MoonBull's Unique Whitelist Ignites Meme Coin Frenzy Fueled by FOMO

- MoonBull, an Ethereum-based meme coin, has gained traction via a sold-out whitelist offering exclusive discounts and staking rewards, fueling speculation of 1000x returns. - Competitors like Solana's Peanut the Squirrel (PNUT) and Cheems (CHEEMS) also attract investors, with PNUT projected to reach $2.16 by 2025 if bullish trends continue. - The volatile meme coin market thrives on retail momentum despite institutional caution, as seen in Ethereum ETF outflows and rapid sentiment shifts affecting tokens

MoonBull, an emerging meme

The meme coin sector remains highly competitive, with tokens like

The wider meme coin landscape remains turbulent, with projects such as

Current market trends reveal a balance between speculative enthusiasm and broader economic influences. While

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Crypto Crash Reasons: Here is why Cryptos are Crashing

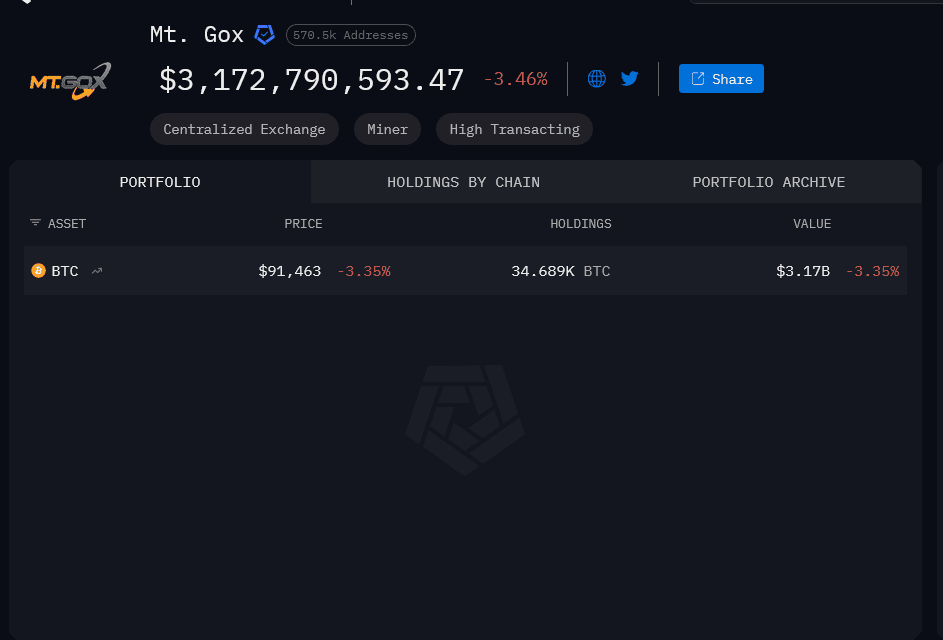

Mt. Gox Just Moved Nearly $1B in Bitcoin. Should You Be Worried?

Bitcoin News Update: Canaan's Shift Toward Bitcoin Mining Drives 18% Increase and Sets New Record in Holdings

- Canaan Inc. shares surged 18% pre-market after Q3 revenue jumped 104.4% to $150.5M, surpassing estimates. - Bitcoin mining revenue soared 241% to $30.6M, driven by 267 BTC mined and 10 EH/s computing power sold. - Company boosted crypto holdings to 1,610 BTC/3,950 ETH by October 2025 and secured a 50,000-unit mining machine order. - Q4 revenue guidance ($175-205M) exceeds $148. 3M estimates, but risks include U.S. tariffs and regulatory shifts. - Analysts maintain "buy" ratings with a $3.00 price target

BCH Climbs 5.6% Over 24 Hours as Institutions Adjust Their Portfolios

- BCH surged 5.6% in 24 hours to $514.6 amid mixed 1-month (-3.14%) and 1-year (19.29%) performance. - Institutional investors reshaped holdings: Itau Unibanco cut 21.3% stake, while Goldman Sachs and Robeco increased positions. - Analysts raised price targets to $33-$35 with "neutral" ratings, though Zacks upgraded to "strong-buy" amid improved long-term outlook. - BCH maintains 1.24% institutional ownership, 12.92 P/E ratio, and stable financial metrics (quick ratio 1.53, debt-to-equity 2.00).