After hoarding coins, SharpLink follows the trend by listing on the US stock market via blockchain

Recently, SharpLink Gaming Inc. (NASDAQ: SBET) released major news: the company plans to collaborate with fintech firm Superstate to directly tokenize SharpLink’s SEC-registered common stock and issue it on the Ethereum blockchain via its Opening Bell platform.

According to official documents, SharpLink’s tokenization path has several key features:

-

Compliance Assurance

Unlike many blockchain projects, SharpLink has chosen a fully compliant route. Its tokenized shares remain SEC-registered common stock, with legal status completely equivalent to traditionally recorded shares. This means shareholder rights are not affected by the change in form. -

Self-Custody and Transparency

Tokenized shares can be stored directly in investors’ digital wallets, enabling “self-custody.” This not only enhances investor control but also improves market transparency and efficiency. -

Potential for DeFi Integration

By being on-chain, shares may in the future be integrated into decentralized finance ecosystems, such as being used as collateral in lending protocols or, under regulatory compliance, traded on Automated Market Makers (AMMs). SharpLink has also stated this is one of its key research focuses. -

Regulatory Support

SharpLink emphasizes that this plan is aligned with the U.S. SEC’s “Project Crypto” initiative. This project is exploring digital assets and blockchain-driven market infrastructure, providing policy references for the implementation of tokenized securities.

Deep Integration with the Ethereum Ecosystem

SharpLink’s choice of Ethereum as the underlying public chain for tokenization is no coincidence. As the world’s largest smart contract platform, Ethereum boasts a mature ecosystem and a vast developer community. Moreover, in June this year, SharpLink announced it had become the world’s first “Ethereum digital asset treasury enterprise” and significantly increased its ETH holdings.

-

As of the end of September 2025, the company holds a total of 838,000 ETH, with a market value of several billions of dollars.

-

During the same period, it also received 3,815 ETH in staking rewards, further highlighting its long-term bullish strategic positioning on Ethereum.

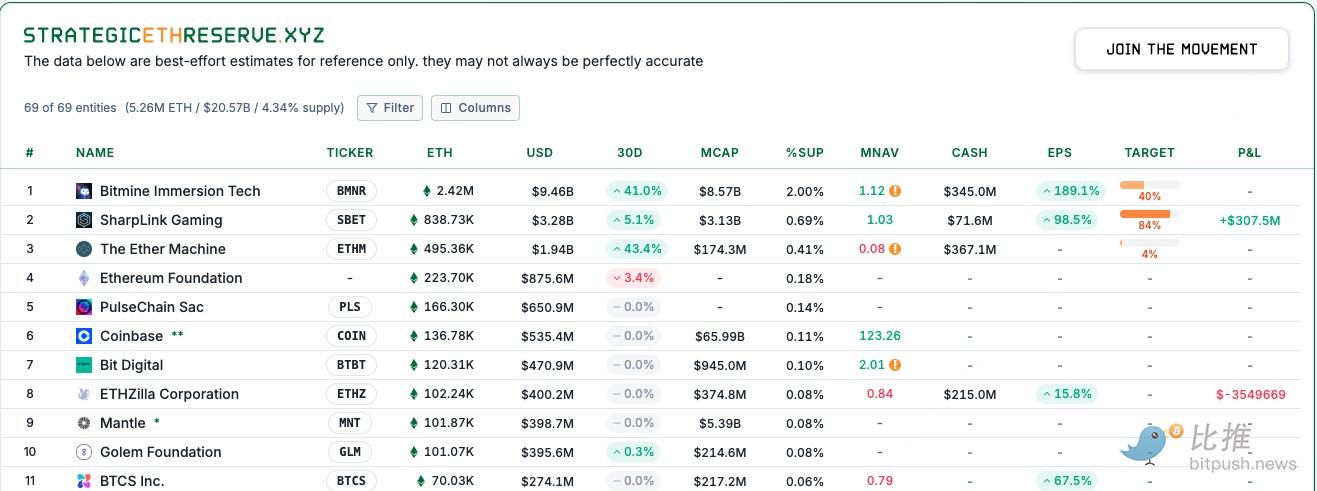

According to data from StrategicETHReserve.xyz, SharpLink holds over 838,000 ETH, worth about $3.3 billion, making it the second largest publicly traded Ethereum holder after BitMine Immersion Technologies.

SharpLink Chairman, Ethereum co-founder, and Consensys CEO Joseph Lubin stated: “Tokenizing and putting SharpLink shares on-chain is a statement about the future direction of global capital markets. We are driving the true convergence of traditional finance and the composable DeFi world.”

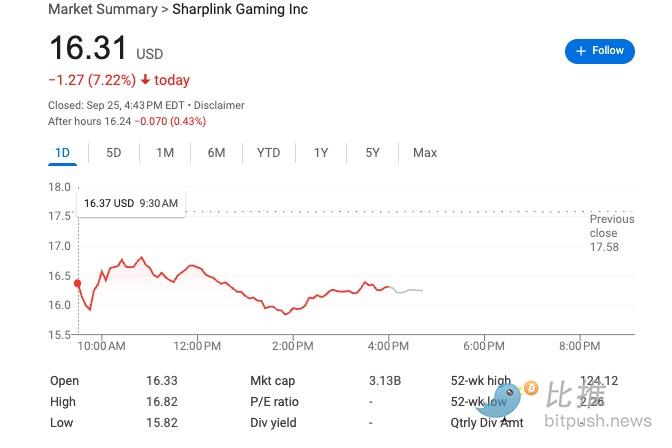

Stock Performance: Positive News Fails to Offset Short-Term Pressure

Although the tokenization plan has attracted strategic attention, SharpLink’s secondary market performance remains sluggish.

-

September 19: Stock price once reached a high of $17.33;

-

September 25: Fell to $16.3, with an intraday drop of up to 9%;

-

Accumulated decline of over 7.8% within a week, with highly unstable performance.

Investors are wavering between optimism and reality. The tokenization strategy is forward-looking, but it is difficult to improve the losses on the financial statements in the short term, making the market more inclined to remain cautious.

Financial Report: The Contradiction Between High Investment and Losses

SharpLink’s latest financial disclosures show the company is in a typical “heavy asset expansion + high-risk investment” phase:

-

Revenue and Profitability Challenges

-

Revenue scale is limited and struggles to meet market expectations.

-

Pre-tax profit margin is negative, with operating losses expanding year by year.

-

Earnings per share are sluggish, failing to demonstrate sustainable profitability.

-

Assets and Capital Structure

-

Total assets are about $454 million, with shareholder equity covering almost all assets.

-

Cash reserves are only $5 million, appearing stretched in a volatile market environment.

-

Dividend and Expense Pressure

-

Preferred stock dividend payments amount to $206.7 million, greatly squeezing profit margins.

-

EBIT (Earnings Before Interest and Taxes) shows losses of several hundred million dollars, indicating the core business has not yet emerged from the capital consumption phase.

In other words, although the company has strong on-chain assets (ETH holdings), it still faces heavy pressure on its core business side.

From an innovation perspective, SharpLink could become the first company to achieve stock tokenization in the U.S. capital market, with huge potential. From a practical perspective, its financial condition and market performance are not optimistic.

For short-term investors, SharpLink’s current trend is weak, with risks outweighing opportunities; for long-term investors, if they believe in the future prospects of tokenized securities and the Ethereum ecosystem, they may choose to build positions at low levels, betting on a “future narrative.”

In the coming months, SharpLink’s development will depend on several key factors:

-

Whether tokenized shares can be successfully implemented and recognized by investors and regulators;

-

Whether the Ethereum asset strategy can unlock value and bring long-term financial returns to the company;

-

Whether the core business profit model can be optimized to gradually reverse the ongoing losses.

If these elements can be gradually realized, SharpLink may be able to emerge from its current trough and become a benchmark case for the integration of traditional finance and blockchain; if not, it may continue to linger on the fringes of the capital market.

Author: Seed.eth

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin (BTC/USD) Price Alert: Bitcoin Breaks Major Resistance - Next Stop $100,000?

Ethereum treasury demand collapses: Will it delay ETH’s recovery to $4K?

Can BNB price retake $1K in December?

Trending news

More[Bitpush Daily News Selection] Trump actively hints at Hassett as the next Federal Reserve Chairman; Bloomberg: Strategy may consider offering bitcoin lending services in the future; Strategy CEO: Strategy sets $1.4 billion reserve through stock sale to ease bitcoin selling pressure; Sony may launch a US dollar stablecoin for payments in gaming, anime, and other ecosystems

Bitcoin (BTC/USD) Price Alert: Bitcoin Breaks Major Resistance - Next Stop $100,000?

![[Bitpush Daily News Selection] Trump actively hints at Hassett as the next Federal Reserve Chairman; Bloomberg: Strategy may consider offering bitcoin lending services in the future; Strategy CEO: Strategy sets $1.4 billion reserve through stock sale to ease bitcoin selling pressure; Sony may launch a US dollar stablecoin for payments in gaming, anime, and other ecosystems](https://img.bgstatic.com/multiLang/image/social/44682a8c7537c9a9b467e17ed74a704d1764777241317.jpg)