How Cryptocurrency is Disrupting Financial Markets and Future Prospects

The most incredible thing is the fusion of meme stocks and speculative cryptocurrencies.

The most bewildering phenomenon is the fusion of meme stocks and speculative cryptocurrencies.

Written by: Yueqi Yang

Translated by: Block unicorn

Preface

In the past four months, cryptocurrencies have swept through the traditional financial system, penetrating banks and stock markets more deeply than ever before. These dizzying changes have generated billions of dollars in profits for the industry, while also bringing more risks to investors and regulators.

The changes have come so quickly that it’s hard to keep up. We have reviewed the past few months to help readers understand the four major trends driving the cryptocurrency boom. We’ll also tell you what to watch for during the rest of the year. Will stablecoins thrive or collapse? Will there be more cryptocurrency trading on the stock market? Will stocks be traded on cryptocurrency exchanges? Can the good times last?

The biggest factor driving these four trends is President Donald Trump’s support for cryptocurrencies. He has turned regulators from adversaries to friends of crypto and pushed Congress to pass the first-ever cryptocurrency legislation.

The result has been an explosive growth in cryptocurrency products, trading, and strategies. This shift has caused strong reactions in the stock market, banking, and fintech industries. Here’s what’s happened specifically.

Stablecoin Legislation

Event Review: In July this year, President Trump signed legislation regarding stablecoins. Stablecoins are blockchain-based currencies used as cash in the cryptocurrency market. They are the category of cryptocurrency most closely linked to the mainstream financial system. These tokens are pegged 1:1 to the US dollar and maintain their price by holding liquid assets such as cash and short-term US Treasuries. They are similar to money market funds but typically do not pay interest to investors. Today, cryptocurrency traders mainly use stablecoins to store funds on the blockchain as collateral or for international payments.

Significance: The new law legalizes stablecoins and is expected to promote their use. This has attracted the attention of banks, fintech, and payment companies, who are exploring whether stablecoins can make transactions faster and cheaper than traditional wire transfers. In emerging markets, individuals and businesses are already using US dollar-backed stablecoins to hedge against inflation, cope with local currency volatility, and receive remittances from family members working overseas.

The new rules may increase demand for US Treasuries that back stablecoins. Increased use of stablecoins could reduce investor deposits in banks, potentially reducing the funds banks have available for lending.

What’s Next: In the coming months, regulators will negotiate the details of stablecoin regulation amid intense lobbying from the cryptocurrency and financial industries. One point of contention is whether crypto platforms can pay yields to investors holding stablecoins. Banking industry groups oppose this, saying it threatens bank deposits; crypto groups support it, saying they need to offer competitive products.

Another cryptocurrency bill called the “Clarity Act” will be submitted to Congress, which will establish a regulatory framework for cryptocurrencies and may affect stablecoin rules.

Surge of New Stablecoins

Event Review: Until recently, there were only two major stablecoins: Tether’s USDT, with a circulation of $171 billions, and Circle’s USDC, valued at $74 billions. Now, more stablecoins have emerged, with others in development. Startups, banks, and fintech companies are joining in, launching their own US dollar-backed stablecoins or integrating with existing ones.

Payment giant Stripe announced it will launch a blockchain called Tempo, focusing on stablecoin transactions in areas such as payroll and remittances. Banks like BNY and Morgan Stanley offer asset management services for supporting stablecoins, while JPMorgan provides deposit tokens representing users’ bank deposits on the blockchain.

Stablecoins are mainly issued by cryptocurrency exchanges, giving them the power to pick winners and losers. Recently, the booming startup crypto exchange Hyperliquid launched a bidding process and allowed users to vote for stablecoin issuers, causing industry upheaval. This has also triggered a race to the bottom, which could erase stablecoin providers’ profits.

Significance: The widespread acceptance of stablecoins means these tokens can be used for payments to merchants and suppliers, cash management for multinational corporations, and interbank settlements. Small lenders like Cross River Bank are considering accepting stablecoins directly from their fintech clients.

The surge in stablecoins increases the risk of cryptocurrency volatility spilling over into the traditional financial system. If one stablecoin collapses, it could cause investors to lose confidence and sell off other stablecoins. This could lead to a sell-off of US Treasuries that support the market and the US economy.

What’s Next: Tether and Circle face pressure from new competitors to maintain their market dominance. Tether is launching a US token compliant with the new stablecoin legislation. The details of stablecoin rules and the terms of cooperation between platforms and issuers will determine whether the industry remains profitable or turns into a commoditized business where only the largest companies make money.

Cryptocurrency IPOs

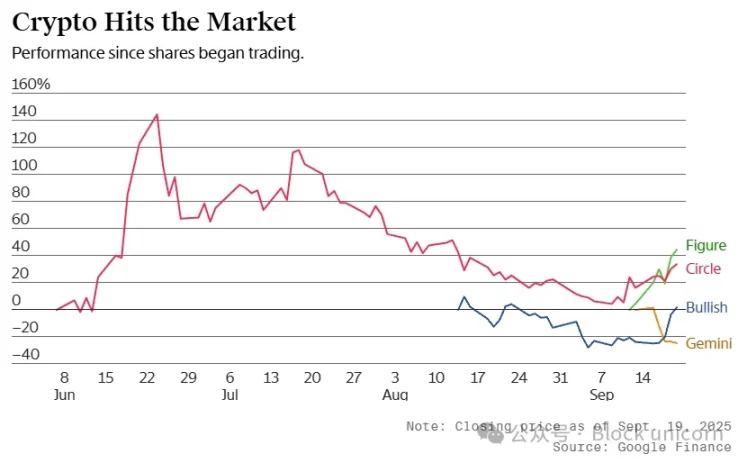

Event Review: Cryptocurrency companies are going public and achieving huge gains. Stablecoin issuer Circle, blockchain lender Figure, and crypto platforms Gemini and Bullish all saw significant surges on their first day of listing.

Lawyers say part of the reason is that under Trump’s leadership, the US Securities and Exchange Commission has taken a friendly stance toward cryptocurrencies and is now giving the green light to crypto companies seeking IPOs.

Significance: The enthusiasm of the public markets for these companies has surprised even insiders in the crypto industry. Circle’s stock price soared 358% from its IPO price in June. Even relatively small, unprofitable exchanges like Gemini saw their stock prices rise, although the company’s stock has since fallen below its IPO price.

Many of these companies are essentially betting on cryptocurrency trading volumes, which are highly volatile, shifting some industry risk to the stock exchanges. Less than three years ago, the collapse of crypto exchange FTX seems to have been forgotten by investors.

What’s Next: More IPOs are coming. Crypto exchanges Kraken and OKX, custodian BitGo, and asset manager Grayscale are preparing to go public, with some expected as early as this year.

While IPOs bring crypto companies to stock exchanges, the next goal for the crypto industry is to have stocks traded on crypto exchanges. Their aim is to put stocks on the blockchain via crypto tokens, which represent investments in stocks like Tesla, Nvidia, and Circle. Companies such as Robinhood, Kraken, and Galaxy Digital are working to promote tokenized stocks, especially among overseas crypto users who may not have access to the US market.

Stocks Flood into Cryptocurrency

Event Review: The most bewildering phenomenon is the fusion of meme stocks and speculative cryptocurrencies. This began with Strategy (formerly Microstrategy), a publicly traded software maker that snapped up $75 billions worth of bitcoin, turning itself into a crypto proxy in the stock market.

This strategy has spread to small-cap stocks, which are competing to become vehicles for various tokens, including Ethereum, Solana, Dogecoin, and the Trump family’s World Liberty token.

According to crypto advisory firm Architect Partners, more than 130 US-listed companies have announced plans this year to raise over $137 billions to purchase cryptocurrencies.

Significance: This means more crypto-related stock issuances. Many are set up through complex private financing deals. These stocks often surge at the start of trading, allowing holders of crypto tokens to sell them at high prices to stock market investors.

This is not necessarily good for investors. Of the 35 such stocks tracked by Architect, the average return since the announcement of crypto purchase plans is -2.9%. On the first trading day after the announcement, these stocks fell by 20.6%.

What’s Next: Many of these crypto stocks, especially Strategy, have market capitalizations far exceeding the value of the cryptocurrencies they hold, mainly because investors are chasing the meme coin craze. Investor demand enables these companies to efficiently raise funds and buy more cryptocurrencies.

The market capitalization of these companies relative to the value of their crypto holdings is beginning to decline. This makes it difficult for them to raise funds and may force them to stop buying cryptocurrencies. The factors driving stock prices up may begin to reverse.

Meanwhile, Nasdaq is stepping up scrutiny of these issuances, in some cases requiring shareholder approval.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin battles $50K price target as Fed adds $13.5B overnight liquidity

Bitcoin valuation metric projects 96% chance of BTC price recovery in 2026

Bitcoin's ‘more reliable’ RSI variant hits bear market bottom zone at $87K

XRP ETF inflows exceed $756M as bullish divergence hints at trend reversal