Cryptocurrencies continue to plunge, Ethereum falls below the $4,000 mark, and bulls suffer massive liquidations!

Analysts warn that falling below $3,800 will trigger more liquidations.

Analysts warn that a drop below $3,800 will trigger more liquidations.

Written by: Dong Jing

Source: Wallstreetcn

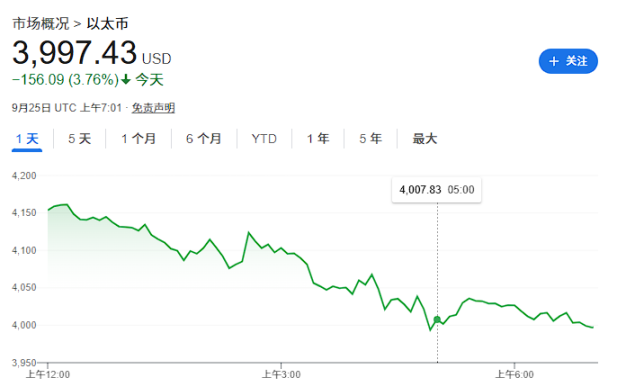

Ethereum fell below the $4,000 mark on Thursday, hitting a nearly seven-week low and continuing the sharp cryptocurrency correction seen this week. The entire crypto market has lost over $140 billions in market capitalization.

On Thursday (September 25), Ethereum, the world’s second-largest cryptocurrency, dropped as much as 4.7%, hitting a low of $3,969, while bitcoin also fell by 1.7%.

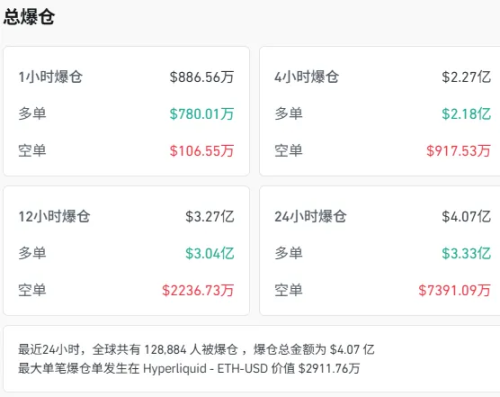

According to Coinglass, nearly 130,000 people were liquidated globally in the past 24 hours, with total liquidations exceeding $400 million.

The cooling of institutional inflows has intensified selling pressure. Since Monday, investors have withdrawn nearly $300 million from US-listed Ethereum ETFs. On Monday alone, a sudden market drop led to $1.7 billions worth of long positions being forcibly liquidated, impacting almost all mainstream cryptocurrencies.

According to Rachael Lucas, a cryptocurrency analyst at BTC Markets, Ethereum’s pullback is due to “cooling institutional inflows” and “technical indicators showing short-term pressure.” Lucas warned that if Ethereum falls below $3,800, it is expected to trigger more liquidations.

Although the supply of Ethereum on exchanges has dropped to a nine-year low, suggesting long-term holders are accumulating, selling by these long-term holders has offset the positive impact of new capital inflows, putting Ethereum in a tug-of-war between bullish and bearish forces.

Long-term holders’ selling offsets positive signals

Despite the continued decline of Ethereum’s exchange supply to a nine-year low—indicating investors are withdrawing tokens from centralized platforms for long-term holding—the market still faces selling pressure from long-term holders.

Over the past month, investors have accumulated more than 2.7 million Ethereum, worth over $11.3 billions, demonstrating strong confidence in Ethereum’s long-term potential.

However, Ethereum’s activity indicator has been on the rise. This metric measures the behavior of long-term holders, and an increase usually means these investors are selling rather than accumulating.

Analysts point out that selling by long-term holders has offset the bullish pressure from new capital inflows, putting Ethereum in a stalemate between two opposing market forces.

If long-term holders continue to sell in large quantities, Ethereum’s price may fall further, potentially testing the $3,910 level, which would completely break the current bullish expectations.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Coinpedia Digest: This Week’s Crypto News Highlights | 29th November, 2025

QNT Price Breaks Falling Wedge: Can the Bullish Structure Push Toward $150?

Digital dollar hoards gold, Tether's vault is astonishing!

The Crypto Bloodbath Stalls: Is a Bottom In?