Aster S2 Sprint Guide: $700 million airdrop, how can retail investors participate effectively?

Source: Blockbeats

Original Title: Planning a $700 million airdrop, What’s the Best Way to Farm Aster S2?

Pumping the price is the best publicity.

In just one week, the Aster platform’s new user count has surpassed 710,000, and the perpetual contract trading volume in the past 24 hours reached $21.112 billion, more than double that of the veteran DeFi derivatives platform Hyperliquid. The platform’s TVL has reached $1.744 billion, with a 24-hour revenue of $7.12 million, ranking just behind stablecoin giants Tether and Circle in the global revenue leaderboard.

Besides “Can you still buy ASTER?”, “Can you still farm Aster?” is also a frequently asked question.

Aster’s second season airdrop has 11 days left, with the airdrop pool accounting for 4% of the supply, about 320 million ASTER. This means that, at the time of writing and at the price of $2.3 per ASTER, the S2 airdrop is worth over $700 million. Against this backdrop, BlockBeats has summarized the core airdrop farming strategies for Aster right now.

1. Aster × Backpack Hedging Arbitrage Strategy

This is currently the main point-farming strategy. The core steps are: place opposite orders for the same asset on two trading platforms (such as Backpack and Aster) simultaneously to achieve “point farming + fee spread capture.”

The only thing to note: use “market orders” on Aster, because taking liquidity on Aster earns double points.

The detailed steps are: place a “limit order” to short $ASTER on Backpack to earn maker points; then use a “market order” on Aster for immediate execution. Also, market orders must be executed quickly; otherwise, if one side is not filled, you may be exposed to one-sided risk.

Additionally, you need to manage the weight of holding time and opening frequency yourself. The longer the position is held, the higher the points, but the points cap is twice the weekly trading volume.

To avoid being flagged as a Sybil, try changing various parameters, such as position size, leverage, direction, etc. Don’t always use the same set of parameters, or high-frequency hedging may trigger risk controls and Sybil detection. Beginners should start with small amounts and gradually increase leverage and size as they get comfortable.

2. Funding Rate Arbitrage

This strategy builds on the dual-platform hedging, taking it a step further by arbitraging the funding rate.

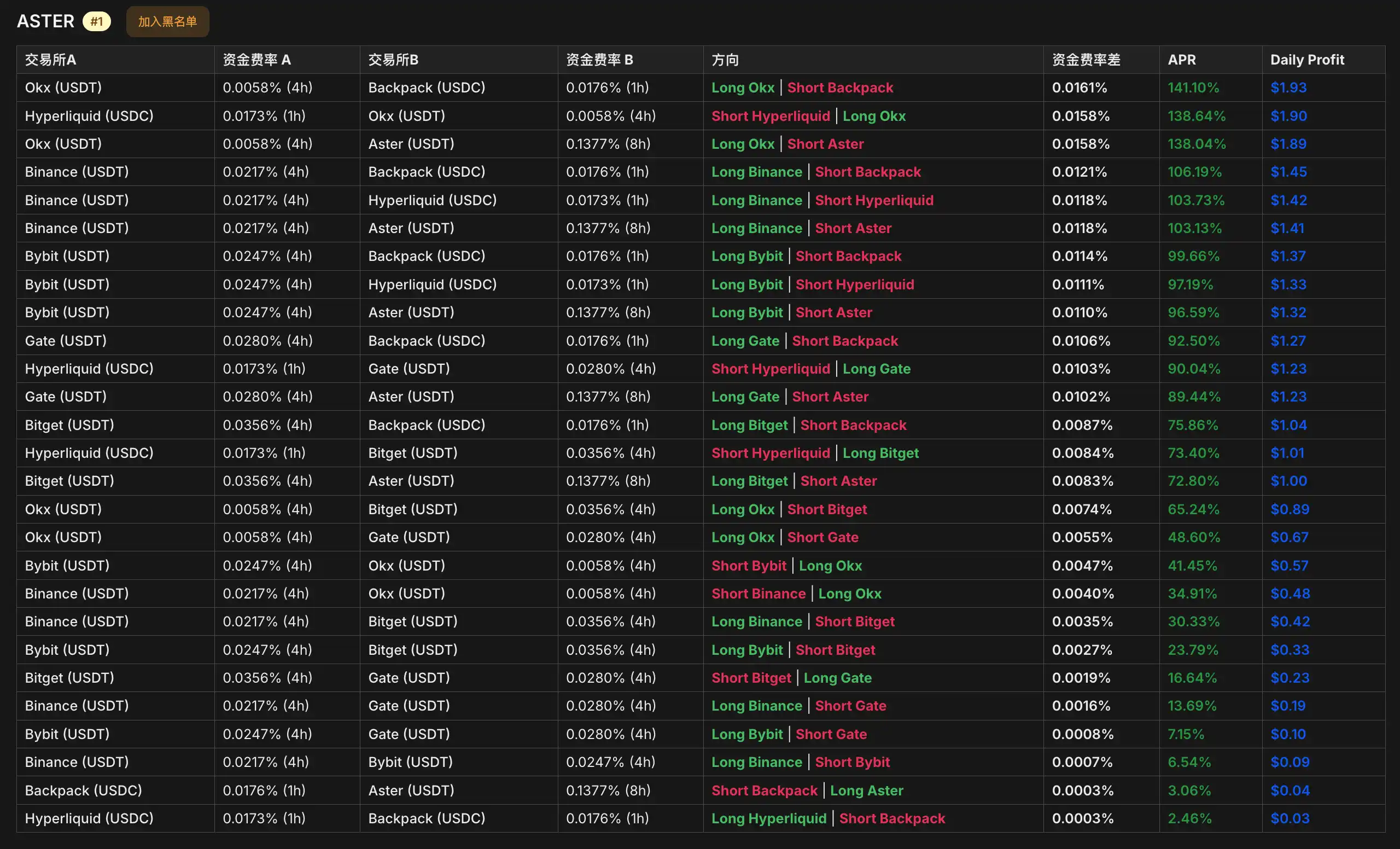

This mainly leverages the funding rate mechanism of perpetual contracts. When the funding rate is positive, short perpetuals to earn the funding rate; when the funding rate is negative, long perpetuals to earn the funding rate. There is usually a difference in funding rates between two trading platforms. For example, the tool in the image below shows the funding rate differences, suitable position directions, and APRs across platforms.

Data source: hibot

Continue to use the previous Backpack (limit order) + Aster (market order) spot hedging method to earn points. Net profit = point value + funding rate income – fee cost – slippage loss.

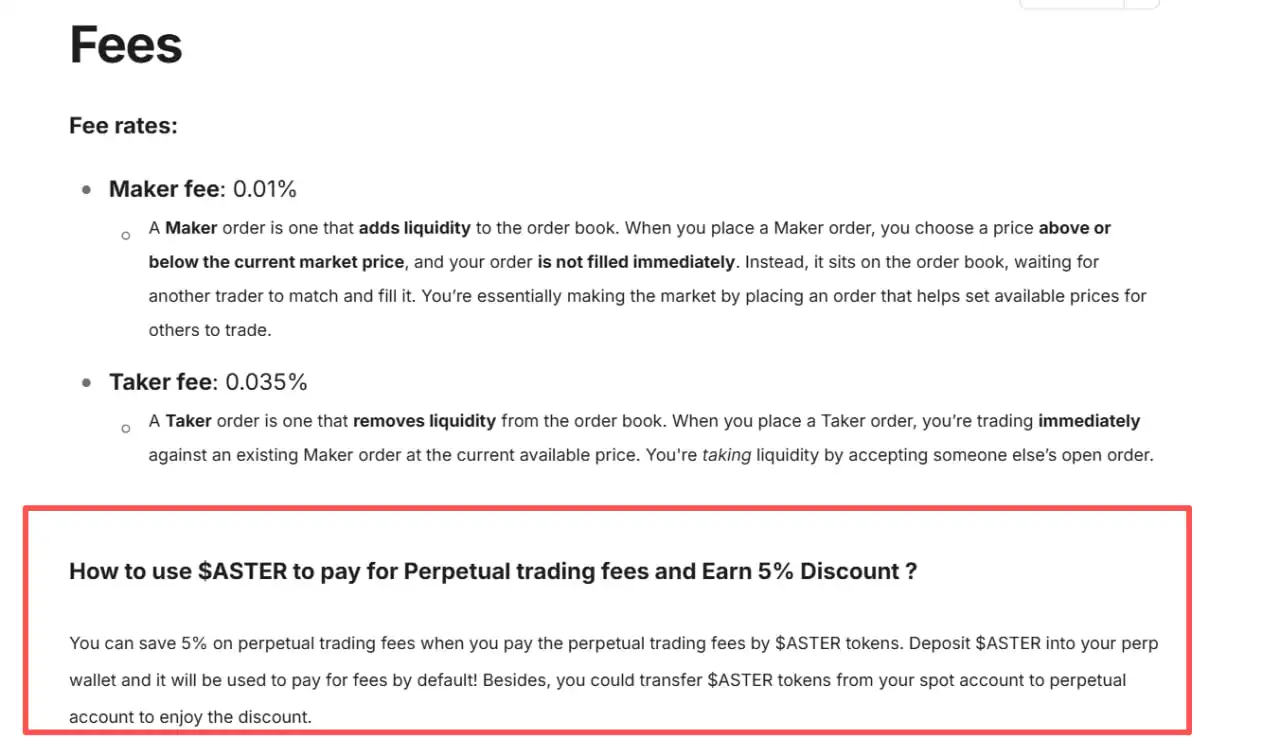

Be sure to consider the fee structure of the trading platforms. Fees are usually of two types: Taker (market order): orders executed immediately, higher fees; Maker (limit order): orders placed on the order book waiting to be filled, lower fees.

Since real-time monitoring is required, this is suitable for experienced traders or those using funding rate bots. Pay attention to latency and reconciliation between multiple accounts and platforms. Funding rate arbitrage usually takes longer than point arbitrage, so don’t neglect position management.

3. Deposit and Convert to USDF

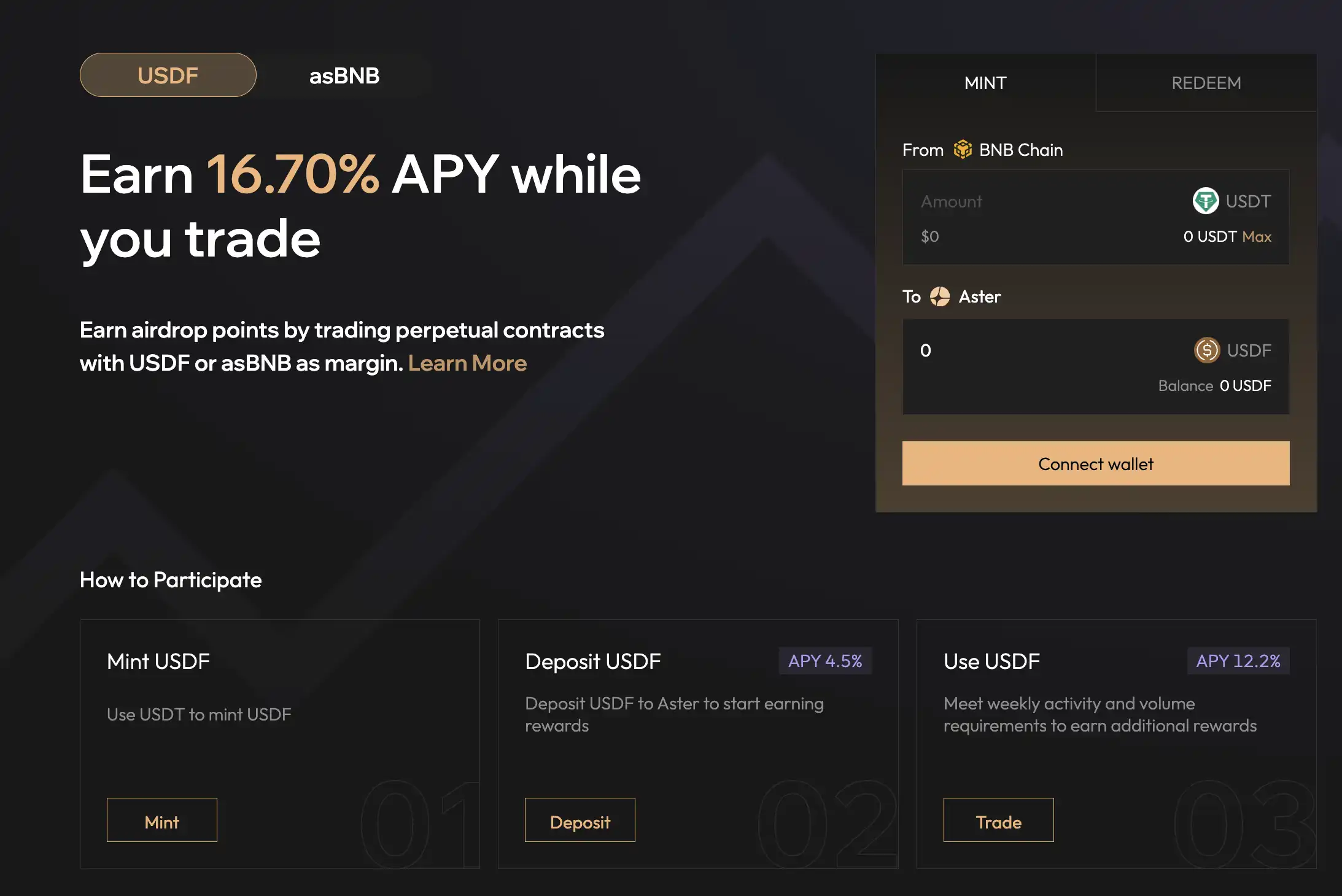

Besides the hedging and funding rate strategies mentioned above, Aster also offers a relatively “low-risk, passive income” approach based on the “Trade & Earn” system with USDF and asBNB. This product continues Aster’s previous experience in staked asset liquidity, essentially combining “trading” and “wealth management,” allowing users to remain active in trading while also enjoying stable annualized returns.

Currently, USDF offers about 16.7% annualized yield (APY), with two ways to participate: First, deposit rewards—if your account holds more than 1 USDF, you automatically earn interest; second, trading rewards—which require users to be active at least 2 days per week and have a cumulative trading volume over 2,000 USDT. Once the conditions are met, the system distributes rewards the following week directly to your trading account and automatically reinvests them.

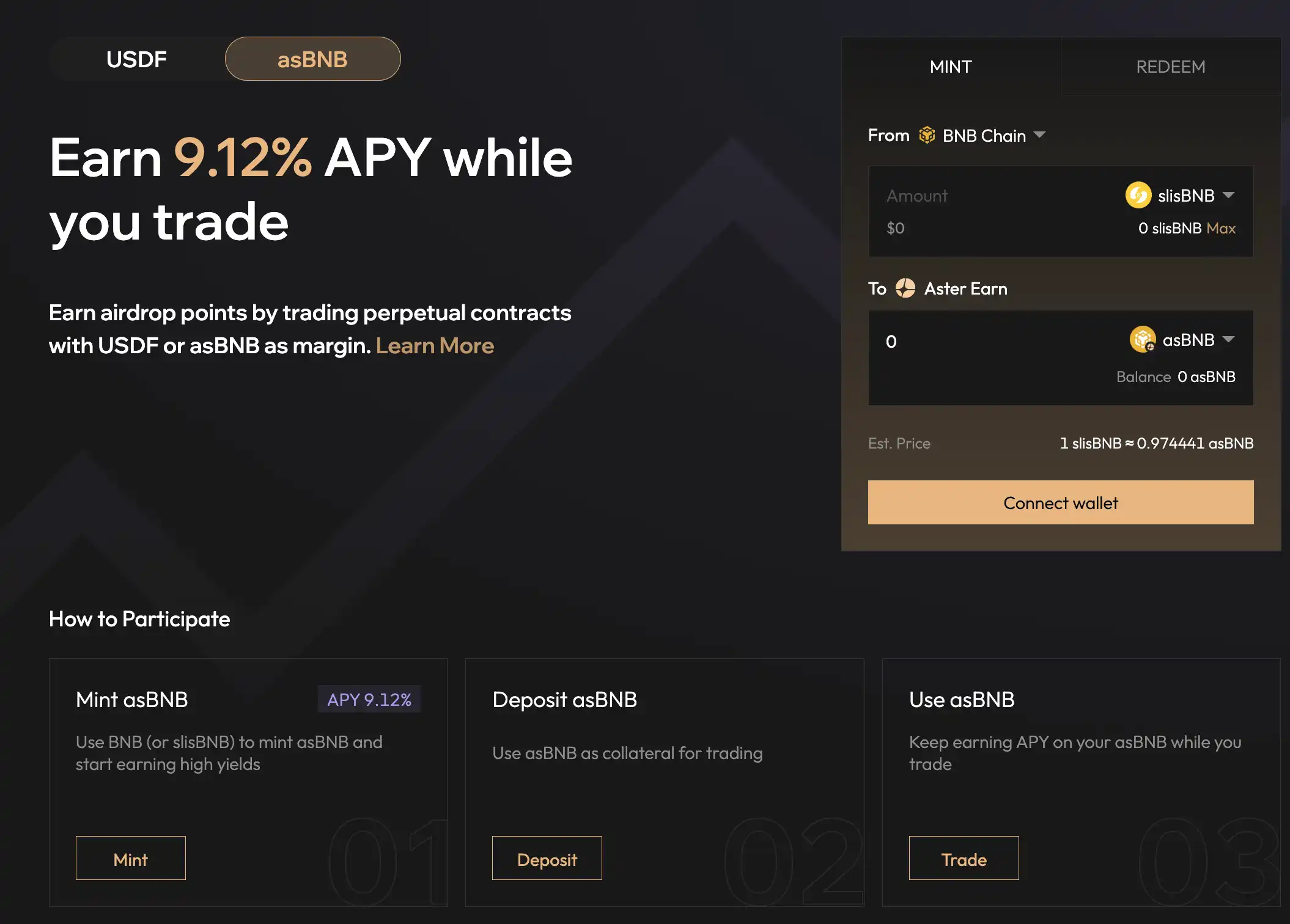

Besides USDF, Aster also offers asBNB, which functions similarly to USDF. Users can swap BNB or slisBNB for asBNB to use as margin, while enjoying about 9.1% annualized yield.

Furthermore, Aster has introduced a “double points” mechanism in its incentive design. If you use USDF or asBNB as margin, your trading points are doubled, and the weekly trading volume points cap is also increased to twice the normal limit. For those seeking airdrop points or rebate rewards, using these two assets is almost a must, as it stacks interest income and point advantages on top of trading.

In addition, holding $ASTER gives a 5% discount on trading fees, so it’s best to keep some $ASTER in every wallet.

4. Team Bonus

Individual players can only earn limited points, but if you can form a “team” and expand your network through invitations, you can leverage the points generated by others’ trading and further increase your share in the global ranking through team rankings. In the long run, the points an individual account can farm may be far less than the total contribution of an active team, so “invitation + team” will be the key for players to widen the gap in the later stages.

The core logic is to integrate the power around you into a team through the dual mechanisms of “referral” and “team contribution” to boost your own points.

Specifically, invitation rewards are divided into two levels: if you invite a first-level user, you get 10% of the Rh points they generate; if it’s a second-level user (i.e., someone your direct invitee invites), you get a 5% share of their points. Note that this share only applies to their trading point earnings, not referral or team points themselves, preventing “infinite nesting.”

Aster has also introduced the concept of Team Points. Think of it as a team; each team’s points are settled on T+1 and compared horizontally with other teams. Before final point distribution, the system will make some “fairness adjustments,” including limiting monopolization by large holders and smoothing out abnormal fluctuations. In other words, team rewards are not just about “the more people I invite, the better,” but rather a comprehensive evaluation of “team activity” + “overall contribution share.”

Ultimately, these scores are converted weekly into your share of the platform-wide point pool, directly determining how much you can get in the upcoming $ASTER airdrop distribution. Simply put: referral relationships give you a stable 10%/5% share; team points determine whether you can get into the top ranks and earn higher extra rewards.

Aster’s second season airdrop has 11 days left, with the airdrop pool accounting for 4% of the supply, about 320 million ASTER. At the time of writing, the S2 airdrop is worth over $700 million.

Facing such massive user growth and a complex points ecosystem, the Aster team has also made it clear: professional market makers will be excluded from the Rh points system and will not be eligible for the $ASTER token airdrop. In the current second phase of Rh points calculation, pure spot holding and trading are not included in the points system for now, but this does not mean spot trading is worthless—based on official statements, it’s not hard to infer that the Q3 airdrop rules are likely to include spot trading back into the points calculation.

Therefore, for now, there are still many opportunities for retail investors. However, note that the market is overheated, FOMO sentiment is high, scripts are everywhere, and the distribution time for the second season airdrop is uncertain, so competition is fierce and users need to manage their risks.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

The Federal Reserve is likely to implement a hawkish rate cut this week, with internal "infighting" about to begin.

This week's Federal Reserve meeting may feature a controversial "hawkish rate cut." According to the former Vice Chair of the Federal Reserve, the upcoming 2026 economic outlook may be more worth watching than the rate cut itself.

Discover How ZKsync Fast-Tracks Blockchain Security

In Brief ZKsync Lite will be retired by 2026, having achieved its goals. ZKsync team plans a structured transition, ensuring asset security. Future focus shifts to ZK Stack and Prividium for broader application.

Bittensor Follows Bitcoin Path With TAO Halving

Mining Sector Falls 1.8 % Despite Bitcoin Rally