Anoma TGE Analysis: An Intent-Centric, Unified Blockchain Operating System

With the launch of the gamified public testnet and the mainnet scheduled to go live on Ethereum in Q4 2025, the project is now entering the narrative and execution phase.

Original Title: "Anoma Pre-TGE Analysis"

Translation: Hu Tao, ChainCatcher

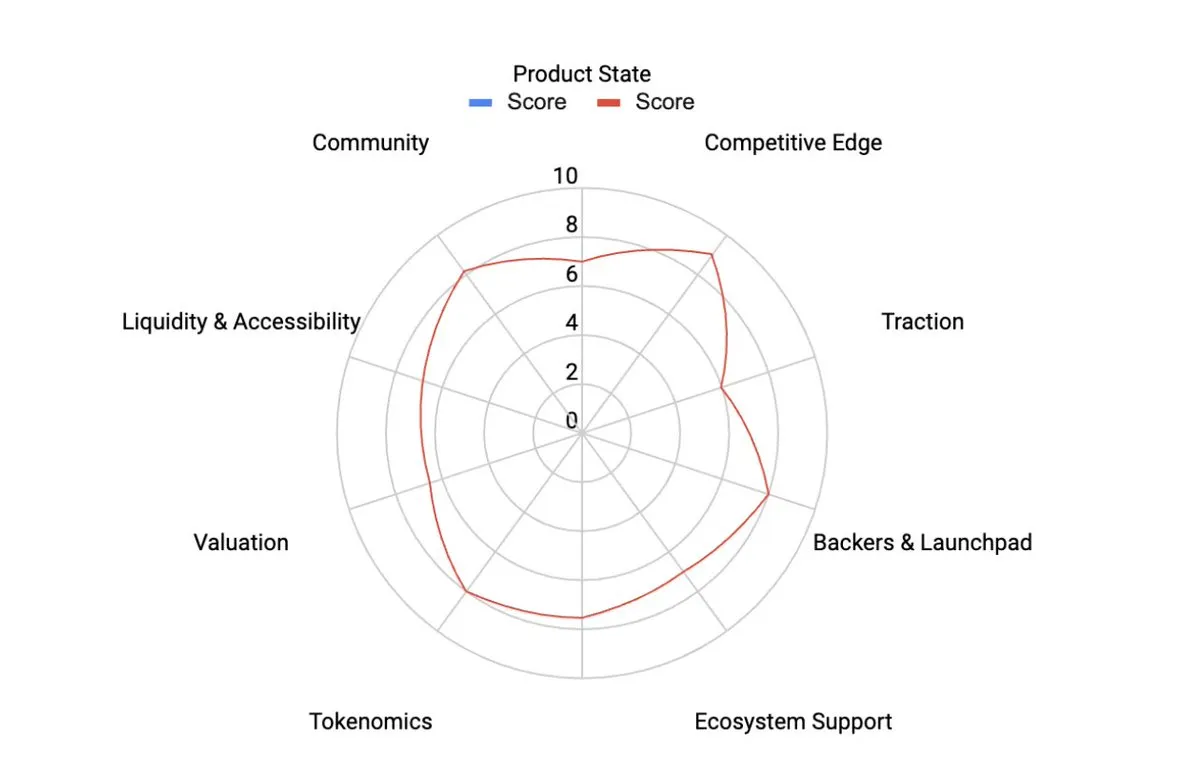

Score Details

-

Product: 7.25

-

Tokenomics: 7.42

-

Community: 8.20

-

Liquidity and Accessibility: NA (Pre-TGE)

-

Market: +0.5 → Slight bonus for current narrative tailwinds (Intent + ZK privacy are hot topics for 2025), but overall market conditions are neutral and the competitive field is crowded.

Weighted Final Score: 8.12

Excluding this narrative-driven market momentum, Anoma's score would be 7.62—still strong for a pre-mainnet project, but its execution remains to be proven.

Anoma's core viewpoint is that the expansion of crypto does not come from building isolated applications, but from cross-chain coordination of intents. The scores highlight where its conviction lies, and where delivery remains crucial.

Muur Framework

The Muur framework divides projects into five weighted categories: product, tokenomics, community, liquidity, and market environment.

Scores are weighted by importance, giving us not only raw metrics but also a belief-adjusted map to show the current reality versus what still needs to happen.

For Anoma, the strongest signals come from its competitive advantage (9/10) and ecosystem support (7/10), as well as healthy community influence. Risks are mainly concentrated on the clarity of tokenomics (still before token generation) and proof of scalable execution.

Anoma's Core Argument

Essentially, Anoma is not just a DEX or MEV solution, but a coordinated operating system.

-

Intent → Users specify the outcome they want (e.g., trade, borrow, hedge), but not how it happens.

-

Solver Network → Competing participants solve these intents, finding the optimal cross-chain execution path.

-

Atomic Settlement → Execution guarantees that all steps across chains are either all completed or none at all.

-

ZK Privacy → Zero-knowledge proofs ensure users control data and strategies.

The end result is: Anoma aims to be broader than UniswapX or CoW Swap (which are limited to trading), deeper than SUAVE (MEV infrastructure), and more general than Espresso (ordering). If successful, it will become the coordination layer for crypto.

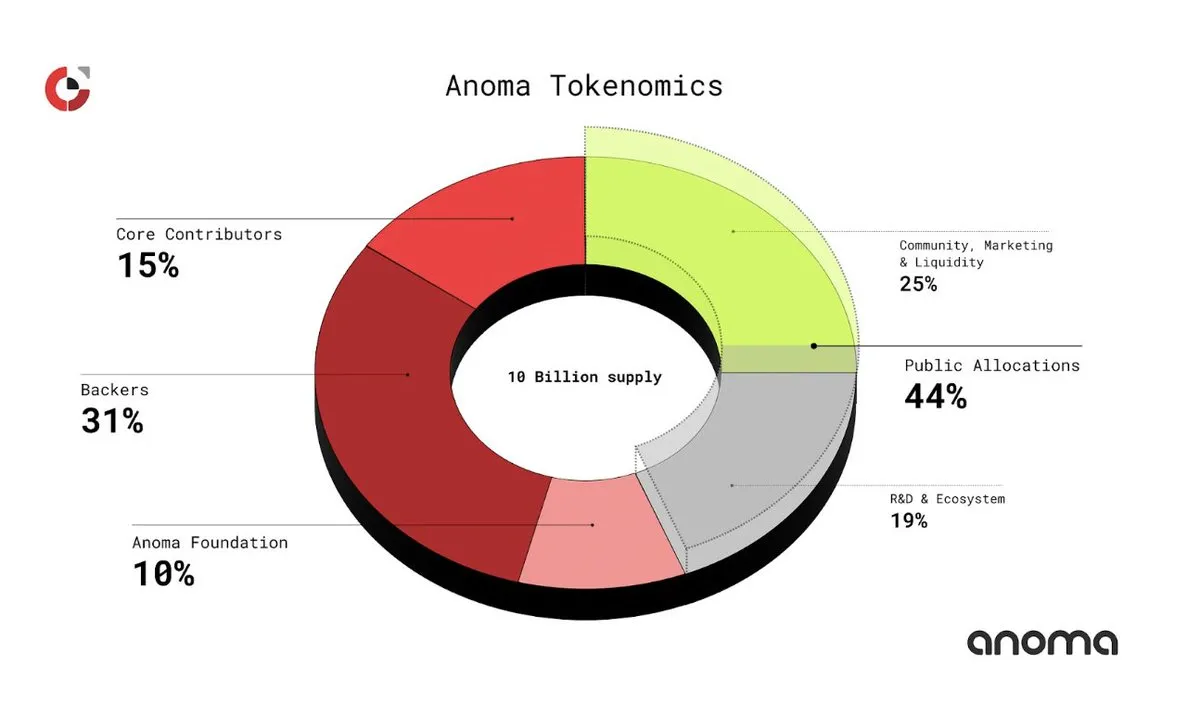

XAN: Token Fundamentals and Positioning

Anoma's token XAN will serve as the coordinating asset of the system.

-

Utility → Coordination fees, staking, governance. Unlike a fee-burn model, there is currently no clearly designed fund pool.

-

Allocation → Max supply of 10 billion. Supporters 31%, community 25%, R&D 19%, contributors 15%, foundation 10%. Closely tied to long cliffs (12 months) and linear vesting (36 months).

-

Valuation → Last private round (2023) raised $25 million, FDV at $1 billion. External speculation puts TGE FDV between $500 million and $1 billion.

-

Liquidity → Pre-TGE → Not yet scored.

The design leans towards balance: reasonable community allocation, but supporters' share is still considerable. The key is whether community appeal can translate into sustained token demand after TGE.

Product Strength

-

Stage: Gamified public testnet will launch on July 15, 2025. The first Ethereum mainnet confirmation will be launched in Q4 2025.

-

Competitive Advantage: Score 9/10—Intent-centric operating system with multi-chain atomic settlement, solver network, and zero-knowledge privacy. No direct competitors currently cover this scope.

-

Traction: Testnet activity shows high developer engagement driven by incentives. Testnet is still pre-mainnet, so signals are early and partially gamified.

-

Supporters: $26 million (2021: Polychain, Electric, Delphi, Coinbase), $25 million (2023: CMCC, FDV $1 billion), $2.5 million community round (January 2025). Strong long-term capital support.

-

Ecosystem: The first batch of "Intents Initiates" projects has launched, including 15 projects (Orda, Epoch, Fairblock, Mycel). Ethereum-first strategy gives it broad adoption in the short term.

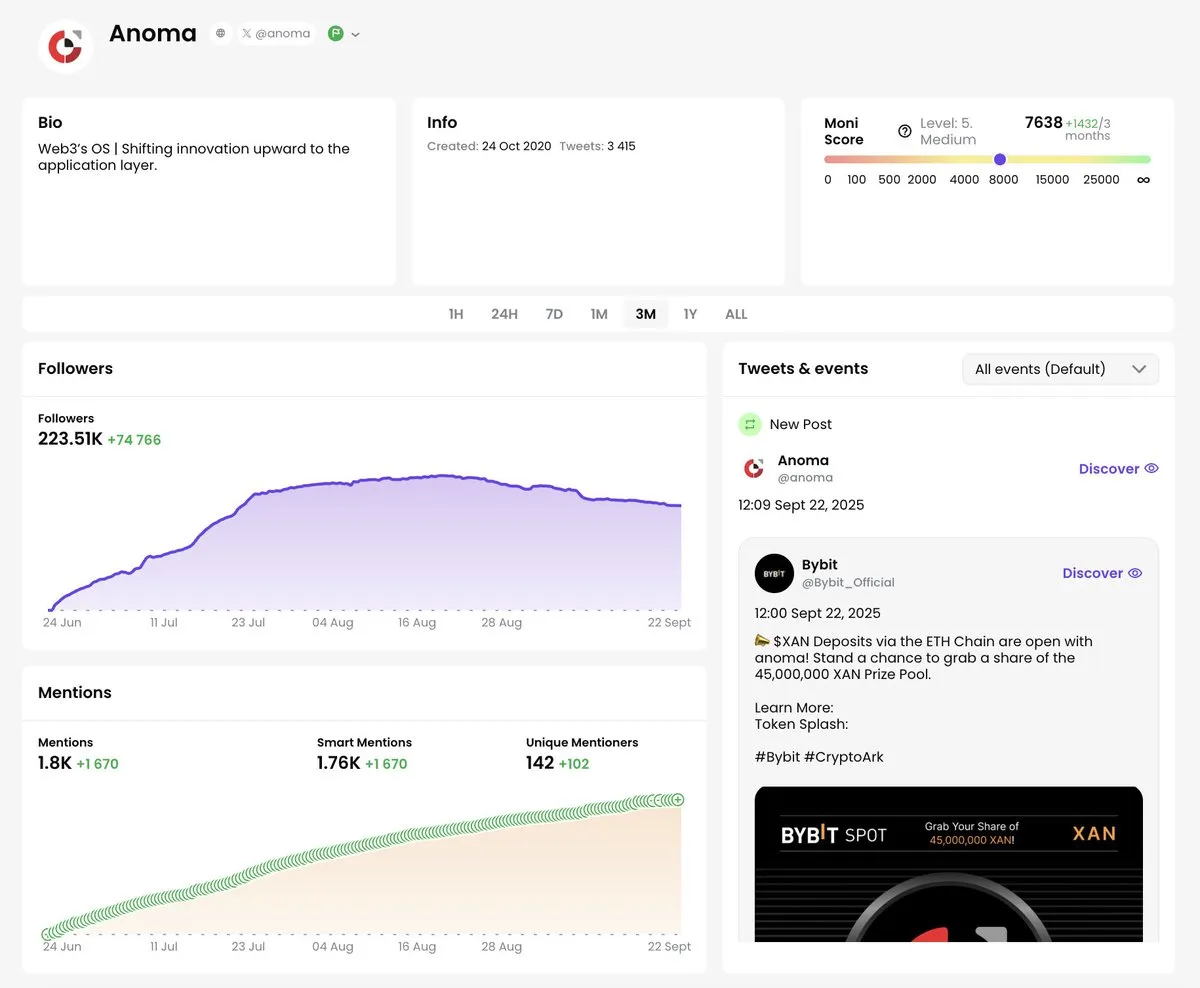

Community Engagement

Anoma's community score is as high as 8.2/10.

-

Followers: ~228K (September 2025).

-

Engagement: Tokenomics post: 1.5K likes / 17.7K views. The launch of Shrimpers NFT (September 9, 2025) expanded meme appeal and retail recognition.

-

Signals: Clear signs of grassroots narrative power.

This shows that Anoma has successfully attracted both retail users and intellectuals, a rare balance for infrastructure projects.

Market Setup

-

Narrative: Intent + ZK privacy are hot topics for 2025.

-

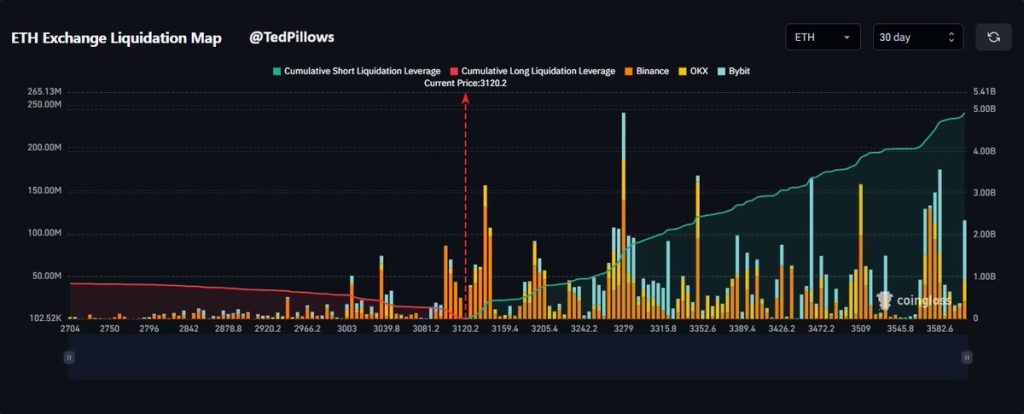

Macro: Fear and Greed Index is around 54 → neutral. Bitcoin dominance remains high.

-

Competition: Crowded field (UniswapX, CoW, SUAVE, Espresso), but Anoma's positioning as an OS-level coordination layer makes its scope unique.

The market category contributed +0.5 to the total score, reflecting narrative momentum. Without the market category, Anoma's score would be 7.62, highlighting that execution, not hype, ultimately determines its ranking.

Opportunities and Risks

Opportunities

-

Launching Ethereum-first gives access to the largest developer and liquidity pools.

-

Intent initiators can sow the seeds for a persistent ecosystem of solver applications and integrations.

-

ZK privacy integration differentiates Anoma from other intent protocols.

Risks

-

Traction quality → Current signals are incentive-driven; must prove organic demand post-mainnet.

-

Tokenomics → No clear absorption mechanism yet; demand drivers may lag behind supply unlocks.

-

Execution → Large-scale atomic settlement + privacy is technically complex.

Conclusion

Anoma's Muur score reaches 8.12, making it one of the most notable cases of 2025. Its argument is bold: crypto needs an intent-centric operating system, not isolated applications or infrastructure. It has strong backers, a vibrant community, and clear competitive advantages.

But the project is still pre-mainnet. This means its development relies mainly on incentives, tokenomics remain untested, and the hardest parts (atomic cross-chain settlement + large-scale privacy) are yet to be validated.

Currently, Anoma's valuation is based on its narrative strength and execution potential. After TGE, the real test will be whether developer adoption and the solver network can provide enough liquidity and coordination depth to justify its ambitions as an operating system.

This is a project to watch closely and accumulate cautiously—a rare case where vision, community, and market timing align, but the delivery clock has only just started.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Solana Price Drops to $140, Is a Fall to $134 the Next Move?

Dogecoin Price Sinks to New Lows, Can Bulls Regain $0.171 Soon?

Is Ethereum Starting Its Own Bitcoin-Style Supercycle? Tom Lee Weighs In

Ethereum Price Analysis: ETH Eyes $3,600 Liquidation Zone as BTC Crashes—Is a 12% Rebound Coming?