Bitcoin is trading inside a symmetrical compression triangle, with declining exchange inflows and reduced volatility indicating a likely breakout soon; traders should watch for a decisive candle and volume surge to confirm direction.

-

Bitcoin compression triangle signals consolidation ahead of a breakout.

-

Volatility has sharply contracted, with smaller candles and tightening ranges on shorter timeframes.

-

Exchange inflows have fallen, suggesting holders are moving BTC off exchanges and limiting available sell-side supply.

Bitcoin compression triangle shows tightening volatility and declining exchange inflows—watch for breakout confirmation with volume surge. Read the full analysis from COINOTAG.

What is the Bitcoin compression triangle and why does it matter?

The Bitcoin compression triangle is a symmetrical consolidation pattern where price forms converging lower highs and higher lows. It matters because the pattern often precedes a sharp breakout in either direction; confirmation requires a decisive candle and accompanying volume spike.

How has market volatility behaved during the triangle?

Volatility has contracted markedly, shown by smaller daily and intraday candlesticks. This tightening is typical of compression patterns and reflects market indecision. Historically, similar compressions often resolve with rapid directional moves once liquidity is swept.

Why are exchange inflows important for Bitcoin price action?

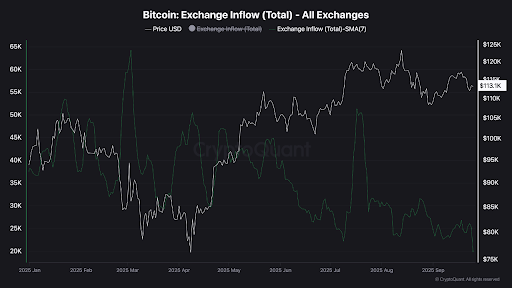

Exchange inflows measure coins moving onto trading venues. A sustained decline in exchange inflows — visible in 7-day moving averages reported by on-chain data providers such as CryptoQuant (plain text) — often signals that holders are retaining assets off exchanges, which can reduce immediate sell pressure.

What are the observable on-chain and market signals now?

Key signals right now:

- Converging highs and lows: Price continues to respect triangle boundaries on multiple timeframes.

- Lower exchange inflows: 7-day averages show a downtrend, indicating reduced deposit activity to spot venues.

- Compressed volatility: Narrower ATR and smaller candles suggest energy is accumulating for a breakout.

Frequently Asked Questions

How can traders confirm a Bitcoin triangle breakout?

Confirmation requires a close beyond triangle boundaries on higher timeframes (4H–1D) with above-average volume. Watch for follow-through candles and reduced wick rejection as evidence of sustained momentum.

Are declining exchange inflows bullish for Bitcoin?

Declining inflows are generally bullish because they can reduce available immediate selling supply; however, direction still depends on breakout confirmation and macro liquidity conditions.

Bitcoin trades in a compression triangle with declining exchange inflows, signaling potential breakout as volatility tightens.

- Bitcoin trades within a symmetrical triangle, showing converging lower highs and higher lows, indicating a buildup before potential price breakout.

- Volatility has sharply declined, with smaller candlesticks reflecting market consolidation and tightening price action within the compression triangle pattern.

- Exchange inflows for Bitcoin continue decreasing, suggesting holders are retaining assets off exchanges, potentially reducing available supply for trading.

Bitcoin resolution is approaching as BTC trades within a compression triangle, signaling tightening price action and reduced volatility. The market shows a clear convergence of lower highs and higher lows. Traders are watching for breakout confirmation.

Bitcoin Trading Within a Compression Triangle

Bitcoin is moving inside a symmetrical triangle, forming a classic compression pattern. The structure shows both bulls and bears defending key levels. This consolidation often precedes a directional breakout.

Over recent months, BTC has repeatedly respected triangle support and resistance. Candlestick ranges have narrowed, and intraday volatility has dropped, which typically precedes an impulsive move when liquidity is triggered.

Titan of Crypto (plain text) notes, “Bitcoin resolution is coming. BTC is trading within a compression triangle, with volatility drying up.” The commentary underscores market readiness for a decisive move.

#Bitcoin Resolution is Coming 🔥 #BTC is trading within a compression triangle, with volatility drying up. pic.twitter.com/bsbxOjJdRb

— Titan of Crypto (@Washigorira) September 24, 2025

Market Volatility and Potential Breakout

Compression triangles in crypto frequently precede sudden volatility spikes. Bitcoin’s current setup could produce a sharp upward or downward breakout. Traders should monitor confirmation candles and volume surges closely.

The pattern can act as either continuation or reversal depending on the prior trend. Historical examples show rapid moves following prolonged compressions, so risk management is critical.

The cautionary note from Titan of Crypto highlights the importance of being prepared: when Bitcoin exits this compression, the move can be swift and large.

Declining Bitcoin Exchange Inflows

Bitcoin exchange inflows have displayed a consistent decline in the 7-day moving average across major venues, according to on-chain analytics providers (plain text: CryptoQuant). Reduced inflows imply holders are withdrawing coins to custody or cold storage.

Source: Cryptoquant (plain text)

High inflows to spot exchanges typically suggest mounting selling pressure; derivative exchange inflows can mean increased leverage on either side. The current downtrend in inflows suggests a defensive stance by holders.

Traders tracking inflows can gauge available liquidity. Periods of declining inflows often align with consolidation phases ahead of significant moves.

Key Takeaways

- Compression triangle: Converging highs and lows indicate an imminent breakout opportunity.

- Lower volatility: Narrowing price action increases the likelihood of a swift directional move when breakout occurs.

- Falling exchange inflows: Reduced deposits to exchanges can limit sell-side liquidity and support higher ranges on bullish breakouts.

Conclusion

Bitcoin’s compression triangle, combined with declining exchange inflows and compressed volatility, points to a high-probability setup for a strong move once confirmed. Traders should prioritize breakout validation via volume and follow-through candles and apply disciplined risk management. COINOTAG will continue monitoring price action and on-chain flows for the next developments.