- XRP trades at $2.78, down 0.3% in 24 hours, with immediate support at $2.77 and resistance at $2.82.

- Liquidity maps show stronger clusters below spot, especially between $2.70–$2.75, signaling potential short-term downside pressure.

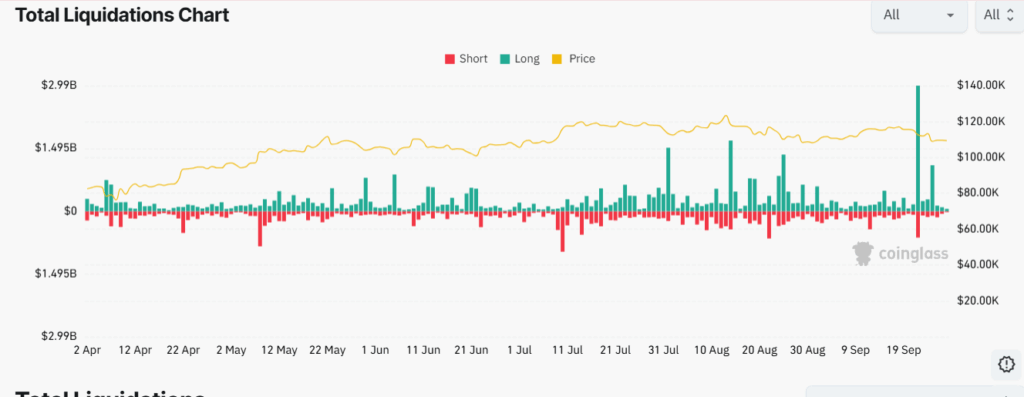

- Derivatives data highlights increased liquidations, with long positions hit hardest during recent pullbacks across the market.

XRP trades on the tight market and the liquidity data indicates higher concentrations below the current spot. The cryptocurrency is valued at $2.78, a decrease by 0.3 % in the past 24 hours. Liquidity distribution suggests a possible test of lower levels, with short-term support and resistance guiding market direction. Traders are closely watching how the coin reacts to this liquidity structure, especially with large liquidation volumes appearing across derivatives markets.

Price Levels and Current Trading Range

The coin’s support level stands at $2.77, only slightly below the prevailing price. This creates a narrow buffer zone for immediate market activity . On the upside, the resistance level is placed at $2.82, forming the ceiling within the 24-hour trading range.

Such tight margins suggest limited breakout potential in the short term, keeping the price movement contained. This balance between support and resistance highlights where near-term reactions may develop, depending on liquidity shifts.

Liquidity Distribution Below Spot

Order book heatmaps indicate that more liquidity rests below the $2.78 mark than above, creating potential downside pressure. Notably, the largest clusters are concentrated near the $2.70–$2.75 range, where bids appear stronger. These levels may act as magnets for price testing, especially if sellers increase volume in the coming sessions.

The highlighted imbalance underlines a short-term market risk, as liquidity depth often attracts movement. However, the defined support level at $2.77 remains the first line of defense.

Liquidation Spikes Highlight XRP’s Sensitivity to Leverage

Coinglass data further emphasizes heightened market volatility through visible spikes in liquidation activity. Over recent weeks, both long and short positions faced heavy unwinds, with long liquidations dominating during price pullbacks. Notably, liquidation volumes have reached substantial levels, particularly around September, suggesting that traders are managing higher leverage exposures.

Source: Coinglass

Source: Coinglass

The data shows that liquidation flows remain aligned with sharp spot price movements, reinforcing the sensitivity of XRP to sudden liquidity shifts. With the coin maintaining a 0.00002540 BTC value, reflecting a 0.3% gain against Bitcoin, comparative strength contrasts with its dollar performance. This divergence provides insight into broader market dynamics where XRP aligns differently depending on pairings.