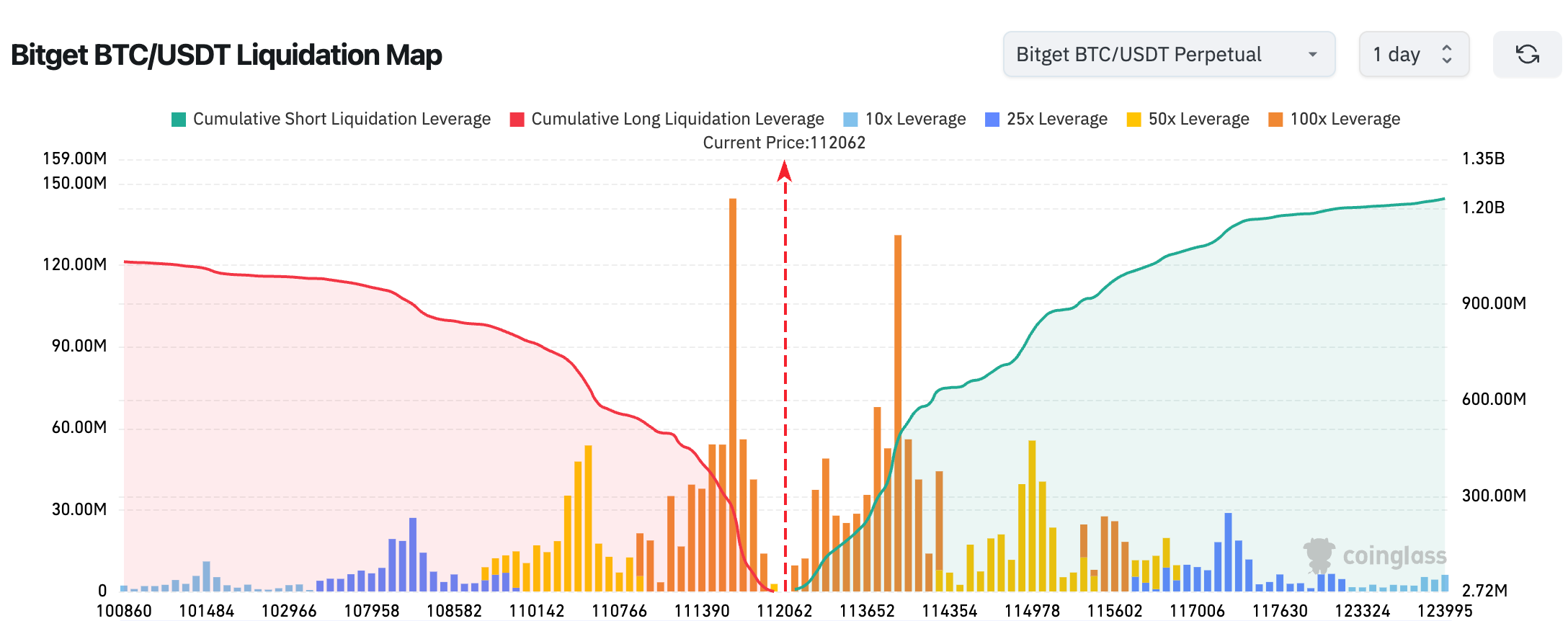

3.According to the Bitget BTC/USDT liquidation map, at the current price of $111,659, there is a substantial risk of high-leverage long liquidations in the $110,942–$114,260 range. A breakout could trigger a long squeeze and heightened short-term volatility.

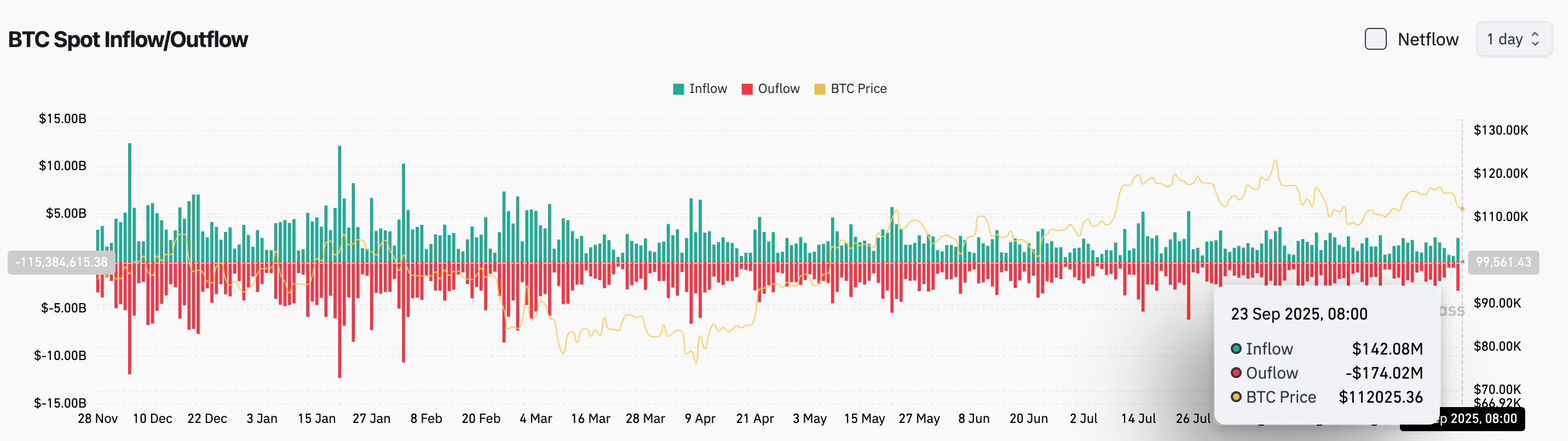

4.In the past 24 hours, BTC spot inflows totaled $211 million, while outflows reached $294 million, resulting in a net outflow of $83 million.

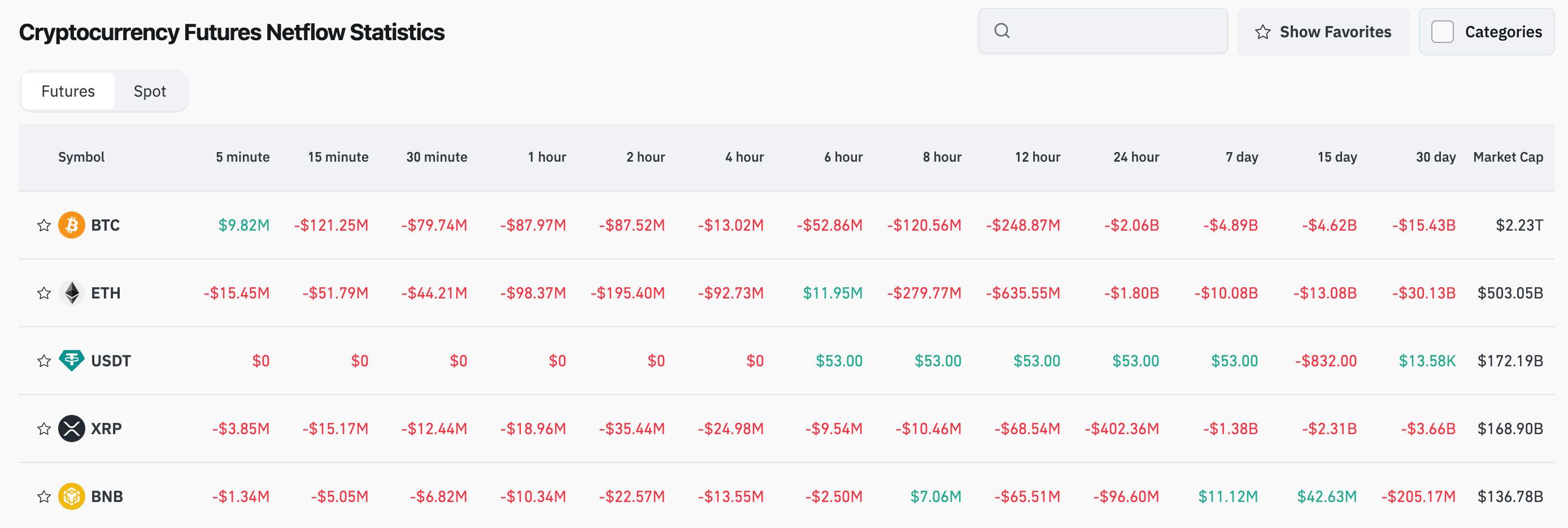

5.Over the last 24 hours, BTC, ETH, XRP, and BNB futures have seen leading net outflows, possibly presenting trading opportunities.

News Updates

- U.S. and U.K. have established a special task force to coordinate on cryptocurrency and capital markets issues.

- Deutsche Bank predicts Bitcoin could become a central bank reserve asset within ten years, serving as a complementary hedge to gold.

- U.S. lawmakers are urging the SEC to implement policies allowing 401(k) retirement plans to invest in Bitcoin and other cryptocurrencies.

- 21Shares' spot Dogecoin ETF has been listed on the DTCC under the ticker TDOG.

Project Progress

- Aria launches its institutional-grade on-chain IP investment platform, Aria PRIME.

- Pyth Network to launch CO-PIP 9 governance vote, advancing innovations in data chain subscription services.

- ssv.network will host a “Bring ETH Back – One Ethereum Again” technical event on September 24.

- Internet Computer (ICP) will hold a live AMA on Internet Identity 2.0 on September 24.

- Router Protocol (New) will initiate a DAO vote on September 24 to close down Router Chain.

- Tether denies abandoning its Uruguay mining project, reaffirming its commitment to overseas expansion.

- 21Shares has completed its spot Dogecoin ETF listing on DTCC, further enhancing its ETF product range.

Disclaimer: This report is AI-generated and manually fact-checked. It does not constitute any investment advice.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

US Lawmaker Grills Fed’s Bowman Over Digital Assets and Stablecoin Definitions

Mt Pelerin Launches Personal Crypto IBAN, Bridging Blockchain and Traditional Banking

Stable Unveils STABLE Tokenomics to Power High-Performance Settlement Network

Taurus Partners With Everstake to Bring Enterprise Staking to Institutional Custody