Syz Capital partners pull funds from MSTR and ETFs and invest in Metaplanet

On September 27th, it was reported that Richard Byworth, a partner at the Swiss hedge fund Syz Capital, is withdrawing funds from investments in Strategy (formerly MicroStrategy) and some Bitcoin ETFs, and is starting to invest in the Japanese Bitcoin treasury company Metaplanet. He expects the company's market performance to outperform Bitcoin's recent market trend by over 50%.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Astar 2.0: Is This a Strong Opportunity for Institutional Investors to Enter?

- Astar 2.0 upgrades blockchain scalability via Polkadot's async protocol, cutting block time to 6 seconds and boosting TPS to 150,000. - Institutional adoption grows with $3.16M ASTR purchase, 20% QoQ wallet growth, and partnerships with Sony , Casio, and Japan Airlines. - Cross-chain liquidity via Chainlink CCIP and hybrid architecture position Astar as a bridge between decentralized innovation and enterprise needs. - Analysts project ASTR could reach $0.80–$1.20 by 2030, though liquidity constraints and

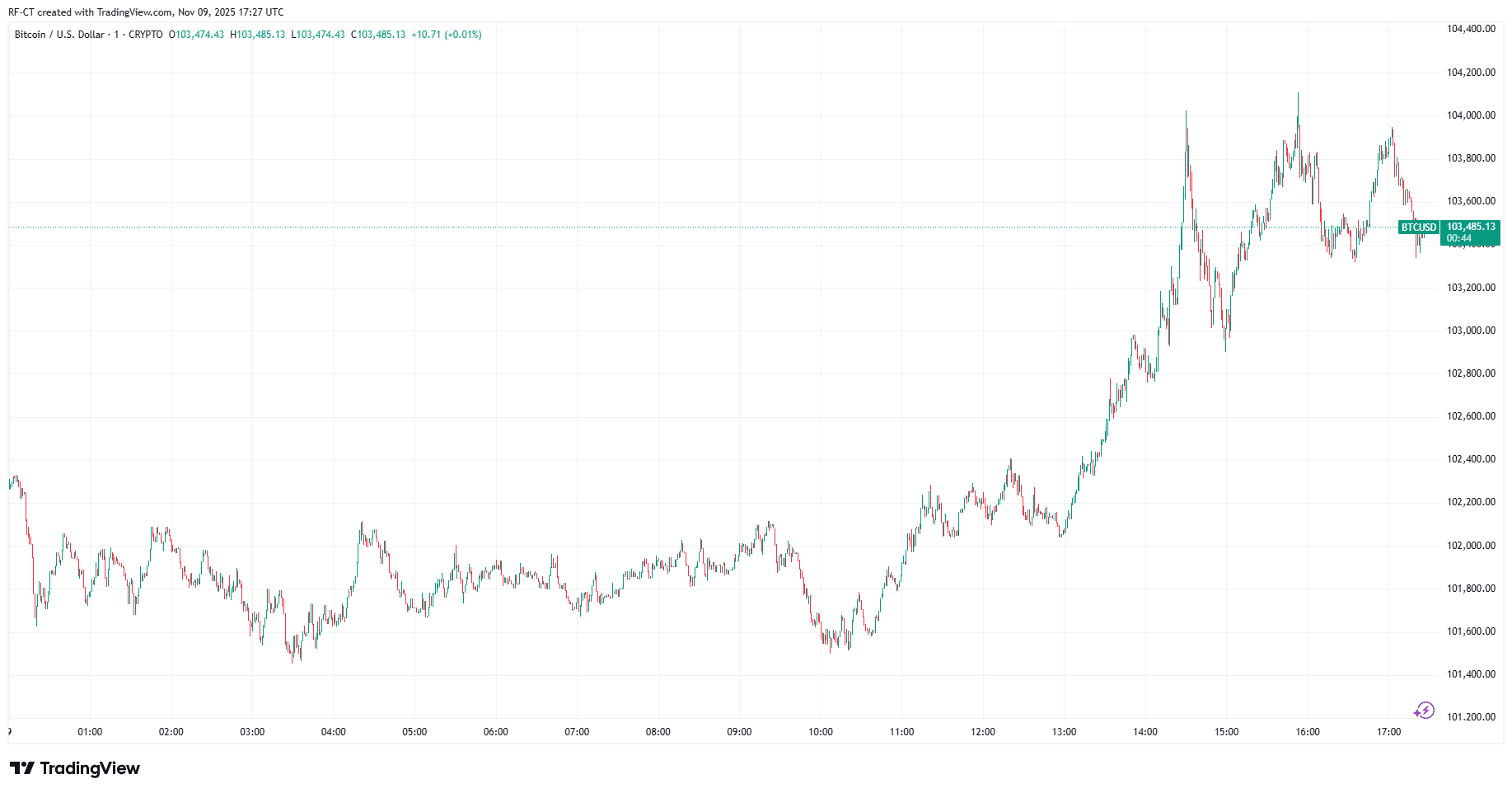

Bitcoin Bounces Back as Trump’s $2,000 Dividend Plan and Michael Saylor’s Hint Spark Market Optimism

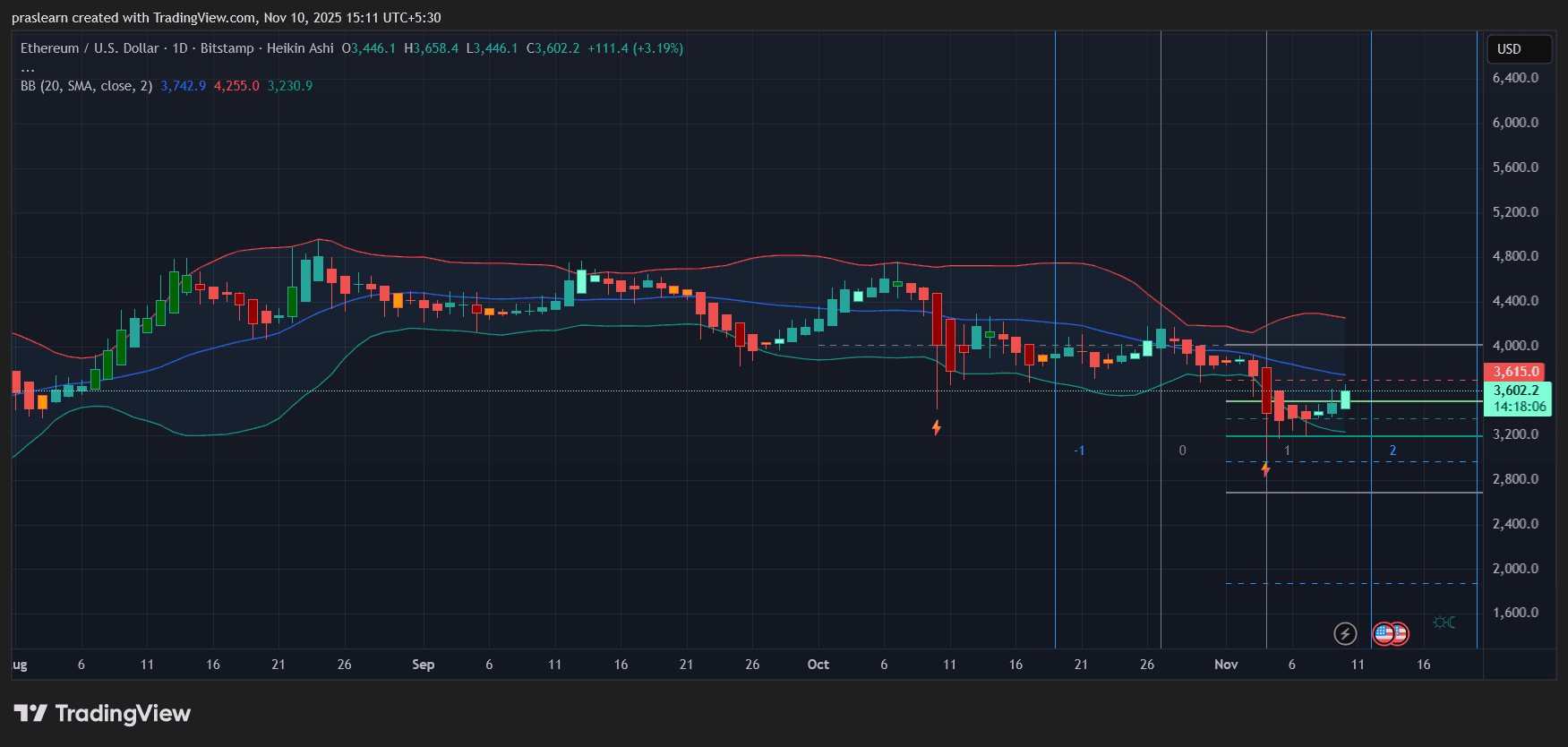

Will Political Calm Push ETH Price Toward $4,000?

Vitalik Buterin's Latest Advocacy for ZK Technology in Ethereum: Evaluating the Impact of ZK on Ethereum's Future Scalability and Investment Potential

- Vitalik Buterin prioritizes ZK proofs to enhance Ethereum's scalability, privacy, and quantum resistance amid institutional demand and post-AGI risks. - Ethereum's "Lean Ethereum" upgrades remove modexp precompiles and adopt GKR protocol, boosting TPS and quantum security while temporarily affecting gas fees. - ZK layer 2 solutions like Lighter (24k TPS) and ZKsync (15k TPS) drive institutional adoption, with 83% of enterprise smart contracts now using ZK-rollups. - ZK-driven infrastructure (ZKsync, Star