Google’s $3 Billion HPC Investment in Cipher Indicates a Surge in AI Infrastructure as Crypto Miners Shift Focus

- Google secures 5.4% stake in Cipher Mining via $3B HPC hosting deal with Fluidstack, supporting 168MW Texas data center expansion. - Agreement includes $1.4B lease backstop and 10-year term with $7B potential value, positioning Cipher as key AI infrastructure player. - Cipher shifts from Bitcoin mining to AI, leveraging 587-acre Texas site with 500MW expansion potential and $800M private financing. - Partnership reflects broader crypto-to-AI industry trend, with Google strategically accessing HPC capacit

Google has acquired a 5.4% ownership interest in

The agreement covers the provision of 168 megawatts of essential IT power at Cipher’s Barber Lake facility in Colorado City, Texas, with support for up to 244 MW of total capacity. The site is projected to be fully operational by September 2026 and could expand to 500 MW, with 587 acres available for further growth. Cipher will maintain complete control of the project and may seek additional capital through the markets if necessary. The initial $3 billion contract includes two optional five-year extensions, potentially raising the total value to $7 billion Google Supports Cipher Mining’s $3 Billion Data Center Pact [ 2 ].

Financial aspects of the initiative reveal a substantial investment and focus on efficiency. The estimated expenditure is between $9 million and $11 million per megawatt of critical IT load, with anticipated Net Operating Income (NOI) margins of 80%-85%. These margins surpass standard data center returns, underlining the strategic importance of HPC assets. Cipher also revealed an $800 million private placement of convertible senior notes maturing in 2031, with an option to raise an extra $120 million. The funds will be used to minimize shareholder dilution, finance the Texas project, and grow its 2.4-gigawatt HPC pipeline Cipher Taps Google-Backed $3B AI Hosting Deal [ 3 ].

This agreement signals a major strategic change for

The market’s response to the news was generally favorable. Cipher’s stock price jumped as much as 24% in premarket trading before settling at a 5.4% increase by press time. Since April 2025, the stock has climbed over 700%, fueled by a broader trend of Bitcoin miners converting energy assets for AI purposes. Google’s participation aligns with Alphabet’s wider AI ambitions, as shown by recent product launches and legal successes that strengthen its industry standing Google (GOOG) Strikes AI Hosting Deal with CIFR [ 5 ].

This collaboration illustrates a wider movement within the industry, where crypto companies are transitioning into AI hosting services. Other deals between Google and Fluidstack, such as a previous partnership with TeraWulf, highlight the tech giant’s approach of securing cloud resources through third-party providers. This strategy enables Google to boost its AI operations without constructing new data centers, instead utilizing existing energy and land resources optimized for high-performance computing Google Bets Big on Cipher Mining with $3 Billion AI Infrastructure Deal [ 6 ].

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

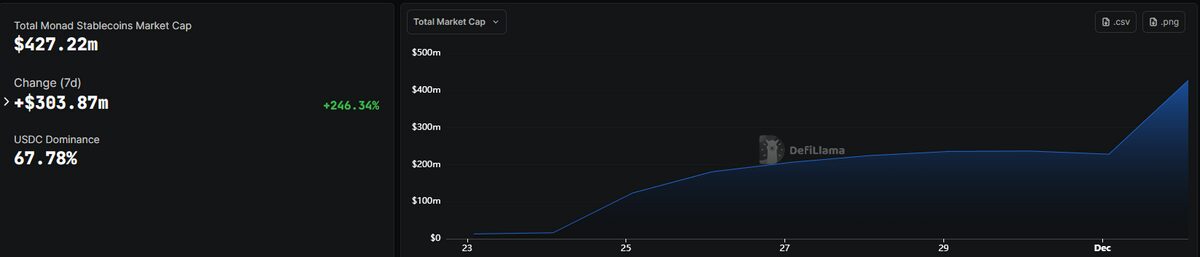

Transak Joins Monad, Unlocking Global MON Access

Astar 2.0's Market Rally and Growing Institutional Interest: Evaluating the Long-Term Strategic Impact for Cryptocurrency Investors

- Astar 2.0's 2025 market surge driven by cross-chain tech and partnerships with Sony/Animoca Brands. - Institutional $3.16M ASTR acquisition and 4.32% inflation reduction via tokenomics reforms. - Governance shifts to community council and regulatory clarity boost institutional trust. - Projected $0.80–$1.20 ASTR price by 2030, contingent on roadmap execution and macro risks.

BitMine Invests $70M in Ethereum Despite Market Crash

ZK Atlas Upgrade: Transforming DeFi with Enhanced On-Chain Scalability

- ZKsync's 2025 Atlas Upgrade introduces ZKPs and modular architecture, enabling 15,000-43,000 TPS with $0.0001 proof costs, addressing DeFi scalability challenges. - Full EVM compatibility and 70% lower gas fees attracted Deutsche Bank/UBS for asset tokenization, while TVL surged to $28B with $15B in Bitcoin ETF inflows. - ZK token value rose 50% post-upgrade, supported by deflationary mechanics, as analysts project 60.7% CAGR for ZK Layer-2 solutions through 2031. - Upcoming Fusaka upgrade (Dec 2025) aim