Japanese Auto Parts Maker Launches Stablecoin Initiative to Reform Trade Finance

Ikuyo will launch the Stablecoin Settlement Association to reduce trade finance costs, streamline cross-border payments, and enhance Japan’s digital economy through collaboration with financial institutions, trading companies, and blockchain technology providers.

Tokyo-listed automotive parts maker Ikuyo announced plans to establish the Stablecoin Settlement Association to modernize Japan’s trade finance system.

The initiative seeks to cut payment costs, reduce settlement delays, and streamline complex procedures that hamper the nation’s export competitiveness. Ikuyo aims to foster collaboration among financial institutions, trading companies, and fintech firms to promote standardized, blockchain-based settlement infrastructure.

Ikuyo Targets Trade Finance Inefficiencies

The Tokyo-listed firm unveiled plans on September 24 to create the Stablecoin Settlement Association. This initiative addresses persistent inefficiencies in Japan’s trade finance sector, including high transaction costs and delayed settlements that undermine export performance.

The planned association will leverage stablecoins to enhance cross-border payment efficiency and reduce friction in import-export transactions.

According to Ikuyo, current trade finance practices remain heavily paper-based, while industry groups rarely focus on B2B trade finance. Government initiatives promoting trade digitalization have advanced slowly, particularly in the payment space.

Goals for Businesses, Technology Firms, and Policymakers

Through the new association, Ikuyo seeks to deliver multiple benefits. Exporters and importers could gain from lower settlement costs and improved cash flow. For technology companies, the initiative offers new market opportunities, while government agencies would gain a trusted private partner to drive digital economic innovation.

Membership will be open to financial institutions handling payment flows, trading companies and manufacturers managing logistics, and fintech or blockchain providers supplying technical infrastructure.

The association plans to establish operational standards, create safety guidelines, and collaborate with government bodies to support Japan’s digital economy.

The stablecoin effort follows Ikuyo’s June decision to regularly purchase Bitcoin as part of a growth and asset diversification strategy. In July, the company also announced its entry into cryptocurrency mining operations.

Although no official figures on Bitcoin acquisitions have been released, the firm has already used stablecoins for partial payments of mining equipment, electricity, and maintenance fees in Canada through a capital alliance with US-based Galactic Holdings.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Anti-CZ Whale Loses $61M Profit in 10 Days on Hyperliquid

Quick Take Summary is AI generated, newsroom reviewed. The "Anti-CZ Whale" lost $61 million in profit in 10 days, suffering losses on aggressive long positions in ETH and XRP. The whale's overall realized and unrealized profit dropped from $100 million to $38.4 million. One of the whale's accounts is running 12.22x leverage on a $255 million long exposure, with alarmingly thin 95.40% margin usage. The reversal highlights the high risk and volatility in perpetual futures trading, even for successful contrar

Watch Out: Numerous Economic Developments and Altcoin Events in the New Week – Here is the Day-by-Day, Hour-by-Hour List

‘I Won’t Back Down,’ Michael Saylor Reinforces Strategy’s Bitcoin Mission

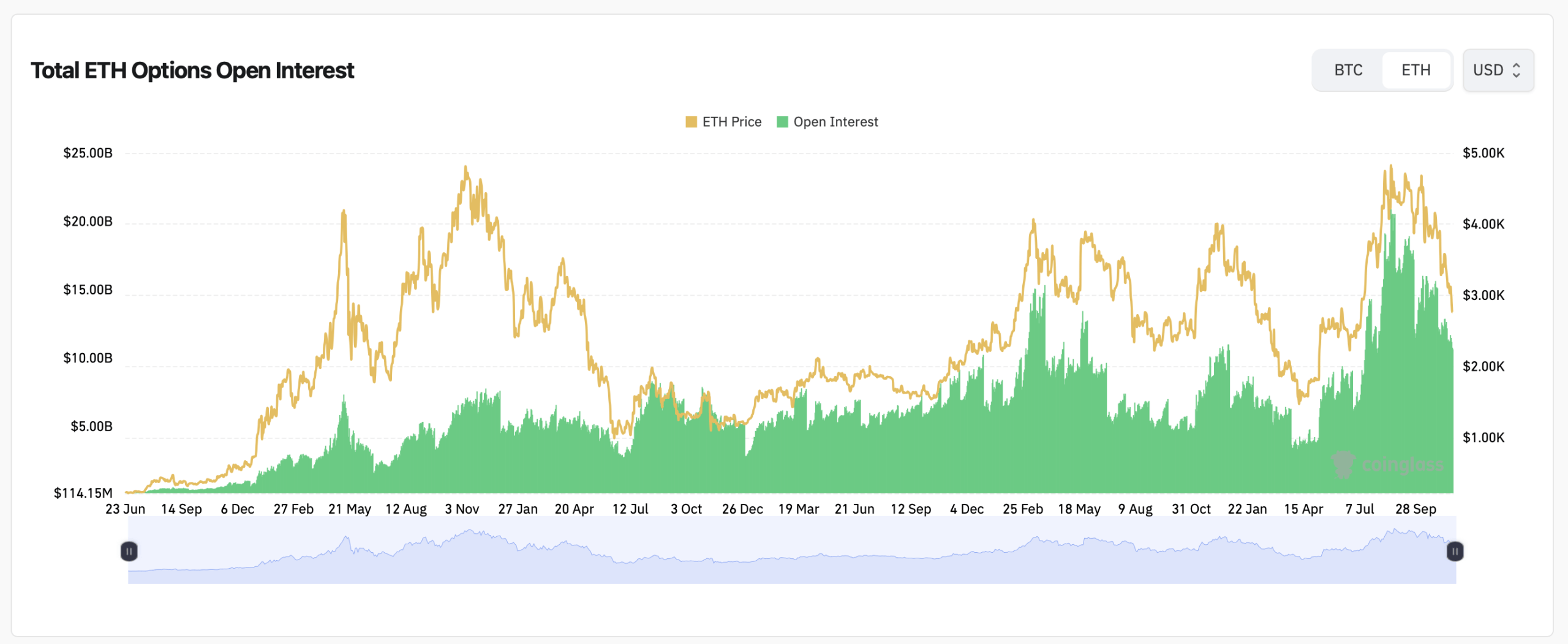

Ethereum Price Stalls as Derivatives Traders Load up for the Week Ahead