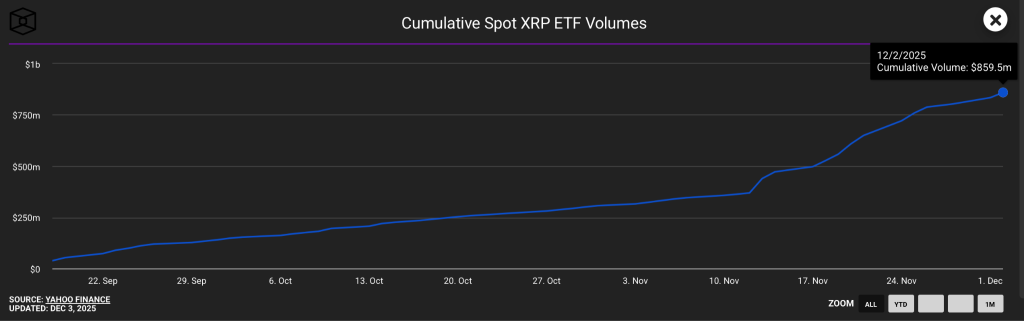

Date: Fri, Sept 26, 2025 | 06:00 AM GMT

The cryptocurrency market continues to face sharp retracement, with both Bitcoin (BTC) and Ethereum (ETH) sliding into weekly losses. Ethereum has been hit especially hard, dropping more than 13% and falling below the $3,950 mark. Unsurprisingly, major altcoins are also under pressure — including XRP (XRP).

Over the past week, XRP has declined by nearly 9%. But beyond the short-term red candles, the charts are now flashing something more concerning: a bearish fractal setup that looks strikingly similar to Chainlink’s (LINK) previous trajectory.

Source: Coinmarketcap

Source: Coinmarketcap

XRP Mirrors LINK’s Path

A closer look at XRP’s daily chart reveals a structure that echoes LINK’s price action from late 2024 into 2025.

Back in Q1 2024, LINK formed a head-and-shoulders pattern before rallying strongly into Q4. However, the bullish move eventually gave way to a descending triangle formation. Once LINK broke below its 100-day moving average (MA) and lost support in the highlighted green zone, a cascade followed. The breakdown extended through the 200-day MA, ultimately dragging LINK nearly 49% lower before staging a rebound.

XRP and LINK Fractal Chart/Coinsprobe (Source: Tradingview)

XRP and LINK Fractal Chart/Coinsprobe (Source: Tradingview)

Fast forward to now, and XRP appears to be tracing a similar path.

The token is currently consolidating inside a descending triangle, having already failed to hold its 100-day MA near $2.84. Price is now hovering just above a key support zone at $2.74 — a fractal region that could determine the next directional move.

What’s Next for XRP?

If this fractal setup continues to play out, the roadmap looks clear. A decisive breakdown below the $2.65 support zone could trigger a selloff similar to LINK’s, pushing XRP toward the 200-day MA at $2.53 and potentially further down to the major bottom support near $1.61. Such a move would represent a steep 42% correction from the point where XRP lost its 100-day MA.

However, there is still room for bulls to invalidate this bearish scenario. A successful reclaim of the 100-day MA at $2.83 would weaken the descending triangle breakdown narrative and could pave the way for renewed upside momentum.