Written by: Duo Nine

Translated by: Saoirse, Foresight News

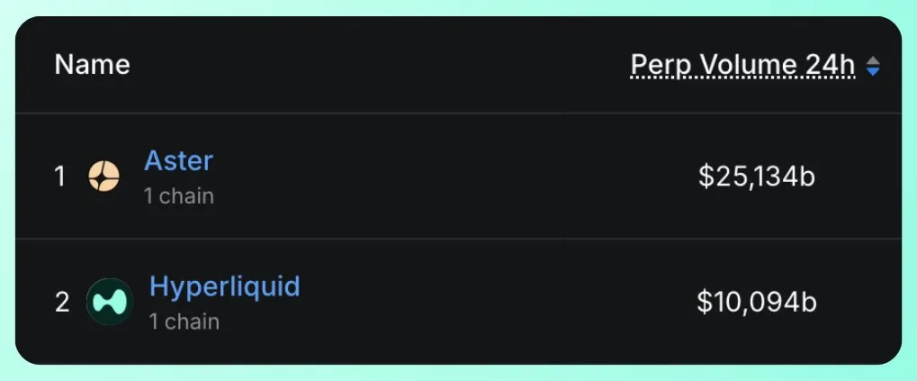

Since Aster launched, the HYPE token has plummeted 27% in just five days. Even worse, with a massive HYPE token unlock imminent, its outlook remains bleak.

No coincidence here.

Binance founder CZ has been pushing the Aster project for months and had already chosen the strategic timing to launch an offensive against Hyperliquid. This article will analyze why he chose to act now.

First, let’s look at the impact of this event. As shown in the chart, before the Aster token launch, Hyperliquid’s price kept hitting new highs. But after CZ posted about Aster on social media, this upward momentum abruptly stopped.

The result? The HYPE token dropped 27% in five days.

Meanwhile, Aster’s performance was the complete opposite. Since I posted the entry signal in the community, its price has tripled. As the chart shows, I’ve already taken some profits—holding from $0.06 all the way to $2.1, achieving a 3x gain in just five days.

As mentioned last Sunday, for months, Hyperliquid has been a thorn in Binance’s side, posing a systemic threat. Hyperliquid’s rapid rise has impacted Binance’s market position.

As soon as CZ was released from prison, he immediately set out to address this "problem." Their plan was exposed as early as June this year, as you can see from the timestamp on the following X platform post.

Clearly, the key issue was not whether Binance would act, but when. In the past, they tried to destroy the platform by liquidating Hyperliquid’s protocol treasury, but failed. So, they switched to Plan B: launching Aster.

Why act now?

CZ is no newcomer to the crypto world, and timing is everything. Previously, he single-handedly dealt a heavy blow to FTX with just one tweet, and the timing was perfect. The launch of Aster is no coincidence either—it was timed exactly two months before Hyperliquid’s massive HYPE token unlock.

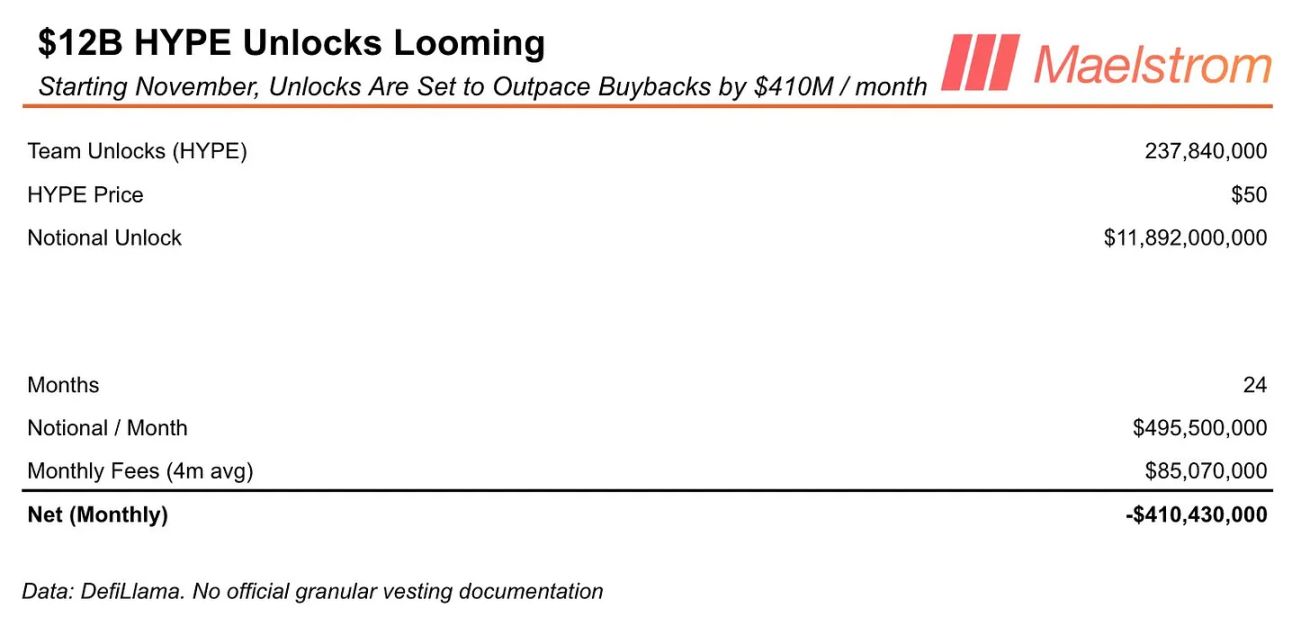

In late November 2025, Hyperliquid will begin linearly unlocking 237.8 million HYPE tokens over 24 months. At $50 per token, this means the team’s unlocked tokens will be worth as much as $11.9 billions, with nearly $500 millions in nominal value entering the market each month. Currently, there is no buyback mechanism capable of absorbing such massive selling pressure.

The above data is provided by Maelstrom. Maelstrom is led by Arthur Hayes, who is also a key participant in the Ethena/ENA/USDe project—of which Binance is a major partner.

Coincidentally, Arthur sold his HYPE tokens this week and was outspoken about it. He explained that due to the upcoming unlock plan, the HYPE token price is likely to crash. Meanwhile, Aster’s price continues to rise.

Is this really a coincidence? Highly unlikely.

CZ, Binance, and their affiliates are essentially taking advantage of HYPE’s current weakness. Even if the Hyperliquid team chooses not to sell their vested tokens for now, CZ doesn’t care.

All he needs to do is create the illusion of "HYPE weakness" while launching a more attractive alternative—stabilizing retail sentiment by pushing Aster’s price to new highs. With tight control over Aster’s token supply and deep financial reserves (billions of dollars), his strategy has been executed quite successfully so far.

Having won this round, the market momentum has clearly shifted toward Aster. The question now is whether this momentum can hold and continue. With CZ and his affiliates backing it, the answer is most likely yes.

All things considered, it will be difficult for Hyperliquid to achieve market dominance in the coming months—especially since Aster is not the only exchange trying to eat into its market share. Another strong competitor is Lighter.

Lighter offers zero fees for retail users, while Aster is backed by Binance’s industry giants. In any case, this shows that Hyperliquid has entered the top tier of the industry—after all, its current competitors are the very best in the field. The situation is tough for now, but it also sets the stage for a potential rebound in the future.

Hyperliquid’s emergence is also no coincidence; to some extent, it is a direct result of the FTX collapse—offering users an alternative to centralized exchanges. From this perspective, CZ’s destruction of FTX indirectly led to the birth of Hyperliquid. This undoubtedly creates a rather dramatic cycle.

In the crypto space, as long as a platform can provide better services, market liquidity and user attention can shift in an instant. Hyperliquid is currently suffering because of this, but by 2026, when the DEX market share battle settles, I believe the HYPE token will regain its dominance. Unless a black swan event occurs, its development trajectory is unlikely to deviate significantly.

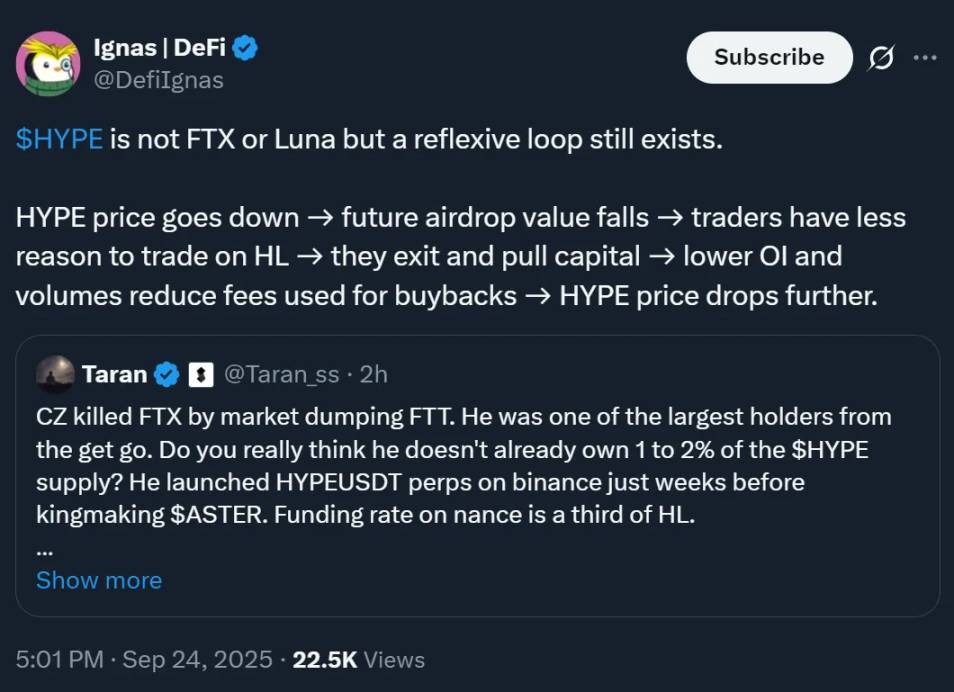

HYPE is not a "catastrophic" project like FTX (crypto exchange bankruptcy) or Luna (algorithmic stablecoin collapse), but it does have a "reflexive cycle" (a closed loop where price and market behavior influence each other), with the following logic:

HYPE price drops → future airdrop value shrinks → traders lose incentive to trade on Hyperliquid (HL, presumed to be the platform issuing $HYPE) → traders exit and withdraw funds → open interest (OI) and trading volume decrease, reducing fees available for buybacks → $HYPE price drops further.

If the HYPE token continues to underperform in the coming months, that will be an excellent opportunity to buy in and build a position. The HYPE token has previously experienced a major correction (a drop of up to 72%), and a similar scenario may play out again, providing investors with an ideal entry point.

In any case, the crypto market is always full of opportunities and unexpected twists, and it’s not uncommon to see funds double, triple, or even increase tenfold in the short term—just like Aster’s performance this time.