TESR FRA is live! Treehouse partners with FalconX to usher in a new era of Ethereum staking derivatives

FalconX launches Ethereum Forward Rate Agreement (FRA).

Globally renowned institutional-grade digital asset prime broker FalconX has announced the launch of the first Ethereum Forward Rate Agreement (FRA) trading market benchmarked to the Treehouse Ethereum Staking Rate (TESR). This marks the first time the crypto market has introduced a derivative tool aligned with traditional financial interest rate markets, signifying a key step for digital assets towards the fixed income market.

The TESR FRA executed by FalconX enables participants to lock in interest rates, hedge risks, and structure allocations by referencing TESR (the Ethereum staking benchmark rate developed by Treehouse specifically for the digital asset market). This not only helps investors stabilize future staking returns, but also provides institutions with more efficient risk management tools, enhancing capital utilization efficiency.

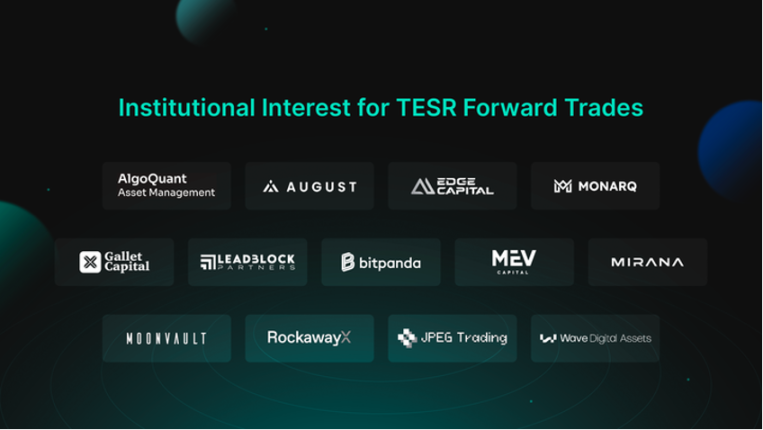

Currently, several well-known institutional investors and hedge funds, including Algoquant, August Digital, Edge Capital, Monarq, Gallet Capital, LeadBlock Partners, BitPanda, MEV Capital, Mirana, Moonvault, RockawayX, Wave Digital Assets, and JPEG Trading, have either participated or expressed trading interest. This not only highlights the growing demand for staking rate derivatives among institutions, but also marks an important milestone in introducing interest rate instruments from traditional finance into the crypto market.

What is an FRA (Forward Rate Agreement)?

An FRA is a commonly used interest rate derivative in traditional financial markets, designed to lock in an interest rate for a future period in advance for hedging or investment purposes.

For example, if you sign a TESR FRA with a counterparty today, agreeing that “for the 3 months starting 3 months from now, the ETH staking rate you will receive is fixed at 4.25%”:

- If, at maturity, TESR > 4.25%: This means the actual market rate is higher than the contract rate → the party with the “floating rate” profits, as they receive higher market returns; but as the “fixed rate” party, you still receive a guaranteed 4.25%, locking in stable cash flow.

- If, at maturity, TESR < 4.25%: This means the actual market rate is lower than the contract rate → the “fixed rate” party profits, as they still receive 4.25%, which is more favorable than the market.

It should be noted that the settlement method for FRAs does not wait until maturity to receive staking returns. Instead, at the start of the contract, the “future interest rate difference” is discounted into a one-time cash flow and paid to the profitable party.

The Role of Treehouse and TESR

Treehouse is building a Decentralized Fixed Income Layer, aiming to address core issues in the current DeFi world such as high yield volatility, lack of transparency, and lack of standardized interest rates. Its main products are:

- tAssets: A new generation of liquid staking tokens with built-in yield strategies.

- DOR (Decentralized On-chain Rate): A decentralized interest rate consensus mechanism, providing a reliable interest rate reference in the DeFi space to enable the scalable development of the fixed income market.

TESR is the first benchmark rate for DOR. TESR can be seen as the crypto equivalent of LIBOR (London Interbank Offered Rate) / SOFR (Secured Overnight Financing Rate), a widely referenced “risk-free benchmark rate” in the market.

TESR has the following features:

- Consensus-driven: Aggregates trading data and expert group calculations

- High transparency: Updated daily, truly reflecting the Ethereum staking yield environment

- High market reference: Has become the reference indicator for FalconX’s first tradable ETH staking forward rate contract

With the launch of TESR FRA, DOR is not just a data indicator framework, but is gradually becoming the core benchmark for pricing yield products and interest rate derivatives, and will be more widely used in the DeFi ecosystem in the future.

If you want to learn more about DOR, you can refer to the introduction article or official documentation.

Application Scenarios for the TESR FRA Market

With FalconX’s infrastructure, the TESR FRA market is now live and tradable in real time, with standardized documentation and operational processes, aligning with traditional markets. For the digital asset market, this enables users to engage in a wider range of operations:

- Risk management: ETH validators, staking service providers, or funds can use FRAs to lock in future staking returns, avoiding uncertainties caused by interest rate fluctuations.

- Trading and strategic allocation: If investors anticipate that ETH staking rates will rise, they can go long via FRAs; if they expect a decline, they can take the opposite position.

- Structured investment products: FRAs can serve as foundational components to further drive interest rate swap products (Swaps) and more structured yield protocols based on the DOR standard.

From TESR FRA Onwards, DeFi Fixed Income Markets Enter a New Stage

The TESR FRA jointly launched by FalconX and Treehouse is a key step in bringing traditional interest rate derivatives on-chain. It not only provides institutions with hedging and yield management tools, but also lays the foundation for the crypto market’s interest rate derivatives market, enabling ETH staking yields to truly have a standardized, tradable, and scalable market structure.

In the future, as the DOR system matures, we will see more DeFi derivatives and structured protocols based on the DOR benchmark rate emerge, driving the crypto market to gradually build a fixed income infrastructure comparable to, or even more efficient than, traditional finance!

If you want to witness this process, follow Treehouse X and continue to participate in its fixed income ecosystem so you won’t miss out! Additionally, if any institutions are interested in participating in TESR FRA trading, please contact FalconX.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Vitalik's "Can't Be Evil" Roadmap: The New Role of Privacy in the Ethereum Narrative

While the market is still chasing the ups and downs of "privacy coins," Vitalik has already placed privacy on the technical and governance roadmap for Ethereum over the next decade.

6% APY? Aave App Enters Consumer Finance

In an era where interest rates are below 0.5%, the Aave App aims to put 6% into the pockets of ordinary people.

Cryptocurrency incubator Obex raises $37 million.

Revolut has integrated Polygon as a primary infrastructure for crypto payments.