You need these tools for trading on Perp Dex

They allow you to get ahead of the curve earlier.

As the founder of Binance, CZ has directly proclaimed the arrival of the Perp Dex era—enough said. There are many Perp Dex products, with issues such as funding rate discrepancies, cross-platform price deviations, and lack of transparency in position information. To participate in the market more efficiently, auxiliary tools have become essential for many players. BlockBeats has compiled several practical PerpDex tools.

On-chain Wallet Analysis

Whether on-chain or on centralized trading platforms, the movements of smart money have always been a concern. They often bring more trading momentum than KOL followers, since tracking them is usually a spontaneous behavior, especially with the emergence of tools for analyzing on-chain trading addresses. Whether during the memecoin craze or prediction market periods, such auxiliary projects are always among the first to appear, and PerpDex is no exception.

Coinglass

Players who frequently participate in secondary market trading are surely familiar with this website. As one of the oldest data sites, its data covers most usage scenarios, including Funding Rate, institutional ETF, options, and more for various tokens on trading platforms.

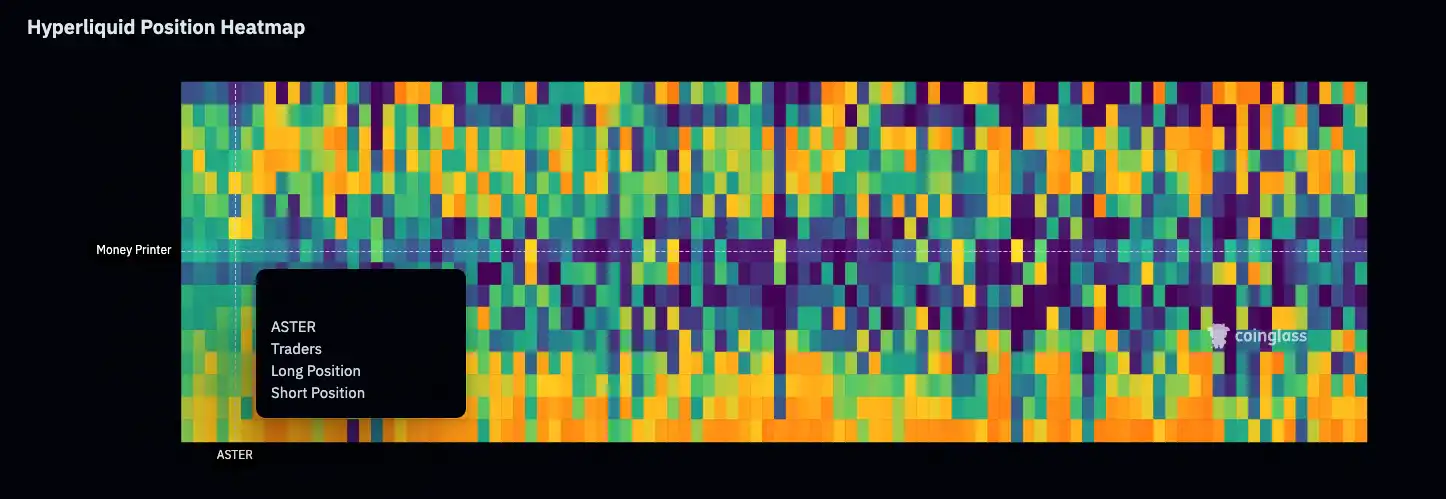

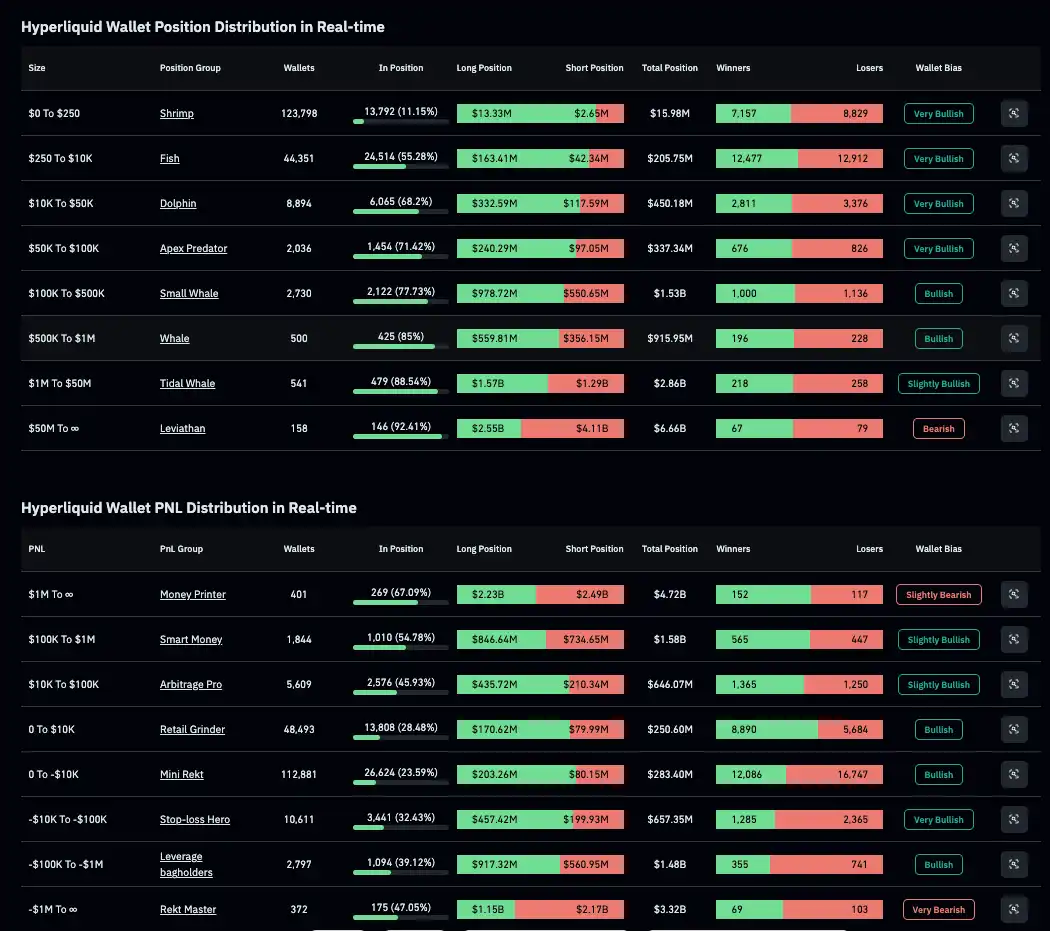

However, for PerpDex, the currently available public data only includes wallet analysis related to Hyperliquid, but the way this data is presented is quite interesting. Coinglass categorizes users into 16 types based on position size and profit or loss (similar to the 16 MBTI types). Using this user heatmap, you can intuitively see these 16 user types’ views (bullish or bearish) on a major token.

As shown in the figure, the attitude of "MoneyPrinter" users who have earned over $1 million towards Aster at present

The second feature is the overall ratio of long/short and win/loss among these 16 user types. At a glance, it reflects the current market stance of players at each position. For example, the proportion of open positions among Shrimp ($0–$250) and Fish ($250–$10,000) like myself is not high, while players with positions over $10,000 are almost all actively trading.

HyperBot

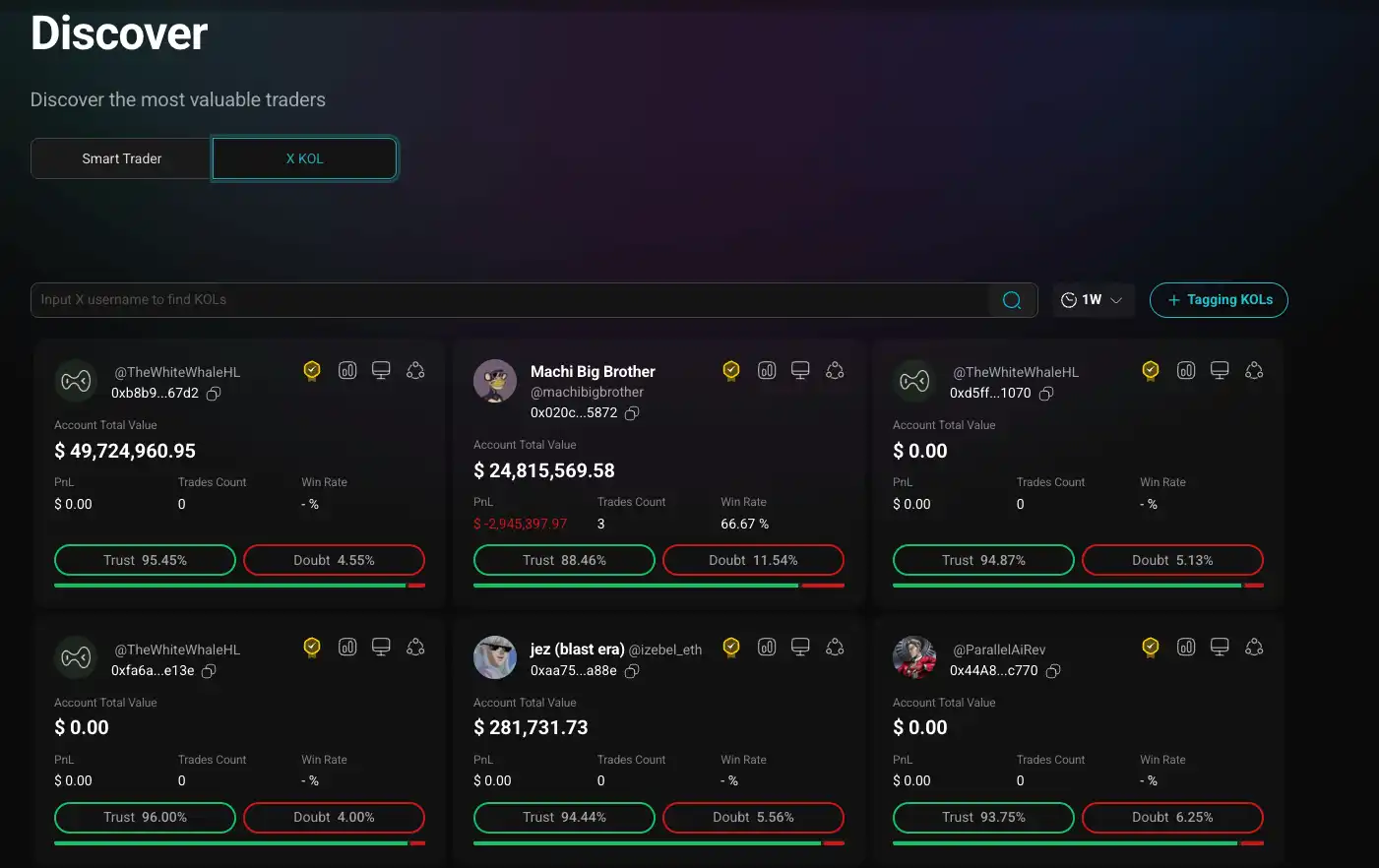

When it comes to tracking smart wallets, Hyperbot is definitely a recent hotspot. Originally a tool in the Hypeliquid ecosystem, it later expanded to the Aster platform. More importantly, it can provide real-time alerts on large account position changes and fund flows, allowing ordinary users to capture smart money movements instantly.

The smart money exploration page provided by HyperBot, similar to the experience meme players have on GMGN or Axiom.

Hyperbot’s token BOT has already launched on Binance Alpha. Due to the recent popularity of Aster and the start of the second airdrop event, the price trend of HyperBot’s token $BOT has also been quite impressive, with a current market cap of $15 million and an FDV of $1.4. For users observing fund behavior, Hyperbot has become a relatively comprehensive assistant.

Further reading: "A $700 million airdrop, how to best farm Aster S2"

Arbitrage

As more perpdex platforms emerge, price and interest rate differences between platforms create arbitrage opportunities. With the prevalence of PerpDex, corresponding data platforms have also started to include this in their data collection scope.

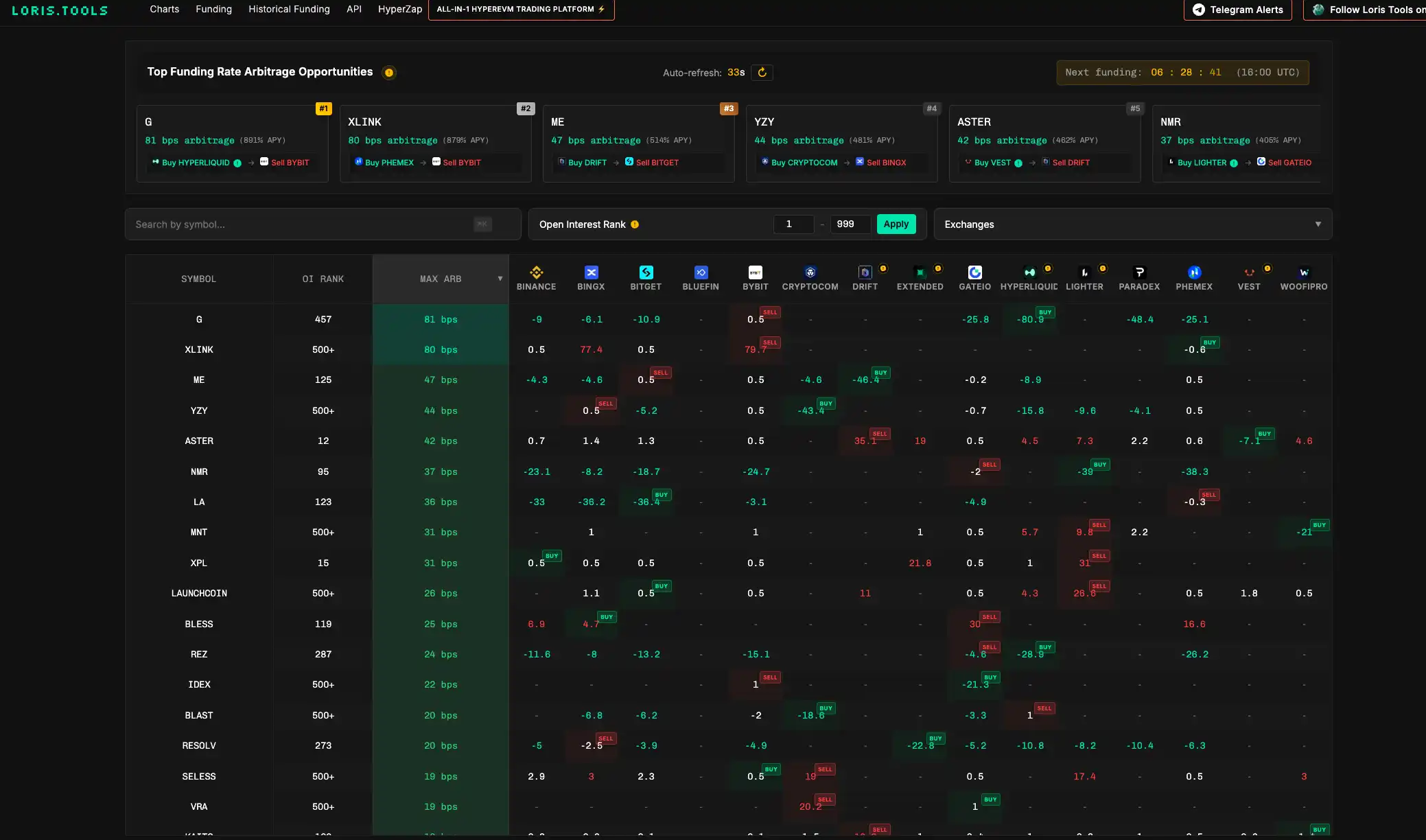

Loris Tools

Loris Tools is a funding rate arbitrage dashboard and market data platform developed by Loris, the founder of HyperZap. The data is relatively clear, showing essential metrics such as OI, the basis points of maximum arbitrage opportunity, and which platforms to operate on. The dashboard updates automatically every 60 seconds and features a scrolling "Best Arbitrage Opportunities" bar.

In addition to tracking on the dashboard, users can also set TG BOT alerts. However, different platforms have different settlement times, so users need to be quite familiar with these mechanisms to use it effectively.

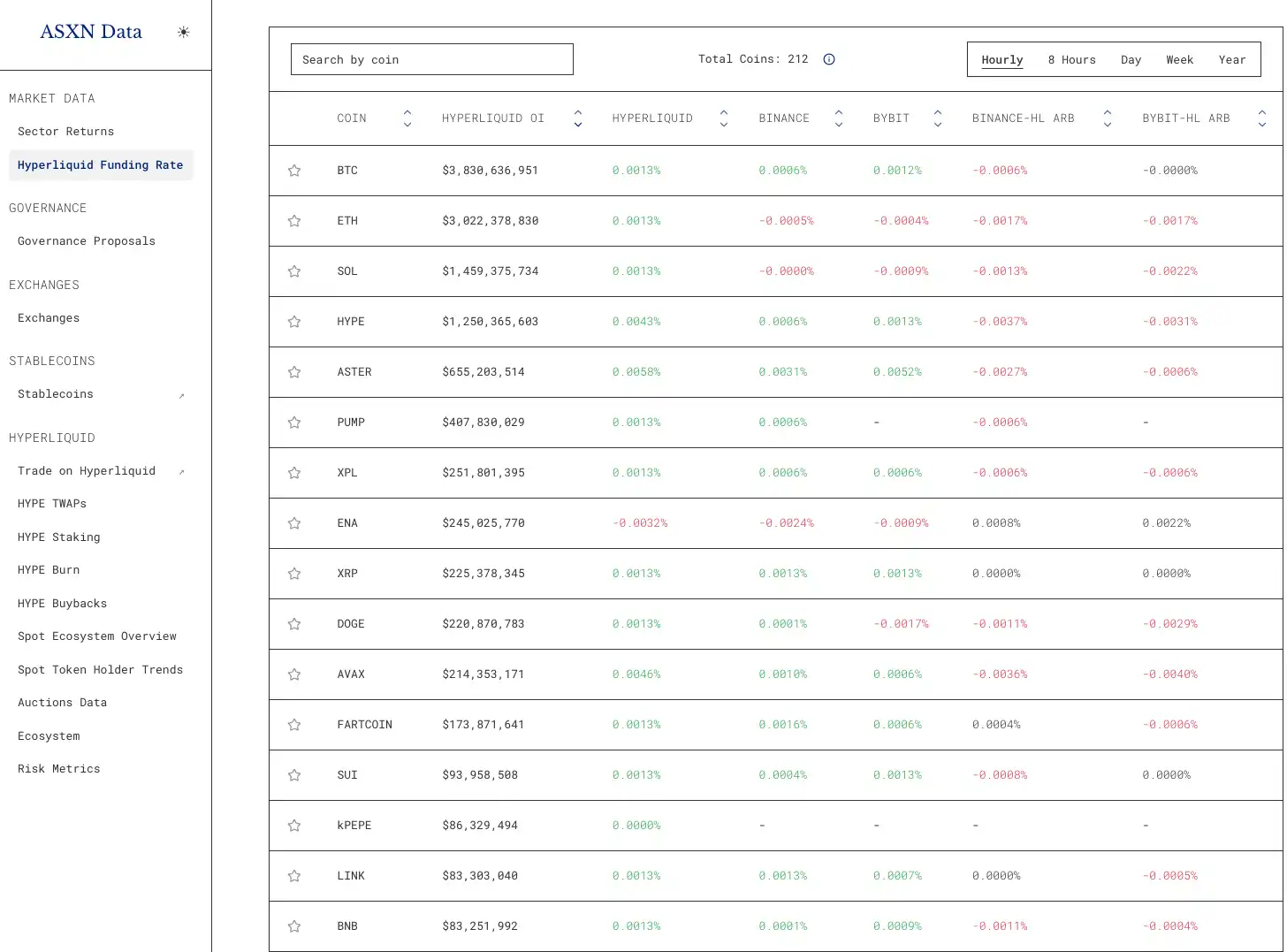

ASXN

Although ASXN is not as comprehensive as Loris in the funding rate data field, its functionality goes far beyond that. ASXN DATA is a dashboard created by crypto researcher ASXN, providing an almost complete set of Hyperliquid data dashboards.

Users can view recent overall trading activity in the Ecosystem Overview interface, and delve into liquidity risks of specific tokens in Risk Metrics. Furthermore, the TWAPs page gives a clear overview of validator distribution and status. These tools consolidate originally scattered on-chain information into actionable data panels, providing strong support for traders with in-depth needs. Unfortunately, the current PerpDex data on the dashboard only includes the Hyperliquid ecosystem.

Data Dashboards

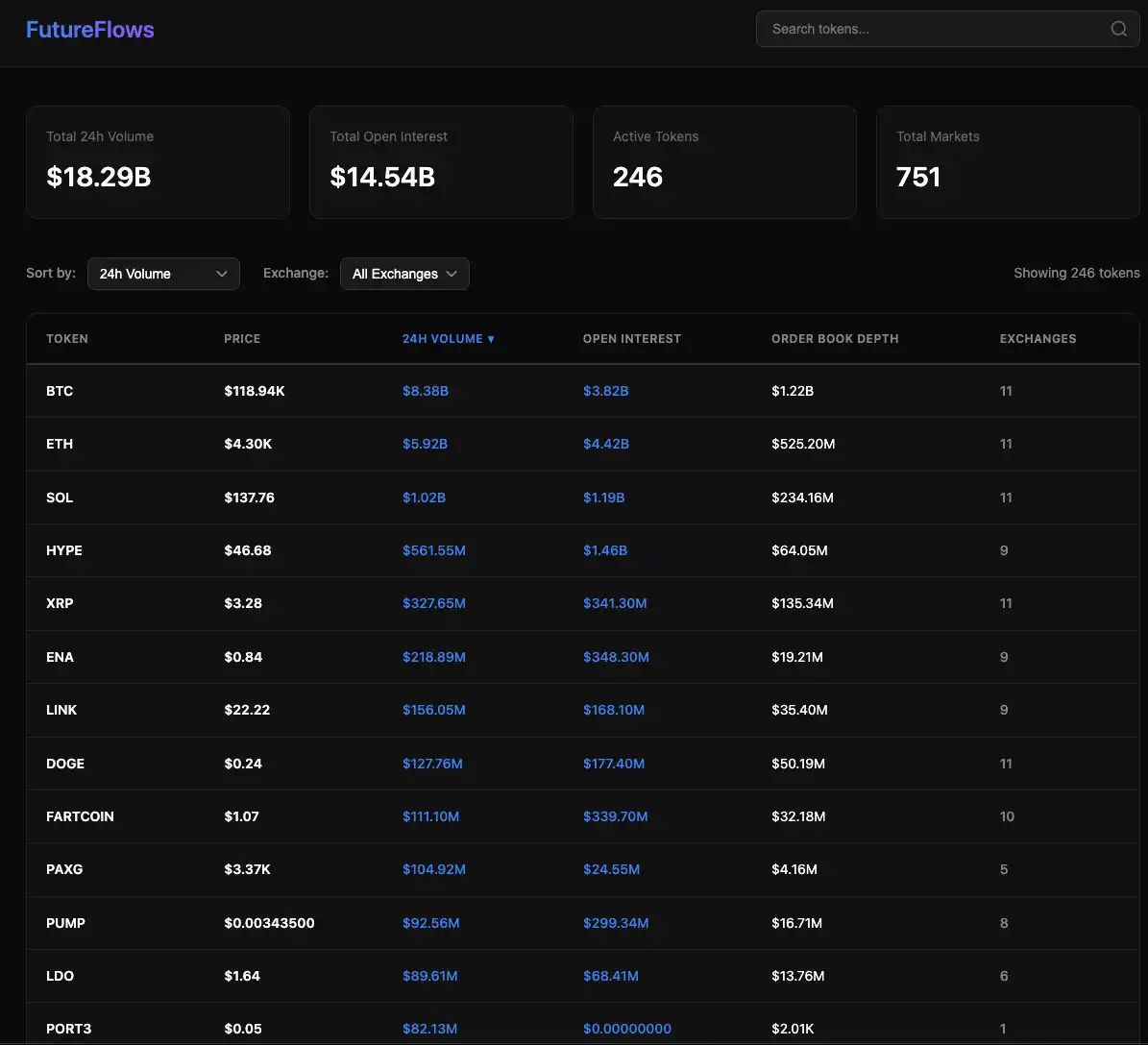

FutureFlows

Unlike Coinglass’s token trading volume heatmap, Future Flows provides more holistic data, covering most PerpDex data on the market. From this dashboard, you can get an overview of the on-chain trading situation for most tokens.

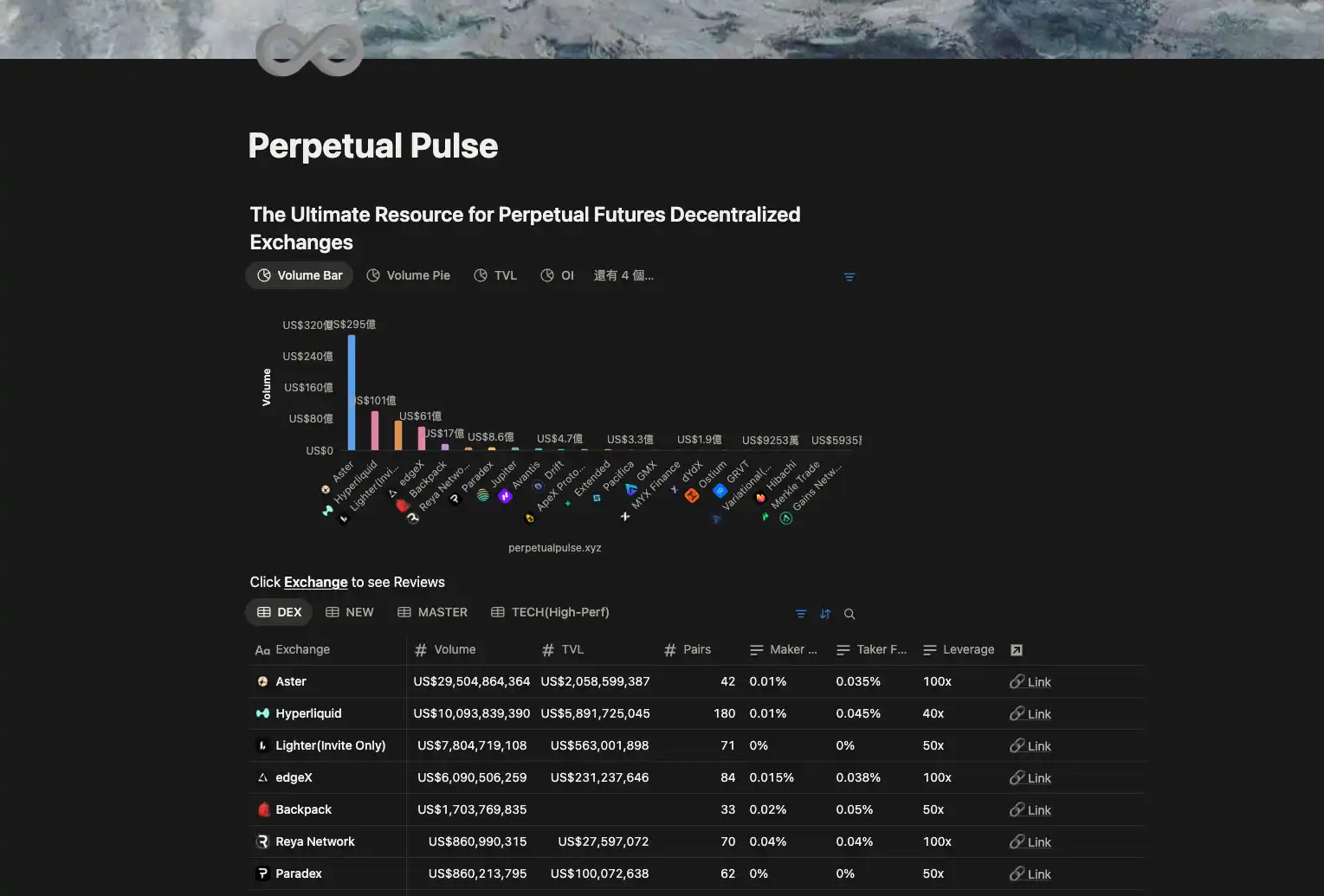

Perpetual Pulse

Perpetual Pulse is a PerpDex data dashboard created by Lighter team member hansolar, offering similar overall market data monitoring features. It tracks contract trading volume, TVL, and OI across multiple chains, with real-time market updates.

Traders can use the platform to view trading volume trends and fund flows for different projects, helping to assess market sentiment and trending sectors.

Trading Tools

Pear Protocol

Pear Protocol is a contract trading aggregator supporting both SYMM (Symmetric Network) and Hyperliquid ecosystems. It has already accumulated nearly $1 billion in trading volume.

Users can access the contract markets of both networks via the Pear platform, eliminating the hassle of manually switching wallets and exchanges. It is suitable for active derivatives traders. Its biggest product advantage is the ability to open both long and short positions for hedging simultaneously, and it offers Pair Markets that update in real-time with suitable pairs for hedging.

As shown in the figure, BNB/FTT can be leveraged up to 3x in the Hyperliquid environment, while in the SYMM environment, pairs like BTC/ETH can be leveraged up to 54x

The platform token $Pear of Pear Protocol is issued on Arbitrum, with a current market cap of $4.2 million and an FDV of $15 million.

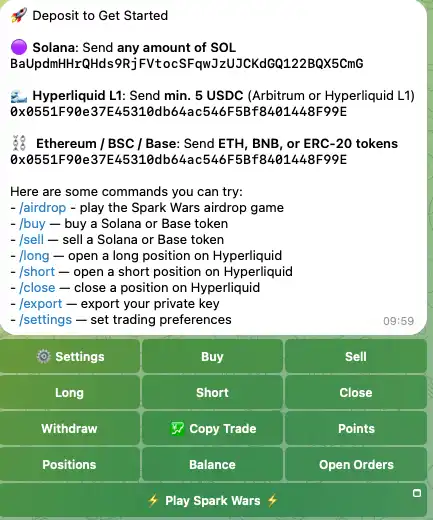

Spark

Spark is a TG trading terminal dedicated to multi-chain trading. Recently, it started supporting contract opening, closing, and smart wallet copy trading on multiple PerpDex platforms. Its all-in-one interface greatly simplifies switching between different PerpDex platforms.

This tool currently covers several mainstream on-chain PerpDex platforms, including Hyperliquid and Aster, and also provides real-time quotes such as deep order books and funding rates. Although the advantage of TGBOT is less obvious now that many platforms have mobile apps, it still brings convenience to multi-platform trading.

Live Streaming Platforms for PerpDex?

Recently, at a KBW SideEvent (Perp-Dex Day), traders live-streamed trading on four major PerpDex platforms, which went viral and was interpreted as "Koreans have turned trading into a live gaming experience."

In terms of reach, the event organizers par_D & Magon were undoubtedly very successful. It also shows that this trading state seems to have been accepted by most crypto players. When the live streaming sector was booming, besides various abstract streamers, the most popular were live trading streams, which accompanied many late-night "dog hunters" in unexpectedly finding some "golden dogs."

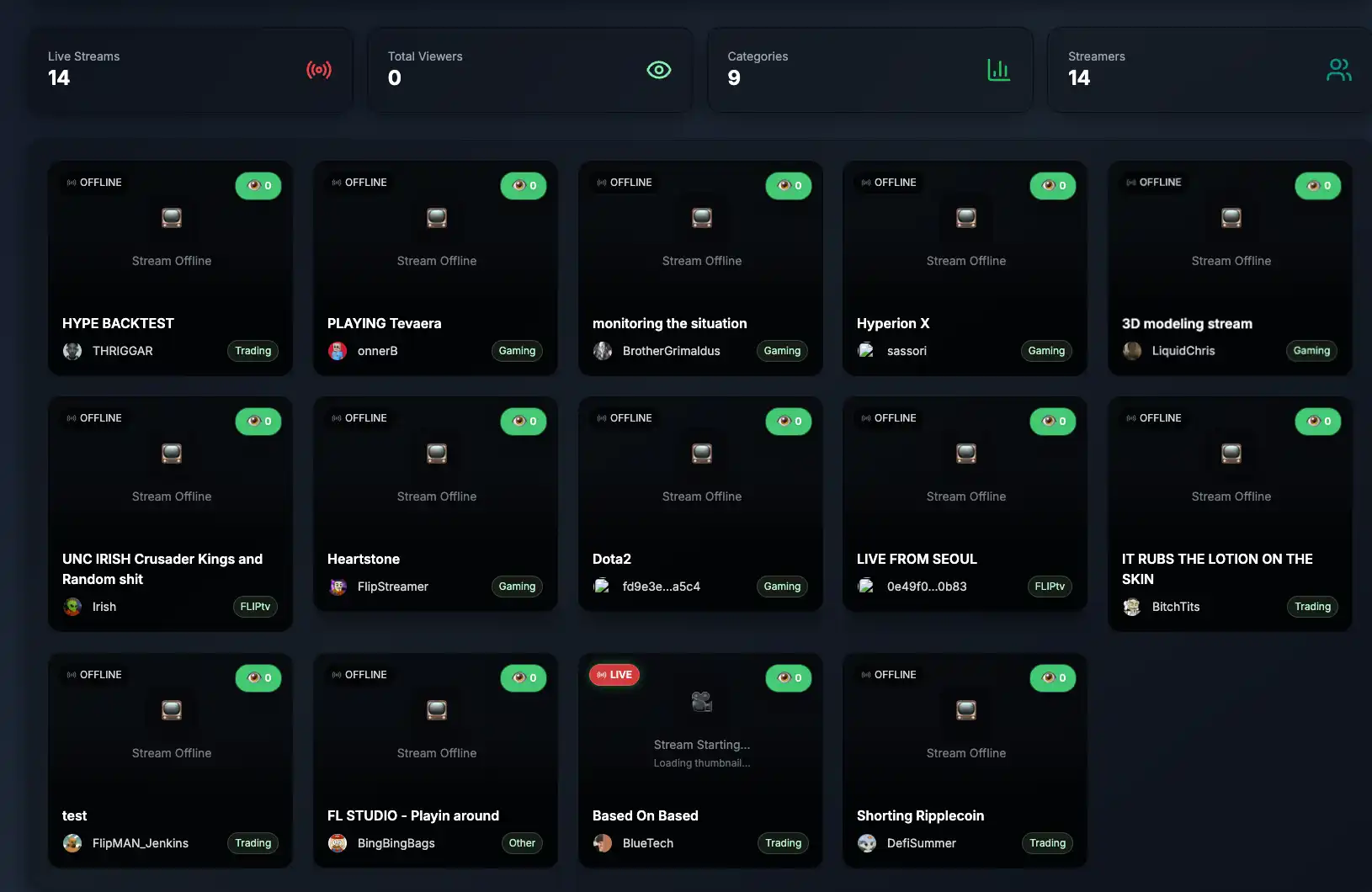

FLIPgo

Besides Solana, Base, and BSC, there is actually a live streaming platform on Hyperliquid as well. Although FLIPgo is not yet fully developed in terms of streaming volume and product UI, if it can excel in the vertical PerpDex sector, its potential as an "esports platform" is considerable.

As expected, FLIPgo also has its own streaming token $FLIP, now issued on HyperEVM, with a current market cap of $1.5 million.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Q3 earnings season: Diverging strategies among 11 Wall Street financial giants—some are selling off, while others are doubling down

Technology stocks led by Nvidia have become a key reference signal for global capital allocation strategies.

Highlights from the Ethereum Argentina Developers Conference: Technology, Community, and Future Roadmap

While reflecting on the past decade of infrastructure development, Ethereum clearly outlined its key priorities for the next ten years at the developer conference: scalability, security, privacy, and institutional adoption.

Compliance Privacy: What is Kohaku, Ethereum’s Latest Major Privacy Upgrade?

Vitalik once said, "If there is no privacy transformation, Ethereum will fail."

Ethereum Argentina Developers Conference: Towards a New Decade of Technology and Applications

While reflecting on the past decade of infrastructure development, Ethereum clearly outlined its key priorities for the next ten years at its developer conference: scalability, security, privacy, and institutional adoption.