MoonBull achieves a 24,540% return: The secure presale leader of 2025

- MoonBull ($MOBU) presale offers 24,540% ROI potential, with early investors buying at $0.000025 for a projected $0.00616 listing price. - The 23-stage presale includes a 95% APY staking program and liquidity locks, supported by smart contract audits and community-driven growth incentives. - Competitors like TRUMP and FLOKI leverage political branding and metaverse projects, but MoonBull’s structured tokenomics and transparency position it as a 2025 standout. - Analysts highlight the shift toward utility-

---

The crypto scene in 2025 is marked by a wave of high-yield prospects, fueled by creative token models and community-led initiatives. Standing out among these is , a meme-based

MoonBull’s achievements are built on principles of fairness and long-term viability. The project ensures locked liquidity and has subjected its smart contract to audits to reduce risk. Its referral program further accelerates growth, granting 15% rewards to both referrers and those they invite. Monthly leaderboards award USDC bonuses, encouraging organic community growth. These features reflect a broader industry movement, where tokens offering real utility—like staking and governance—tend to outperform purely speculative coins.

Other tokens such as and are also gaining momentum.

The meme coin market as a whole is moving toward more organized frameworks. and are responding to market swings by introducing governance improvements and cross-chain features. ApeCoin’s recent token release led to a 10% price drop, illustrating the difficulty of maintaining liquidity while keeping community trust. In contrast, Baby Doge’s

Experts point out that the most promising tokens in 2025 will combine viral appeal with practical use cases. , for example, operates on a decentralized, community-driven platform with no developer reserves. Despite a $141 million market cap and support for cross-chain operations, its lack of governance or utility features may limit its future growth. Likewise, and use humor and gamified elements to keep users engaged, but their ability to scale depends on sustaining their unique appeal.

Fundraising initiatives in the market are also drawing interest from institutional players. Projects like and merge meme culture with DeFi aspects, including NFT features and charity-focused mechanisms. However, their long-term success relies on strong community backing and the avoidance of rug-pull risks. For investors, the most important factors remain clear tokenomics, locked liquidity, and audited smart contracts—areas where MoonBull and a select few excel.

As 2025 unfolds, the crypto sector is increasingly rewarding tokens that offer both speculative upside and solid structural protections. Early sponsorship tiers and governance incentives are prime examples of this shift. For those looking for significant returns, the window of opportunity may be narrow before the market becomes saturated and opportunities diminish.

---

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin News Update: Harvard's $443 Million Investment Confirms Growing Institutional Interest in Cryptocurrency

- BlackRock launches Ethereum ETF in Delaware, expanding crypto offerings amid rising institutional demand. - Harvard's $443M IBIT investment marks 21% of its equity portfolio, signaling rare institutional crypto endorsement. - SEC's regulatory shifts normalize crypto ETFs, removing 2026 examination priority and enabling diversified index launches. - Market volatility sees $257M IBIT outflow as Bitcoin dips 25%, yet long-term institutional allocation persists. - Crypto's transition to strategic asset class

Buffett's Unexpected Investment in Tech Drives Alphabet's AI Boom

- Berkshire Hathaway's $4.3B Alphabet investment drove a 5% stock surge, marking Buffett's rare tech bet. - Alphabet's Gemini 3 AI model improves complex query accuracy and integrates into search/cloud products. - Analysts praise Gemini 3 as a "state-of-the-art" advancement closing AI performance gaps with rivals. - The model's commercial deployment and Buffett's backing position Alphabet as a key AI industry player.

Panera’s ‘Paper Cuts’ Takeaway: Prioritizing Quality Over Reducing Expenses

- Panera Bread’s CEO Paul Carbone launched the "Panera RISE" strategy to boost sales and restore customer trust by reversing cost-cutting measures like replacing romaine with iceberg lettuce. - Key initiatives include reintroducing premium ingredients, expanding menu options, and enhancing service to achieve $7 billion in systemwide sales by 2028. - JAB Holding and franchisees are funding the turnaround, while the IPO of Panera Brands remains delayed to prioritize customer satisfaction over short-term gain

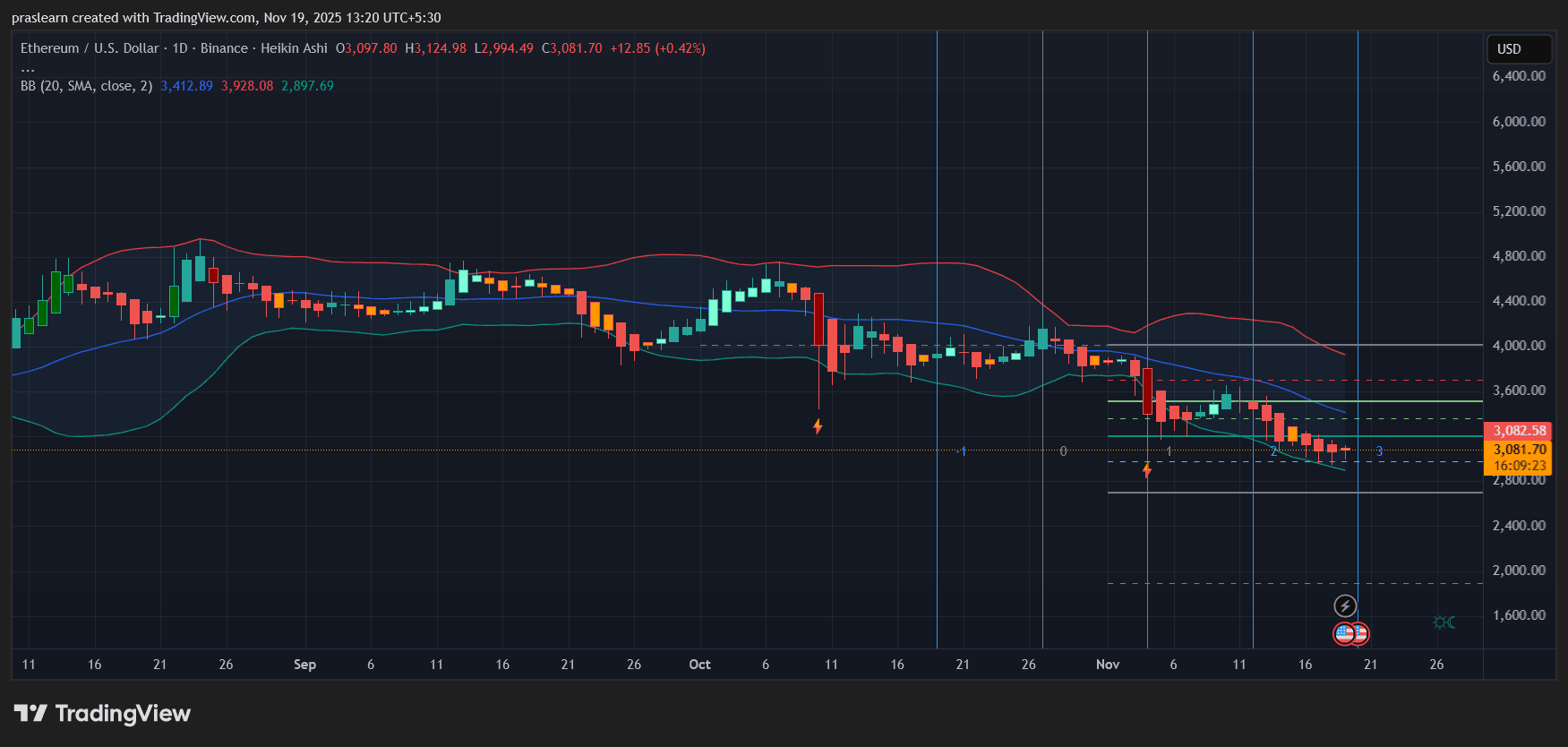

Fed Uncertainty Keeps ETH Stuck in a Tight Downtrend