Grayscale Ranks The Top 20 Tokens That Offered The Best Returns In Q3

Grayscale’s Q3 2025 index revealed altcoins outperformed Bitcoin, with BNB Chain, Prometeus, and Avalanche emerging as top risk-adjusted performers.

Grayscale revealed in an index that altcoins provided the best returns in the third quarter of 2025. Bitcoin’s underperformance became the quarter’s most defining characteristic, while BNB Chain, Prometheus, and Avalanche led the ranking for top risk-adjusted performers.

The index was generally dominated by tokens used for financial applications and smart contract platforms. Thematic narratives centered on stablecoin adoption, exchange volume, and Digital Asset Treasuries (DATs) overwhelmingly drove this outperformance.

Altcoins Dominated Q3 Performance

The third quarter of 2025 proved to be a period of broad-based strength in the digital asset market. According to an index developed by Grayscale Research, some distinct winners generated the best volatility-adjusted price returns.

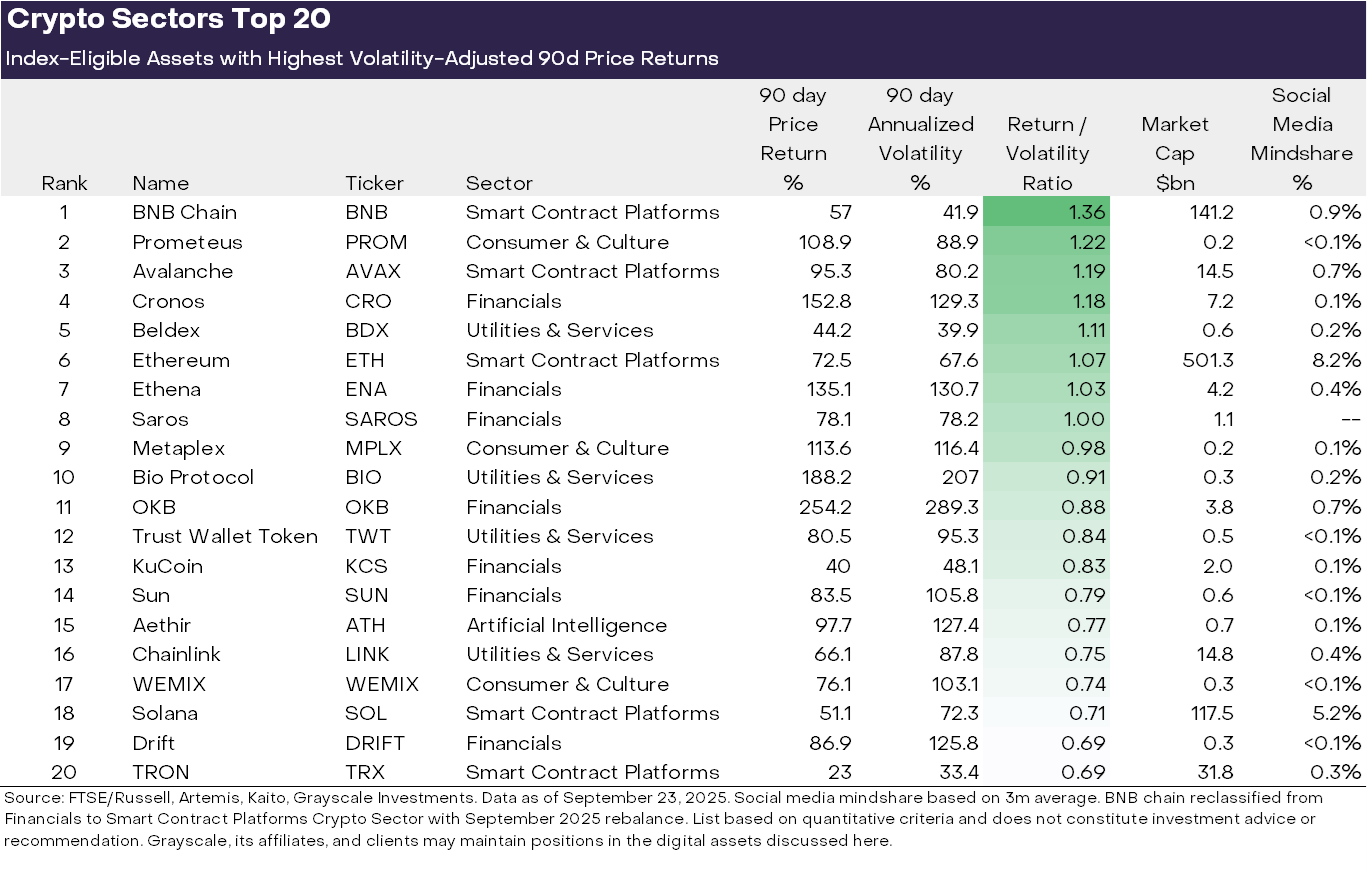

In a ranking of the top 20 best-performing tokens, BNB Chain took the lead, delivering the most favorable returns with relative stability compared to those whose gains were outweighed by excessive risk.

Prometeus, Avalanche, Cronos, Beldex, and Ethereum followed behind it.

Top 20 Performing Tokens. Source:

Grayscale Research.

Top 20 Performing Tokens. Source:

Grayscale Research.

Grayscale organizes the digital asset market into six segments based on the protocol’s core function and use case: Currencies, Smart Contract Platforms, Financials, Consumer and Culture, Utilities and Services, and Artificial Intelligence.

Seven top-performing tokens formed part of the Financials segment, while five came from Smart Contract Platforms. These results effectively quantified the shift away from Currencies. Most notably, Bitcoin did not make the cut.

Why Bitcoin Lagged Behind

The most telling data point of Grayscale’s research was not so much who made the list as who was conspicuously absent: Bitcoin.

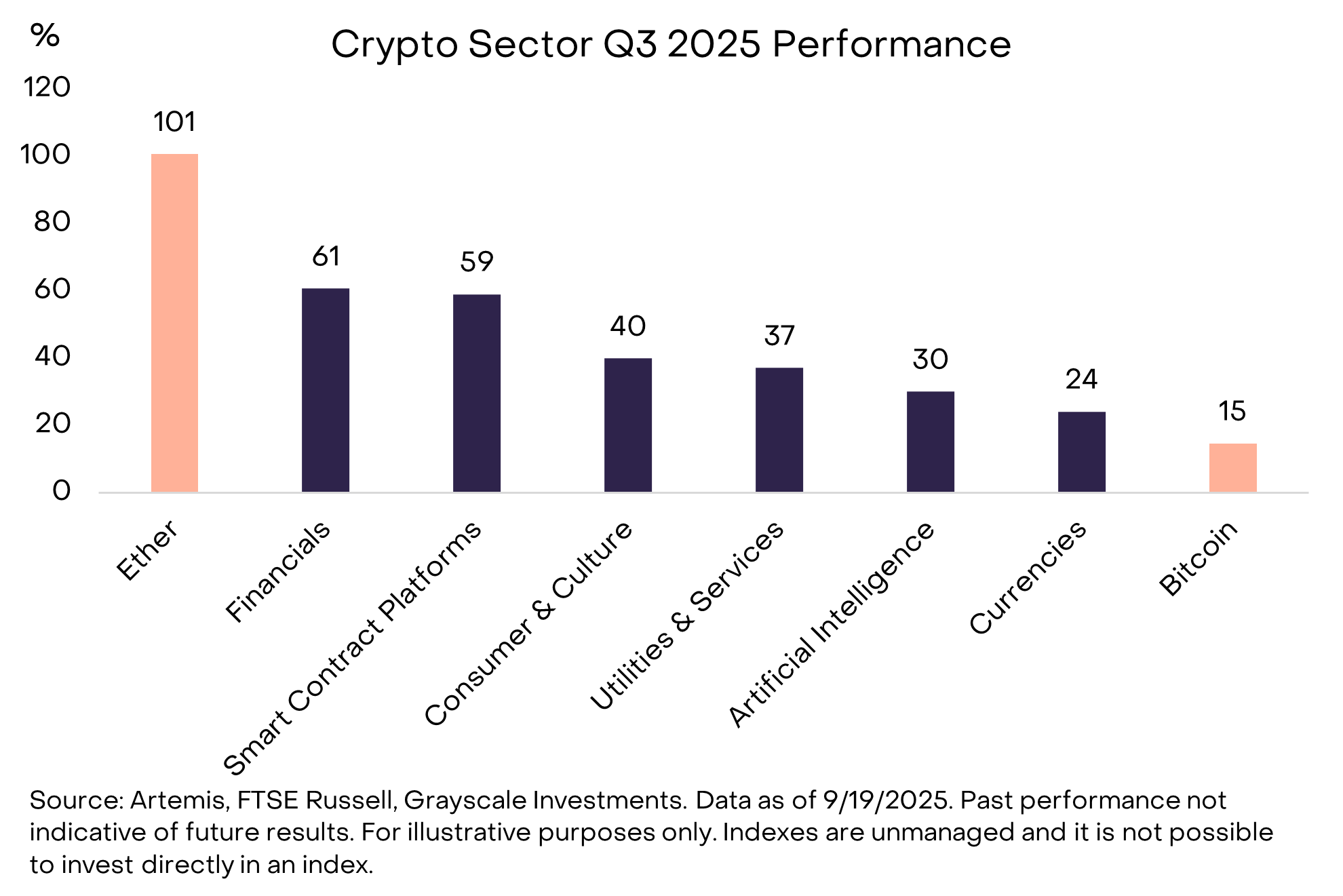

While all six sectors produced positive returns, Currencies notably lagged, reflecting Bitcoin’s relatively modest price gain compared to other segments. When measuring performance by risk, Bitcoin did not offer a compelling profile.

Crypto Sector Q3 2025 Performance: Source:

Grayscale Research.

Crypto Sector Q3 2025 Performance: Source:

Grayscale Research.

The assets that made the list were overwhelmingly driven by thematic narratives related to new utility and regulatory clarity. These narratives specifically centered on stablecoin adoption, exchange volume, and DATs.

According to Grayscale Research, the rising volume on centralized exchanges benefited tokens like BNB and CRO. Meanwhile, increasing DATs and widespread stablecoin adoption fueled demand for platforms like Ethereum, Solana, and Avalanche.

Specific decentralized finance (DeFi) categories also showed strength, such as decentralized perpetual futures exchanges like Hyperliquid and Drift, which contributed to the strength of the Financials sector.

Bitcoin was less exposed to these specific catalysts as a peer-to-peer electronic cash and store-of-value asset. This lack of exposure allowed altcoins tied to functional platforms and financial services to surge in risk-adjusted performance.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

S&P Lowers Tether Rating: Concerns Over Risky Reserves and CEO's Claims of Innovation

- S&P Global downgraded Tether's USDT to "weak" (5) due to increased exposure to volatile assets like Bitcoin (5.6% of reserves) and transparency gaps in custodians and reserve management. - Tether CEO Paolo Ardoino dismissed the downgrade as traditional finance's "loathing" of digital assets, emphasizing the firm's overcapitalization and resilience through market crises. - Chinese traders reacted with skepticism and anxiety to the downgrade, despite USDT's $184B market cap and its role as a backbone of th

Ethereum Updates: Bulls Eye $3,468 Amid Emerging Bearish Signals

- Ethereum showed early rebound signs as RSI rose from oversold levels and MACD signaled bullish momentum, though Death Cross patterns highlighted lingering bearish risks. - Bitcoin's rebound above $90,000 revived BlackRock ETF profitability, with $3.2B in unrealized gains, contrasting Ethereum's struggle to break above $3,468 EMA. - Market caution persisted as BitDegree Fear & Greed Index remained in "Fear" territory at 28, reflecting regulatory uncertainty and sideways crypto trading dynamics. - Structur

Ethereum News Today: Ethereum’s Fusaka: Achieving 100,000 TPS While Maintaining Decentralization

- Ethereum developers are finalizing the Fusaka upgrade (Dec 3), introducing PeerDAS to reduce data verification costs and boost layer-2 scalability. - The upgrade enables 100,000+ TPS via BPO forks and 60M gas limit increases, enhancing transaction throughput while maintaining decentralization. - Historical context includes prior upgrades (Merge, Dencun) and market reactions showing mixed sentiment despite improved technical metrics. - Security features like EIP-7934 (10MB block cap) and deterministic pro

Bitcoin Updates: BlackRock's ETF Surges as Competitors Struggle—Is This the Next Benchmark for Crypto?

- BlackRock's IBIT ETF became its top revenue source with $42.8M inflows, outperforming rivals like FBTC (-$33.3M). - Growing investor demand for regulated Bitcoin exposure highlights shifting preferences toward established asset managers. - Sustained inflows reflect institutional adoption trends and hedging against macroeconomic risks via compliant BTC access. - ETF liquidity and transparency advantages position them as bridges between traditional finance and digital assets. - Market watchers monitor flow