Dovish Fed Chair: Blessing for Bitcoin or Threat to the Economy?

- The Fed's 25-basis-point rate cut sparks debate on Bitcoin's potential rally amid speculation about the next dovish chair. - Historical data shows Bitcoin typically benefits from sustained rate cuts, with 2020's emergency easing correlating to a $28,000 rebound. - Trump's shortlisted Fed candidates (Hassett, Waller, Warsh) all favor rate cuts, with Warsh's balance-sheet reduction plan seen as bullish for risk assets. - Market uncertainty persists as Fed's inflation forecasts and policy tone—rather than c

The recent 25-basis-point interest rate reduction by the U.S. Federal Reserve has sparked renewed debate about Bitcoin’s prospects for a strong upward move, especially as speculation grows regarding the policy direction of the next Fed chair. In the past,

The possibility of a more dovish Fed chair has become a major talking point. President Donald Trump is reportedly considering three main candidates—Kevin Hassett, Christopher Waller, and Kevin Warsh—all of whom have indicated support for rate cuts.

The Fed’s guidance on future policy and its inflation outlook will be crucial. In December 2024, a revised inflation forecast of 2.5% for 2025 and a reduction in expected rate cuts from three to two led to a 4.6% decline in Bitcoin after the announcement title5 [ 5 ]. This demonstrates how sensitive the crypto market is to macroeconomic developments. Although lower rates generally increase liquidity and weaken the dollar—conditions that tend to favor Bitcoin—efforts by policymakers to keep inflation in check could limit potential gains. The Fed’s current projections indicate two more rate cuts in 2025, but differing views among FOMC members highlight ongoing uncertainty title4 [ 4 ].

Both retail and institutional investors are taking a more cautious approach. Strategies such as diversification, lowering leverage, and using dollar-cost averaging are being recommended to manage volatility, especially around Fed announcements. Continued inflows into spot ETFs, reflecting steady institutional participation, could further fuel a Bitcoin rally if dovish policies are enacted title2 [ 2 ]. However, alternative cryptocurrencies remain highly volatile and may experience sharper corrections during periods of uncertainty title2 [ 2 ].

Regulatory and geopolitical developments add further complexity. A dovish Fed could weaken the dollar, potentially encouraging more global adoption of Bitcoin as a hedge. On the other hand, increased regulatory scrutiny—such as SEC decisions on crypto ETFs—could offset the positive effects of looser monetary policy title2 [ 2 ]. Under a Trump administration, the balance between pro-crypto initiatives (like holding Bitcoin reserves) and risks to monetary independence remains unpredictable title9 [ 9 ].

In conclusion, Bitcoin’s short-term outlook will be shaped by the Fed’s policy direction, the next chair’s approach, and wider macroeconomic trends. While a shift toward more accommodative policies could drive significant gains, investors should also consider risks such as stagflation, regulatory challenges, and market saturation. Careful attention to the Fed’s communications is advised, as the interplay of these factors will determine whether Bitcoin continues its rally or faces a correction.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

XRP Eyes $2.75 Breakout as BTC Dominance Dips – Bullish Setup Loading

Quick Take Summary is AI generated, newsroom reviewed. XRP closes with a strong bullish daily candle, reinforcing upward momentum. Analysts project a move toward the $2.75 resistance if Bitcoin continues rising. XRP trades around $2.15–$2.20, reflecting a 6% rebound that supports bullish continuation. Lower-timeframe charts show scalp setups forming, though confirmation remains essential.References X Post Reference

ETH Traders Turn Bold as $6,500 Calls Take Over Deribit

Quick Take Summary is AI generated, newsroom reviewed. Traders push $6,500 ETH calls to $380M in open interest Strong clusters form at $4K, $5.5K, and $6K call strikes Market confidence rises despite a 26% quarterly ETH drop ETH price outlook strengthens as crypto market sentiment turns bullishReferences 🚨DERIBIT TRADERS CALL FOR $6,500 ETH! The $6.5K strike leads with $380 MILLION in open interest, with $4K, $5.5K and $6K calls also active. Despite a 26% quarterly drop, BIG REBOUND bets are in

Crypto Market Ignites as Bitcoin and SUI Drive Massive Trading Activity

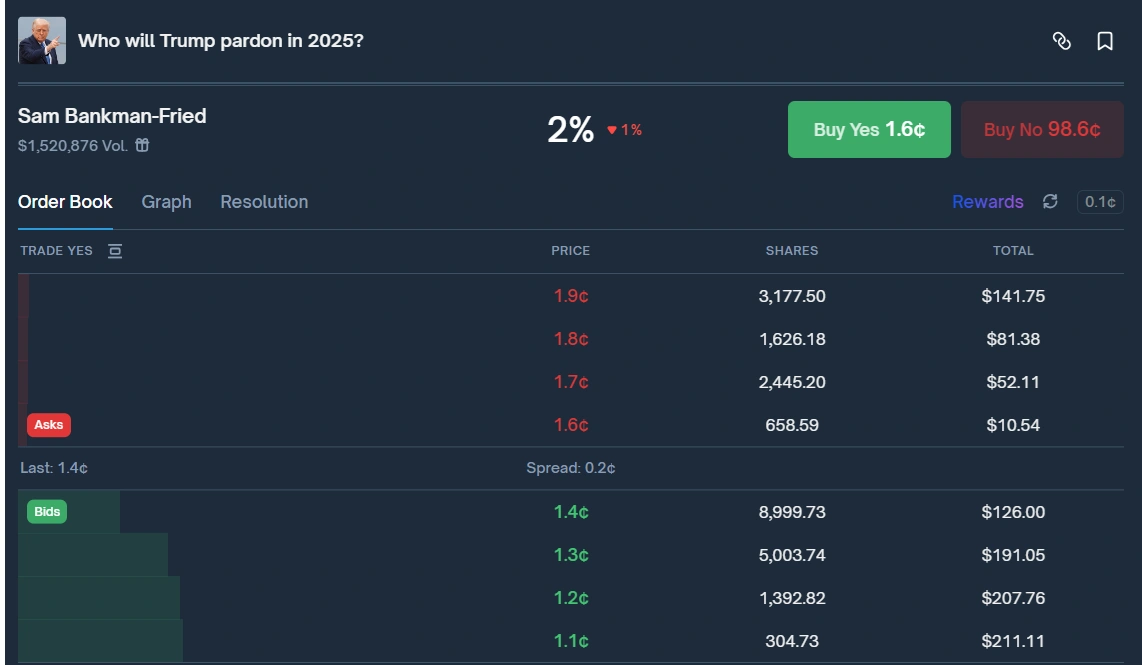

Trump continues to overlook SBF as president issues fresh pardons