SharpLink Paves the Way for TradFi and DeFi Integration Through Ethereum-Based Shares

- SharpLink Gaming becomes first public company to natively tokenize SEC-registered shares on Ethereum via Superstate’s regulated platform. - Initiative aims to modernize capital markets by enabling 24/7 trading, DeFi integration, and faster settlements while maintaining regulatory compliance. - Company’s 838,000 ETH treasury and Ethereum co-founder Joseph Lubin’s leadership highlight strategic alignment with blockchain’s financial infrastructure. - Tokenized equities face challenges like custody risks and

SharpLink Gaming, Inc. (Nasdaq: SBET) has made history as the first publicly listed company to natively tokenize its SEC-registered common shares on the

SharpLink’s approach to tokenization is backed by its robust Ethereum (ETH) treasury, which has accumulated more than 838,000 ETH since June 2025 and earned 3,815 ETH in staking rewards by late September. After naming Ethereum co-founder Joseph Lubin as Chairman in 2025, the company has become one of the largest corporate ETH holders globally. Co-CEO Joseph Chalom stated that this move is more than a technical achievement—it signals the direction of global capital markets, highlighting SharpLink’s commitment to building a reliable digital asset treasury and advancing Ethereum’s adoption. Lubin remarked that the partnership “opens the floodgates” for merging traditional finance (TradFi) with modular DeFi on Ethereum SEC-Registered Equity Comes to Ethereum: Superstate and SharpLink Partner to Launch Tokenized SBET on Ethereum [ 1 ]. Superstate CEO Robert Leshner described the partnership as a “landmark” for a company aligned with Ethereum, emphasizing its potential to transform market structure SEC-Registered Equity Comes to Ethereum: Superstate and SharpLink Partner to Launch Tokenized SBET on Ethereum [ 1 ].

The tokenized shares, distributed through Superstate’s Opening Bell platform, are structured to allow secondary trading on AMMs while staying within regulatory boundaries. This model could improve liquidity and transparency for investors, as tokenized stocks may be traded around the clock on decentralized exchanges and settle in seconds instead of days. The SEC has made it clear that tokenized securities must still comply with federal securities laws, including disclosure and regulatory requirements Enchanting, but Not Magical: A Statement on the Tokenization of Securities [ 3 ]. SharpLink’s project reflects a larger industry movement, with Nasdaq recently suggesting rule changes to support tokenized equity trading on its platform, provided tokens meet standards like fungibility and shared CUSIP numbers Nasdaq Proposes Rule Changes to Tokenize Equity Securities and Exchange-Traded Products [ 4 ]. These trends point to increasing institutional interest in blockchain-based capital markets, though issues such as custody, interoperability, and regulatory certainty remain.

SharpLink’s ETH treasury strategy has already delivered substantial gains, with the company earning $3.51 billion in ETH value by September 2025. The company’s aggressive pursuit of staking rewards—509 ETH in just one week—demonstrates its dedication to utilizing Ethereum’s financial ecosystem. While tokenizing SBET shares introduces risks like price swings and compliance challenges, SharpLink has implemented safeguards, including historical cost accounting for ETH and impairment charges linked to market price changes. The press release’s forward-looking statements highlight possible benefits, such as broader access for global investors and the integration of tokenized stocks into DeFi, while also acknowledging uncertainties like regulatory shifts and market volatility SEC-Registered Equity Comes to Ethereum: Superstate and SharpLink Partner to Launch Tokenized SBET on Ethereum [ 1 ].

The project has received mixed feedback in the crypto space, with Ethereum’s price falling below $4,000 amid overall market turbulence. Nevertheless,

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Fed Rate Cuts and QT End Set Crypto Up for 2026 Tailwind

Russia Calls Bitcoin Mining an Underrated Export as Production Rises

MicroStrategy Builds $1.44B Cash Wall as Bitcoin Signals Turn Bearish

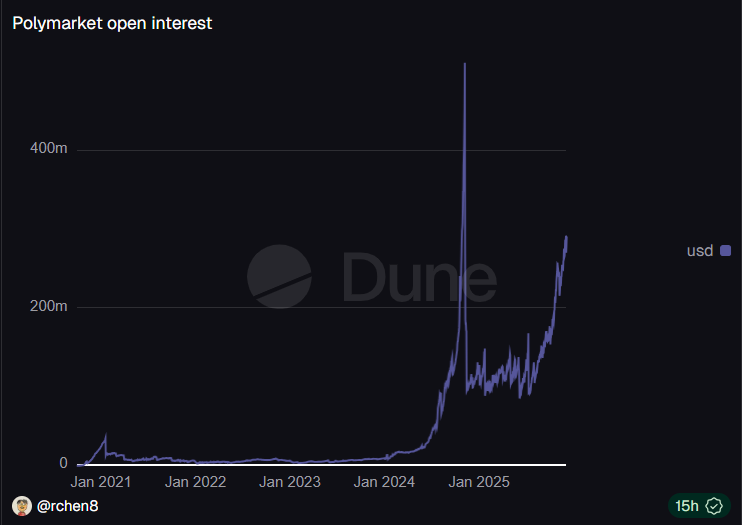

Polymarket may be tapping market making help in shift to boost liquidity