Hyperliquid’s interest-earning USDH poses a challenge to USDC’s dominance among stablecoins

- Hyperliquid launches USDH stablecoin to recapture $220M+ annual yields from $5.6B USDC deposits, redirecting earnings to HYPE buybacks and ecosystem funds. - USDH's yield-bearing design contrasts with Circle's USDC, offering competitive edge in DeFi through 1:1 redeemability and U.S. Treasury-backed reserves via Native Markets. - FalconX custody support and 80% lower trading fees via HyperEVM aim to challenge USDC/USDT dominance while reducing censorship risks and enhancing platform resilience. - 45% HYP

Hyperliquid has introduced the HYPE/USDH spot pair, representing a major milestone in its plan to generate and retain value within its own network. USDH, the platform’s proprietary stablecoin pegged to the US dollar, is designed to reclaim more than $220 million in annual Treasury yield that previously went to third-party issuers such as

USDH sets itself apart by offering yield to holders, unlike Circle’s USDC, which is restricted by U.S. law from paying interest. This feature gives USDH a competitive advantage in the DeFi space, where yield is a key factor for liquidity. Native Markets’ plan to split reserve yields equally between HYPE buybacks and ecosystem growth demonstrates a strong alignment between the issuer and Hyperliquid’s community. Although Paxos,

Hyperliquid’s introduction of USDH signals a broader trend among stablecoin projects to take greater control over their financial frameworks. The stablecoin’s integration with Hyperliquid’s HyperEVM

The rollout of USDH also heightens the rivalry with USDC and

For HYPE holders, the USDH debut brings both potential benefits and uncertainties. The proposal to cut supply by 45%—burning 421 million tokens—aims to offset the $12 billion in scheduled token unlocks over the next two years. While this could increase scarcity, it also raises questions about how it will affect incentives and token allocation within the ecosystem. This tension is reflected in current market trends, with HYPE trading between $47 and $49 in July 2025, a significant rise from $3.81 in November 2024. Major investors, including Arthur Hayes’ Maelstrom Fund, are closely watching large holder activity and the platform’s ability to maintain its 70% dominance in DeFi perpetuals trading.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Vitalik Buterin's Support for ZKsync and Its Influence on Layer 2 Scaling Technologies

- Vitalik Buterin's endorsement of ZKsync in November 2025 boosted its profile as a key Ethereum scaling solution with 15,000+ TPS and near-zero fees. - Institutional partnerships with Deutsche Bank and Sony , plus a 37.5M $ZK staking pilot, strengthened ZKsync's enterprise adoption and tokenomics. - The $0.74 token price surge and $15B capital inflow highlight market confidence in ZK-based infrastructure as Ethereum's primary scaling path. - Upcoming Fusaka upgrade (30,000 TPS) aims to challenge Arbitrum'

CyberCharge and SocialGrowAI Unite to Accelerate Web3 User Growth and Engagement

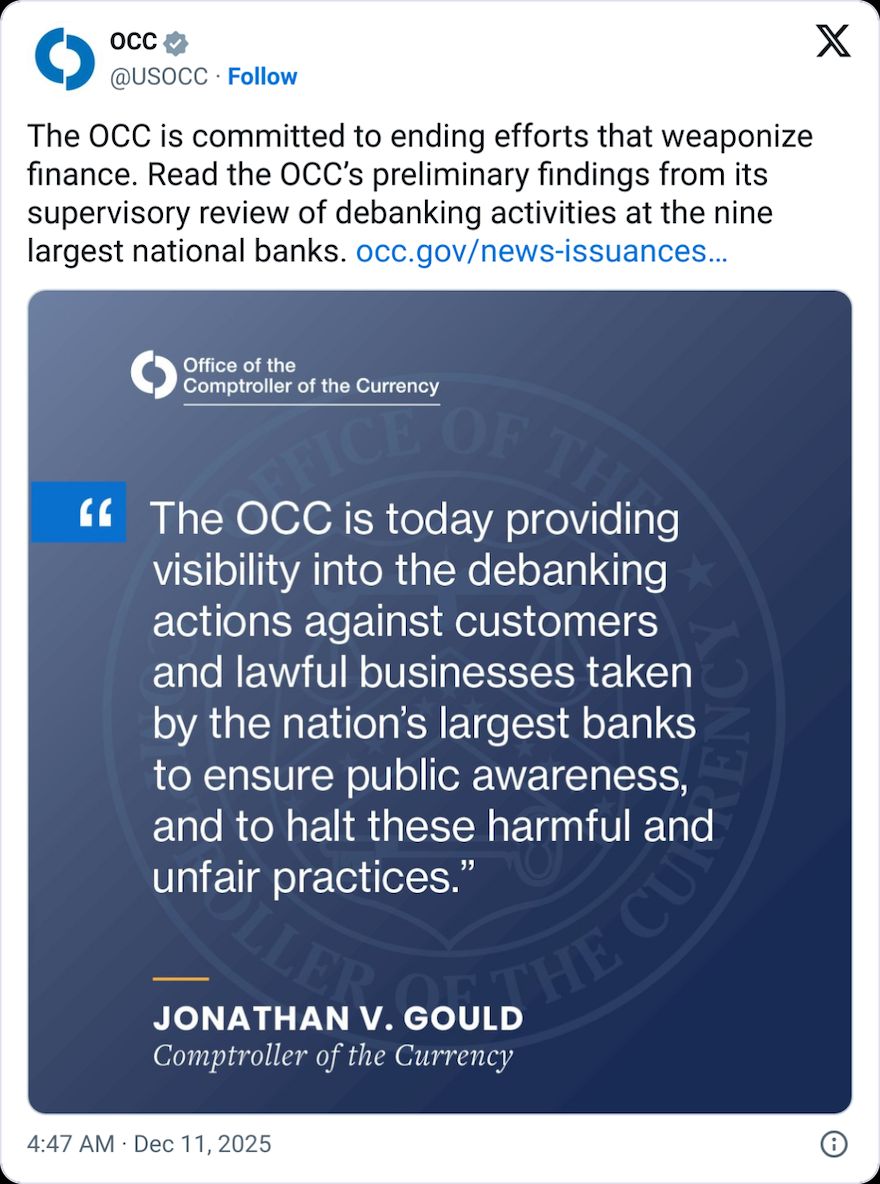

Crypto among sectors ‘debanked’ by 9 major banks: US regulator

Bitcoin Reverses From Channel Resistance as Whale Shorting Intensifies