- XRP liquidity is concentrated between $2.80 and $3.00, forming the strongest support since early August.

- Long liquidations repeatedly surpassed $40M, with one spike near $80M during a rejection below $4.00.

- Whale activity remains focused on liquidity pools below $3, shaping short-term market dynamics.

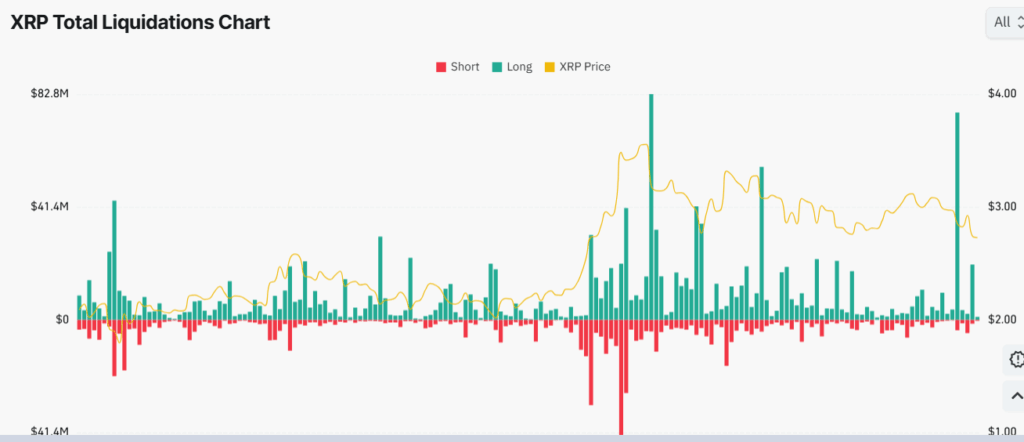

Liquidity pressures around XRP have intensified in recent sessions, with significant positioning emerging below the $3 threshold. Market depth data shows increasing bid levels in the $2.80 to $2.95 range, highlighting areas where liquidity is consolidating. At the same time, recent liquidation records reveal heavy unwinding of leveraged long positions, suggesting heightened volatility in the near term.

Liquidity Pools Form Beneath Key Price Levels

Heatmap visuals indicate concentrated liquidity between $2.80 and $3.00, with orders stacking up as the price trends lower. These zones have attracted attention due to the consistent layering of buy interest during each dip. The build-up marks the most visible liquidity wall since early August, when XRP first tested levels above $3.20.

Notably, liquidity has thickened as price action moves sideways, suggesting traders are anticipating potential retests of these clustered zones. The chart data also shows relatively thinner order density above $3.10, limiting resistance compared to the stronger buy support below $3.

Long Position Liquidations Expand Rapidly

Liquidation data underscores the recent stress among long holders. The liquidation chart highlights repeated spikes above $40 million in long contract closures over the past weeks. These unwinds coincided with pullbacks from $3.50 toward the $3.00 area, amplifying downward moves and accelerating selling momentum.

Source: Coinglass

Source: Coinglass

At the same time, short liquidations remain smaller and less consistent, underscoring the directional pressure against overleveraged longs. The single largest long liquidation spike surpassed $80 million, which aligned with a sharp rejection just below $4.00. This event marked one of the most severe liquidation clusters of the quarter.

However, long liquidations did not fully erase accumulated interest at lower zones. Buyers continue to reappear near $2.90, where several liquidation-driven flushes have found temporary stabilization. This pattern keeps the spotlight on the sub-$3 range.

Market Dynamics Shaped by Whale Activity

Whale positioning appears to play a notable role in the current setup. The stacking of liquidity below $3 suggests large players are targeting clusters where leveraged longs concentrate. Historical liquidation sweeps at these levels highlight recurring patterns of liquidity capture during volatile phases.

Despite significant liquidations, whales have not shifted focus above $3.20, leaving upside resistance less reinforced. Instead, their activity remains centered on exploiting long build-ups below $3, where order density continues to rise. This ongoing concentration of liquidity signals that large orders are shaping short-term market behavior.

With long liquidations persisting and liquidity thickening beneath the $3 mark, the XRP market remains tightly defined by clustered activity zones. The interplay between leveraged unwinds and whale-driven liquidity concentrations continues to dictate immediate price ranges.