Date: Mon, Sept 29, 2025 | 06:05 AM GMT

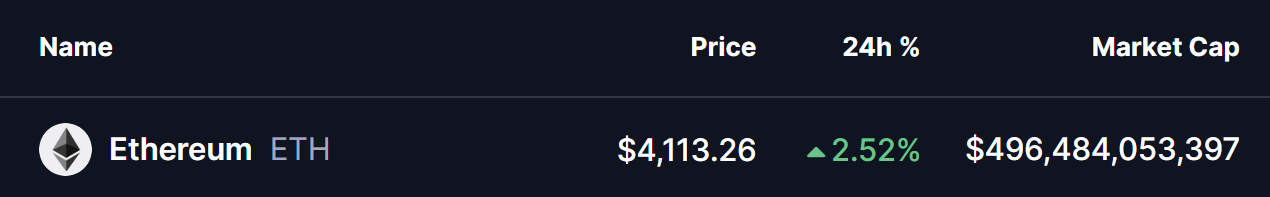

The cryptocurrency market is seeing a recovery attempt after this week’s volatility, which dragged Ethereum (ETH) to lows of $3,832 before bouncing back above $4,100. ETH has gained over 2% in the past 24 hours, and the chart now shows signs of a possible “Power of 3” (PO3) setup — a classic structure that could set the stage for a bullish reversal if confirmed.

Source: Coinmarketcap

Source: Coinmarketcap

Power of 3 Pattern in Play?

On the daily chart, ETH’s price movement appears to be tracking the three key phases of the PO3 pattern:

Accumulation Phase

Throughout August, ETH consolidated in a range between $4,780 resistance and $4,215 support, suggesting accumulation by larger players as the market cooled off.

Manipulation Phase

On Sept 22, ETH broke below the $4,215 support and slid to $3,832 before rebounding to the current zone near $4,100. This red-shaded region represents the manipulation stage, where false breakdowns often flush out weak hands ahead of a potential bullish shift.

Ethereum (ETH) Daily Chart/Coinsprobe (Source: Tradingview)

Ethereum (ETH) Daily Chart/Coinsprobe (Source: Tradingview)

What’s Next for ETH?

ETH is still trading within the manipulation zone, leaving room for further swings. However, if buyers manage to push price back above $4,215 and reclaim the 100-day moving average ($4,404), it would signal the start of the expansion phase — the strongest leg of the PO3 setup.

Next, a breakout above $4,780 could open the door to a rally toward its next technical target of $5,818, potentially resetting bullish momentum across the broader altcoin market.

For now, traders are watching closely to see if ETH can stabilize in this red zone or if another dip is needed before a sustained reversal kicks in.