Opinion: The Future Direction of US Monetary Policy Remains Uncertain

ChainCatcher News, according to Golden Ten Data, Dalip Singh, Vice Chairman and Chief Global Economist of the fixed income division at US asset management company PGIM, stated that the main short-term risk to the US dollar comes from President Trump's continued pressure on the Federal Reserve.

He pointed out that the market is concerned that the Federal Reserve may adopt an overly dovish stance under political pressure, thereby loosening monetary policy. Singh said that there is uncertainty regarding the future direction of monetary policy. If an accommodative policy is combined with fiscal expansion, it could push up inflation and further weaken the US dollar amid global monetary policy divergence.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

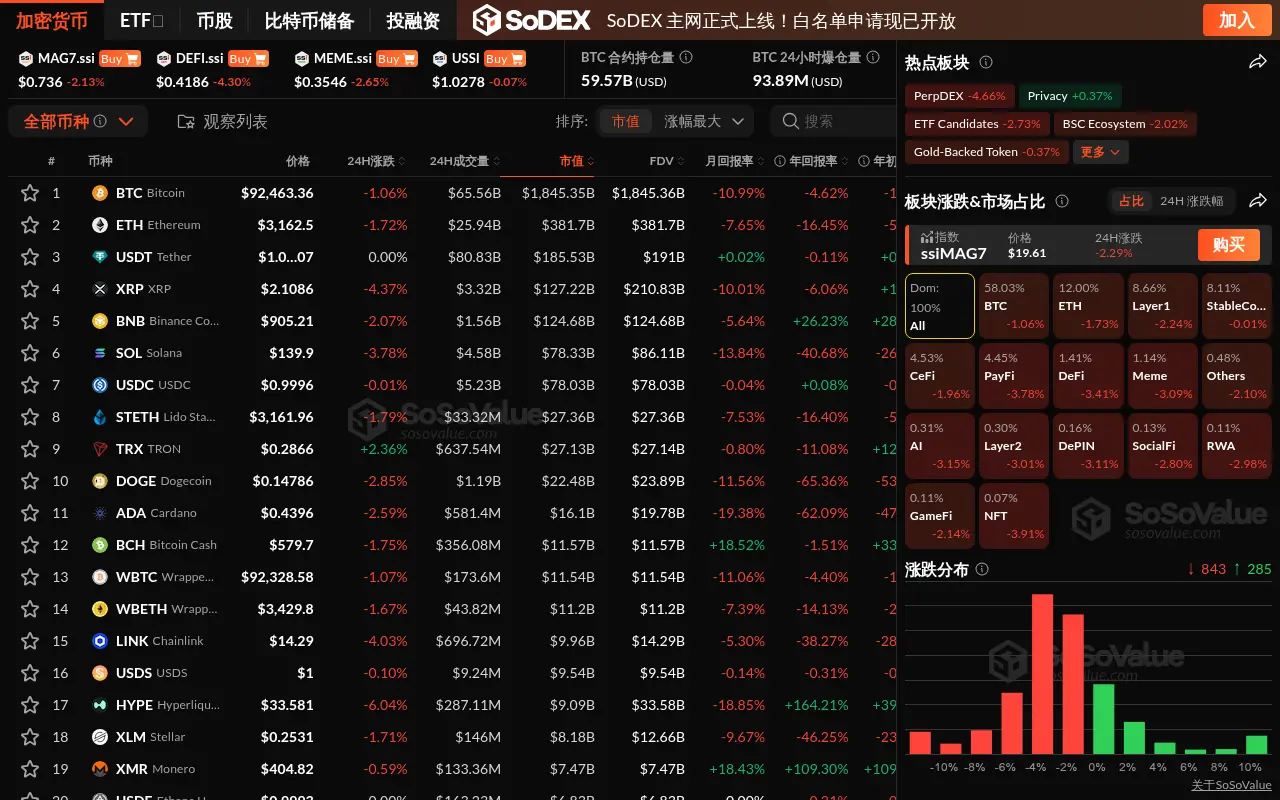

Data: The entire crypto market pulls back, PayFi sector drops nearly 4%

User data from Argentine crypto platform Lemon Cash leaked due to a hack on a third-party service provider