DeFi’s Institutional Transformation: Stablecoin Integration within Unified Ecosystems

- DeFi stablecoin protocol Level announced its acquisition by an unnamed institutional DeFi entity, phasing out its tokens and transitioning operations by late 2025. - Users must unstake slvlUSD by October 2, 2025, to claim final earnings, with direct smart contract access required after December 15 for asset management. - The acquisition reflects DeFi consolidation trends, as institutional players integrate innovative stablecoin solutions into broader ecosystems to enhance scalability and compliance.

Level, a stablecoin protocol focused on DeFi yield generation, has revealed that it is being acquired by a prominent decentralized finance organization. As part of this transition, Level’s platform and its main tokens, lvlUSD and slvlUSD, will be gradually discontinued. The deal, finalized in late September 2025, represents a significant move in the DeFi industry, as major institutions aim to incorporate advanced stablecoin technologies into wider financial networks.

According to the acquisition agreement, Level’s team will become part of the acquiring organization, though the buyer’s identity has not yet been disclosed. The transition strategy involves shortening the cooldown period for unstaking slvlUSD to just 2 seconds, enabling users to access their funds more rapidly. The last round of earnings will be distributed on October 2, 2025, after which no additional yield will accrue, regardless of whether assets remain staked. The platform’s user interface will stay accessible until December 15, 2025; after that date, users must interact directly with the protocol’s smart contracts to manage unstaking and redemptions.

Launched in late 2024, Level’s protocol quickly established itself as a stablecoin platform offering yield opportunities. Its lvlUSD token, fully backed by

This acquisition is in line with the broader trend of consolidation in the DeFi space, as institutional players look to simplify operations and reduce market fragmentation among stablecoins. Level’s open, on-chain yield model—unlike more opaque centralized options—helped it stand out for delivering risk-adjusted returns. Nevertheless, the acquisition highlights the difficulties standalone stablecoin projects face in a crowded market, where scalability and regulatory demands increasingly benefit larger organizations.

For Level users, the transition provides a clear schedule for retrieving their assets. Holders are encouraged to unstake slvlUSD and redeem lvlUSD before October 2 to ensure they receive their final earnings. The reduced cooldown period lowers liquidity risks, making the migration to the new institution’s platform smoother. After December 15, all asset management will require direct interaction with smart contracts, underscoring the importance of self-custody during DeFi transitions.

This acquisition signals the ongoing evolution of the stablecoin industry, where institutional-grade platforms are taking precedence over smaller, specialized protocols. By joining a larger DeFi entity, Level may benefit from broader integrations and improved capital efficiency, meeting the market’s demand for scalable and interoperable financial solutions. As DeFi matures, such mergers are likely to become more common, driving the sector toward more resilient, institution-focused platforms.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin News Update: Tether's Mining Venture in Uruguay Falters Due to High Energy Expenses and Regulatory Challenges

- Tether halts Uruguay Bitcoin mining due to rising energy costs and regulatory hurdles. - The $500M project led to $100M+ spent and 30 layoffs amid unsustainable costs. - The failure highlights crypto mining risks in regions with unstable energy pricing. - Tether shifts focus to Paraguay/El Salvador as industry migrates to cheaper energy. - S&P downgrades USDT stability, warning of undercollateralization risks from Bitcoin exposure.

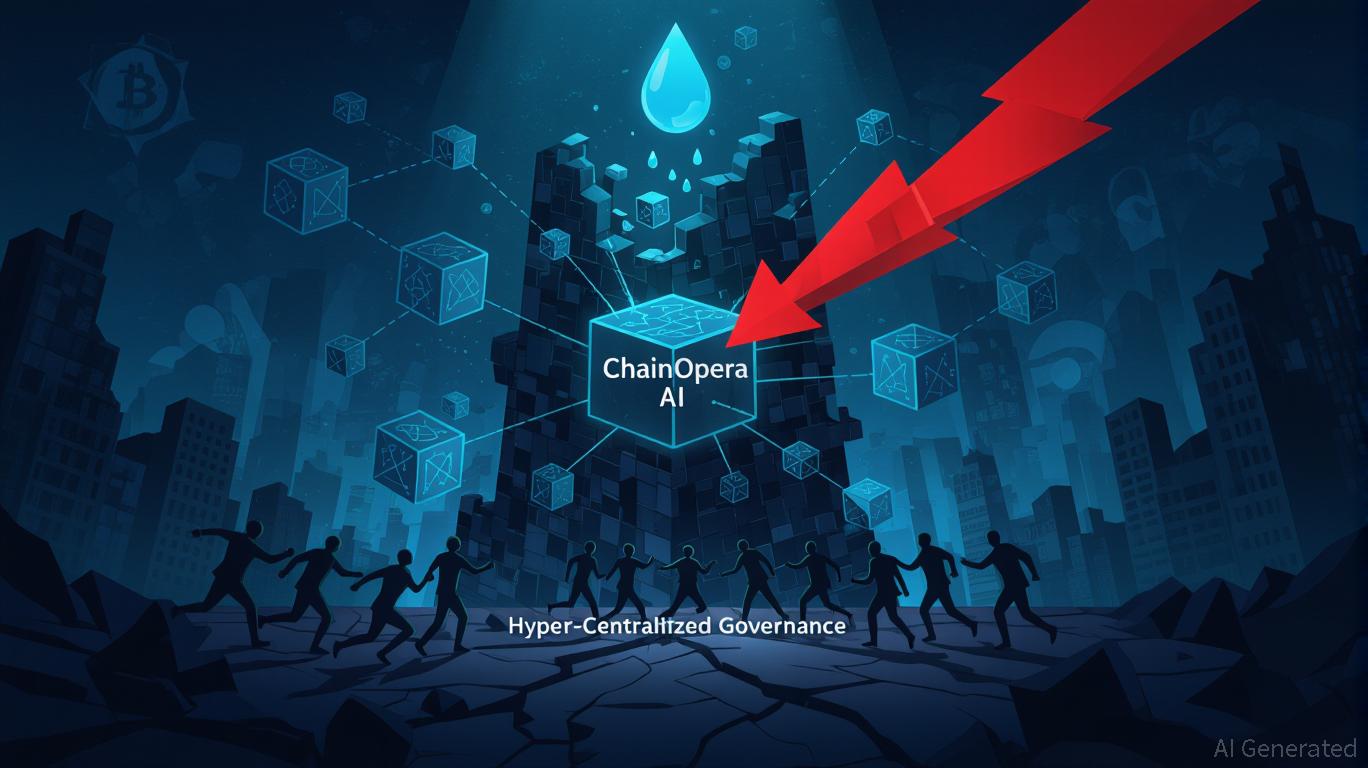

The ChainOpera AI Token Collapse: A Cautionary Tale for Cryptocurrency Initiatives Powered by AI

- ChainOpera AI (COAI) token's 96% collapse in late 2025 exposed systemic risks in AI-integrated blockchain ecosystems, warning investors about conflating innovation with stability. - Hyper-centralized governance (87.9% supply controlled by 10 wallets) and opaque "black box" AI models triggered liquidity crises and panic selling, eroding trust. - Regulatory ambiguities from U.S. CLARITY/GENIUS Acts and speculative hype (96% 24h surge) amplified volatility, as 80% locked supply posed future sell-off risks.

Behavioral Economics and Protecting Investors in Developing Cryptocurrency Markets

- COAI token's 2025 collapse erased $116.8M due to centralized control, unstable AI algorithms, and regulatory ambiguity. - Behavioral biases like overconfidence and herd mentality amplified risks, creating panic-driven feedback loops during the crisis. - Investors are advised to prioritize transparent audits, diversify across vetted projects, and leverage real-time fraud detection tools. - Regulatory frameworks like EU's MiCA and psychological discipline are critical to mitigate systemic and behavioral ri

This week, the US spot Ethereum ETF saw a net inflow of $368 million.