NFT sales jump 8% to $129.1m, Pudgy Penguins show modest 15% recovery

The NFT market has posted solid growth with sales volume rising by 8.13% to $129.1 million. This is the third consecutive week of gains, despite the weakness in the crypto market.

- NFT sales posted 8% growth to $129.1 million marking three consecutive weeks of gains

- Market participation surged with buyer counts more than doubling and seller counts rising 140%

- BNB Chain surged to second place in blockchain rankings with nearly 200% growth

According to data from CryptoSlam , market participation has expanded with NFT buyers surging by 112.37% to 587,381, and NFT sellers rising by 140.76% to 496,112. NFT transactions have declined by 7.99% to 2,088,311.

The market has been tumultuous as Bitcoin ( BTC ) price has dropped to the $119,000 level. At the same time, Ethereum ( ETH ) has dropped to the $4,000 level.

The global crypto market cap is now $3.78 trillion, down from last week’s market cap of $4.04 trillion.

BNB Chain surges to second position

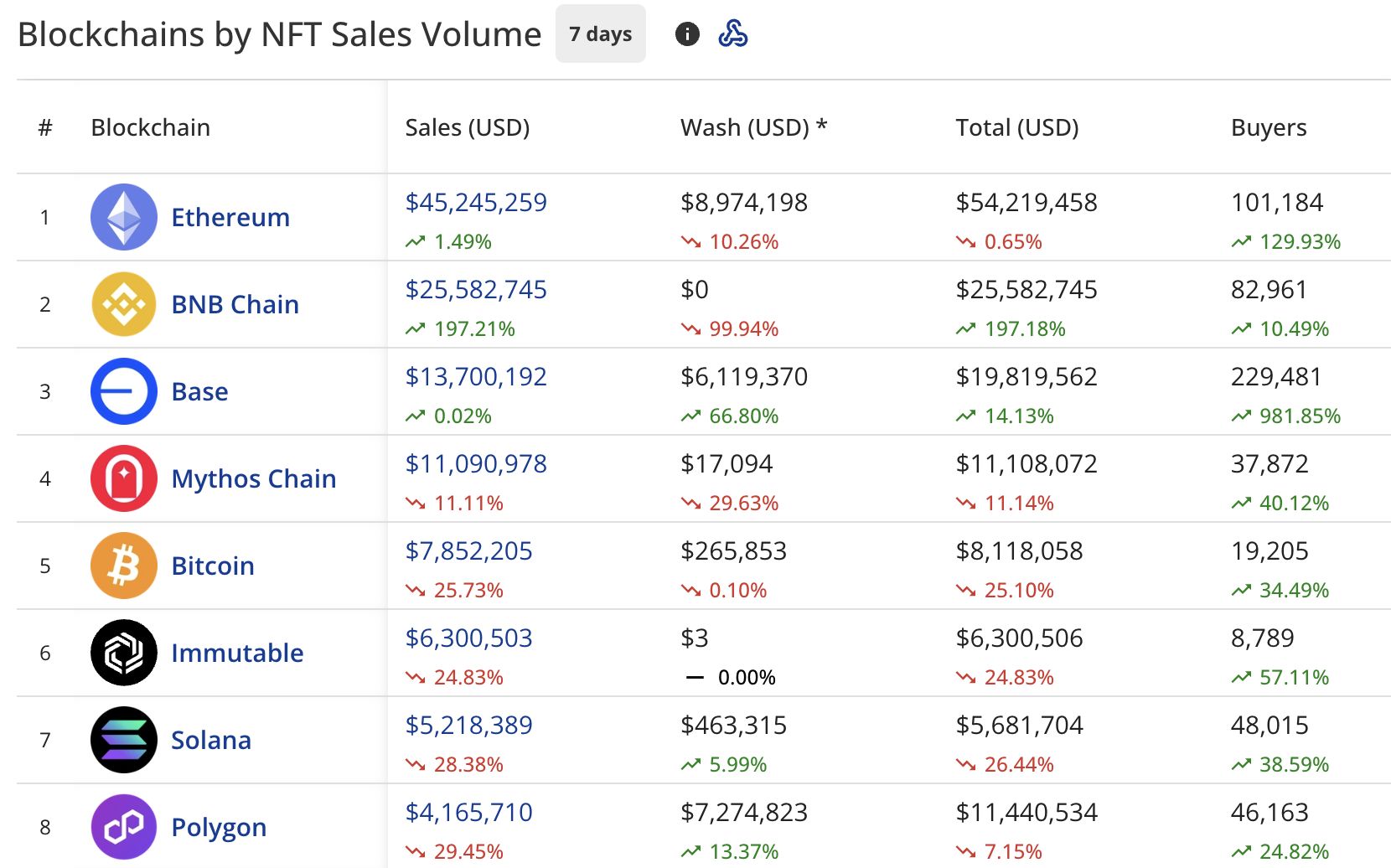

Ethereum has maintained its leading position with $45.2 million in sales, though posting minimal growth of 1.49%. Ethereum’s wash trading has decreased by 10.26% to $8.9 million.

BNB Chain ( BNB ) has surged to second place with $25.5 million, surging by 197.21%.

Source: Blockchains by NFT Sales Volume (CryptoSlam)

Source: Blockchains by NFT Sales Volume (CryptoSlam)

Base has climbed to third position with $13.7 million, though declining 0.02%. Mythos Chain holds fourth place with $11 million, falling 11.11%.

Bitcoin sits in fifth with $7.8 million, declining 25.73%. Immutable ( IMX ) occupies sixth with $6.3 million, down 24.83%.

Solana ( SOL ) holds seventh with $5.2 million, falling 28.38%. Polygon ( POL ) rounds out the top eight with $4.1 million, declining 29.45%.

The buyer count has increased across most blockchains, with Ethereum leading at 129.93% growth, followed by BNB Chain at 10.49% and Solana at 38.59%.

Pudgy Penguins rise 15%

Vesting NFT on BNB Chain has taken the top spot in collection rankings with $17.9 million in sales, showing no change from the previous period. The collection is dominated by a single seller with 22 buyers.

DX Terminal on Base has climbed to second place with $8.6 million, declining 3.55%. The collection has seen decreases in buyers (17.18%) and sellers (16.64%).

DMarket holds third position with $5.9 million, falling 17.73%. Moonbirds sits in fourth with $5.5 million, rising 30.44%.

DKTNFT on BNB Chain occupies fifth place with $3.6 million, declining 3.49%. Panini America holds sixth with $3.6 million, up 40.19%.

Guild of Guardians Heroes sits in seventh with $3.5 million, falling 23.82%. Pudgy Penguins completes the top eight with $3.4 million, rising 15.21%.

Notable high-value sales from this week include:

- CryptoPunks #9286 sold for 48.97 ETH ($220,299)

- CryptoPunks #6482 sold for 48.89 ETH ($218,454)

- CryptoPunks #2406 sold for 48.85 ETH ($217,892)

- BOOGLE sold for 950 SOL ($205,400)

- CryptoPunks #3091 sold for 48 ETH ($201,125)

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin News Update: Bitcoin Surges Back to $90K—Is This a New Beginning or Just a Pause in the Bear Market?

- Bitcoin rebounded from $79,500 to $88,000 amid mid-sized wallet accumulation and ETF inflows, signaling potential market stabilization. - BlackRock ETF holders regained $3.2B profits as price reclaimed $90K, shifting institutional sentiment despite whale selling. - On-chain data shows mid-sized wallets (10–1,000 BTC) stabilizing prices, contrasting with whale outflows and leveraged futures liquidations. - Technical indicators cap Bitcoin below $105K EMAs, with $97K–$98K liquidity pocket as next critical

Visa’s Embrace of Blockchain Technology Updates the Worldwide Payment System

- Visa partners with Aquanow to expand stablecoin settlements in CEMEA, enabling faster cross-border payments via USDC and reducing operational costs. - The initiative scales to $2.5B monthly volume after a 2023 pilot, modernizing payment infrastructure by eliminating intermediaries and weekend delays. - Aquanow's institutional-grade crypto expertise supports Visa's digital asset ambitions, aligning with broader industry trends toward blockchain adoption. - While competitors like Mastercard advance stablec

Uzbekistan’s 2026 Stablecoin Initiative Seeks Expansion While Enforcing Rigorous Regulation

- Uzbekistan will legalize stablecoin payments and tokenized securities under strict 2026 regulations, marking a shift from prior crypto restrictions. - A regulatory sandbox will test stablecoin systems and develop tokenized markets, aligning with its Digital Uzbekistan 2030 innovation strategy. - The central bank will oversee risks, requiring all crypto transactions to flow through licensed providers with mandatory customer identification since 2023. - This controlled approach aims to attract foreign inve

Bitcoin News Update: S&P 500 Maintains Its Criteria, Leaves Out Bitcoin-Focused MSTR

- S&P 500 excludes MSTR for third time, citing reliance on Bitcoin assets over operational revenue. - MSCI reviews crypto-heavy firms, proposing 50% asset threshold for benchmark removal to maintain sector balance. - Saylor defends MSTR's corporate identity but acknowledges financials resemble investment vehicles with minimal software revenue. - Index providers prioritize operational stability and profitability, contrasting MSTR's volatile Bitcoin-linked earnings and losses. - Market context shows S&P 500