FCCPC Withdraws Compliance Case Against MTN Executives, Citing Prosecutorial Judgment

- FCCPC withdraws compliance case against MTN Nigeria executives, citing prosecutorial discretion under criminal justice law. - Case was adjourned to October 2025 due to judicial unavailability, highlighting procedural delays in regulatory enforcement. - Withdrawal follows accusations of obstructing anti-competitive inquiry by refusing to produce requested documents. - MTN faces parallel copyright investigation, underscoring regulatory challenges in telecom sector compliance.

The Federal Competition and Consumer Protection Commission (FCCPC) has decided to drop its case alleging non-compliance against Karl Toriola, the Managing Director of MTN Nigeria Communications Plc, along with three top executives. FCCPC’s legal representative, Nsitem Chizenum, submitted the withdrawal, referencing the Administration of Criminal Justice Act, which permits prosecutors to end proceedings before a verdict is reached. The arraignment, originally planned for September 25, 2025, was postponed to October 30, 2025, due to the absence of Justice Hauwa Yilwa. The formal withdrawal will need to be presented to the court at the next hearing Alleged Breach: FCCPC withdraws case against MTN Nigeria CEO, … [ 1 ].

The FCCPC had previously accused Toriola, Chief Corporate Services and Sustainability Officer Tobechukwu Okigbo, and General Manager Ikenna Ikeme of not responding to a summons issued on May 17, 2024, which required them to provide certain documents and information as mandated by the FCCPC Act. The two-count indictment claimed that the defendants obstructed the commission’s investigation into possible anti-competitive conduct, in violation of Section 33(3) of the 2018 statute. According to the commission, the lack of cooperation hindered its ability to carry out its investigative duties FG Moves to Withdraw Case Against MTN Nigeria CEO Karl … [ 2 ].

The legal basis for the withdrawal is found in Sections 107 and 108 of the Administration of Criminal Justice Act, which authorize prosecutors to discontinue charges at any point before a judgment is delivered. In its submission, the FCCPC highlighted the importance of prosecutorial discretion, stating that “the complainant hereby fully withdraws the charge and ceases proceedings against the defendants.” This action is consistent with the court’s inherent authority to manage its docket efficiently Alleged FCCPC Act Violation: Court Reschedules Arraignment of … [ 3 ].

The rescheduling to October 30, 2025, was a result of procedural setbacks, specifically the judge’s unavailability, which illustrates the administrative hurdles often present in high-profile regulatory matters. The FCCPC’s move to drop the case stands in contrast to its previous stance in another legal matter. In May 2024, the Nigerian Copyright Commission (NCC) also took legal action against Toriola and MTN Nigeria for alleged copyright violations, further exposing the company to ongoing legal risks Alleged Breach: FCCPC withdraws case against MTN Nigeria CEO, … [ 1 ].

This withdrawal highlights a shift in the FCCPC’s enforcement strategy. Although the commission has expressed its intent to pursue anti-competitive practices, questions remain about its effectiveness in ensuring compliance. The dispute with MTN Nigeria, which focused on the submission of documents, points to the broader difficulties in balancing regulatory demands with corporate cooperation. Observers suggest that the delay may prolong uncertainty regarding the commission’s investigative reach, but the withdrawal itself spares the defendants from immediate reputational or financial harm FG Moves to Withdraw Case Against MTN Nigeria CEO Karl … [ 2 ].

This situation is part of a wider regulatory environment in which MTN Nigeria is subject to several investigations. The NCC’s separate copyright lawsuit, which alleges unauthorized use of music as caller tunes, is still ongoing. These concurrent legal proceedings underscore the company’s exposure to regulatory challenges, especially in industries with intricate compliance obligations Alleged FCCPC Act Violation: Court Reschedules Arraignment of … [ 3 ].

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

AAVE drops 1.47% amid Aave’s overhaul of its multichain approach

- Aave's multichain strategy shift caused AAVE to drop 1.47% despite 7.08% weekly gains. - Governance proposal aims to consolidate operations on high-revenue chains like Ethereum , phasing out low-performing deployments. - Strategy prioritizes capital efficiency and risk management by focusing liquidity on core networks with stronger revenue potential. - Unanimous DAO support signals industry trend toward quality-focused chain selection over maximalist expansion in DeFi.

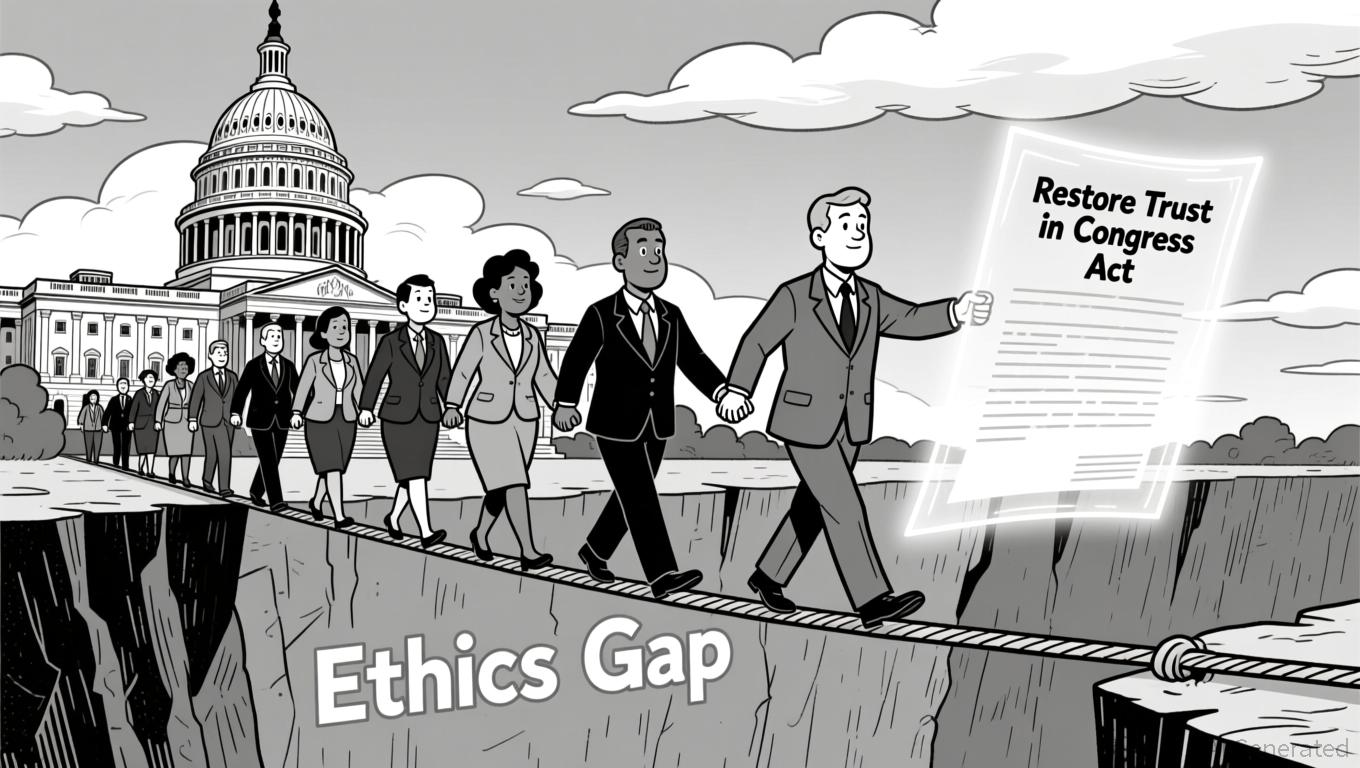

LUNA Price Remains Steady as U.S. Lawmakers Advance Stock Trading Ban

- LUNA's price remained stable at $0.0727 in 24 hours but fell 82.47% annually amid U.S. legislative efforts to restrict congressional stock trading. - Rep. Anna Paulina Luna's bipartisan bill seeks to ban lawmakers, spouses, and children from individual stock trading to address ethical conflicts. - The bill, supported by 100+ co-sponsors, faces opposition over financial flexibility concerns for lower-income legislators amid unchanged congressional salaries since 2009. - A discharge petition aims to force

PENGU Price Forecast for 2026: Managing Fluctuations and Momentum from Key Catalysts After the 2025 Market Adjustment

- 2025 crypto market correction reshaped altcoin dynamics as Bitcoin/Ethereum declined amid macroeconomic uncertainty and regulatory pressures. - Pudgy Penguins (PENGU) saw sharp volatility post-correction, with technical indicators suggesting potential $0.069 rebound by 2026 if adoption metrics align. - Strategic partnerships with Bitso and cross-chain integrations, plus Kung Fu Panda NFT collaborations, aim to boost PENGU's liquidity and mainstream adoption. - Despite 12% early 2026 price drop, Pudgy Inv

ZEC Value Increases by 4.82% Following Recent Exchange Listing

- Zcash (ZEC) surged 4.82% in 24 hours after Bitget listed it for spot trading on Dec 3, 2025, boosting short-term liquidity and visibility. - Zcash’s zero-knowledge proof technology enables encrypted transactions while maintaining blockchain integrity, distinguishing it as a privacy-focused asset. - Bitget’s UEX model supports multi-chain access, aligning with Zcash’s goal to balance transparency and privacy, though recent 7-day and 1-month declines highlight market volatility risks.