Stablecoin Liquidity Soars to $283B While Whales Add 800K LINK

- Stablecoin supply reached $283 billion, with 25.2 million users now active each month.

- Whales added 800K+ LINK as the price dropped from $27 to $21, eyeing a rebound.

- Analysts see whale buying and stablecoin development as signals of market recovery.

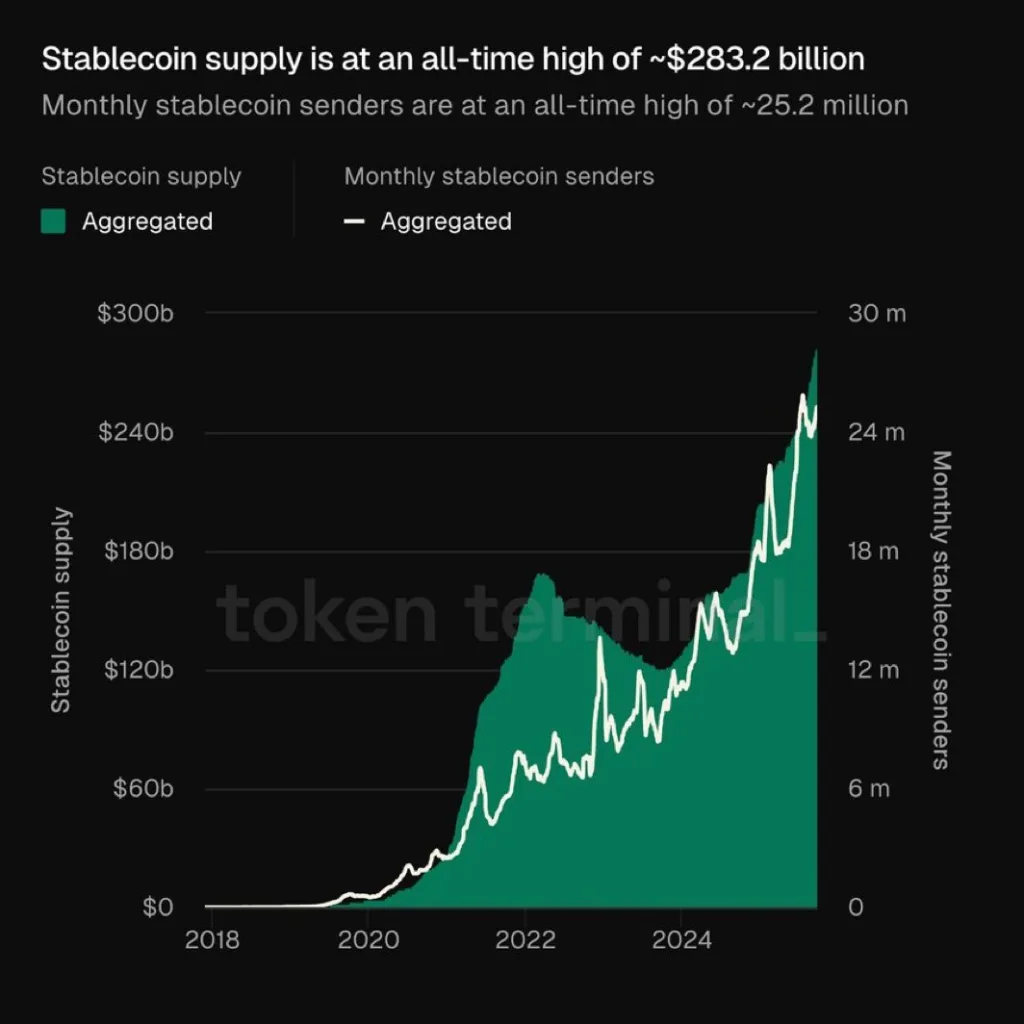

Stablecoin supply has surged to an all-time high of $283.2 billion, while monthly stablecoin senders reached a record 25.2 million, according to Token Terminal data shared by analyst QuintenFrancois. At the same time, on-chain reports show that Chainlink (LINK) whales accumulated over 800,000 LINK during the recent downturn, indicating large investor confidence despite a period of price weakness.

Stablecoin Growth Reaches Historic Levels

The Token Terminal chart tracks consistent growth in stablecoin adoption since 2018. Despite a temporary dip from mid-2022, the market recovered strongly by late 2023.

Source:

X

Source:

X

In 2024, supply expanded further, with totals approaching $300 billion. In 2025, the monthly number of stablecoin senders surpassed 24 million—from just under 6 million in 2020-reflecting huge mainstream acceptance.

QuintenFrancois stated on X that Stablecoin supply is exploding. The growth suggests that stablecoins have moved beyond niche use, now serving as adopted instruments for payments and transfers.

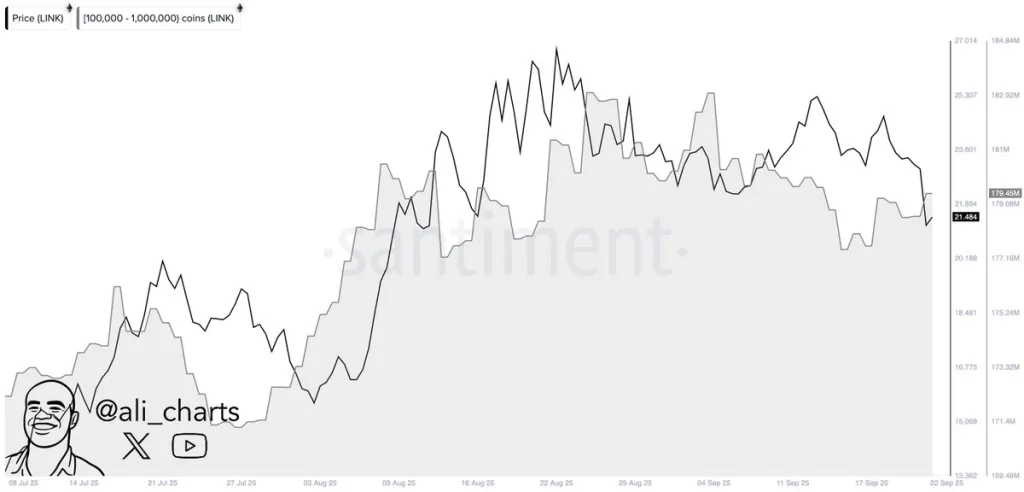

Whale Accumulation Strengthens LINK Outlook

During the latest LINK price correction, analyst Ali reported that wallets holding between 100,000 and 1,000,000 LINK accumulated over 800,000 LINK. The accumulation occurred even as LINK fell from highs near $27.01 to the current $21.48.

Source:

X

Source:

X

The data from Santiment indicates consistent buying pressure. Martinez noted that this divergence shows whales increasing their positions rather than distributing tokens. Large exchange outflows supported this pattern, suggesting whales are preparing for a longer-term rebound.

Related: Polymarket Uses Chainlink Oracles to Boost Market Integrity

Liquidity and Potential Catalysts

The combined effect of whales buying and expanding stablecoin supply brings about a fresh paradigm that could fuel renewed market activity. Stablecoins serve as on-chain liquidity, often acting as dry powder for traders and investors.

The other big catalyst could be the SEC’s potential approval of the LINK ETF. If this happens, it could usher in institutional capital and establish Chainlink as a prime player in the blockchain infrastructure space. With record liquidity, whale accumulation, and regulatory evolutions, a perfect storm is brewing that may affect LINK.

LINK Price Analysis

As of press time, Chainlink is at $21.77, and the token has observed a modest +0.55 percent daily movement. The technical analysis had set a resistance level around $25.21, with an upper cap at around $27.87. Meanwhile, the immediate support is around $21.65, with a lower level at $18.37.

Source:

TradingView

Source:

TradingView

Prices are enclosed in a symmetrical triangle, reflecting tightening volatility. Breaking out of $25.21 targets $27.87, whereas breaking down to $21.65 poses risks, with a further decline to $18.37 and a potential drop to $15.43.

On the fundamental side, LINK has a market cap of $14.78 billion and a circulating supply of 678.09 million LINK out of a total supply of 1 billion. The 24-hour volume has dropped 27.57% to $875.77 million; meanwhile, the fully diluted valuation is $21.8 billion. With whale activity and stablecoin liquidity in tow, LINK continues to remain at a critical junction between resistance and support, awaiting its next decisive move.

The post Stablecoin Liquidity Soars to $283B While Whales Add 800K LINK appeared first on Cryptotale.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitget donates HK$12 million to support fire rescue and reconstruction efforts in Tai Po, Hong Kong

Bitget Spot Margin Announcement on Suspension of ELX/USDT Margin Trading Services

Enjoy perks for new grid traders and receive dual rewards totaling 150 USDT

Bitget Spot Margin Announcement on Suspension of BEAM/USDT, ZEREBRO/USDT, AVAIL/USDT, HIPPO/USDT, ORBS/USDT Margin Trading Services