Bitcoin multisig censorship refers to a proposed multisig quorum that could review and remove illicit data from the chain, replacing it with zero-knowledge proofs to keep transactions valid; this raises governance, legal and censorship-resistance concerns for Bitcoin’s permissionless design.

-

Proposal: a multisig quorum reviews and strips illicit on-chain data.

-

Replacing flagged content with zero-knowledge proofs preserves transaction validity while altering stored data.

-

Node operators could face legal risk and the change may weaken Bitcoin’s censorship-resistant model.

Meta description: Bitcoin multisig censorship proposal threatens Bitcoin’s censorship resistance; learn how multisig quorums, zero-knowledge proofs, and node risks shape this debate. Read more.

Why could this change Bitcoin forever?

Bitcoin multisig censorship is a proposed mechanism where a multisig quorum reviews on-chain data and can remove or replace flagged content, potentially using zero-knowledge proofs to keep transactions valid while altering historical storage. This could shift governance, legal exposure of node operators, and the network’s core censorship-resistance properties.

Source: X

What is the multisig quorum proposal and how would it work?

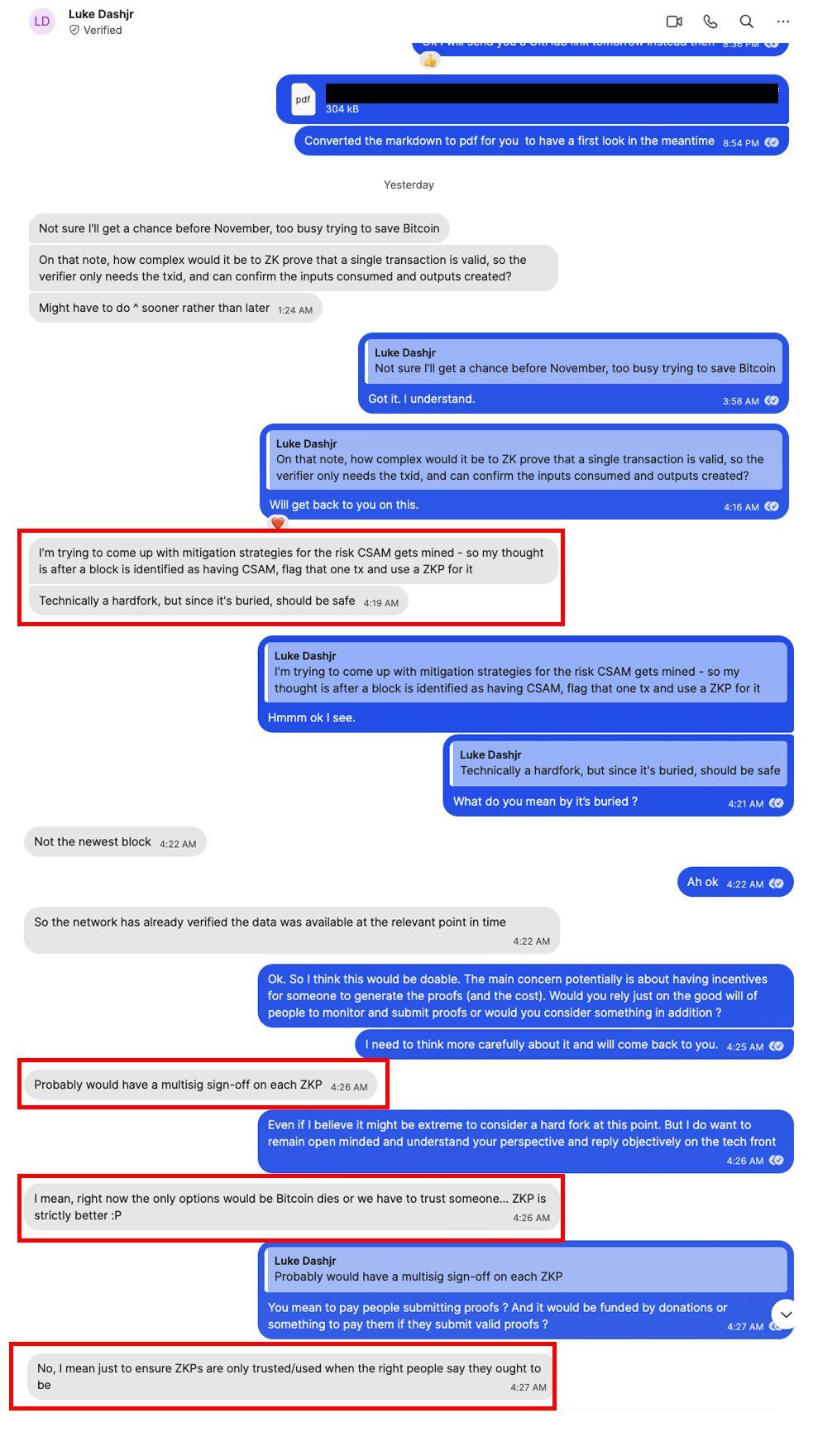

The proposal envisions creating a trusted committee — a multisig quorum — authorized to review transactions that contain illicit material (for example, CSAM flagged in OP_RETURN-like fields). If content is flagged, the quorum could strip or replace the data with a zero-knowledge proof so the transaction remains valid but the blockchain no longer stores the original payload.

How could zero-knowledge proofs be used in this process?

Zero-knowledge proofs would verify that a replacement preserves transaction integrity without revealing original content. Technically, this means embedding a proof that the original transaction semantics remain correct while removing the payload from the visible chain data. This preserves spendability but alters archival data.

What are the key risks for Bitcoin’s censorship resistance and node operators?

Allowing retroactive data alteration changes Bitcoin’s permissionless assumption and introduces centralized decision points. Node operators could be pressured legally to comply with takedown demands. That pressure could fragment the network as operators decide whether to accept quorum-altered blocks, risking forks and reduced global consensus.

Frequently Asked Questions

Could this proposal make transactions easier to censor?

Yes. A multisig quorum with takedown authority creates an enforcement mechanism that can selectively alter chain data, enabling targeted censorship where the quorum decides content is illicit.

Would replacing data with proofs preserve transaction validity?

Replacing data with zero-knowledge proofs can preserve transaction validity and spendability while removing stored payloads, but it changes the historical record and archival verifiability.

Who proposed this idea and what was the reaction?

The proposal surfaced in community discussion attributed to Dashjr; the exchange highlighted the stark choice between centralized trust or risking broader disruption. Reactions in the developer community emphasize the trade-off between legal compliance and preserving permissionless architecture.

Key Takeaways

- Governance shift: A multisig quorum introduces centralized review power into a decentralized system.

- Technical trade-offs: Zero-knowledge proofs can preserve spendability but alter archival transparency.

- Legal and operational risk: Node operators may face legal pressure, increasing the chance of fragmentation and reduced censorship resistance.

Conclusion

This multisig quorum concept poses fundamentally different incentives for Bitcoin’s future: it aims to remove illicit on-chain content while preserving transaction validity, but it also risks undermining the censorship-resistant and permissionless properties that underpin Bitcoin. The community must weigh legal realities, technical feasibility, and long-term governance impacts before adopting any such change.

Author: COINOTAG • Published: 2025-09-26 • Updated: 2025-09-26