More than $1 billion in leveraged positions were wiped out this week as Bitcoin tumbled toward $109,000, setting the stage for one of the market’s most volatile periods of 2025.

With $22 billion in crypto options contracts expiring on Friday and a key U.S. inflation report due the same day, traders say Bitcoin is at a critical crossroads.

Sponsored

On Thursday, Bitcoin (BTC) slid to $108.7K, its weakest level in nearly a month, before steadying just above $109K threshold.

Ethereum (ETH) tumbled even more in 24 hours to around $3,800, extending its losses to 14.3% since last month’s record highs.

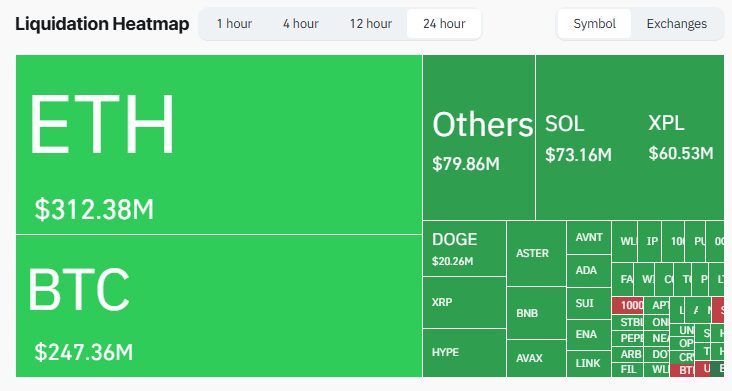

The declines triggered a broad leverage flush. Data from CoinGlass shows that more than $975 million in liquidations occurred, led by $312 million in wiped ETH longs and $247 million in BTC.

Source: CoinGlass

Source: CoinGlass

Crypto equities mirrored the slump. MicroStrategy (MSTR), the largest corporate holder of Bitcoin, fell as much as 10% to a five-month low, erasing its 2025 gains. Shares of miners Marathon Digital (MARA) and Riot Platforms (RIOT), along with Ether treasury firms Bitmine (BMNR) and Sharplink Gaming (SBET), slid 7–8%.

The selloff comes just as the market braces for the expiration of $22.3 billion in crypto options contracts on Friday. According to Deribit, a crypto options exchange, this is one of the biggest quarter-end expiries.

More than $17 billion is tied to Bitcoin, with dealer positioning clustered around $108,000–$109,000. A decisive break lower could force hedging flows that accelerate losses toward $96,000.

Macro risk adds another layer. The U.S. Core PCE report, a key Federal Reserve inflation gauge, is expected to show a slight cooling, but an upside surprise could strengthen the dollar and deepen the selloff across risk assets.

Still, not all signals point bearish. Meanwhile, crypto traders urge investors to zoom out to higher timeframes, which they say remain “unequivocally bullish,” describing the current pullback as a normal, healthy correction in a broader context.

According to @CredibleCrypto, the decline should either hold above the $98,000 lows — a pattern known as a “running flat” — or briefly dip below them in what’s called an “expanded flat.” In both scenarios, he said, the higher-timeframe structure remains intact.

Why This Matters

The convergence of forced liquidations, record options expiry, and pivotal macro data threatens to break Bitcoin’s critical support, which could set the tone for crypto markets into the fourth quarter.

Read DailyCoin’s most popular crypto news:

Celestia’s Matcha Magic Kicks In With Huge Inflation Cut

Bitcoin’s Calm Before the Storm? $105K Support Faces Test

People Also Ask:

Bitcoin fell after a sharp selloff in crypto markets triggered more than $975 million in liquidations.

Liquidations occur when leveraged traders can’t meet margin requirements. Exchanges automatically close their positions, which often amplifies price swings.

Options expiry refers to contracts reaching their settlement date. Large expiries can increase volatility as traders and dealers rebalance their positions.

The Core PCE inflation report influences Federal Reserve policy. A hotter reading could boost the dollar and pressure risk assets, including Bitcoin.

Yes. Some analysts see the pullback as a healthy correction within an intact bullish trend, expecting higher prices later in 2025.