Avalanche's Downturn: Bearish Sentiment in Tech Faces Off Against $1B Treasury and ETF Optimism

- Avalanche (AVAX) fell 7.1% to $34 as technical indicators worsened, with MFI below 50 and bearish Supertrend signals. - Institutional moves include a $1B treasury plan by Avalanche Foundation and ETF proposals from VanEck/Grayscale, aiming to boost demand. - Ecosystem growth shows 493% QoQ transaction surge and $2.23B TVL, but price projections remain split between $55 rebound or $17.33 drop risks. - SEC's late-September ETF decision could trigger massive liquidity shifts, mirroring Bitcoin's ETF-driven

Avalanche (AVAX) dropped by 7.1% to $34 in the most recent CoinDesk 20 update, weighing down the broader crypto index as market sentiment shifted due to conflicting institutional and technical signals. The token’s decline came after it retreated from a 30-day peak of $36.50, with analysts pointing to profit-taking following a 30% surge over the past two months. AVAX now has a market cap of $14.6 billion, placing it 13th on CoinMarketCap, and its 24-hour trading volume hit $2.7 billion, indicating ongoing liquidity despite the recent downturn Avalanche (AVAX) Snapshot – Price Dynamics: InsideBitcoins [ 1 ].

The sell-off was accompanied by a significant breakdown in technical signals. The Money Flow Index (MFI) for

Institutional activity has added further complexity. The

Growth across the Avalanche ecosystem continues to fuel optimism. The April Octane upgrade cut C-Chain fees by 98%, driving daily transactions to 1.4 million in Q2—a 493% quarter-over-quarter jump—and pushing total value locked (TVL) to $2.23 billion by late August. Stablecoin market cap on Avalanche also climbed 81% in 30 days to $2.16 billion, spurred by protocols like Aave Avalanche Defies Crypto Market Dump With 10% Gains [ 2 ]. Coin Bureau noted a record $1 billion in decentralized exchange (DEX) volume in early September, marking the highest daily trading activity for Avalanche in 18 months Avalanche (AVAX) Snapshot – Price Dynamics: InsideBitcoins [ 1 ].

Price outlooks remain mixed. A rounded bottom pattern on the daily chart hints at a possible 61% rebound to $55 or even a 511% rally to $212, provided buying pressure holds above the $36 resistance Avalanche Defies Crypto Market Dump With 10% Gains [ 2 ]. On the other hand, bearish projections warn of a potential slide to $17.33 if the $30 support fails, citing overbought RSI levels and previous corrections after similar technical patterns Will AVAX Price Drop Below $20 After Losing Key … [ 3 ].

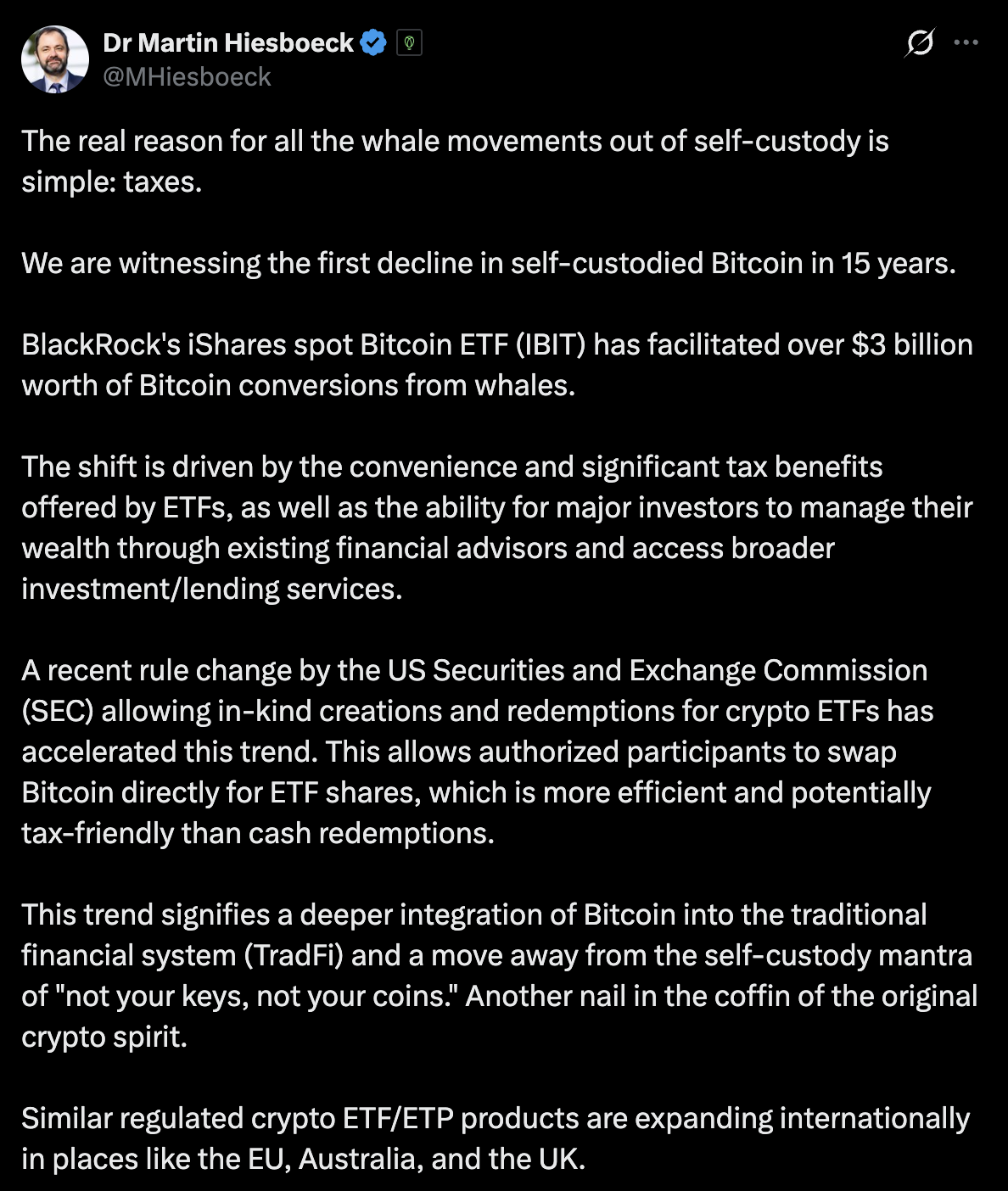

The SEC’s upcoming decision on AVAX ETF applications, expected by late September, will be crucial. Approval could unlock billions in institutional capital, similar to the impact seen with

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

PBOC Intensifies Crypto Restrictions to Safeguard the Yuan’s Dominance in Digital Currency

- China's central bank reaffirmed its strict crypto ban and stablecoin warnings, emphasizing financial stability over speculative growth. - Regulators blocked ByteDance from using Nvidia chips in data centers, accelerating domestic semiconductor adoption amid tech self-reliance efforts. - The crackdown raises concerns about stifled innovation, as global investors monitor China's balancing act between regulation and AI competitiveness. - PBOC's focus on digital finance control aligns with broader goals to s

Dr. Jim Willie Says Big Banks Are Deliberately Suppressing XRP Price to Accumulate More at Discount

Stablecoins and the battle for monetary influence | Opinion

Crypto self-custody is a fundamental right, says SEC's Hester Peirce