Bitcoin’s Hidden Risk — DAT Stock Meltdown May Trigger Forced Selling

An analysis shows that Bitcoin holding company stocks that raised capital through PIPE programs have plummeted, with some facing a potential for up to a 50% further decline.

The stock prices of Digital Asset Treasury (DAT) companies that acquired Bitcoin as a strategic asset are in significant decline, raising the possibility of a new headwind for Bitcoin’s price.

According to a new report from on-chain data platform CryptoQuant, a continued weak performance in Bitcoin’s price could create a negative feedback loop.

What Is a PIPE?

CryptoQuant’s report focuses on Bitcoin holding companies that have raised capital through Private Investment in Public Equity (PIPE) programs. The firm’s analysis of these companies’ stock performance found a significant downtrend.

A PIPE is a private offering where a public company sells newly issued shares (or convertible securities) to a select group of accredited or institutional investors. This method allows a company to raise capital quickly by selling shares at a discount to the market price.

Many Bitcoin DAT companies raised capital this year. The method’s key disadvantage—that it dilutes existing shareholders and puts downward pressure on the stock price—was largely ignored due to Bitcoin’s strong upward trend at the time. CryptoQuant notes that Bitcoin firms that used PIPE programs have since experienced significant drops in their stock prices.

Vicious Cycle of Decline

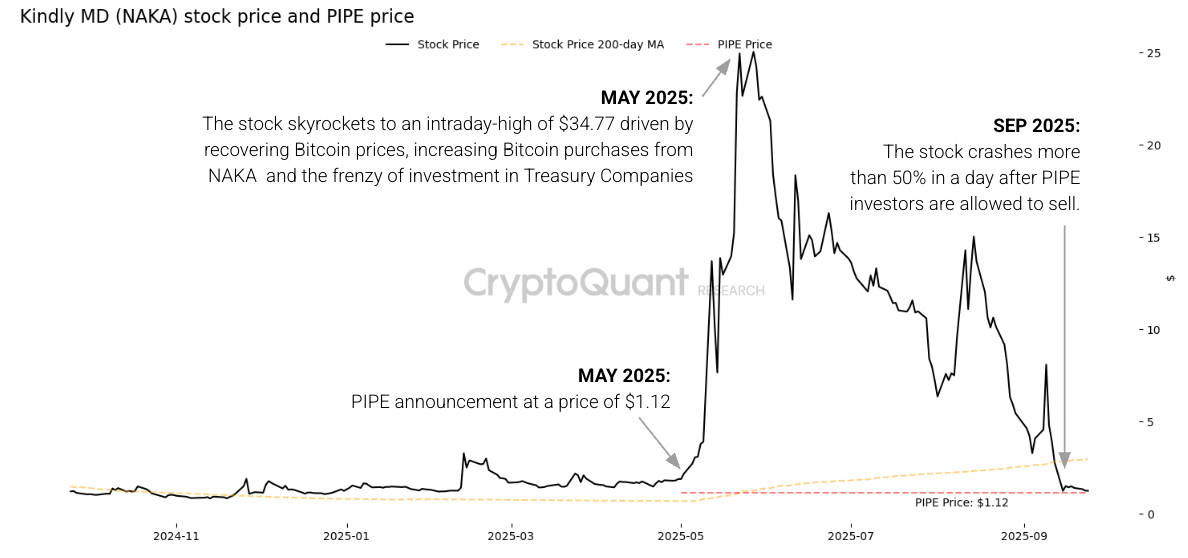

For example, Kindly MD (NAKA), a Bitcoin DAT company, saw its share price surge from $1.88 in late April to a high of $34.77 in less than a month—an 18.5x increase. However, the stock has since plummeted by 97% to a low of $1.16 and is currently trading near its PIPE price of $1.12.

NAKA stock price and PIPE price. Source: CryptoQuant

NAKA stock price and PIPE price. Source: CryptoQuant

CryptoQuant explained that other Bitcoin trust companies, including Strive (ASST), Cantor Equity Partners (CEP), and Empery Digital (EMPD), have seen their stock prices fall between 42% and 97%. Some stocks still trading above their PIPE issuance prices face a potential for up to an additional 50% decline.

While these DAT companies may have accumulated a large amount of cryptocurrency, their market valuation is falling even faster. This trend is seen in the rapid decline of their Market Value to Net Asset Value (mNAV).

Domino Effect

As Bitcoin’s price remains weak, the stock prices of DAT companies fall. This decline leads to selling by PIPE investors. If continues, companies may lose their primary method of raising additional operating capital, leaving their only option to sell their Bitcoin holdings for cash.

This would put more downward pressure on Bitcoin’s price, creating a vicious cycle in which Bitcoin’s price and DAT company stocks fall in tandem. CryptoQuant argues that a sustained Bitcoin rally is the only catalyst to prevent further decline in these stocks. Without such a move, the firm’s analysts believe many crypto equities will continue to fall toward or below their PIPE prices.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

After a 1460% surge, re-examining the value foundation of ZEC

Narratives and sentiment can create myths, but fundamentals determine how far those myths can go.

Wall Street is counting on bitcoin's high volatility for year-end bonuses

ETF has not "tamed" bitcoin; volatility remains the most attractive indicator of the asset.

Bitcoin Faces Intensifying Sell-Off as ETF Outflows and Leverage Unwinds Pressure Markets

Solana ETF Hit 18-Day Inflow Streak