SEC's Latest Regulations Accelerate Approval of XRP ETFs

- SEC's 2025 commodity ETF rules could fast-track XRP ETFs, reducing approval timelines from 240 to 75 days. - BlackRock's $700M Ripple partnership aims to integrate XRP into institutional products, leveraging its cross-border payment utility. - XRP's low-cost transactions and undervalued market cap position it as a potential institutional diversification tool amid Bitcoin ETF dominance. - Analysts project $1,000/XRP by 2025 if regulatory approvals and institutional adoption accelerate, citing technical ad

Recent changes in regulations and institutional strategies are setting the stage for a possible comeback for

BlackRock, the world’s top asset management firm, has already expressed interest in broadening its crypto offerings. Although its primary attention is still on

Current market trends also favor XRP’s outlook. With spot Bitcoin ETFs attracting the majority of institutional capital—BlackRock’s iShares Bitcoin Trust (IBIT) alone manages $86 billion—the crypto market is poised for broader diversification. XRP’s minimal transaction fees and high processing capacity, together with its use in international payments, make it a strong option for institutions aiming for operational efficiency. Experts point out that XRP’s market value, which is currently seen as low compared to its practical uses, could rise sharply if ETF approvals are granted.

Industry analysts’ price outlooks further fuel optimism. Some predictions, especially from those focused on XRP, estimate the token could hit $1,000 by the close of 2025 if institutional uptake increases. These forecasts depend on regulatory green lights, greater ETF investments, and Ripple’s ongoing collaborations with banks and financial entities. While these estimates are speculative, they underscore faith in XRP’s core applications and its rising appeal among large investors.

The SEC’s updated regulations have already led to a spike in ETF filings, with more than a dozen altcoin ETF proposals expected to follow the path set by Bitcoin and Ethereum. After years of waiting for regulatory certainty, XRP is now better positioned to benefit from this trend. Bloomberg’s James Seyffart has pointed out that XRP ETFs could join this new wave, emphasizing that the asset’s technical strengths and practical uses might set it apart from other digital currencies.

---

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Fed Rate Cuts and QT End Set Crypto Up for 2026 Tailwind

Russia Calls Bitcoin Mining an Underrated Export as Production Rises

MicroStrategy Builds $1.44B Cash Wall as Bitcoin Signals Turn Bearish

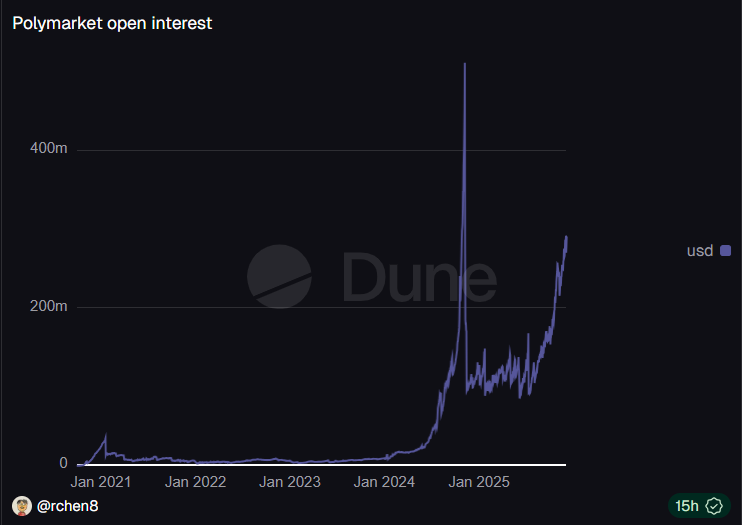

Polymarket may be tapping market making help in shift to boost liquidity