When the market is down, consider Plasma mining—how to mine effectively

On September 25, the highly anticipated Plasma native token XPL was officially launched, with the opening price once soaring to $1.6. Plasma subsequently initiated a large-scale 7-day liquidity incentive program (lasting until October 2), in collaboration with major DeFi protocols such as Aave, Euler, and Fluid. Users can earn WXPL (Wrapped XPL) rewards by depositing stablecoins (mainly USDT0) into these protocols, with some pools offering an annual percentage rate (APR) exceeding 35%.

On September 25, the highly anticipated Plasma native token XPL was launched, and its price once soared to $1.6 after opening. In addition to those who participated in the presale, early depositors also received a large amount of airdrop rewards. Coupled with airdrop events from major trading platforms, even Binance Alpha's airdrop allowed users to claim about $220 worth of $XPL, making it a windfall for everyone.

Almost immediately after its launch, the generous Plasma project kicked off a large-scale liquidity incentive program lasting 7 days, running until October 2, covering mainstream protocols such as Aave, Euler, Fluid, Curve, and Veda. Users can deposit stablecoins into these protocols or hold related tokens to receive XPL rewards as well.

If you missed out on deposits, missed the presale, and missed the on-chain arbitrage opportunities, you definitely shouldn't miss this chance to earn some easy rewards. BlockBeats has compiled five mainstream mining pools, some of which even offer APRs exceeding 35%.

Preparation Before Mining

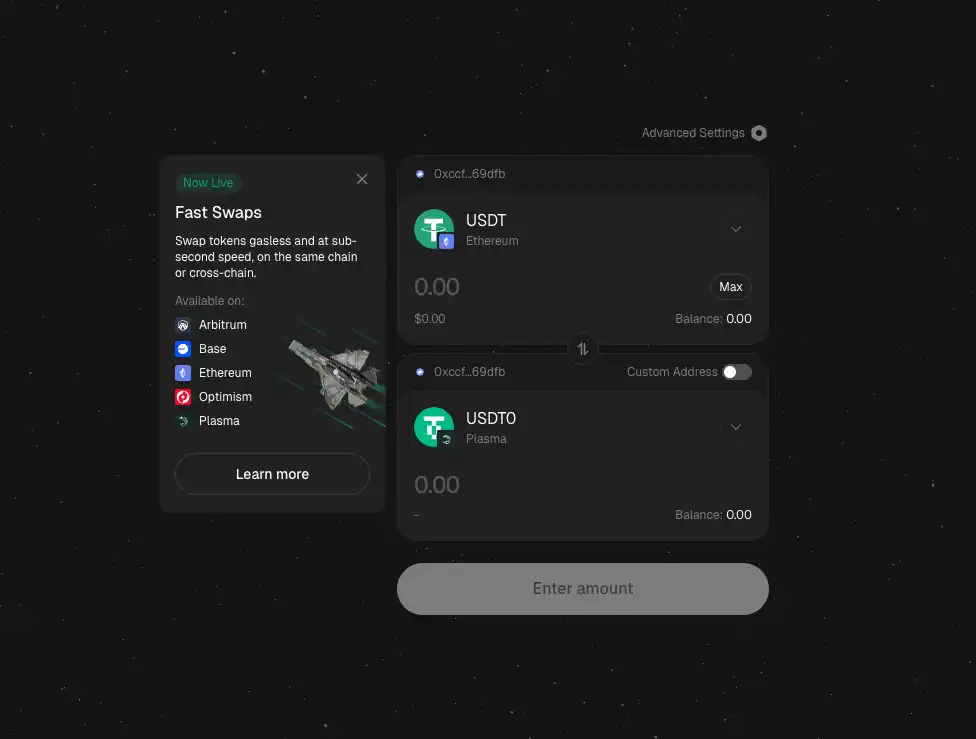

Before starting mining, you need to prepare your assets. Some protocols require you to use Stargate to bridge mainnet USDT to Plasma, obtaining an equivalent amount of USDT0; you will also need a small amount of XPL as transaction gas fees (EVM-based chains are generally supported).

Most of Plasma's current events are in cooperation with Merkl. You can log in to Merkl's Dashboard at any time to track your rewards. The Merkl platform automatically calculates rewards based on the size and duration of user deposits, and users only need to manually claim them periodically.

Which Pools Are Good for Mining?

PlasmaUSD Vault

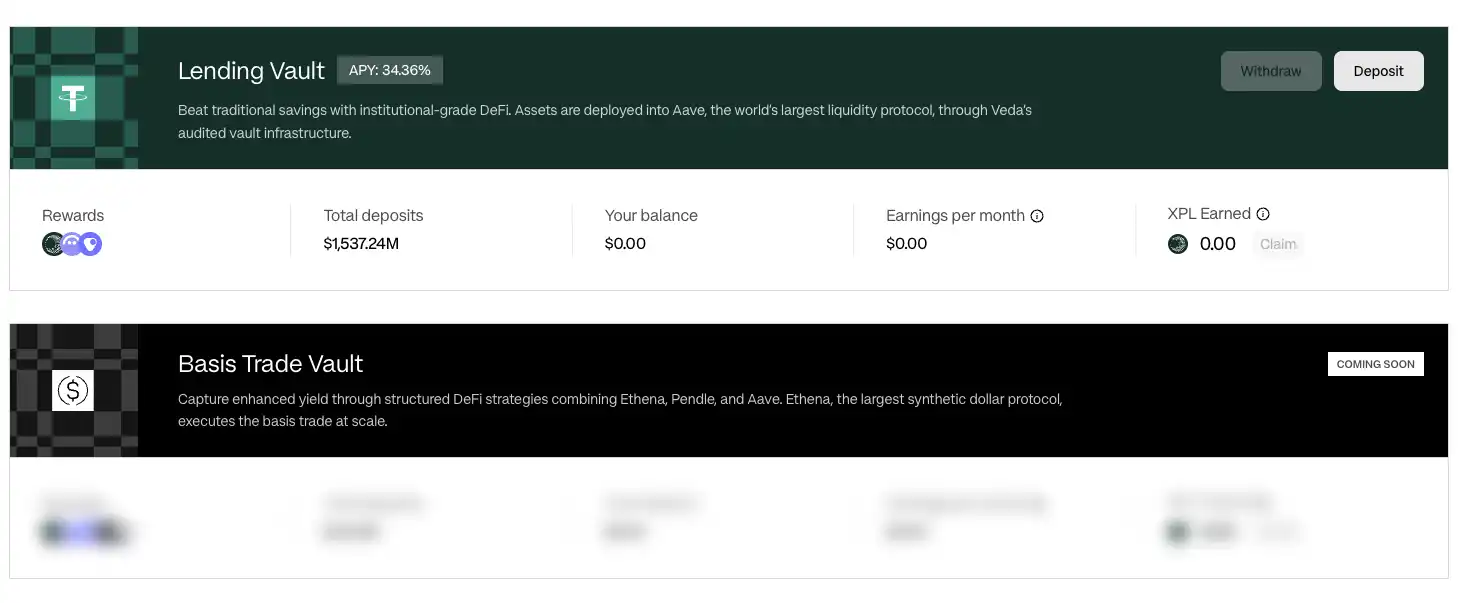

This event is initiated by the official Plasma team. Under the Veda protocol, the PlasmaUSD Vault distributes WXPL in a staking mining format. Currently, only the Lending Vault is open, but the Basis Trade Vault will be available in the future.

The operation is quite simple: just click Deposit to deposit USDT0/USDT, and by holding shares of this Vault, you can receive WXPL rewards whether on the mainnet or Plasma chain. Rewards can be claimed every 8 hours, but after borrowing, USDT0 has a 48-hour withdrawal cooldown period.

The current annualized yield is about 34.36%, with daily rewards as high as $1.4 million. It is worth noting that $1 million of the main reward pool will only last for 3 days, ending on September 29. It is unclear whether the official team will continue incentives after that.

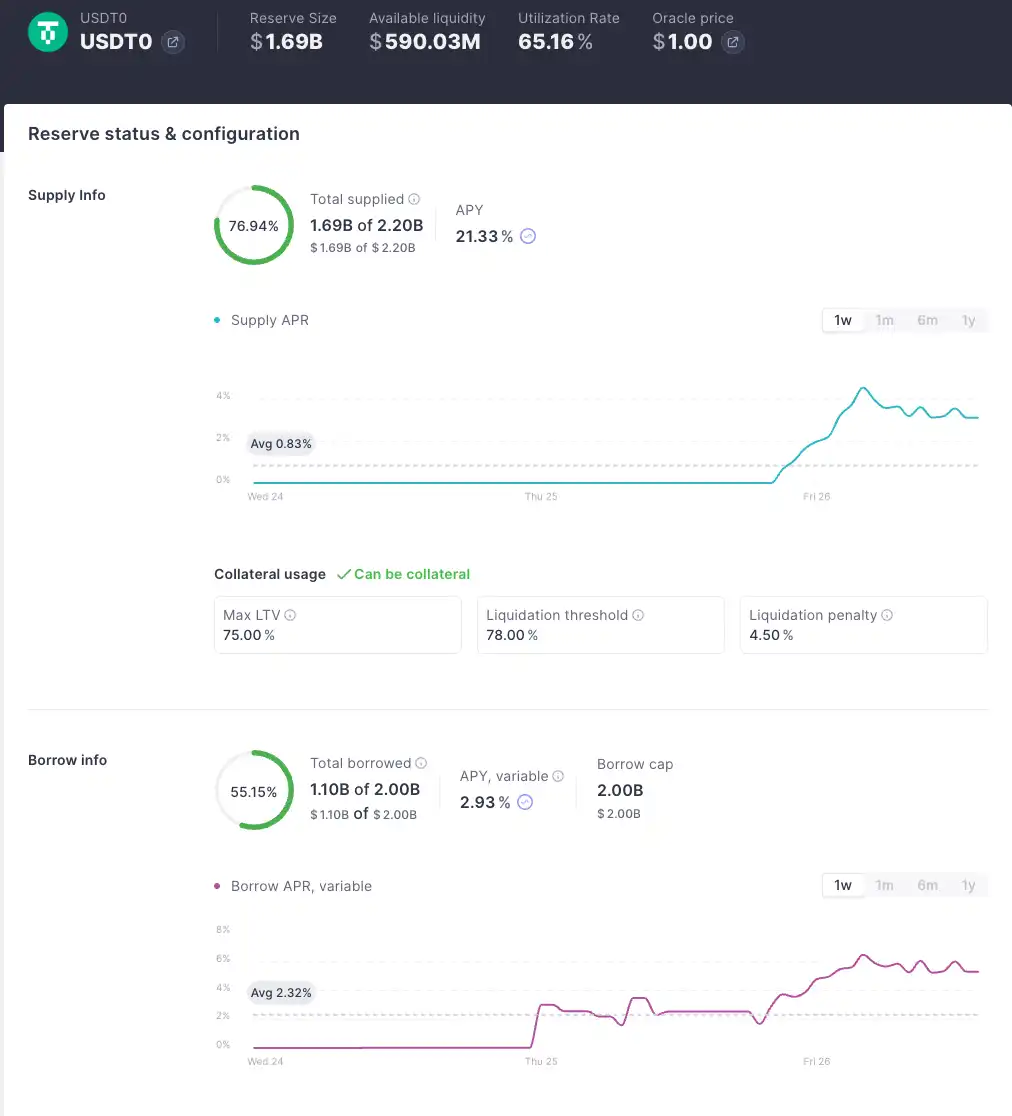

Aave USDT0

Similar to Plasma's lending Vault, depositing USDT0 into Aave for lending also earns WXPL rewards. Currently, $1.7 billion has been deposited into the protocol, with an annualized yield of about 21.33% (the protocol's own APY is about 3.19%, WXPL APY is 18.15%), and daily rewards are about $700,000 worth of XPL.

Compared to Plasma, its advantage is that you can withdraw at any time, but you must provide USDT0 without holding any USDT0 or USDe debt, meaning you cannot use loop lending to increase utilization.

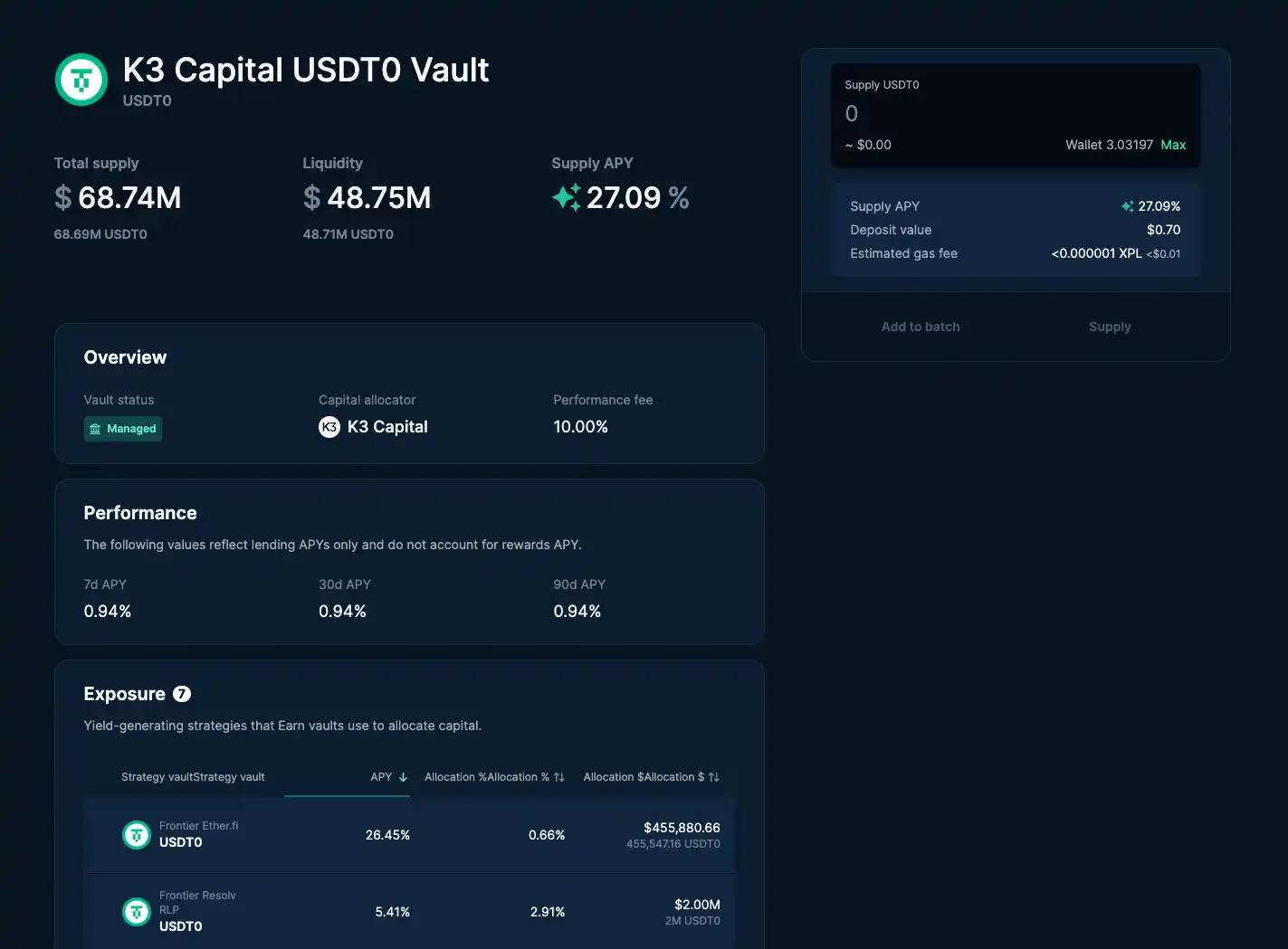

Euler K3 Capital USDT0 Vault

In Plasma's Euler protocol, the USDT0 Vault managed by K3 Capital currently has an annualized yield of about 27%, with daily incentive distribution of about $55,000 worth of WXPL.

Users only need to deposit USDT0 on the Plasma mainnet and supply USDT0 to this Vault to start mining.

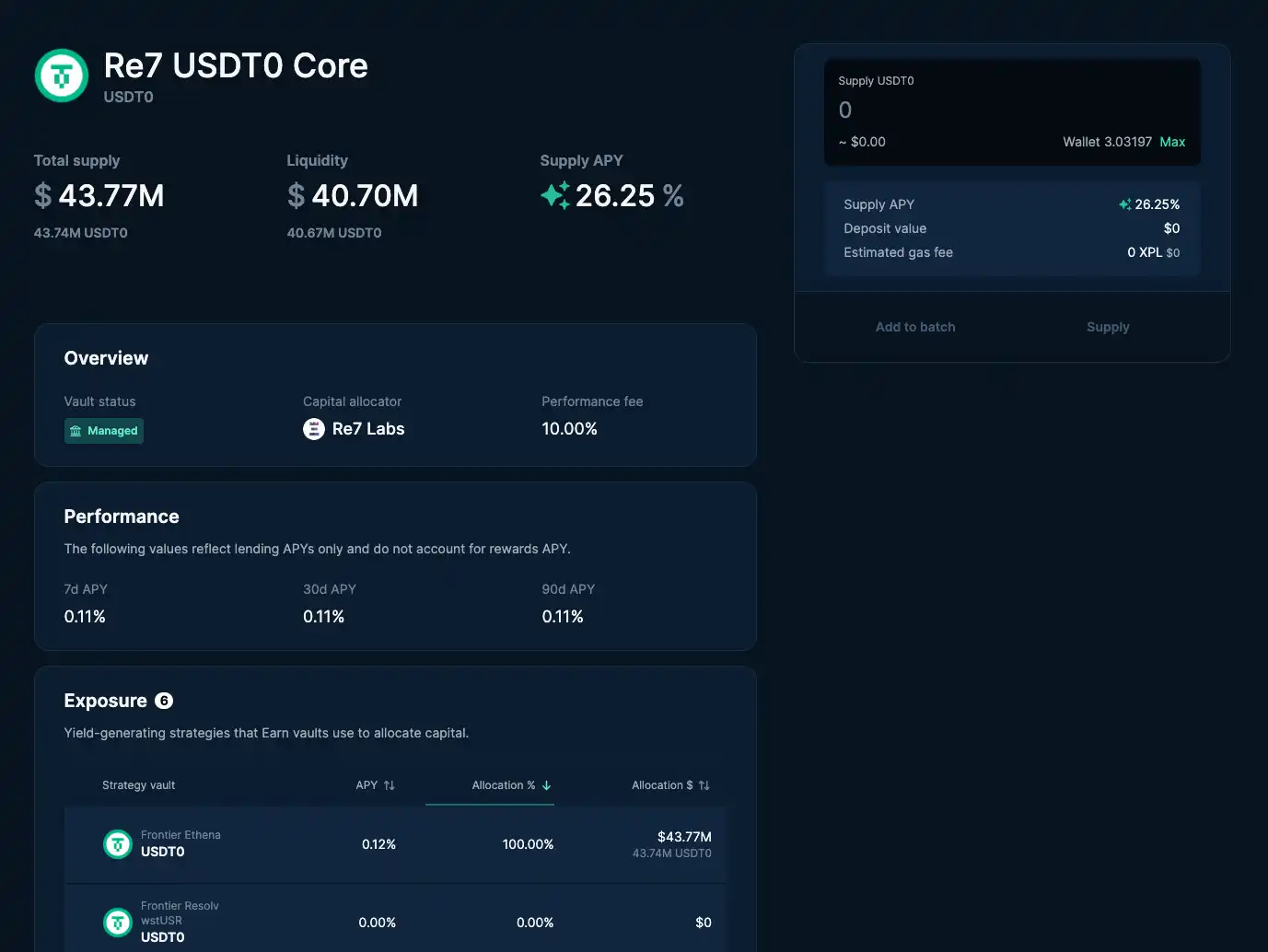

Euler Re7 Core USDT0 Vault

Also under the Euler protocol, the Re7 Core USDT0 Vault adopts a lossless flexible lending model. Users can participate by depositing USDT0 into this Vault. The current annualized yield for this pool is about 30.43%, with daily rewards of about $35,000 worth of XPL. Although Euler's pools have relatively low TVL, the yield and reward levels are still considerable, making them suitable for retail investors to diversify their allocations.

Fluid fUSDT0 Vault

The Fluid protocol's fUSDT0 Vault provides rewards for users who deposit USDT0, USDe, or ETH into the lending Vault, as well as rewards for borrowing USDT0 using USDai and USDTO as collateral. This means you can first use USDai and USDT0 as collateral to borrow USDT0 and obtain an annualized yield of about 24%.

Then, by providing liquidity to the lending pool with USDT0, the current annualized yield is about 25%.

It is worth noting that most of the APR for borrowing USDT0 is provided by Plasma's activities. The actual borrowing rate is currently around 3%. If borrowing demand rises, the rate may quickly increase, squeezing your net returns.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

In this bull market, even those who stand still will be eliminated: only "capital rotation" can survive the entire cycle.

Summary of the 7 deadly mistakes in the crypto market: 99% of traders keep repeating them

This Week's Preview: BTC Falls Below 94,000, AI "Judgment Day" and Macro "Settlement Day" Both Looming

Bitcoin and Ethereum prices have declined as the market adopts a risk-off approach ahead of the upcoming Nvidia earnings report and the release of the Federal Reserve minutes. Nvidia's earnings will influence the AI narrative and capital flows, while the Fed minutes may reinforce a hawkish stance. Summary generated by Mars AI. The accuracy and completeness of this summary are still being iteratively improved by the Mars AI model.