Tether Dominance (USDT.D) Hits 2-Month High — Why This Is Concerning

Tether Dominance’s rise to a two-month peak is raising alarms for traders. Analysts caution that a push above 5% could confirm a bearish shift, though some see room for a rebound in Q4.

Tether Dominance (USDT.D) is one of the metrics closely correlated with Bitcoin’s price and overall market capitalization. Yet it is often overlooked in many market analyses. Now, this data has confirmed warning signals worth paying attention to.

USDT.D represents Tether’s share of the total crypto market capitalization. Changes in USDT.D can help measure how actively traders spend USDT, providing a basis for predicting possible scenarios.

Analysts Warn as Tether Dominance (USDT.D) Reaches 2-Month High

Tether (USDT) remains the leading stablecoin in terms of both market share and liquidity. A decline in USDT.D usually means traders spend more USDT to buy Bitcoin and altcoins, driving higher prices.

On the other hand, a rise in USDT.D indicates that traders are selling assets and moving back into USDT. This reflects cautious sentiment toward volatility and often signals potential downside risk.

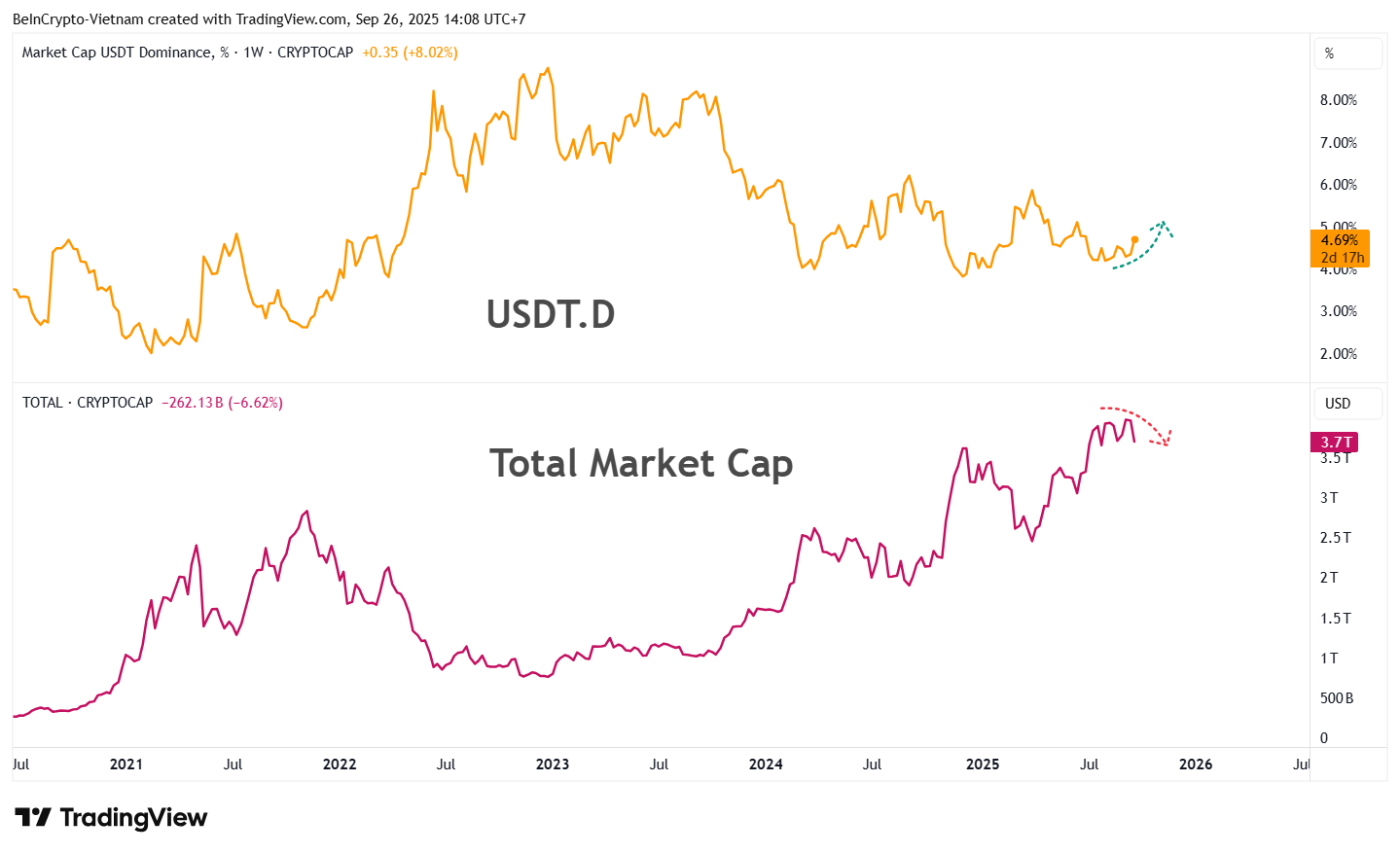

TradingView data shows that the inverse correlation between USDT.D and total crypto market capitalization has been observed repeatedly over the years.

Total Market Capitalization And USDT.D. Source:

TradingView

Total Market Capitalization And USDT.D. Source:

TradingView

During the final week of September, USDT.D climbed to 4.69%, its highest level in two months. Analysts see this breakout as a move that could push it even higher, raising concerns about a prolonged bearish outlook in the days ahead.

Market analyst Jason Pizzino remains hopeful that USDT.D will soon correct. However, he does not rule out a breakout above 5% as a troubling confirmation.

“Here’s the breakout no crypto bull wants to see. The good news is that USDT dominance is now testing the macro 50% level. However, above ~5% and the trend could be changing for the bulls. Hopefully, it’s a test and rejection. Otherwise, be prepared,” Pizzino commented.

Technical vs. Fundamental Considerations

At this stage, most negative analyses based on USDT.D rely heavily on technical signals, where trendlines and resistance levels play a central role. This limits reliability when broader fundamental factors are added to the picture.

Those fundamental factors include record-high USDT reserves on exchanges, new peaks in USDT netflows, and rising demand from traders reflected in Tether’s recent surge in USDT minting. This setup acts like gunpowder ready to be deployed.

“Now, given the perfect negative correlation between USDT.D and $TOTAL, this would imply ‘one more sweep of the lows’… But TA isn’t always perfect. It doesn’t make much sense to unload bags here just to maybe buy them back slightly lower. We are likely close to finalizing our high time-frame swing low for a bullish Q4,” Max, founder of BecauseBitcoin, said.

The late-September market decline has intensified doubts. Debate continues over whether this is a bear trap or the start of a broader downtrend. As a result, every new signal is being closely examined.

USDT.D is part of those signals. It should not be viewed in isolation but rather in combination with other indicators to minimize risk as much as possible.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Resilience-Focused Business Strategies: The Role of Challenges in Shaping Entrepreneurs and Organizations

- Adversity-driven founders build resilient enterprises through operational discipline and long-term vision, outperforming peers during economic crises. - Case studies like Nikita Hair and Dyson show hardship fosters innovation, customer focus, and iterative resilience critical for scalability. - 2025 investors prioritize founder-led companies with adversity-fueled cultures, exemplified by Berkshire's $30.8B Q3 earnings and Palantir's 121% revenue growth. - Resilient leadership correlates with 20% higher e

Blockchain-Based Charity Transforms the Impact of Cryptocurrency in Hong Kong Fire Recovery Efforts

- Crypto firms led by Animoca Brands and Bitget raised HK$24.5M for Hong Kong fire victims via blockchain-based donations and stablecoin conversions. - Animoca's EVM/Solana fundraiser ensured 100% transparency by channeling funds directly to Red Cross via platforms like Flip. - Bitget's $12M HKD donation through Yan Chai Hospital and Salvation Army highlighted crypto sector's rapid crisis response capabilities. - The initiative demonstrated blockchain's potential for real-time humanitarian aid while addres

Crypto’s Susceptibility to Quantum Attacks Revealed in North Korea’s $30 Million Breach

- South Korea's Upbit suffered a $30M hack by North Korea's Lazarus Group, exploiting Solana wallets and using multi-chain laundering to convert stolen assets into Ethereum . - Hackers employed "Harvest Now, Decrypt Later" tactics, storing encrypted data for future quantum decryption, raising concerns about current encryption standards. - Dunamu halted transactions and faces potential fines, while the attack coincided with its $10.3B Naver Financial merger, sparking timing scrutiny and regulatory delays. -

Solana News Today: Solana Price Swings and Institutional Trust: $140 Emerges as Key Breakout Trigger

- Solana's price nears $140 threshold as technical indicators and record ETF inflows signal institutional-driven structural shift. - $621M in 21-day ETF inflows highlight growing institutional adoption, contrasting with Bitcoin/Ethereum outflows and positioning Solana as a long-term capital magnet. - Franklin Templeton's pending ETF filing and stable derivatives positioning suggest imminent catalysts could trigger breakout or consolidation. - Market remains in holding pattern with $140 resistance critical