PunkStrategy Token Surges as NFT-Linked Model Gains Attention

PunkStrategy (PNKSTR) combines NFT trading with token buybacks, spurring an 87% surge in market value. Experts caution investors about significant price volatility and speculative risks in this emerging crypto strategy.

PunkStrategy (PNKSTR), a token linking NFT trading with reinvestment mechanisms, has recorded substantial growth, reflecting increasing interest in crypto-NFT hybrid strategies.

Analysts caution, however, that volatility remains high in such experimental tokens.

PunkStrategy’s Innovative Model and Recent Performance

PunkStrategy, developed by TokenWorks, utilizes a trading model that allocates 10% of transaction fees to purchase Cryptopunk NFTs. These NFTs are then resold at a markup, and proceeds are reinvested into buying back PNKSTR tokens. This cyclical approach aims to support both the NFT market and the token’s liquidity.

In the past 24 hours, PNKSTR surged by 87%, pushing its market capitalization to approximately $36.4 million. While the model has attracted attention for its innovative structure, experts emphasize that its speculative nature can lead to significant price fluctuations.

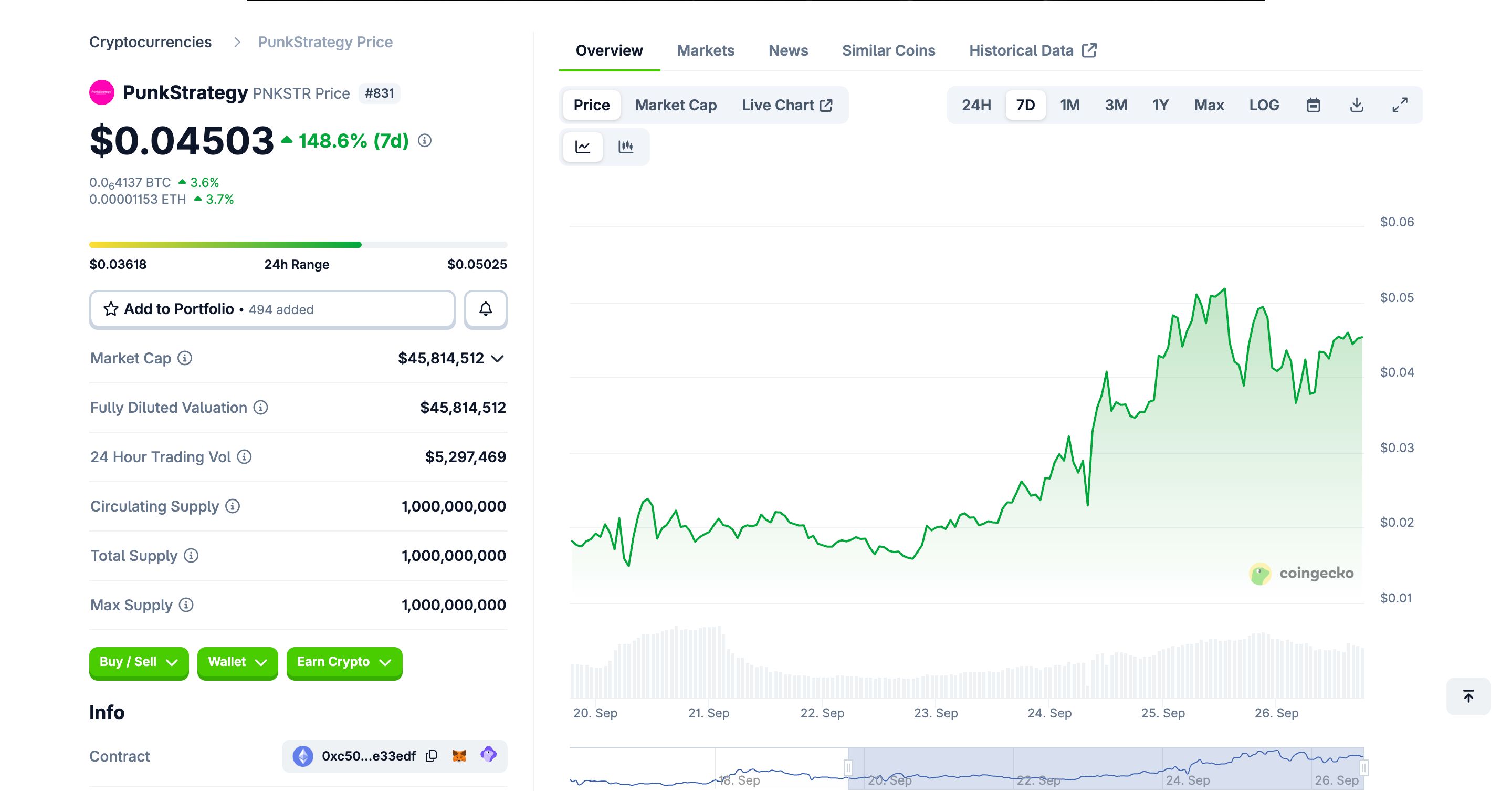

PNKSTR surged by approximately 150% over the past week. Source:

PNKSTR surged by approximately 150% over the past week. Source:

The strategy builds on earlier NFT-centric approaches, expanding the concept of tokenized art and collectibles as investment instruments. Analysts note that while the gains are notable, underlying risks remain prominent, such as NFT market illiquidity and speculative trading. Investors must evaluate the potential upside and inherent market volatility before committing funds.

Market Implications and Investor Considerations

The rapid appreciation of PNKSTR illustrates a broader trend in integrating NFTs into crypto tokenomics. By creating a flywheel effect—where NFT sales fund token buybacks—the model attempts to stabilize token price while fostering NFT demand. However, industry observers, including ChainCatcher, caution that the approach is untested at scale and may experience abrupt price swings.

Financial analysts stress that such tokens exemplify the growing intersection of digital art and blockchain finance. Institutional investors and retail participants are observing PNKSTR as a case study in NFT-token synergy. Despite impressive short-term gains, the model’s long-term sustainability depends on continued market interest in NFTs and the token’s ability to maintain liquidity amid price volatility.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Ethereum Updates: Institutional ETF Investments Indicate Ethereum's Rise to $3,200

- Ethereum (ETH) eyes $3,200 rebound as stablecoin yields decline and market dynamics shift, supported by Santiment’s analysis of 3.9-4.5% lending rates indicating non-overheated conditions. - ETH ETF inflows reversed after three weeks, with BlackRock’s ETHA fund driving $88.22M entry amid post-October price dips and regulatory clarity improvements. - Technical indicators like the ETH-BTC "bullish ribbon flip" and Crypto Fear & Greed Index moving from "extreme fear" to "fear" signal cautious optimism and r

Securitize Gains EU License, Connecting Blockchain Finance Between the U.S. and Europe

- Securitize secures EU regulatory approval to operate blockchain-based trading/settlement systems, becoming the first firm licensed in both EU and US for digital securities infrastructure. - The Avalanche-powered platform enables sub-second settlements across 27 EU states, supporting tokenized equities, debt, and funds while bridging U.S.-EU capital markets. - This milestone validates blockchain's role in institutional finance, with AVAX surging past $15 as Avalanche's institutional-grade infrastructure g

Ethereum News Update: Institutional Investors Acquire 3% of Ethereum’s Total Supply While Valuation Models Indicate a 57% Undervaluation

- Ethereum price holds above $2,900 amid $96.67M net inflows into U.S. spot ETFs, led by BlackRock’s $92.6M contribution ending an eight-day outflow streak. - Institutional buyers like BitMine added 69,822 ETH ($200M), now holding 3% of total supply, while adopting "dip-buying" strategies aligned with Tom Lee’s "supercycle" thesis. - Valuation models estimate Ethereum’s fair value at $4,747 (56.9% undervalued), with DCF and Metcalfe’s Law models suggesting 200-217% undervaluation despite mixed P/E signals.

Hyperliquid News Today: Hyperliquid's HYPE Token Unlock: Will Clearer Governance Mitigate the Threat of Selling Pressure?

- Hyperliquid's 2025 HYPE token unlock (2.66% supply) sparks market stability concerns amid 23% monthly price drop. - Community tensions rise over unlock transparency, with experts warning verbal assurances cannot counter sell-pressure risks. - Weak technical indicators (34 RSI, $35.50 support level) highlight fragility despite $259B monthly trading volume. - Institutional partnerships (BlackRock, Stripe) bolster credibility but governance controversies persist over decentralization. - Future trajectory de