Grayscale Q3 Asset Review: What Will Drive Q4 Performance?

Recently, four major themes have stood out in the market: Digital Asset Treasury (DAT), the adoption of stablecoins, increased exchange trading volume, and the growth of decentralized perpetual contracts.

Original Article Title: Grayscale Research Insights: Crypto Sectors in Q4 2025

Original Source: Grayscale

Original Translation: Golden Finance

Key Points of This Article:

· In Q3 2025, the price returns of all six cryptocurrency sectors were positive, while fundamental changes were mixed. The "cryptocurrency sectors" are a proprietary framework we developed in collaboration with index provider FTSE/Russell to organize the digital asset market and measure returns.

· Bitcoin's performance was below that of other cryptocurrencies, and the return pattern of other cryptocurrencies can be seen as a "Alt Season" — although different from the past.

· The ranking of the top 20 tokens before Q3 (based on volatility-adjusted price returns) highlighted the importance of stablecoin regulation and adoption, the rise in centralized exchange trading volume, and the significance of Digital Asset Treasuries (DAT).

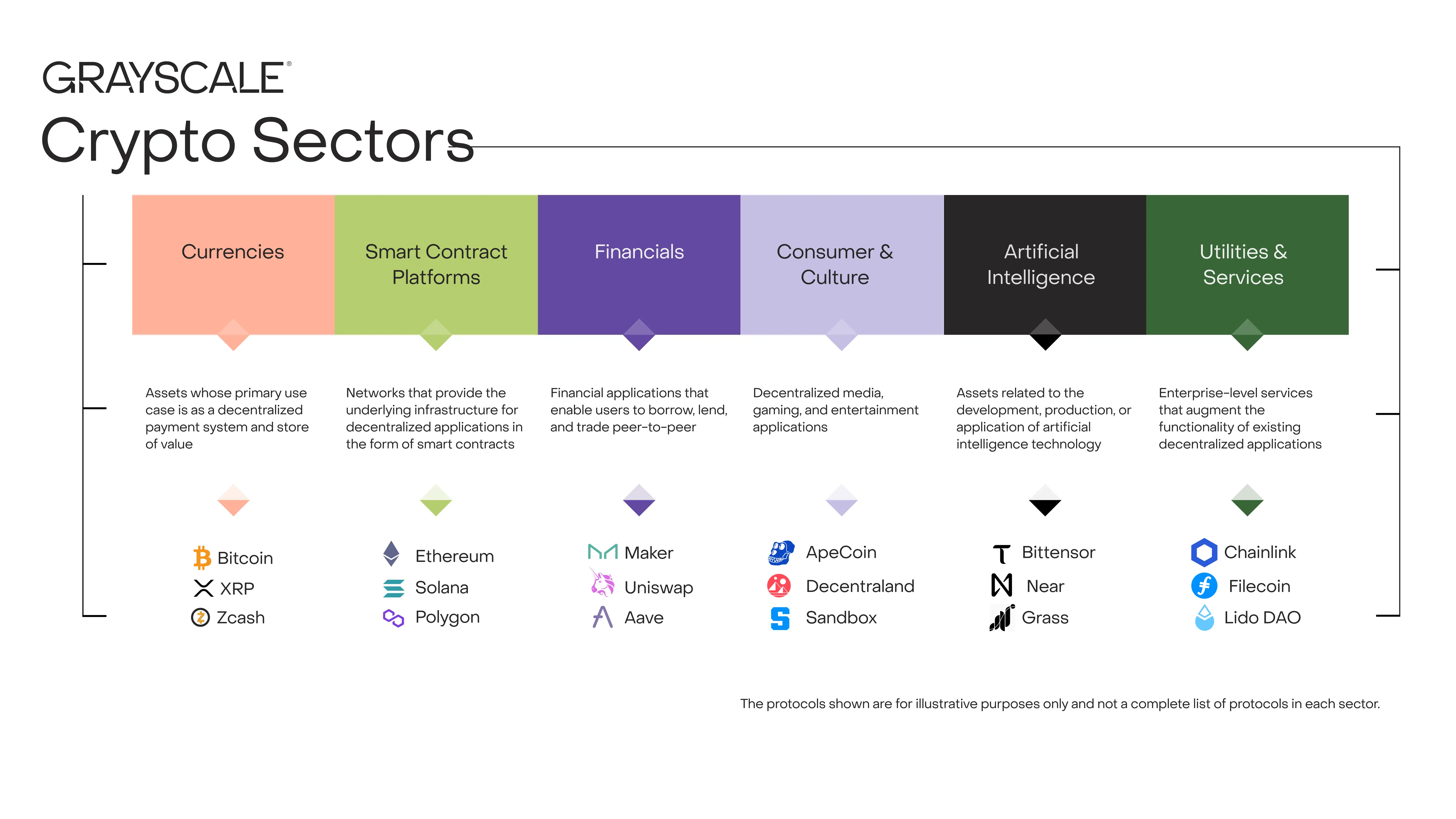

Each asset in cryptocurrency is somehow related to blockchain technology and shares the same underlying market structure — but that's where the similarities end. This asset class covers a broad range of software technologies applied in consumer finance, artificial intelligence (AI), media, and entertainment, among other fields. To organize the data neatly, Grayscale Research uses a proprietary classification and index series developed in collaboration with FTSE/Russell, namely "Crypto Sectors." The "Crypto Sectors" framework covers six different sub-markets (Chart 1). Together, they encompass 261 tokens with a total market capitalization of $3.5 trillion.

Chart 1: The "Crypto Sectors" framework helps organize the digital asset market

Measuring Blockchain Fundamentals

Blockchain is not a company, but its economic activity and financial health can be measured in a similar way. The three key metrics of on-chain activity are users, transactions, and transaction fees. Since blockchain is anonymous, analysts typically use "active addresses" (blockchain addresses with at least one transaction) as an imperfect proxy for the number of users.

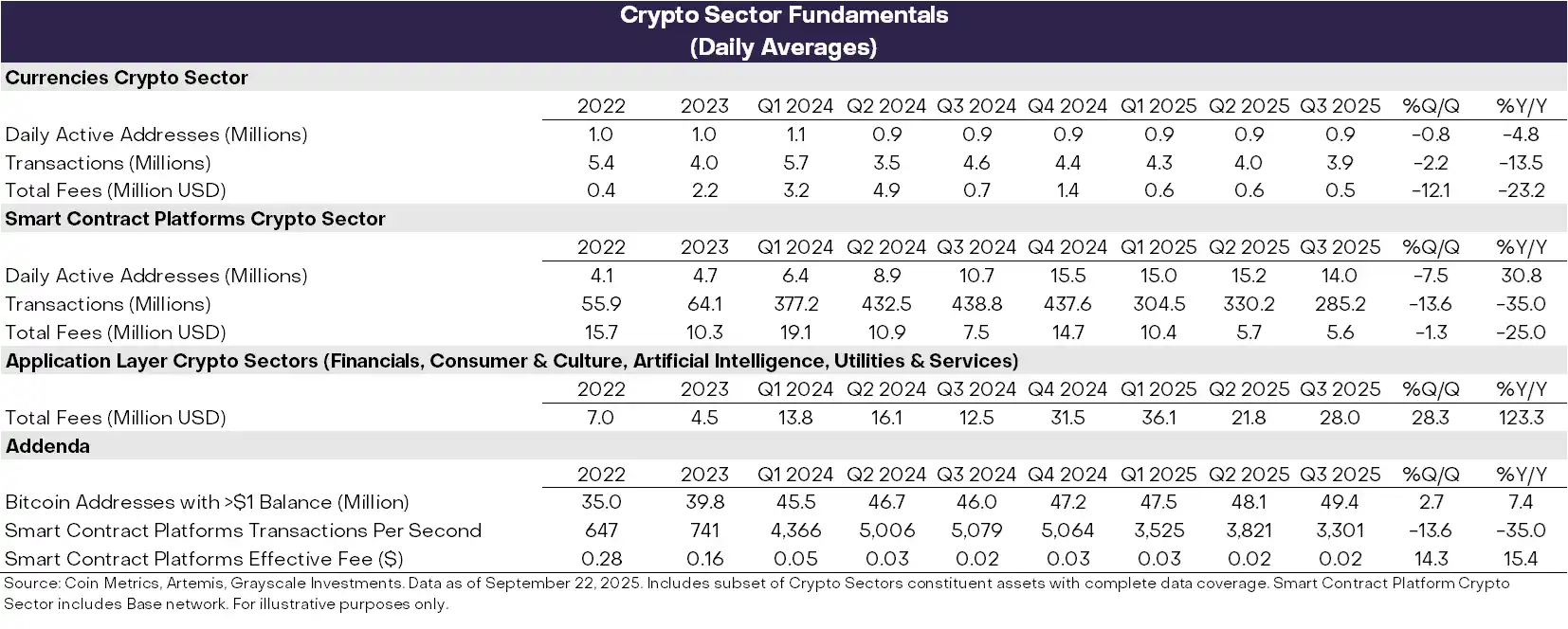

In Q3, the fundamental indicators of blockchain health fluctuated (Chart 2). On the negative side, the number of users, transaction volume, and fees for the currency and smart contract platform cryptocurrency sectors all decreased compared to the previous period. Overall, since Q1 2025, speculative activity related to Meme coins has declined, leading to a decrease in transaction volume and activity.

What is even more encouraging is that the fee revenue of blockchain-based applications has grown by 28% quarter-over-quarter. This growth has been primarily driven by the activity of a few top-ranked applications in terms of fee revenue: (i) Jupiter, a decentralized exchange based on Solana; (ii) Aave, a leading cryptocurrency lending protocol; and (iii) Hyperliquid, a leading perpetual futures contract exchange. On an annualized basis, application layer fee revenue has now exceeded 10 billion US dollars. Blockchain serves as both the network for digital transactions and the platform for applications. Therefore, higher application fees can be seen as a sign of the increasing adoption of blockchain technology.

Figure 2: Fundamental Performance of Cryptocurrency Sectors in Q3 2025

Tracking Price Performance

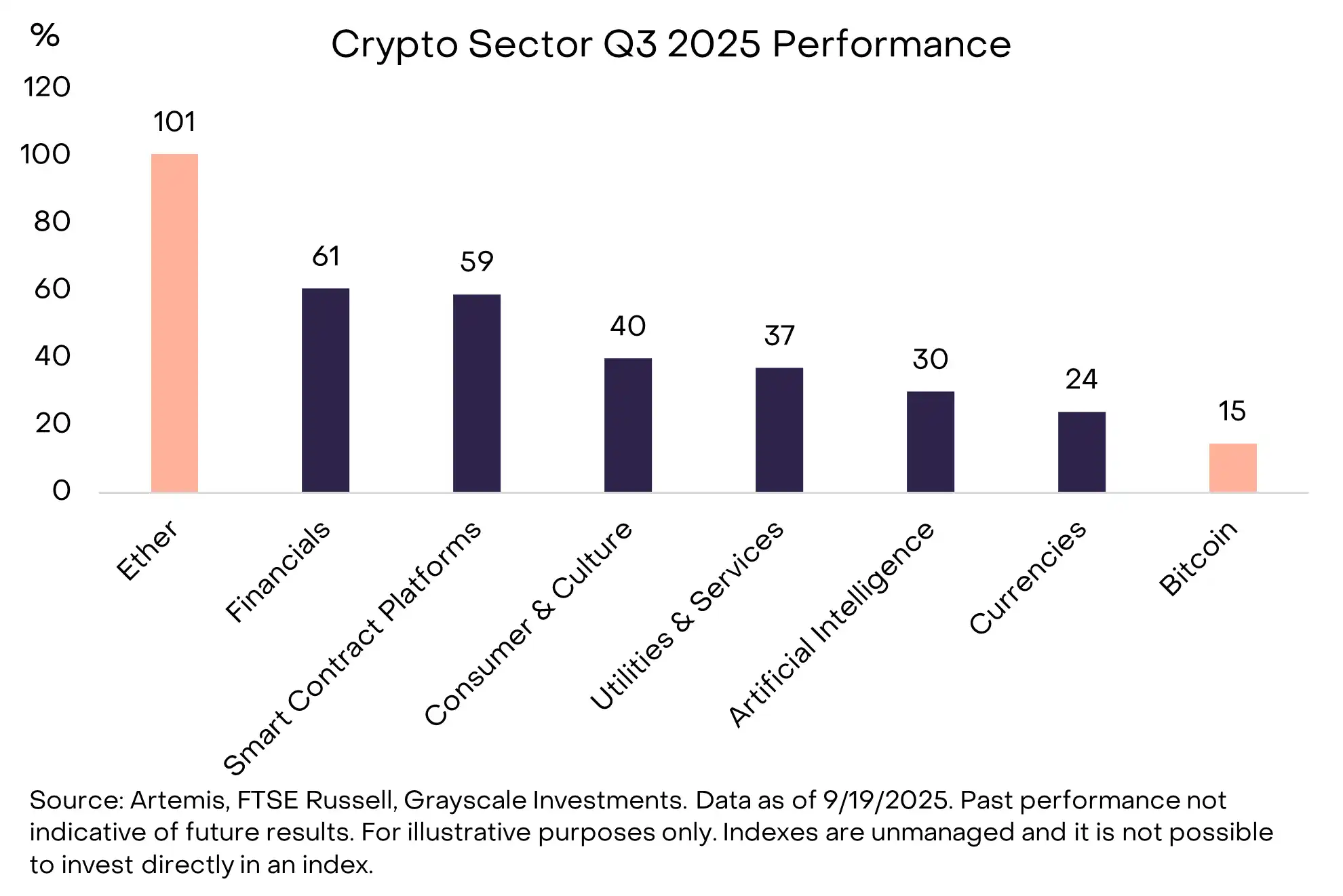

In Q3 2025, the return on investment for all six cryptocurrency sectors was positive (Chart 3). Bitcoin's performance lagged behind other submarkets, a return pattern that can be seen as a "altcoin season" for cryptocurrencies—although different from other periods of Bitcoin dominance decline in the past. Driven by the increase in trading volume on centralized exchanges (CEX), the financial crypto sector led the gains, while the smart contract platform crypto sector may have benefited from stablecoin legislation and adoption (smart contract platforms are networks where users transact with stablecoins for peer-to-peer payments). Although all crypto sectors achieved positive returns, the artificial intelligence crypto sector lagged behind other submarkets, reflecting a period of underperformance in AI stock returns. The currency crypto sector also underperformed, reflecting a relatively moderate price increase in Bitcoin.

Figure 3: Bitcoin's Performance Lags Behind Other Cryptocurrency Sectors

The diversity of cryptocurrency asset classes implies frequent rotations of dominant themes and market leadership. Chart 3 displays the top 20 index-eligible tokens ranked by price return adjusted for volatility in Q3 2025. The list includes some large-cap tokens with a market capitalization exceeding 100 billion US dollars, such as ETH, BNB, SOL, LINK, and AVAX, as well as some tokens with a market capitalization below 5 billion US dollars. The financial crypto sector (seven assets) and the smart contract platform crypto sector (five assets) had the highest representation in the top 20 list for this quarter.

Figure 4: Best Performing Assets in Each Crypto Sector Based on Risk-Adjusted Returns

We believe that there are 4 major themes that have stood out in recent market performance:

(1) Digital Asset Treasury (DAT): Last quarter, the amount of DAT surged: public companies holding cryptocurrency on their balance sheets as a treasury reserve asset and as an investment tool for equity investors. Among the top 20 tokens, several may benefit from the creation of new DAT, including ETH, SOL, BNB, ENA, and CRO.

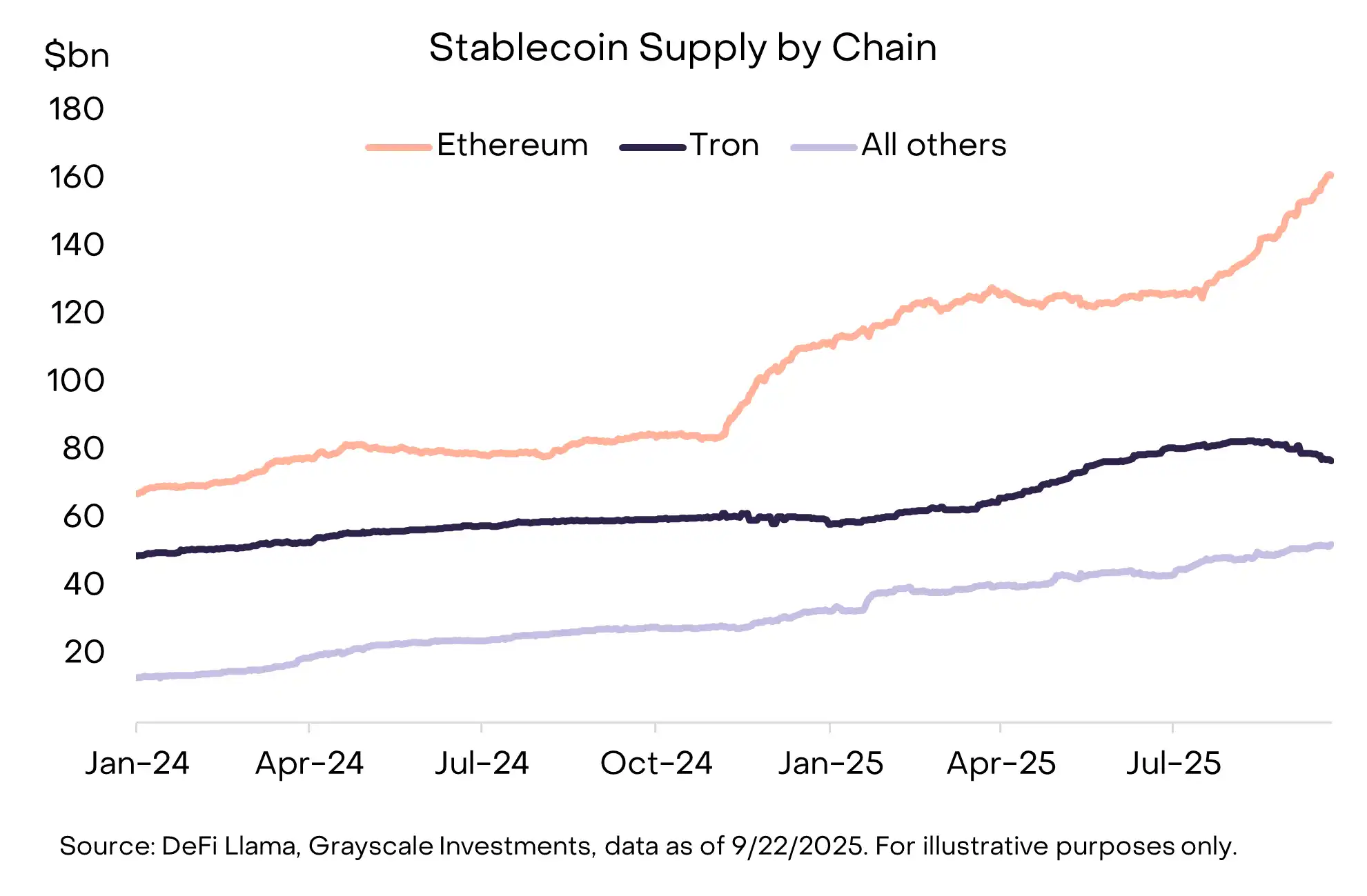

(2) Adoption of Stablecoins: Another key theme of last quarter was the legislation and adoption of stablecoins. On July 18, former President Trump signed the "Stablecoin Act" (GENIUS Act), providing a comprehensive regulatory framework for stablecoins in the United States. Following the passage of this act, stablecoin adoption accelerated, with the circulation supply growing by 16% to over $290 billion (Chart 4). The main beneficiaries were smart contract platforms hosting stablecoins, including ETH, TRX, and AVAX—where AVAX saw a significant increase in stablecoin transaction volume. Stablecoin issuer Ethena (ENA) also saw strong price performance, even though its USDe stablecoin does not meet the requirements of the "Stablecoin Act" (USDe is widely used in decentralized finance, while Ethena has launched a new stablecoin that complies with the act).

Chart 5: Growth in Stablecoin Supply this Quarter, Led by Ethereum

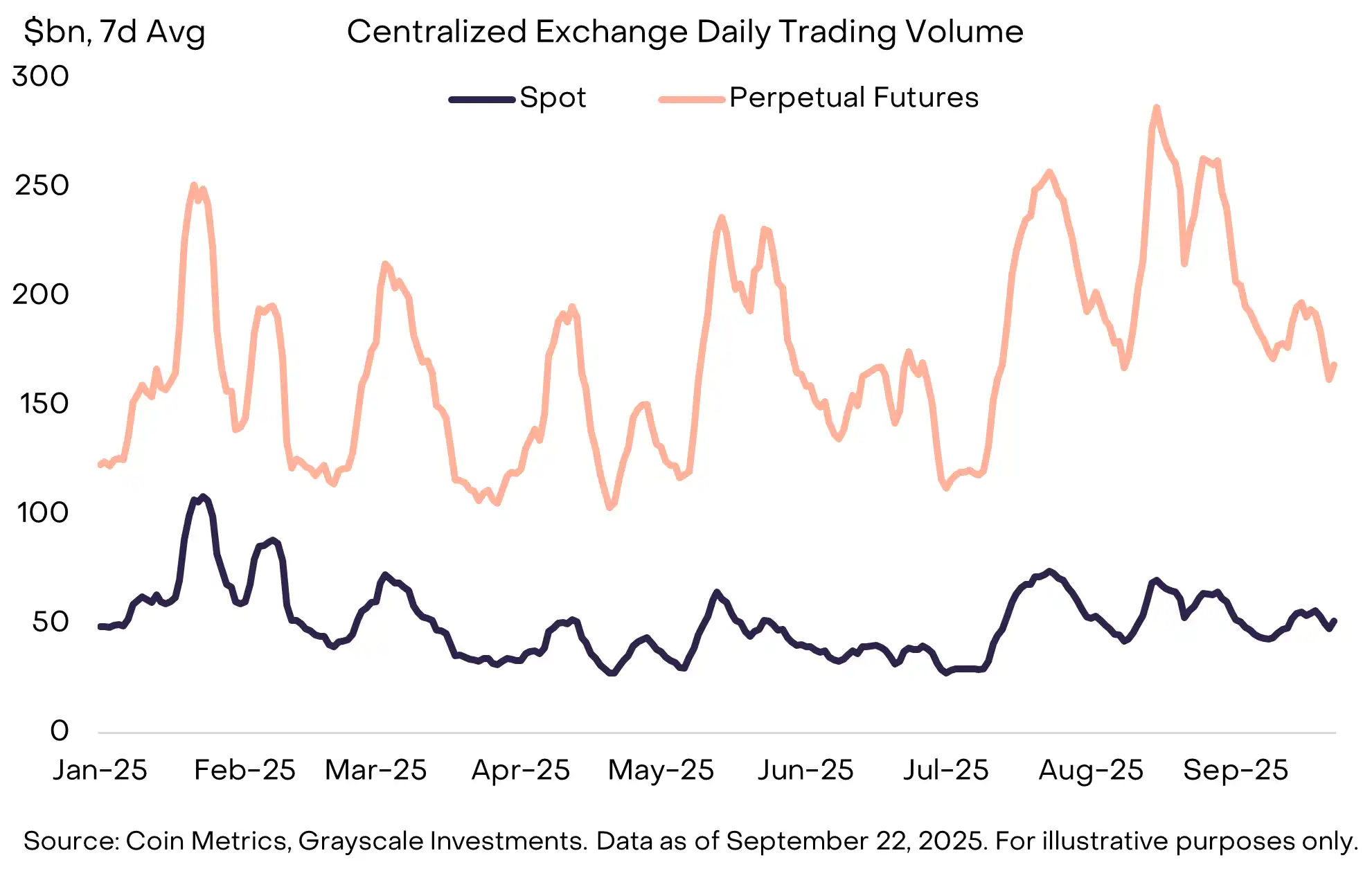

(3) Rise in Exchange Trading Volume: Exchanges were another major theme, with centralized exchange trading volumes hitting a new high since January in August (Chart 5). The increase in trading volume appeared to benefit several assets associated with centralized exchanges, including BNB, CRO, OKB, and KCS, all of which are in the top 20 (in some cases, these assets are also linked to smart contract platforms).

(4) Meanwhile, decentralized perpetual contracts continued their strong momentum. Leading perpetual contract exchange Hyperliquid saw rapid growth, ranking top three in fee revenue this quarter. Smaller competitor DRIFT entered the top 20 in the cryptocurrency industry after significant growth in trading volume. Another decentralized perpetual contract protocol, ASTER, launched in mid-September, growing from a $145 million market value to $3.4 billion in just one week.

Chart 6: CEX Perpetual Contract Trading Volume in August Reached a Yearly High

In Q4 2025, returns in the crypto sector may be driven by a series of unique themes.

Firstly, following the bipartisan House approval of relevant bills in July, the U.S. Senate committee has begun work on crafting cryptocurrency market structure legislation. This signifies comprehensive financial services legislation for the cryptocurrency industry, potentially acting as a catalyst for its deep integration with the traditional financial services sector.

Secondly, the U.S. SEC has approved a universal listing standard for commodity-based Exchange-Traded Products (ETPs). This could lead to an increase in the number of cryptocurrency assets available to U.S. investors through the ETP structure.

Lastly, the macro environment may continue to evolve. Last week, the Federal Reserve approved a 25 basis point rate cut and hinted at two more cuts later this year. Under unchanged conditions, cryptocurrency assets are expected to benefit from the Fed's rate cuts (as rate cuts reduce the opportunity cost of holding non-interest-bearing money and can support investors' risk appetite).

Meanwhile, softness in the U.S. labor market, rising stock market valuations, and geopolitical uncertainty may all be seen as sources of downside risk in the fourth quarter.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

After Pectra comes Fusaka: Ethereum takes the most crucial step towards "infinite scalability"

The Fusaka hard fork is a major Ethereum upgrade planned for 2025, focusing on scalability, security, and execution efficiency. It introduces nine core EIPs, including PeerDAS, to improve data availability and network performance. Summary generated by Mars AI. The accuracy and completeness of this summary are still being iteratively updated by the Mars AI model.

Decoding VitaDAO: A Paradigm Revolution in Decentralized Science