Trader Says Bitcoin Primed for More Downside Before ‘Up-Only Mode,’ Updates Outlook on Ethereum

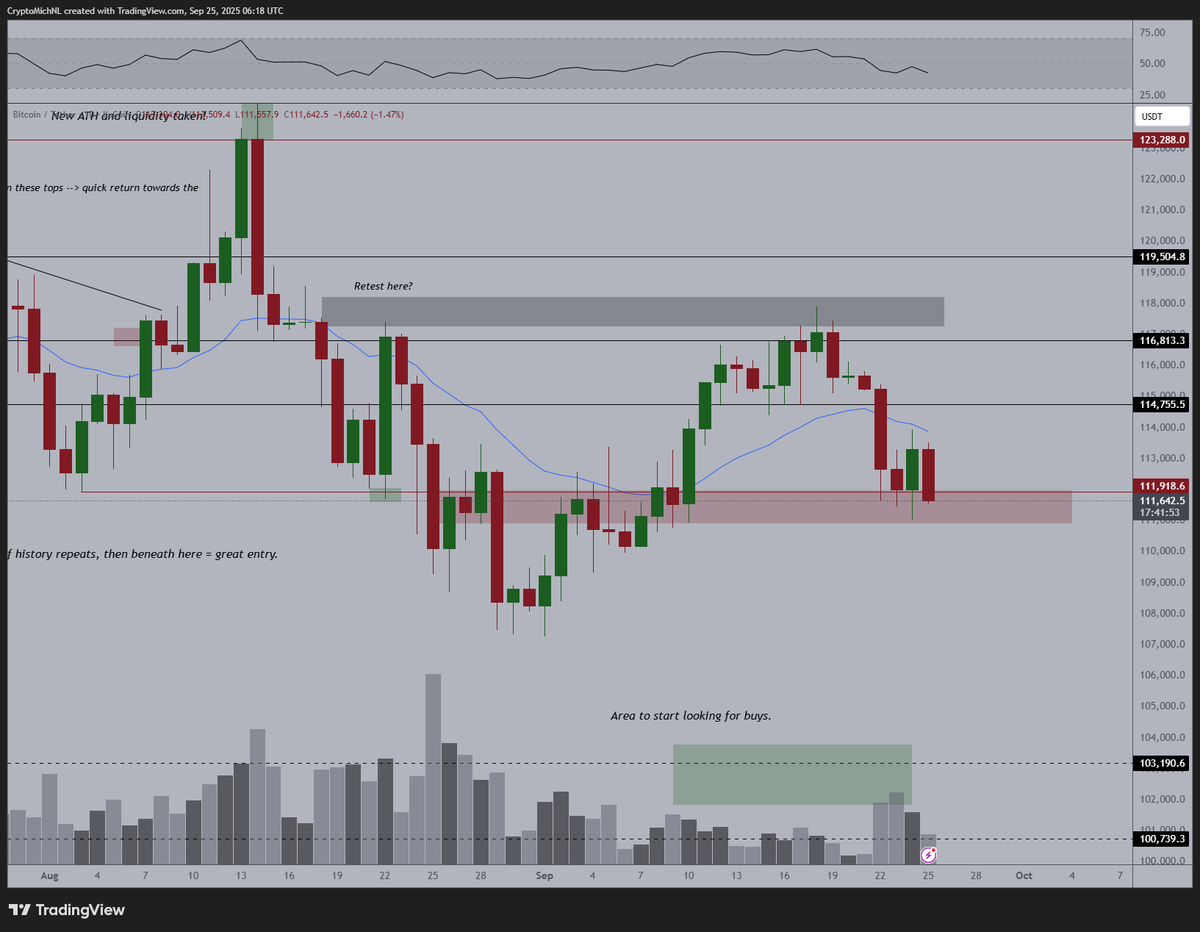

Crypto trader Michaël van de Poppe says that Bitcoin ( BTC ) may have a deeper correction before an explosive move to the upside.

Van de Poppe tells his 808,600 followers on X that Bitcoin may decline below its current $111,000 range before entering a period of bullish momentum.

“I would assume that we’ll be going to get some more downside and then we’re done for the current period, meaning that we’ll be in up-only mode.”

Source: Michaël van de Poppe/X

Source: Michaël van de Poppe/X

Looking at his chart, the trader suggests Bitcoin may retest the level around $108,000 similar to late August.

Bitcoin is trading for $111,075 at time of writing, down 2.3% in the last 24 hours.

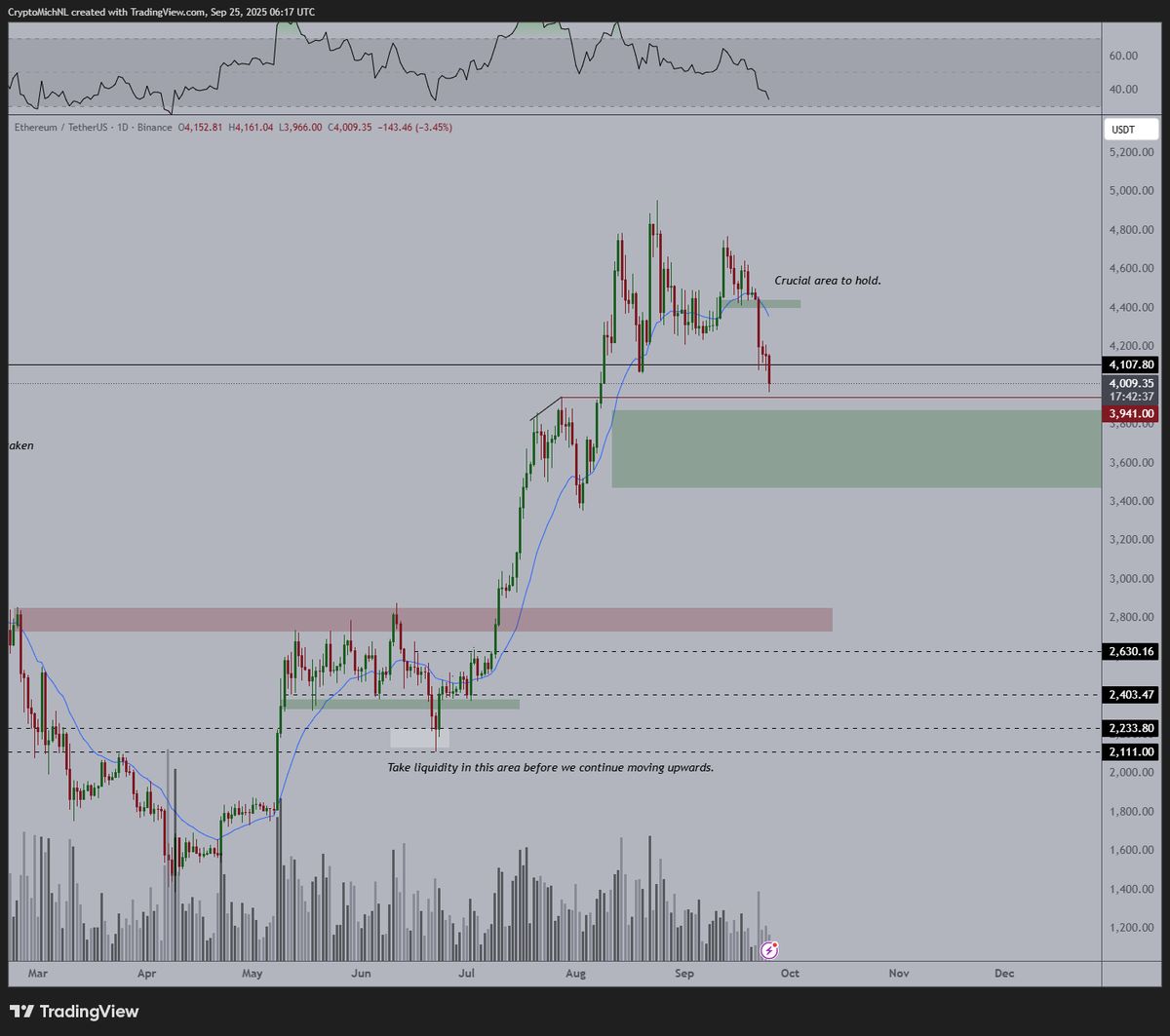

Next up, the analyst says that Ethereum ( ETH ) may form a local market bottom around the $3,800 level.

“I don’t think there’s much more downside to come. Would suggest that the green zone is where we’ll be bottoming out. Perhaps another 5% drop on ETH and that should be it.”

Source: Michaël van de Poppe/X

Source: Michaël van de Poppe/X

The analyst also predicts that ETH will hit five-figures this cycle and other altcoins may increase 400% from their current values.

“It’s near the bottom on altcoins and ETH. What’s next? ETH at $10,000. Altcoins to go 3-5x. It’s not the end of the bull market, it’s the start of the bull market and recent listings have shown proof of this.”

ETH is trading for $4,002 at time of writing, down 4.5% in the last 24 hours.

Generated Image: Midjourney

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Cardano News Today: How Getting in Early Fuels the Intense Competition in Crypto Presales

- Apeing's 2026 presale offers early access at $0.0001, targeting a 10x return as investors seek high-potential crypto opportunities amid market volatility. - Cardano (ADA) faces recovery challenges after a network split, while SUI's price surges and institutional interest highlight contrasting crypto market dynamics. - Grayscale's Zcash ETF filing and Securitize's EU tokenized securities platform signal crypto's growing institutional adoption and regulatory progress. - Analysts warn of systemic risks from

COAI Token Fraud Aftermath: Dangers and Warning Signs in New Cryptocurrency Ventures

- COAI Token's 88% collapse erased $116.8M, exposing systemic risks in algorithmic stablecoins, centralized governance, and regulatory gaps. - 87.9% token concentration in ten wallets enabled manipulation, contradicting decentralization claims while CLARITY Act ambiguities allowed regulatory exploitation. - Southeast Asia's crypto fraud hub status amplified risks, with COAI's failure mirroring FINRA-identified red flags like opaque tokenomics and anonymous teams. - Investors must prioritize technical audit

The Xerox Campus Transformation: Ushering in a New Era of Industrial Property Expansion in Webster, NY

- Xerox’s 300-acre NY campus, funded by a $9.8M FAST NY grant, is transforming into a $1B+ industrial hub by 2025. - Infrastructure upgrades and EPA-approved remediation, including groundwater treatment and bedrock enhancement, ensure the site’s viability for advanced manufacturing and logistics. - Subdividable land parcels (40–100 acres) with pre-built infrastructure attract manufacturers, supported by state incentives and a 10.1% surge in local property values. - Low vacancy rates (2%) and proximity to I

Crypto Market Watch: TAO Shows Early Bullish Rebound Signs Toward $400