Celestia Upgrade and Proof-of-Governance: A Turning Point for TIA?

Celestia’s Matcha upgrade and PoG proposal could transform TIA into a deflationary asset. But execution and adoption will decide if it breaks out.

Celestia is entering a pivotal stage with two fundamental changes: the Matcha upgrade and the proposed Proof-of-Governance (PoG).

These technical improvements and a restructuring of tokenomics could transform TIA from a highly inflationary token into a potentially deflationary asset. With rising community expectations and a rapidly expanding ecosystem, the question is: Can TIA break out strongly in the coming years?

Matcha: Technical upgrade and supply tightening

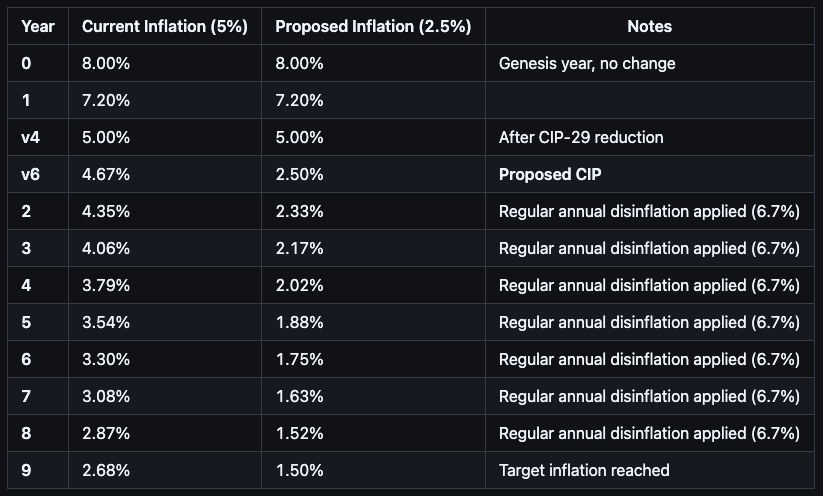

According to Celestia’s official announcement, the Matcha upgrade will increase block size to 128MB, optimize block propagation, and improve performance under proposal CIP-38. More importantly, the CIP-41 proposal reduces annual inflation from around 5% to 2.5%, directly tightening TIA’s circulating supply. This change makes TIA more attractive to long-term investors and strengthens its role as a potential collateral asset in DeFi.

Inflation rate over time for Celestia. Source:

Celestia

Inflation rate over time for Celestia. Source:

Celestia

Beyond supply dynamics, Matcha also expands available “blockspace” for rollups, removes token-filter barriers for IBC/Hyperlane, and positions Celestia as the central data availability (DA) layer for other chains. This lays the foundation for new revenue streams, as DA fees from rollups could be channeled to support TIA’s value in the future.

PoG: The path toward a deflationary token?

The next highlight is the Proof-of-Governance (PoG) proposal. According to Kairos Research, PoG could lower annual issuance to just 0.25% — a 20x reduction from current levels. With such a sharp drop in issuance, the revenue threshold required to push TIA into net-deflationary status becomes very low.

“Our analysis shows that TIA can potentially transition from an inflationary token to a deflationary, or near zero-inflation asset under the right conditions,” Kairos Research noted.

Some experts argue that even DA fees alone may be enough to push TIA into deflationary territory. Adding new revenue streams, such as an ecosystem stablecoin or revenue-generating DATs, could “completely flip TIA’s tokenomics story”. This perspective strengthens community confidence that Celestia could become a model for aligning token value with real business performance.

Even Celestia Co-founder Mustafa Al-Bassam, who was once skeptical of PoG, has changed his stance. He compared the system to resilient decentralized structures like ICANN and IANA, which have outlasted centralized applications without concentrating power.

“This perspective aligns with Celestia’s vision: by enabling verifiable light nodes, the network ensures that validators need not be trusted for correctness, preserving security without concentrating power,” Mustafa Al-Bassam shared.

If Celestia delivers, PoG could be an extremely positive step for the entire network.

TIA: High expectations, but risks remain

On the price front, TIA has recently corrected downward, reflecting short-term bearish technical signals such as RSI, MACD, and net capital outflows. At the time of writing, BeInCrypto data shows TIA trading more than 93% below its February 2024 ATH.

TIA price chart. Source:

BeInCrypto

TIA price chart. Source:

BeInCrypto

With such volatility, market sentiment remains largely pessimistic. Some investors argue that TIA exemplifies the saying, “don’t marry your bags.” The hype from the airdrop 18–24 months ago, combined with venture investors continuously unlocking tokens and suppressing its value, has weighed heavily on the token. Some even described TIA’s chart as “pain and suffering!”

Therefore, these new proposals and the $100 million treasury could become a lifeline for the project. Still, the key lies in execution. PoG requires community approval, revenue distribution, and transparent buyback/burn mechanisms, and the number of rollups using Celestia must be large enough to generate sustainable DA fee revenue. If DA revenue fails to grow quickly or competitors like EigenDA pull ahead, the deflationary scenario could be delayed.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Starknet Price Prediction 2025: Can STRK Turn Its Rebound Into a Full Recovery?

XRP News: SEC’s Peirce Says She Never Backed Ripple Lawsuit

Zcash Price Prediction 2025: Can Rising Network Strength Push ZEC Toward a New Cycle?

XRP Price Prediction For November 22