The Crypto Crash Orchestrated by the Federal Reserve: With $1.82 Trillion Evaporated, Is the Real Rally Only Just Beginning?

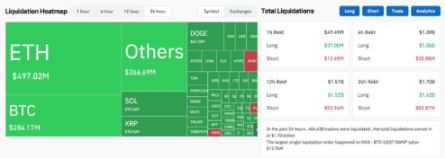

In the past week, the crypto market experienced a cold shower-like plunge. In just one day, $1.7 billions in funds were liquidated, catching many investors off guard. But if you think this was just a random market fluctuation, you may be underestimating the tactics of the Federal Reserve and Wall Street.

1. Profit Taking After Good News, Plunge Lurking

The recent rally was almost entirely built on market expectations of a Federal Reserve rate cut. The media and social platforms kept amplifying this sentiment, creating the illusion of a “one-way up” market. As a result, after the Federal Reserve meeting, the market chose to “sell the news,” triggering large-scale liquidations.

This is not the first time—this is the classic “buy the rumor, sell the news” market pattern.

2. Market Makers Manipulation: Plunge as a Deeper Liquidation Tool

In addition to the Federal Reserve’s statements, the actions of market makers and major platforms also amplified market volatility. For example, large exchanges may create long and short traps on their own platforms, selling off while liquidating retail investors’ positions. Such scenarios have been common in several past bull market cycles.

3. Turning Point in Market Sentiment

Before the plunge, there were already signs of overheating in the market:

Perpetual contracts were excessively popular

Certain tokens (such as $ASTER) surged too quickly

Social platforms were filled with “new highs keep coming” sentiment

This is the typical market rhythm of local frenzy → plunge and liquidation.

4. The Medium-Term Trend Remains Upward

Although the short-term plunge caused panic, the mid- to long-term logic has not changed:

The U.S. economy remains resilient

There are still expectations of 1–2 rate cuts in the coming months

Global crypto asset adoption continues to rise

Funds are still steadily flowing into the crypto market

These factors together lay the foundation for the next round of gains. Historical data shows that October (Uptober) and November are the strongest months for the crypto market:

Average increase in October: 21.89%

Average increase in November: 46.02%

Looking back at 2021, it was the massive rate cuts that triggered a 21-fold surge in bitcoin. A similar logic may play out again in 2025.

Conclusion

This round of crypto market plunge is not the end of the bull market, but more like a carefully orchestrated liquidation and shakeout. Whether it’s the Federal Reserve’s policy guidance or short-term manipulation by market makers, the goal is to clear out weak hands and pave the way for the next rally.

Investors need to remember:

Short-term declines ≠ trend reversal

Patience and position management are key

With rate cuts, a weakening dollar, and the continued advance of global adoption, October to November may once again become an acceleration phase for bitcoin and crypto assets. True returns often belong to those who can remain calm amid chaos.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

What major moves have mainstream Perp DEXs been making recently?

Perp DEXs are all unveiling major new features.

After a 1460% surge, re-examining the value foundation of ZEC

History has repeatedly shown that extremely short payback periods (super high ROI) are often precursors to mining disasters and sharp declines in coin prices.

Tom Lee reveals: The crash was caused by the 1011 liquidity crunch, with market makers selling off to fill a "financial black hole"

Lee stated directly: Market makers are essentially like the central banks of crypto. When their balance sheets are damaged, liquidity tightens and the market becomes fragile.

Boxing champion Andrew Tate's "Going to Zero": How did he lose $720,000 on Hyperliquid?

Andrew Tate hardly engages in risk management and tends to re-enter losing trades with higher leverage.