Date: Thu, Sept 25, 2025 | 06:20 PM GMT

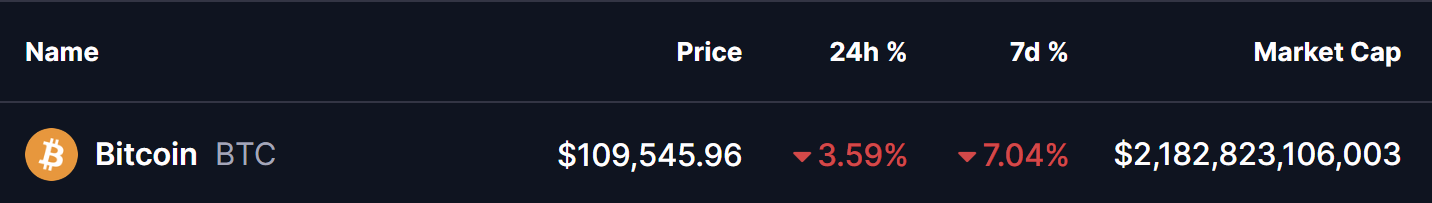

The cryptocurrency market is facing heavy selling pressure, with more than $1.12 billion in liquidations recorded in the past 24 hours. Bitcoin (BTC) alone slipped over 3%, testing the $108K level, while the total crypto market cap has contracted nearly 5% to $3.72 trillion.

But beneath the bearish momentum, a potential harmonic pattern on BTC’s daily chart is hinting at a rebound.

Source: Coinmarketcap

Source: Coinmarketcap

Potential Harmonic Pattern Signals Upside Move

On the daily chart, Bitcoin appears to be forming a Gartley harmonic pattern. This formation is often known for marking reversal zones, where the final leg of the structure (point D) completes and price tends to reverse higher.

The current move started in mid-August when BTC failed to sustain above the $123,731 resistance, identified as point X. From there, price retraced sharply into point A, bounced toward point B, and then corrected once again to reach point C near $108,707. After that low, Bitcoin has shown resilience and is currently consolidating around the $109,512 level, though a stronger rebound is yet to be confirmed.

Bitcoin (BTC) Daily Chart/Coinsprobe (Source: Tradingview)

Bitcoin (BTC) Daily Chart/Coinsprobe (Source: Tradingview)

Another important factor is the 200-day moving average, which currently sits at $113,332. BTC is trading just below this level, and a decisive reclaim could flip it into strong support, opening the door for further upside momentum.

What’s Next for BTC?

For the bullish setup to remain valid, Bitcoin needs to protect the $108K support zone near point C and make a move back above the 200-day moving average. If this happens, the Gartley structure points toward a potential extension into the PRZ (Potential Reversal Zone) between $120,215 and $123,731.

This range represents the 0.786–1.0 Fibonacci retracement levels and suggests a possible 13% upside from the current market price.

Although the harmonic setup appears promising, it may be too early to fully rely on the C-point support, as prices could still dip further before forming a stronger base. Traders should be prepared for such a scenario.