HEMI has dropped by 471.2% over the past week as its price has seen a significant decline

- HEMI plunged 471.2% in seven days to $5.47 on Sep 25, 2025, extending multi-month/annual declines. - Technical indicators show broken support levels, prolonged bearish momentum, and no reversal signals. - Analysts warn of continued downward pressure due to absent bullish catalysts and risk-off investor behavior. - Proposed short-selling strategy targets 200-day MA crossovers and volume spikes to capitalize on directional declines.

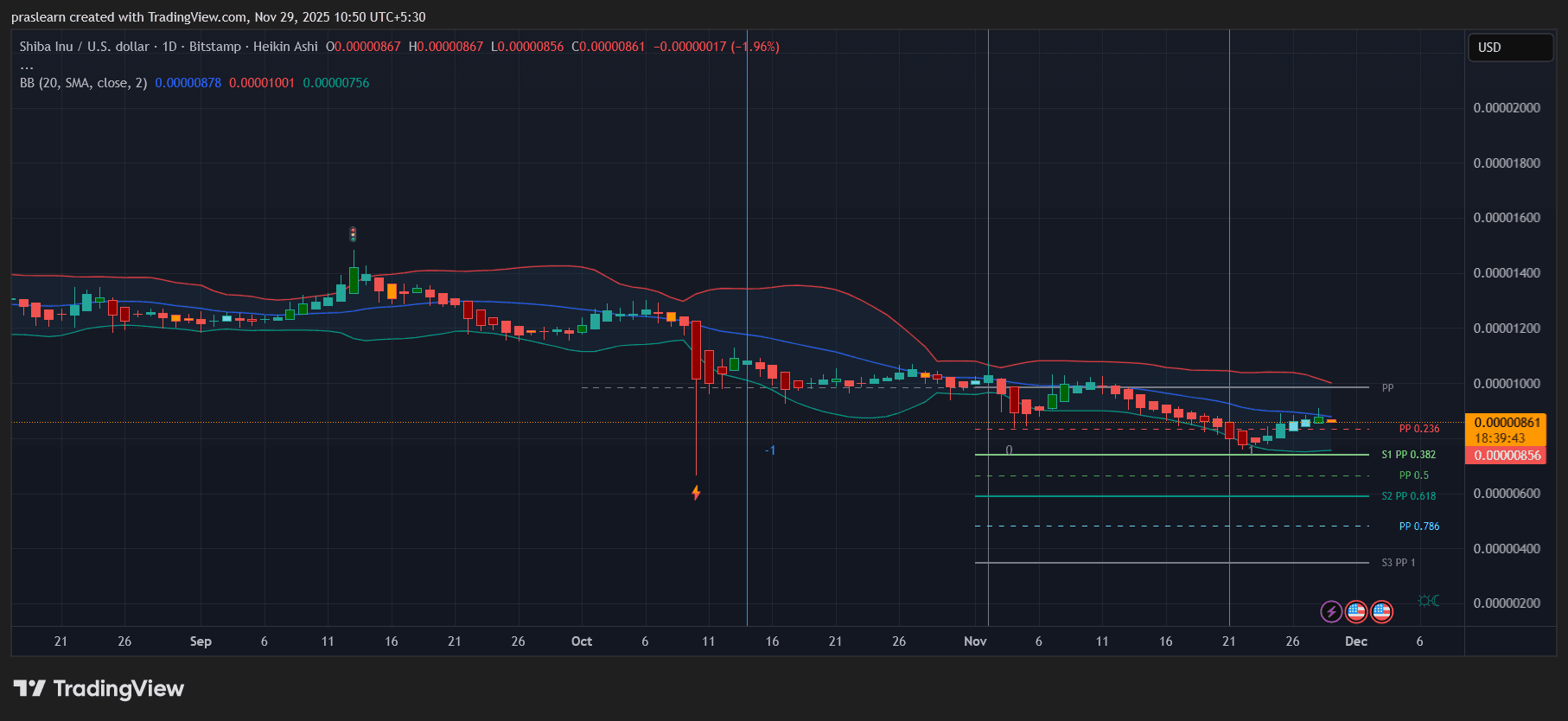

Over the last week, HEMI saw its value plunge by 471.2%, dropping to $5.47 as of September 25, 2025. This sharp fall extended an already steep downward trajectory, with the asset losing 471.2% over the past month and experiencing a comparable decline throughout the year. The 24-hour decrease of 179.86% further illustrates the severity of the sell-off and points to a growing pessimism among traders.

This significant drop has prompted a reassessment of HEMI’s core strengths and its position in the market. Technical analysis indicates that bearish momentum has persisted, with crucial resistance points breached and no immediate indications of a turnaround. Market experts anticipate ongoing downward movement unless a major catalyst emerges to shift investor outlook. With no clear support or stabilizing factors in sight, the market for

Further analysis of the current environment shows a lack of positive drivers, as there have been no significant updates or strategic moves to counteract the persistent decline. Trading patterns have shifted toward caution, with participants seeking liquidity and reducing their exposure to assets with high volatility. This trend is mirrored across the broader market, where HEMI’s sharp drop exemplifies a widespread move toward defensive strategies.

From a technical perspective, HEMI’s fall has involved the breakdown of several important support zones and an inability to rebound from recent lows. This has triggered a wave of stop-loss executions and heightened selling activity, fueling a self-perpetuating downward cycle. Although there have been brief recoveries, none have established a lasting reversal, reinforcing the prevailing negative outlook.

Backtest Hypothesis

Given the strong downward momentum and absence of short-term recovery signals, a backtesting approach is suggested to model a short-selling strategy that aligns with the current price movement. This method utilizes a blend of moving average crossovers and volume surges to pinpoint ideal moments for entering and exiting trades during a bearish trend.

The premise is that a short position would be opened when the 200-day moving average crosses below, confirmed by a notable increase in trading volume. Exits would be determined by either hitting a preset stop-loss or reaching a profit target based on recent price action. This strategy aims to capitalize on prolonged declines in a strongly trending market, as is currently the case with HEMI.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Institutional Buying Returns: BlackRock, Fidelity, and Ark Invest Quietly Load Up on Crypto

Shiba Inu Price Just Woke Up: Here’s What Could Happen Next

Europe’s Biggest Asset Manager Amundi Is Now Using Ethereum

Resilience-Focused Business Strategies: The Role of Challenges in Shaping Entrepreneurs and Organizations

- Adversity-driven founders build resilient enterprises through operational discipline and long-term vision, outperforming peers during economic crises. - Case studies like Nikita Hair and Dyson show hardship fosters innovation, customer focus, and iterative resilience critical for scalability. - 2025 investors prioritize founder-led companies with adversity-fueled cultures, exemplified by Berkshire's $30.8B Q3 earnings and Palantir's 121% revenue growth. - Resilient leadership correlates with 20% higher e