Solana price trades around $212 inside a rising wedge, repeatedly failing at the $260 ceiling while strong volume near $200 preserves structure; traders watch the wedge’s diagonal support for a breakout or breakdown that will determine the next major move.

-

Solana price near $212 with $260 as key resistance

-

Volume support around $200 keeps the trend intact despite stalled rallies

-

Wedge pattern since June signals potential compression before a decisive breakout or breakdown

Solana price analysis: SOL trades near $212 in a rising wedge; monitor $260 resistance and $200 support for the next decisive move — read strategy insights now.

Solana holds near $212 within a rising wedge as $260 remains tough resistance, with volume support guiding the next major move.

- Solana trades near $212 while holding its rising wedge, with $260 resistance keeping traders cautious about the next move ahead.

- Strong volume support near $200 keeps Solana’s structure intact as rallies repeatedly stall below the critical $260 ceiling.

- Solana moves within a wedge pattern since June, balancing buyer support and seller pressure as traders watch for breakout signals.

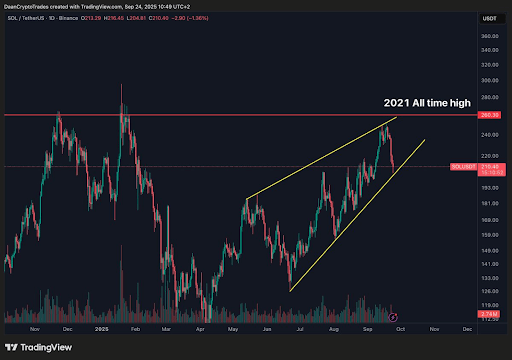

Solana price trades near $210 after sharp swings in recent weeks. The token now sits well within a rising wedge pattern, a setup that traders closely monitor for breakout or breakdown signals. Solana price remains capped near $260 while buyers defend diagonal support around $200–$210.

What is the current technical setup for Solana price?

The current technical picture shows Solana price compressed inside a rising wedge since June, with the lower diagonal holding support and the upper trendline repeatedly capping rallies around $260. Volume spikes near support suggest buyer interest, while failed advances indicate persistent seller pressure.

Professional commentators monitor the wedge because it often precedes a strong directional move. Price oscillations have compressed volatility, increasing the likelihood of a decisive breakout (above $260) or breakdown (below trendline support near $200).

How has Solana performed since early 2025?

Solana entered 2025 in the $140–$150 range, surged above $260 in January–February, then corrected sharply in March–April to near $120–$130. Mid-year recovery re-established an ascending channel before the wedge formed in June. The pattern now shows clearly defined upper and lower trendlines with repeated tests of both.

Market participation increased on recoveries, evidenced by rising volume during rallies. That growing volume on upswings contrasted with muted selling on dips, a sign that buyers remain engaged despite resistance near the 2021 peak.

Source: Daan Crypto Trades

Why is $260 a critical level for Solana?

$260 represents Solana’s 2021 peak and a psychological resistance zone. Multiple rallies this year reached this area and reversed, establishing $260.30 as a technical ceiling. A sustained close above $260 would invalidate the immediate wedge ceiling and likely trigger renewed upside momentum.

Conversely, failure to clear $260 combined with a break below the wedge’s lower trendline could accelerate downside, potentially testing the $180–$200 region where prior volume support concentrated.

How should traders use volume and trendline confirmation?

Traders should look for higher-than-average volume on a breakout above $260 to confirm bullish intent. On the downside, a breakdown accompanied by expanding volume suggests distribution and higher downside risk. Use tight risk controls: set stops beneath the confirmed trendline support on long positions and consider scaled entries after confirmation.

Quotes from market commentators remain relevant: Daan Crypto Trades noted that “$SOL is moving higher within this rising wedge with relatively volatile price action” and that the diagonal support “held since June.” Milk Road observed the same wedge dynamics and highlighted the potential for a pullback before retesting the wedge top.

Source: Milk Road

When should traders expect a decisive move for SOL?

Expect a decisive move when price either closes and holds above $260 on increased volume or breaks and closes below the wedge lower trendline with expanding volume. Watch oscillators and volume profile for confluence. Timeframe can vary; wedges often resolve within a few weeks of clear trendline compression.

Frequently Asked Questions

What defines a rising wedge in crypto charts?

A rising wedge is a bearish-converging pattern where higher highs and higher lows form narrowing range; it often resolves as a breakdown, though breakouts can occur if momentum and volume confirm bullish strength.

Is $200 a reliable support level for Solana?

Yes. Historical volume and recent price reactions show $200–$210 as an active support area; continued buyer interest at this level would preserve the wedge structure and reduce immediate downside risk.

Key Takeaways

- Technical setup: Solana sits in a rising wedge, testing diagonal support since June.

- Critical levels: $260 is major resistance; $200–$210 is primary support to watch.

- Trading action: Seek volume-confirmed breakouts above $260 or breakdowns below wedge support before committing large positions.

Conclusion

Solana price remains range-bound within a rising wedge, balancing $260 resistance and $200 support as volume dictates the next directional move. Traders should prioritize confirmation via volume and trendline closes. COINOTAG will continue to monitor price action and provide timely updates as the pattern resolves.