$8 Billion in Bitcoin Accumulation Could Drive BTC Price To $115,000

Bitcoin’s price rebounded to $111,842 after heavy accumulation worth $8 billion. While investors eye $115,000 next, the RSI shows bearish momentum still poses short-term risks.

Bitcoin is once again capturing investor attention after a sharp dip below $110,000, raising concerns about its near-term recovery.

The crypto king has bounced back quickly, climbing above $111,800 within a day, as growing signs of investor conviction suggest that support may fuel the next rally.

Bitcoin Investors Move To Accumulate

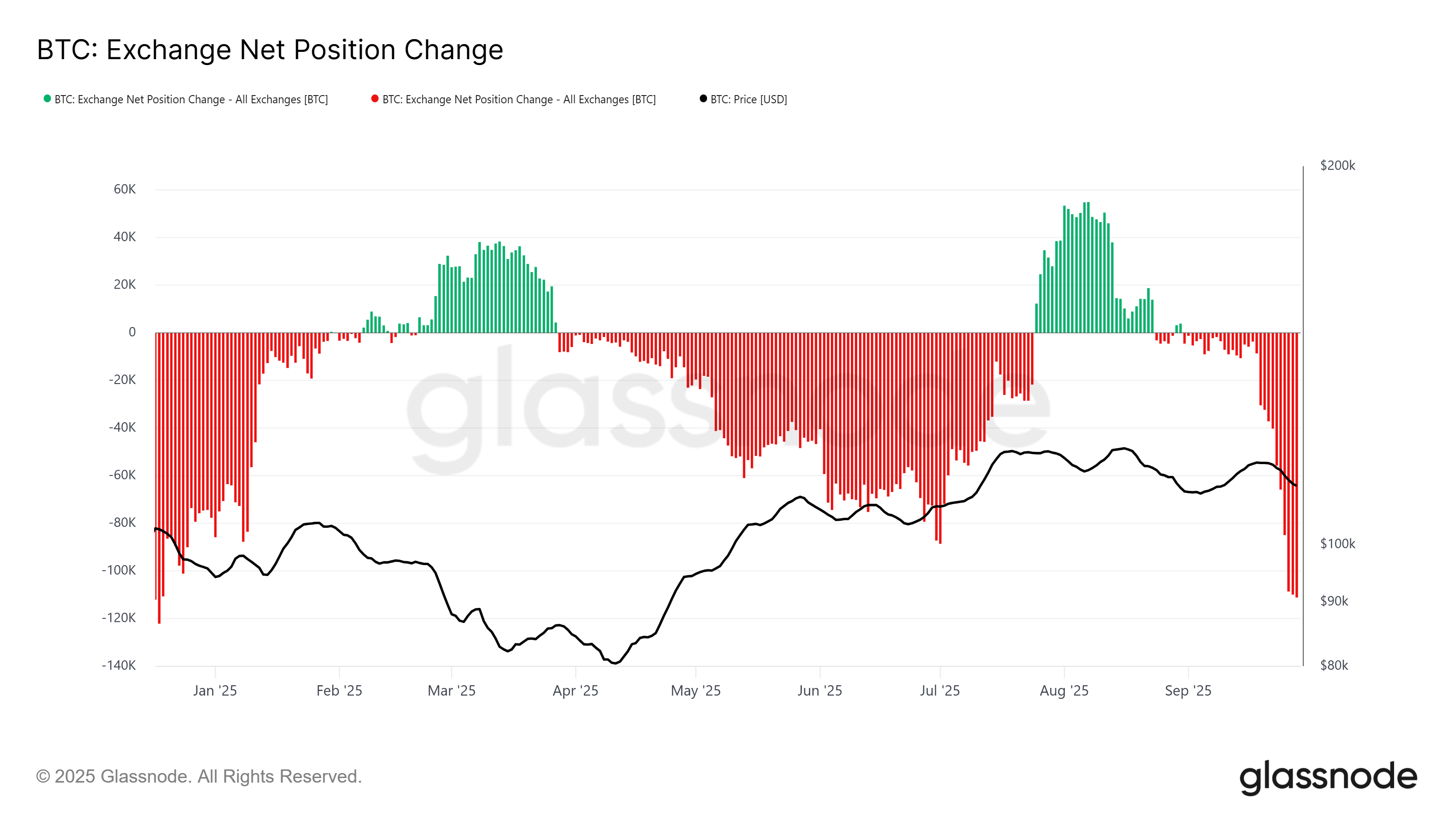

Exchange data reveals that Bitcoin has witnessed its strongest accumulation phase in more than eight months. The exchange net position change highlights that in the past week, 70,956 BTC worth nearly $8 billion has been withdrawn, indicating large-scale investor confidence in buying at discounted levels.

Such accumulation typically signals optimism about a price rebound. Long-term holders and institutional investors appear to be capitalizing on Bitcoin’s temporary weakness, setting the stage for potential upward momentum. The sharp outflows from exchanges also suggest reduced selling pressure, which could stabilize the market in the short term.

Bitcoin Exchange Net Position Change. Source:

Glassnode

Bitcoin Exchange Net Position Change. Source:

Glassnode

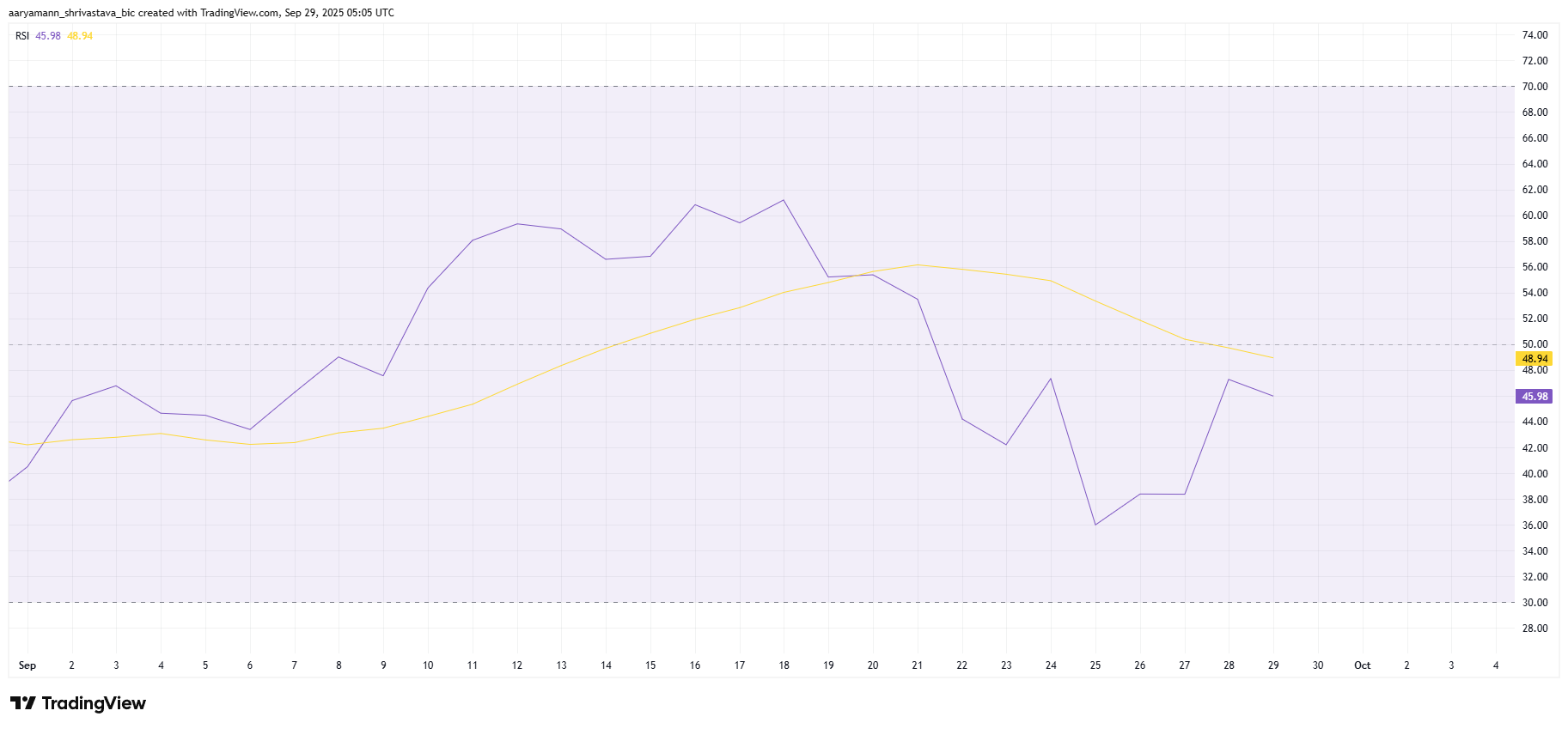

Despite this optimism, macro momentum indicators show that challenges remain. Bitcoin’s relative strength index (RSI) is still sitting below the neutral 50.0 mark, suggesting that bearish momentum is not entirely over. This highlights that market conditions could keep the pace of recovery slower than investors anticipate.

The balance between growing accumulation and lingering bearish cues suggests a tug-of-war for Bitcoin’s direction. While strong inflows point to long-term conviction, the RSI shows that short-term sentiment may still struggle against broader market pressures until stronger bullish signals emerge.

Bitcoin Bitcoin RSI. Source:

TradingView

Bitcoin Bitcoin RSI. Source:

TradingView

BTC Price Needs A Push

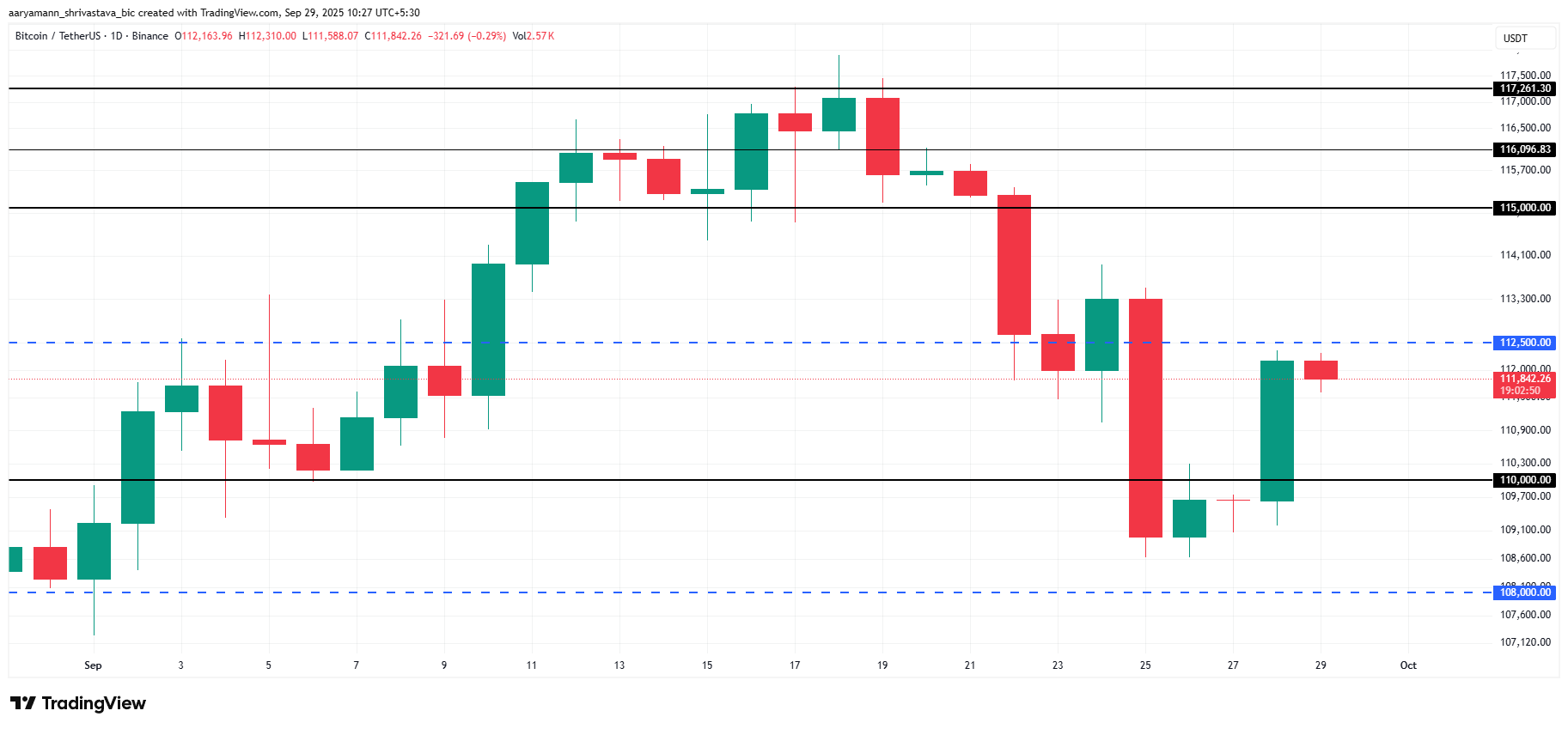

At the time of writing, Bitcoin was trading at $111,842, which was just shy of the $112,500 resistance. The recent bounce from below $110,000 reflects investor demand, but breaching key resistance remains critical for further upside momentum.

If Bitcoin successfully climbs past $112,500, the crypto king could reclaim $115,000 as a support level. This would open the door for a rally toward $120,000 in the coming days, fueled by accumulating investor demand and reduced selling pressure on exchanges.

Bitcoin Price Analysis. Source:

TradingView

Bitcoin Price Analysis. Source:

TradingView

However, failure to overcome $112,500 resistance would expose Bitcoin to further downside risks. A drop back to $110,000 or even $108,000 remains possible. This would invalidate the bullish outlook and trigger renewed skepticism about Bitcoin’s near-term recovery.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

From Queen’s Dream to Prison Gate: Zhi Min Qian and the Absurd Scam Involving 60,000 Bitcoins

The specific handling of this huge amount of Bitcoin will be decided early next year.

After zero commission, the new battleground is the "discovery and discussion layer"—whoever captures the talent there will be the new broker.

Social is becoming the underlying infrastructure of finance.

Analysis of Monad's 18-Page Sales Document: How Does 0.16% of Market Making Chips Support a 2.5 Billion FDV?

This document also systematically discloses a large number of important details such as legal pricing, token release schedule, market-making arrangements, and risk warnings.

Tom Lee: Recognize the eve of the crypto asset explosion, fasten your seatbelt!