Bitcoin is under pressure ahead of a $17 billion options expiry and mixed macro flows; traders are sidelined as elevated open interest and a 0.75 put/call ratio raise volatility risks, keeping BTC vulnerable to deeper retracement until clear risk-on rotation resumes.

-

Max pain driven by $17.04B notional options and heavy open interest at expiry.

-

Stablecoin dry powder (~$308B total supply) suggests capital ready to re-enter once risk appetite returns.

-

Macro signals — record equities and 10-year Treasury moves — are diverting flows away from BTC.

Bitcoin options expiry, BTC outlook and volatility risks — actionable update and what traders should know. Read our market brief and prepare. (150-160 chars)

Why is Bitcoin struggling to find a bottom?

Bitcoin is struggling to find a bottom because traders are waiting on a decisive trigger — the $17.04 billion options expiry, clearer equity signals, or a deeper rate-cut path — before redeploying dry powder. Elevated open interest and mixed macro flows are keeping volatility elevated and bids thin.

How do macro markets affect Bitcoin right now?

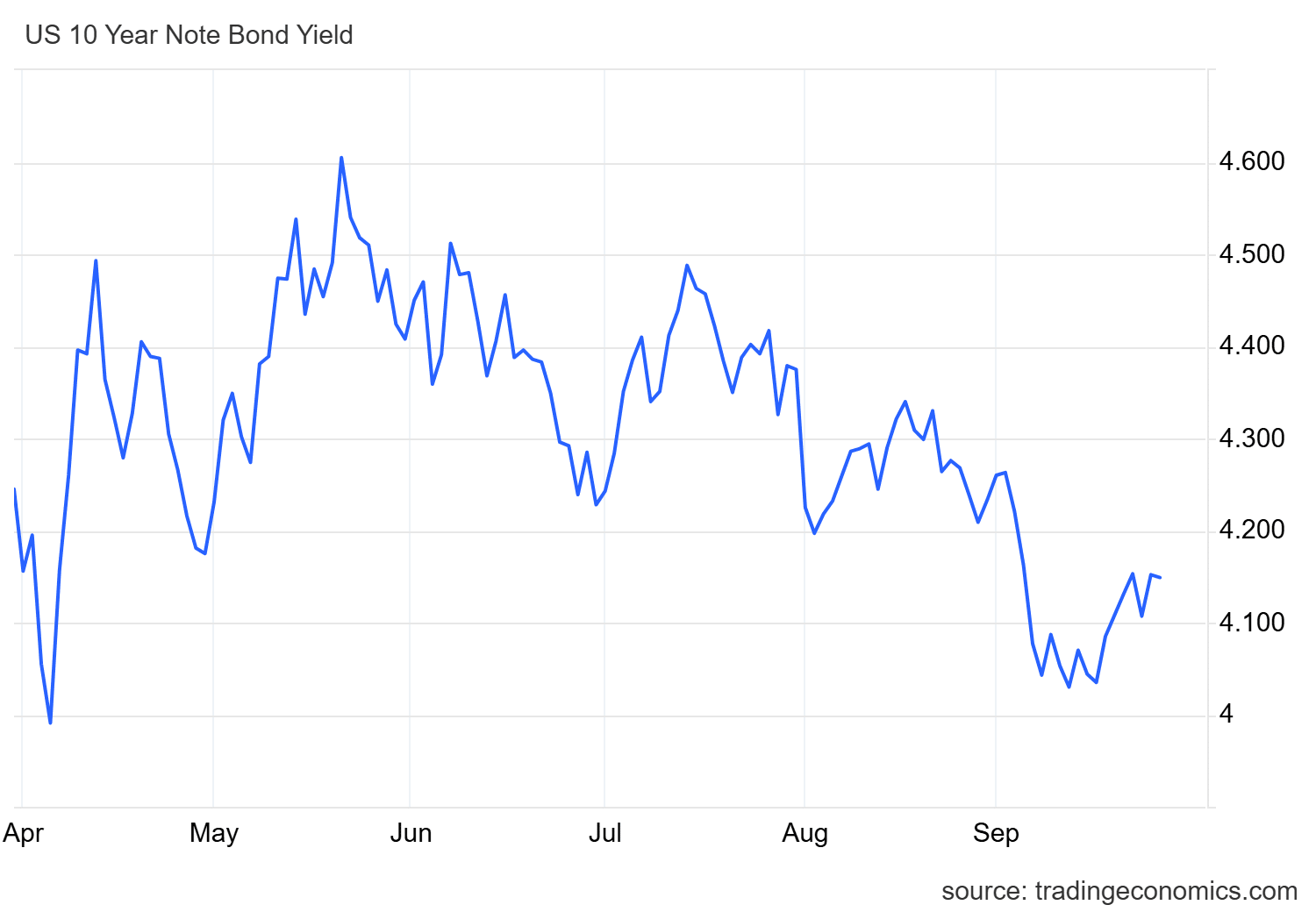

Equity markets are making fresh highs across the major indexes, drawing risk capital toward legacy markets. At the same time, the U.S. 10-year Treasury yield slipped to a quarterly low near 4.01% in mid‑September, suggesting shifts between risk-on and safe-haven allocations. Sources: Trading Economics.

Investor conviction in BTC has not returned despite a 25 bps rate cut. Stablecoin supply has risen from approximately $204B in January to about $308B in September, indicating sizable liquidity on the sidelines ready to rotate back into crypto when risk appetite improves.

Source: Trading Economics

What does the options market signal for BTC near-term?

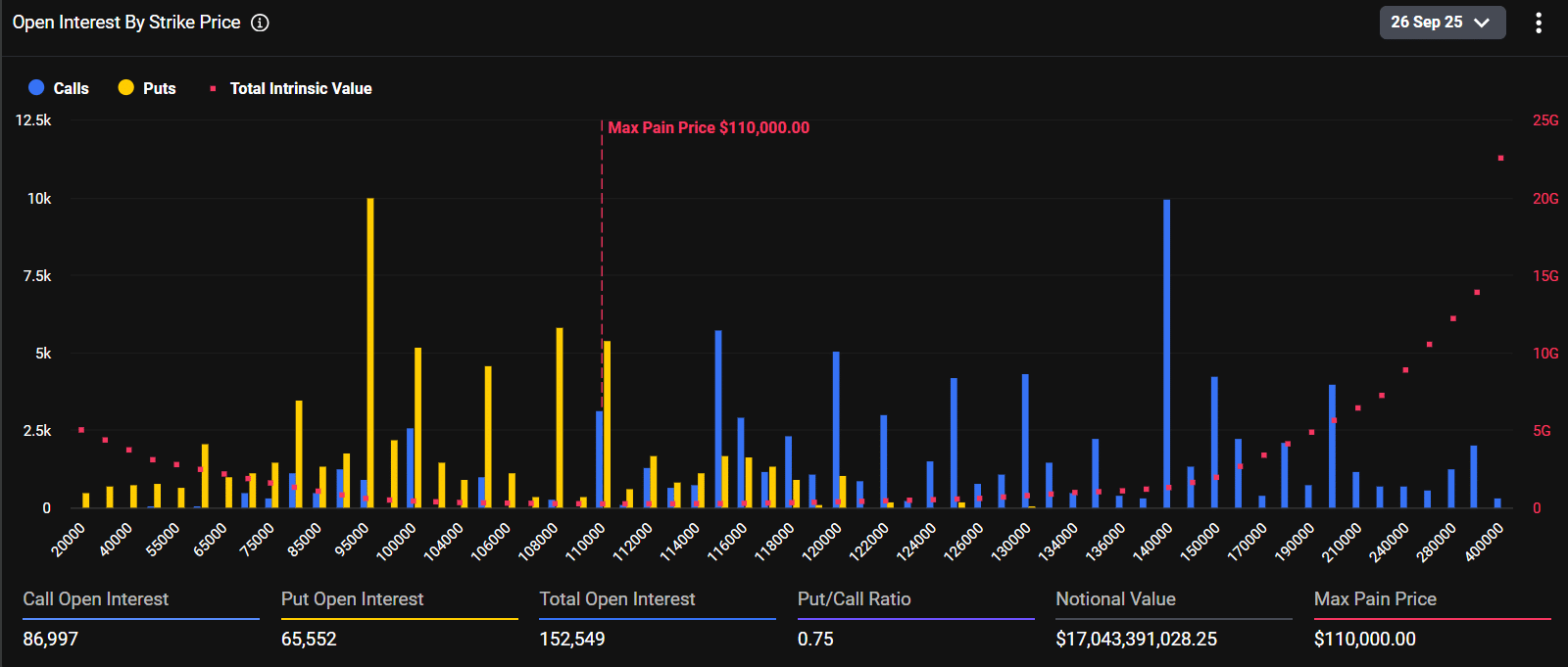

The options market shows concentrated risk ahead of expiry with total Open Interest (OI) of 152,549 contracts. Calls total 86,997 and puts 65,552, yielding a Put/Call Ratio of 0.75 — mildly bullish on balance but with significant gamma and liquidity risk around expiry. Sources: Deribit.

The notional value of outstanding contracts sits at roughly $17.04 billion. The market’s max pain point is currently calculated near $110,000, which could magnetize price action as traders and market makers hedge and roll positions into expiry.

Source: Deribit

What is the near-term outlook for BTC price and volatility?

Bitcoin could see further retracement and elevated volatility in the near term as the market digests macro pressures and the large options expiry. Traders holding sizable notional exposure may induce range compression or sharp moves toward strike clusters as hedging flows unwind.

Frequently Asked Questions

How can traders prepare for the expiry?

Prudent steps reduce unexpected losses: reduce directional size, monitor OI and gamma exposure, set clear stop levels, and use staggered entries. Keep an eye on stablecoin inflows and equity market signals for clues on risk-on rotation.

Key Takeaways

- Options concentration: $17.04B notional and 152,549 contracts create elevated expiry risk.

- Macro diversion: Record equity highs and Treasury yield moves are diverting capital from BTC.

- Dry powder exists: Roughly $308B stablecoin supply signals potential rapid rotation when risk-on returns.

Conclusion

Bitcoin’s current weakness is rooted in concentrated options exposure, shifting macro flows, and sizable stablecoin dry powder. Market participants should expect elevated volatility and possible retracement until an unmistakable risk‑on rotation or options settlement reduces uncertainty. Stay prepared and monitor OI, put/call dynamics, and macro signals for entry cues. COINOTAG will continue tracking developments and updating this brief as new data emerges.

By: COINOTAG | Published: 2025-09-25 | Updated: 2025-09-25