A leading cryptocurrency investment manager, Bitwise Investment Advisers, has filed a new ETF application with the U.S. Securities and Exchange Commission (SEC). In the S-1 document submitted to the SEC, Bitwise revealed its intention to introduce the first ETF based on Hyperliquid’s mainnet asset, the HYPE coin. This application marks a new phase in the growing interest in crypto-based ETFs within the U.S. market.

Bitwise’s Hyperliquid ETF Application

The proposed ETF aims to track the performance of the HYPE coin, which is linked to the Hyperliquid Blockchain. Hyperliquid functions as a Layer 1 Blockchain tailored specifically for decentralized finance applications, with a particular focus on perpetual futures trading. If approved, the ETF would enable investors to access HYPE through a traditional stock market setting.

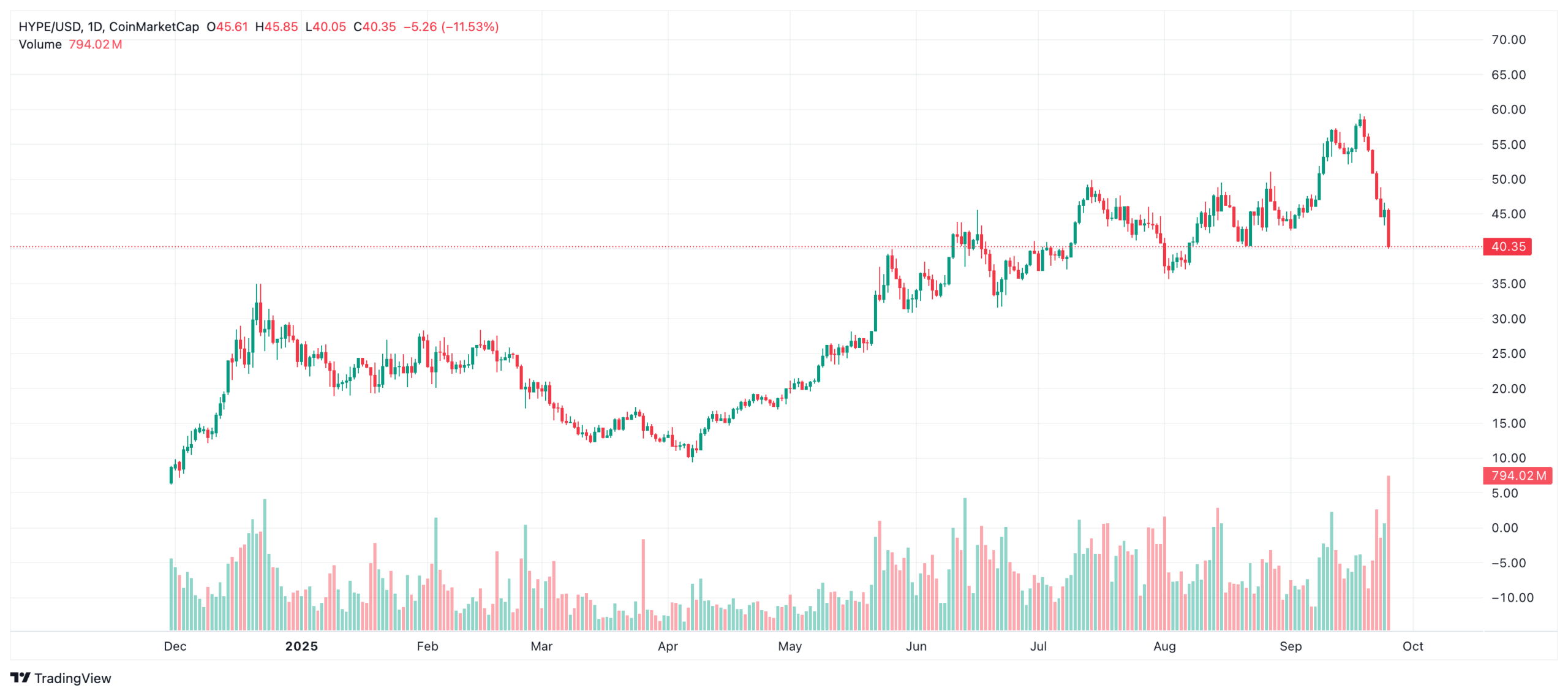

According to Cryptoappsy data, the price of HYPE coin dropped by 16.22% in the last 24 hours, reaching $42. With a circulating supply of 270.8 million, the altcoin boasts a market capitalization of $14 billion, making it the 21st largest cryptocurrency. Notably, HYPE coin recently reached an all-time high of $59.04.

SEC’s Decision Awaits on Altcoin ETFs

Concurrently with Bitwise’s application, the SEC has postponed decisions on various other altcoin ETF applications. The pending applications include Canary’s SUI and PENGU ETFs, as well as staked ETFs for INJ and SEI. Additionally, applications for Avalanche ETFs submitted by Grayscale and VanEck have been delayed similarly.

The cautious stance of the SEC has led to numerous crypto ETF applications awaiting approval. The regulatory body’s decision to extend the approval process contributes to ongoing uncertainty in the market, even as the number of ETF applications continues to rise swiftly.