From ETF Buzz to Rising Network Activity: Why Litecoin Could Lead in Q4

Litecoin’s Q4 prospects strengthen as ETF optimism grows, large transaction volumes rise, and payment adoption surges, hinting at undervaluation.

Litecoin (LTC), an altcoin that uses the proof-of-work consensus mechanism and was once called “digital silver,” is working to regain its former glory. Fundamental factors strengthen the network’s resilience and utility, but the price does not reflect those underlying values.

A few signals suggest that Litecoin’s momentum is reviving and growing in the year’s final quarter.

Average Transaction Value, Litecoin ETF, and More

According to expert Nate Geraci, the US Securities and Exchange Commission (SEC) will soon issue final decisions on spot crypto ETF applications in the coming weeks.

The Canary Litecoin ETF application is the first in line. A decision is expected this week on October 2, followed by rulings on other altcoins such as SOL, DOGE, XRP, ADA, and HBAR.

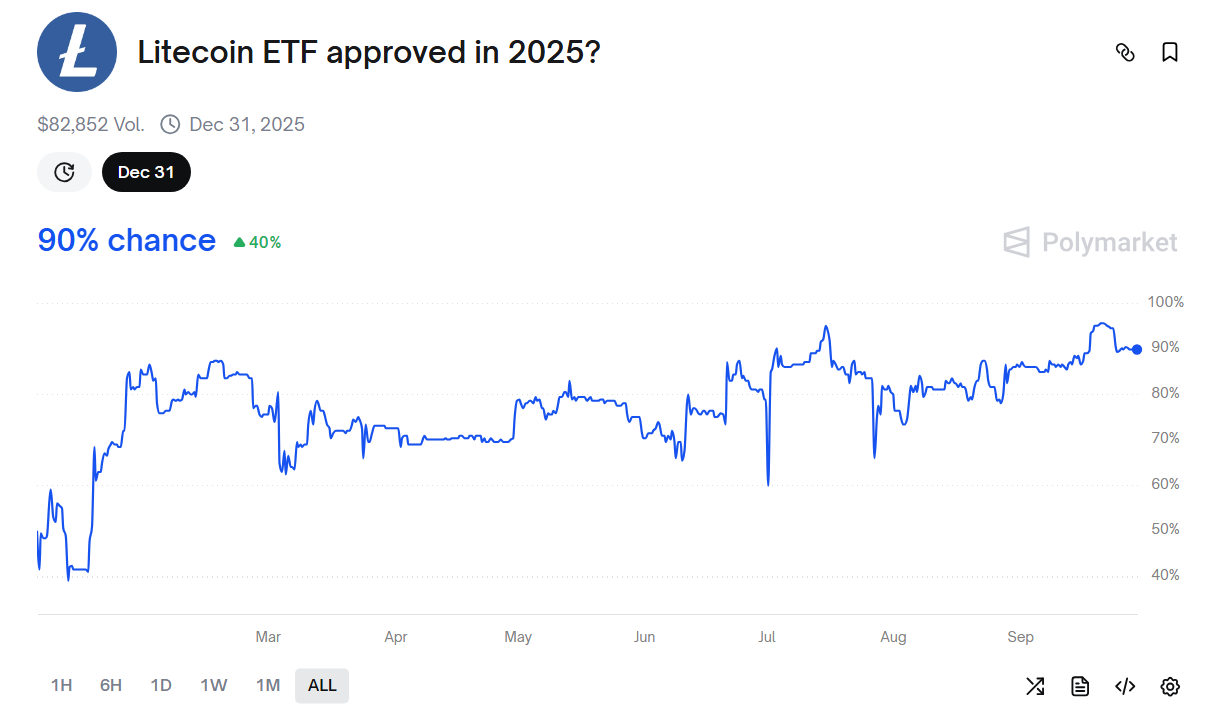

Prediction platform Polymarket currently assigns a 90% probability that regulators will approve a Litecoin ETF in 2025. Investors show strong confidence in this outcome.

Litecoin ETF Approval Possibility in 2025. Source:

Polymarket

Litecoin ETF Approval Possibility in 2025. Source:

Polymarket

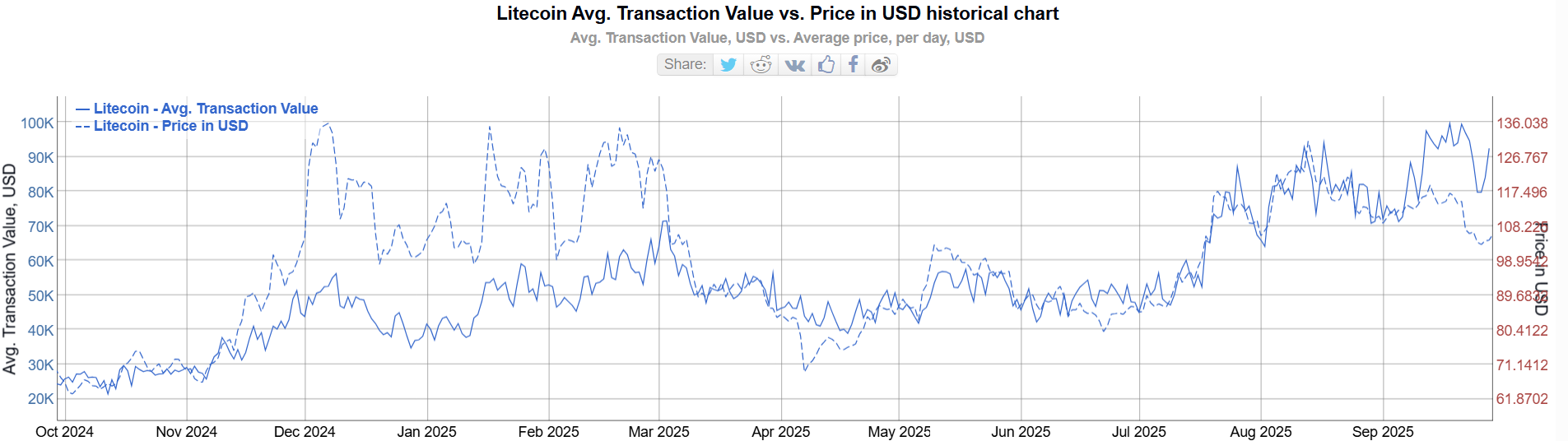

Second, Litecoin’s average transaction value has reached a two-year high, signaling a surge in large transactions across the network.

Data from BitInfoCharts shows that the average transaction value (solid line) climbed from $25,000 at the end of 2023 to nearly $100,000 in September 2025, four times higher and the highest level in two years.

Average LTC Transaction Value. Source:

Bitinfocharts

Average LTC Transaction Value. Source:

Bitinfocharts

The rise is noteworthy because LTC’s price remained stable at around $100 without hitting new highs. This suggests more LTC is moving across the network. These could be payment transactions or accumulation moves.

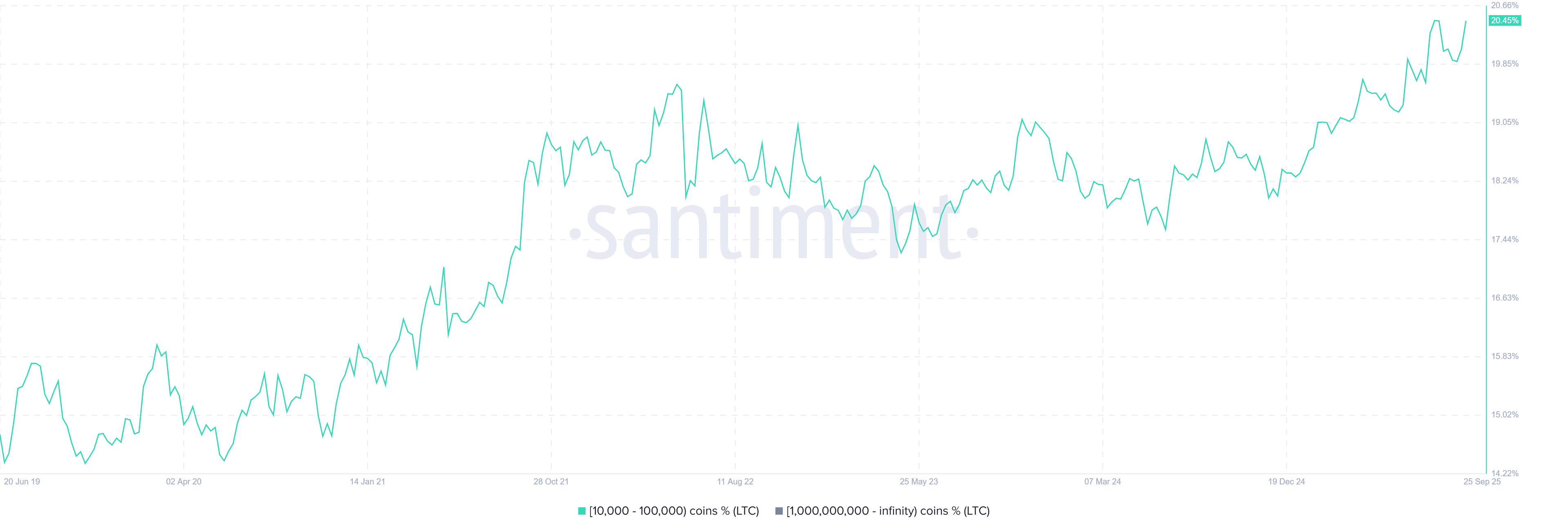

Recent Santiment data support the accumulation thesis. Wallet addresses holding between 10,000 and 100,000 LTC have grown steadily over the past five years, accounting for more than 20% of the supply.

Share of Supply Distribution of Wallet Addresses Holding Between 10,000 and 100,000 LTC. Source:

Santiment

Share of Supply Distribution of Wallet Addresses Holding Between 10,000 and 100,000 LTC. Source:

Santiment

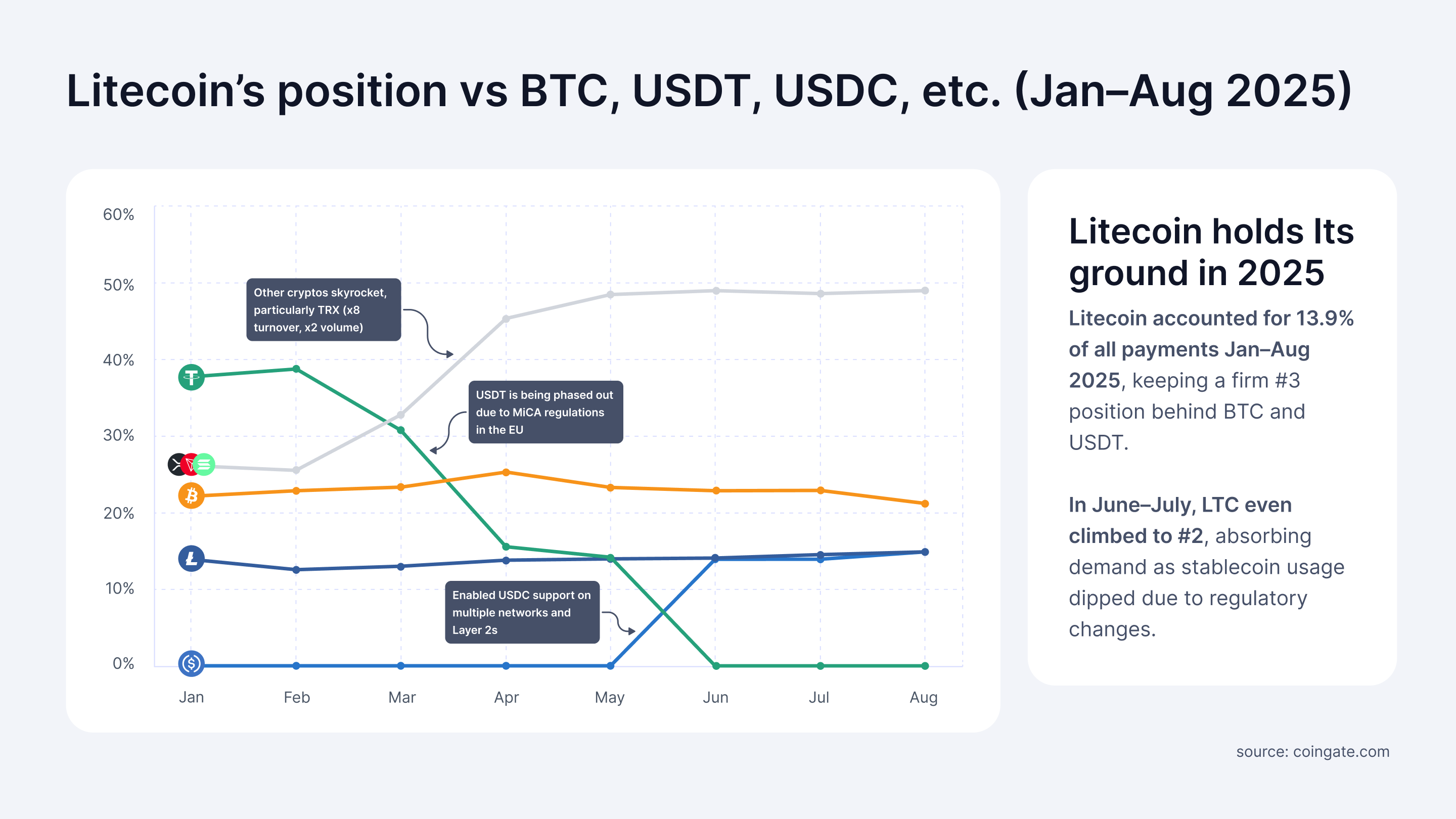

Third, a report from CoinGate highlights Litecoin’s dominance in consumer payments on its platform. From January to August 2025, LTC represented 13.9% of all transactions, ranking third behind Bitcoin (23%) and USDT (21.2%).

Litecoin’s Dominance in Consumer Payments. Source:

Coingate

Litecoin’s Dominance in Consumer Payments. Source:

Coingate

“Litecoin payments remain steady across the year, with higher usage when competing assets face headwinds. Rather than being a marginal alternative, Litecoin has proven it can capture meaningful share when circumstances change, which is a clear sign of resilience and user trust,” CoinGate reported.

These positive signs of adoption lead many analysts to argue that LTC is undervalued compared to the utility its network delivers.

“Litecoin is at least 50x undervalued… it’s actually more once price goes vertical and it catches the next wave of adoption, likely sending it another 10x… so 500x undervalued,” analyst Master predicted.

However, competition remains fierce. Other altcoins, such as ETH, SOL, XRP, and XLM, are also cementing their roles in the growth of DeFi and global payments. Investors, therefore, may find strong alternatives for their portfolios beyond LTC.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

The Revival of STEM Learning as a Driving Force for Tomorrow’s Technology Investments

- Emerging STEM universities are driving tech innovation through interdisciplinary curricula and industry partnerships, focusing on AI, biotech , and advanced manufacturing. - U.S. programs like STEM Talent Challenge and NSF Future Manufacturing allocate $500K-$25.5M to bridge skills gaps and fund projects in quantum tech and biomanufacturing. - Leadership-focused STEM programs at institutions like Florida State and Purdue boost startup success rates (75-80%) and align with venture capital trends favoring

Assessing KITE’s Price Prospects After Listing as Institutional Interest Rises

- Kite Realty Group (KRG) reported Q3 2025 earnings below forecasts but raised 2025 guidance, citing 5.2% ABR growth and 1.2M sq ft lease additions. - Institutional investors showed mixed activity, with Land & Buildings liquidating a 3.6% stake while others increased holdings, reflecting valuation debates. - Technical indicators suggest bullish momentum (price above 50/200-day averages) but a 23.1% undervaluation vs. 35.1x P/E, exceeding sector averages. - KRG lags peers like Simon Property in dividend yie

Evaluating How the MMT Token TGE Influences Crypto Ecosystems in Developing Markets

- MMT's volatile TGE highlights tokenized assets' dual role as liquidity engines and speculative risks in emerging markets. - Institutional investors allocate up to 5.6% of portfolios to tokenized assets, prioritizing real-world integration and cross-chain utility. - Regulatory fragmentation and smart contract risks demand CORM frameworks to mitigate operational vulnerabilities in DeFi projects. - MMT's deflationary model and institutional backing face macroeconomic challenges, requiring hedging against gl

Trust Wallet Token's Latest Rally and Growing Institutional Interest: Driving Sustainable Value

- Trust Wallet Token (TWT) surged in 2025 due to institutional partnerships, utility upgrades, and real-world asset (RWA) integrations. - Collaborations with Ondo Finance (tokenizing $24B in U.S. Treasury bonds) and Onramper (210M+ global users) expanded TWT's institutional-grade utility. - Governance upgrades, FlexGas payments, and Binance co-founder CZ's endorsement boosted TWT's credibility and institutional appeal. - Analysts project TWT could reach $5.13 by year-end, driven by cross-chain integrations