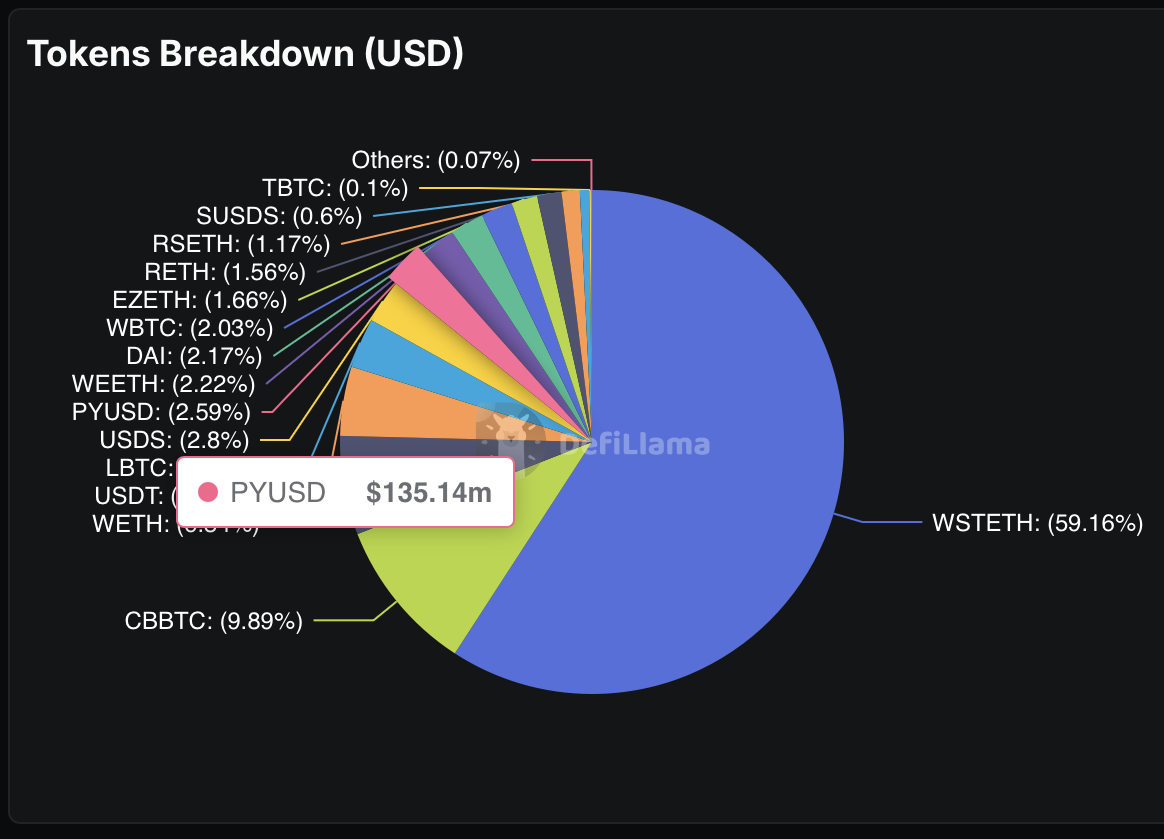

PayPal has increased PYUSD liquidity by listing its stablecoin on SparkLend; deposits exceed $135 million, providing market liquidity and yield opportunities for PYUSD holders across DeFi lending markets.

-

Over $135M in PYUSD deposits on SparkLend

-

PayPal partnered with Spark to access onchain lending rails and scalable liquidity deployment.

-

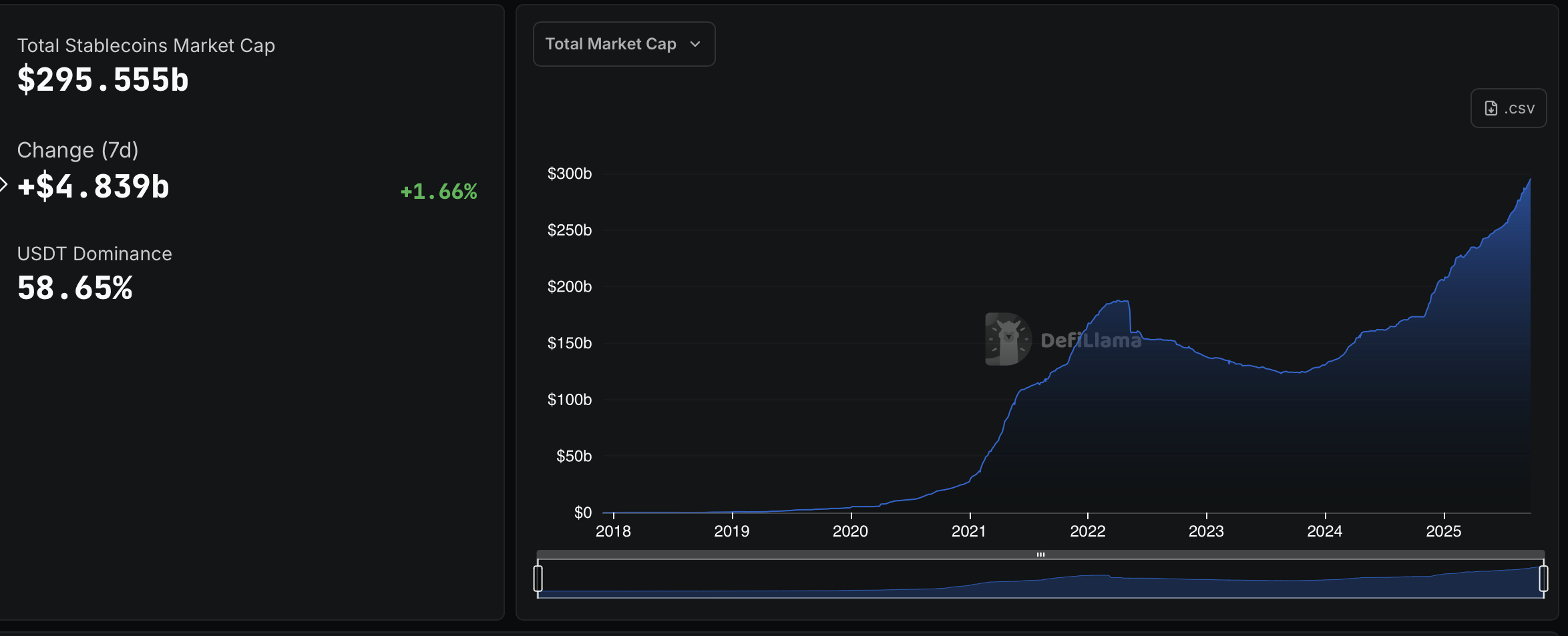

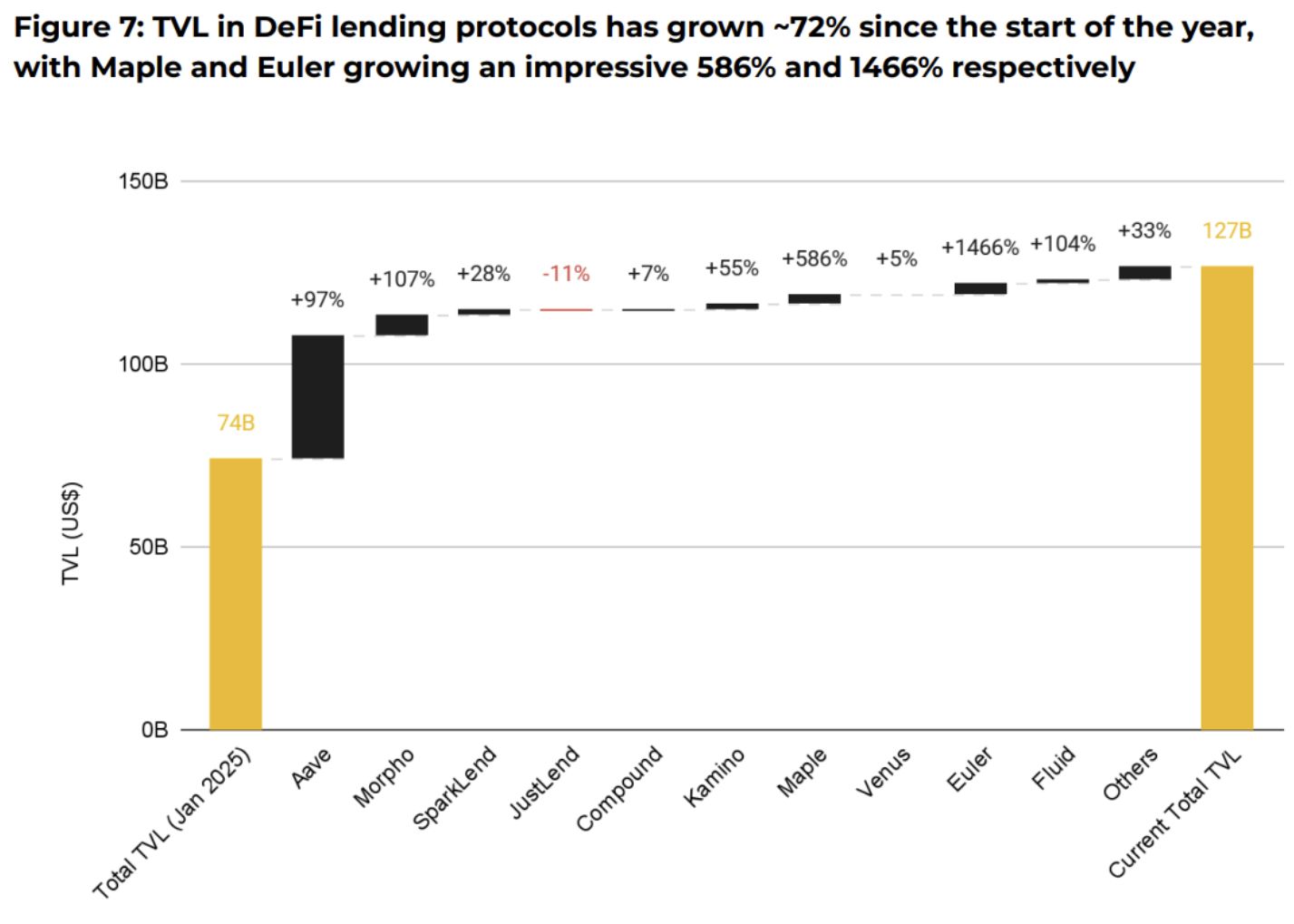

Stablecoin market cap nearing $300B; DeFi lending TVL up 70% year-to-date per industry reports.

PYUSD liquidity jumps as PayPal teams with Spark: over $135M deposited on SparkLend. Read the full analysis and implications for DeFi liquidity now.

PayPal has teamed up with Spark to boost PYUSD liquidity, with deposits already topping $135 million on the decentralized finance (DeFi) lending protocol.

PayPal has partnered with decentralized finance (DeFi) protocol Spark to expand liquidity for its US dollar stablecoin, PayPal USD (PYUSD).

PayPal’s stablecoin has attracted more than $135 million in deposits since its August listing on SparkLend, a lending market focused on stablecoins, according to a Thursday statement.

Staked stablecoins on Sparklend protocol. Source: DeFiLlama

Sam MacPherson, co-founder and CEO of Phoenix Labs, a core contributor to Spark, told Cointelegraph that PayPal chose Spark because it “is the only at-scale DeFi protocol that can actively deploy capital into other protocols.” He added that DeFi will provide the rails for broad financial integration in the future.

Spark is a non-custodial lending protocol where users deposit stablecoins into Spark Savings and receive non-rebasing yield tokens. According to Messari, these tokens keep a fixed balance but grow in value as yields are funded through protocol revenue and set by Sky governance.

PYUSD was added to SparkLend after passing the protocol’s risk assessments. Related coverage: Aave, Sky float partnership to bridge DeFi, TradFi. Magazine note: How Ethereum treasury companies could spark ‘DeFi Summer 2.0’.

What is the impact of PayPal listing PYUSD on SparkLend?

PayPal’s PYUSD listing on SparkLend increases onchain liquidity and yields for PYUSD holders while enabling PayPal to deploy stablecoin capital across DeFi lending markets. The move immediately drew over $135 million in deposits and strengthens stablecoin utility in lending markets.

How does SparkLend support PYUSD liquidity?

SparkLend, launched from the MakerDAO ecosystem and integrated into Sky, runs the Spark Liquidity Layer backed by over $8 billion in stablecoin reserves. The protocol routes deposited stablecoins into yield opportunities across DeFi, maintaining non-custodial custody and risk controls.

Key mechanics: deposits convert into yield-bearing tokens that track value growth rather than rebasing balances. Governance (Sky) sets yield parameters and funds distributions from protocol revenue streams.

Why does PYUSD matter for the stablecoin market now?

Stablecoin demand is rising amid new regulation—MiCA in Europe and U.S. stablecoin legislation—and market cap nears $300 billion, up over $90 billion year-to-date per DefiLlama data. PYUSD’s integration into DeFi lending taps demand for yield-bearing stablecoins and institutional liquidity.

Total Stablecoins Market Cap. Source: DefiLlama

Growth in yield-bearing stablecoins—examples include Ethena’s USDe and Sky’s USDS—illustrates a shift toward “stablecoin 2.0,” where liquidity provision and yield generation become core utilities beyond simple onchain dollarization.

Industry reports from Binance Research and others indicate DeFi lending protocols are positioned to absorb increasing institutional participation as stablecoin adoption accelerates.

DeFi lending protocols, TVL, year-to-date chart. Source: Binance Research

How can users access PYUSD yield on Spark?

1. Acquire PYUSD through PayPal or supported onramps. 2. Deposit PYUSD into SparkLend’s Spark Savings pool. 3. Receive non-rebasing yield tokens and monitor yields via Sky governance updates.

These steps reflect typical DeFi lending flows; always confirm protocol risk disclosures and governance settings before depositing funds.

Frequently Asked Questions

How does Spark assess PYUSD for SparkLend?

Spark conducts protocol risk assessments that evaluate collateral characteristics, peg stability, and counterparty risk before adding any stablecoin like PYUSD to SparkLend.

Will PYUSD deposits change DeFi lending rates?

PYUSD deposits increase supply of yield-bearing stablecoin liquidity, which can compress borrowing rates for stablecoin-backed loans while expanding lending depth across pools.

Key Takeaways

- Immediate liquidity boost: PayPal’s PYUSD generated over $135M in deposits on SparkLend.

- DeFi integration: Listing on Spark enables non-custodial yield deployment across protocols via the Spark Liquidity Layer.

- Market context: Stablecoin market nears $300B and demand for yield-bearing stablecoins is accelerating amid regulatory clarity.

Conclusion

PayPal’s PYUSD integration with SparkLend significantly enhances PYUSD liquidity and reinforces the trend toward yield-generating stablecoins in DeFi. As stablecoin markets expand and governance mechanisms mature, institutional and retail liquidity is likely to find new onchain yield pathways. Watch Sky governance updates and protocol disclosures for next steps.