Transaction reversibility is a proposed mechanism allowing issuers or validators to roll back or freeze stablecoin transfers in cases of fraud or hacks, while preserving settlement finality for routine payments. Circle says reversible transactions could help recover stolen funds and boost institutional trust in USDC.

-

Reversibility aids fraud recovery and institutional adoption.

-

It introduces centralization risks vs. permanent settlement.

-

Recent Sui validator action froze $162 million after a $220M exploit, showing a practical precedent.

Transaction reversibility: Circle explores reversible stablecoin transactions to aid fraud recovery and institutional adoption — read how this may reshape compliance and custody practices.

What is transaction reversibility for stablecoins?

Transaction reversibility is a mechanism that would allow issuers, validators or governed processes to reverse or freeze specific stablecoin transfers in response to hacks, fraud or court orders. The aim is to protect victims and increase mainstream trust while preserving settlement finality for normal commerce.

How would reversible transactions work in practice?

Circle president Heath Tarbert explained the company is exploring technical and governance models that permit reversibility for exceptional cases while keeping routine payments final. Possible approaches include multi-party custody controls, on-chain governance votes, and time-limited dispute windows that allow authorized rollbacks when fraud is proven.

Supporters say reversibility could speed recovery for scam victims and make stablecoins more acceptable to banks. Critics warn it undermines the core crypto principle that transactions are permanent and immune to unilateral change.

How has reversibility been used before?

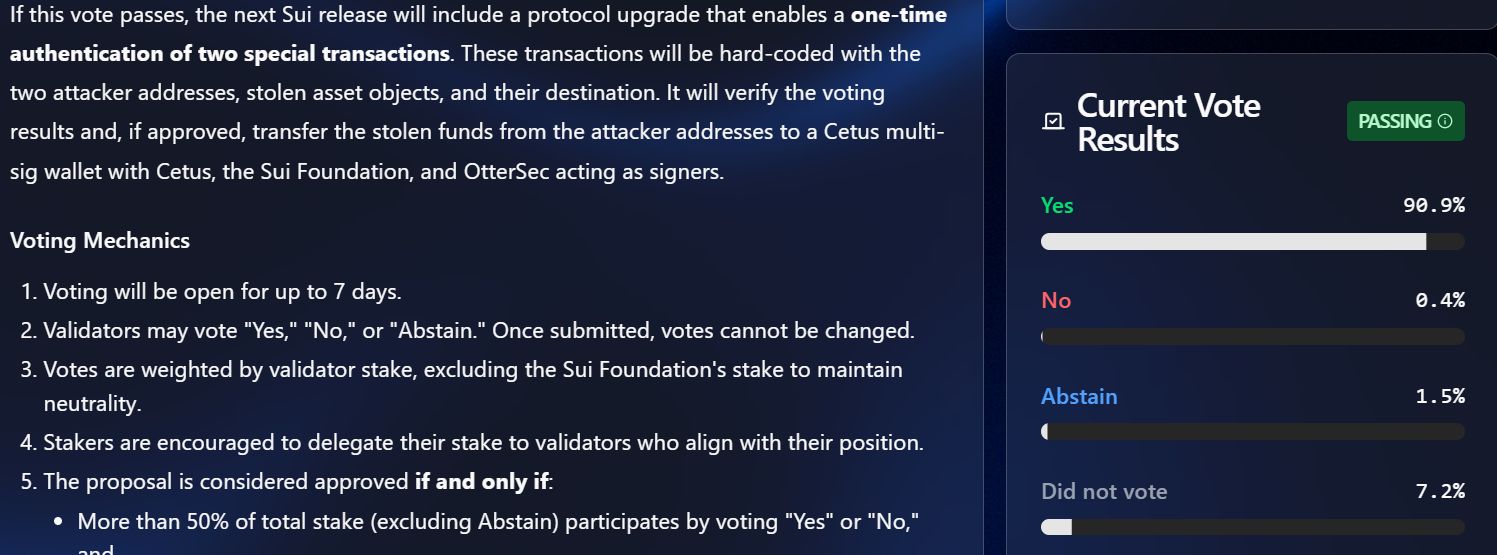

In May, following a $220 million exploit on decentralized exchange Cetus, Sui validators froze roughly $162 million and later approved returning the funds to the protocol. That incident is frequently cited as a real-world example demonstrating both the utility and controversy of reversible actions in crypto.

The Sui community passed a vote for frozen Cetus funds. Source: Sui

Why is Circle considering reversibility for USDC?

Circle views some TradFi features as useful additions to blockchain payment rails. The company argues that controlled reversibility could make USDC more compatible with banking expectations around fraud remediation and compliance, helping stablecoins integrate with institutional infrastructure.

Circle is also pursuing institutional-grade infrastructure with its Arc layer-1 network and partnerships for custody and compliance. That push signals a strategy to make USDC suitable for banks, asset managers and regulated markets that expect dispute resolution mechanisms.

When could reversible features and Arc roll out?

Circle has announced Arc public testnet plans for this fall with a full network launch targeted by the end of 2025. The company intends Arc to use USDC as the native gas token and to integrate with institutional custody solutions to give banks and asset managers immediate access.

Source: Fireblocks

What are the risks and benefits of reversible transactions?

- Benefits: Faster fund recovery, stronger institutional adoption, clearer compliance paths.

- Risks: Increased centralization, governance capture, potential for wrongful reversals.

- Mitigations: Multi-stakeholder governance, transparent dispute criteria, audit logs and legal oversight.

Frequently Asked Questions

How does reversibility affect settlement finality?

Reversibility aims to keep everyday settlement final while allowing narrowly scoped reversal windows for fraud remediation. Implementations typically separate instant finality for regular payments from governed exception processes.

Who decides when to reverse a transaction?

Decision authority varies by design: possibilities include multisig custodians, validator councils, on-chain governance votes or legal orders. Robust governance rules and clear thresholds are essential to limit misuse.

How-to: Steps to design reversible transactions

- Define strict reversal criteria: fraud, legal orders, confirmed hacks.

- Implement multi-party authorization: custodians, validators, or governance quorums.

- Build transparent audit and appeal processes to protect users and mitigate errors.

- Integrate with institutional custody and compliance tooling for traceability.

- Test on public testnets and publish security audits before mainnet deployment.

Key Takeaways

- Reversibility can boost trust: It may help recover stolen funds and attract regulated institutions.

- Design safeguards matter: Multi-party governance and clear criteria are essential to limit centralization risks.

- Precedent exists: Sui validator actions after a $220M exploit show how reversible measures can work in practice.

Conclusion

Circle’s exploration of transaction reversibility for stablecoins balances victim protection and institutional adoption against decentralization concerns. Thoughtful governance, transparent rules and integration with custody solutions will determine whether reversible transactions can become a trusted feature in future stablecoin systems. Watch Arc’s testnet and governance proposals for practical implementations.